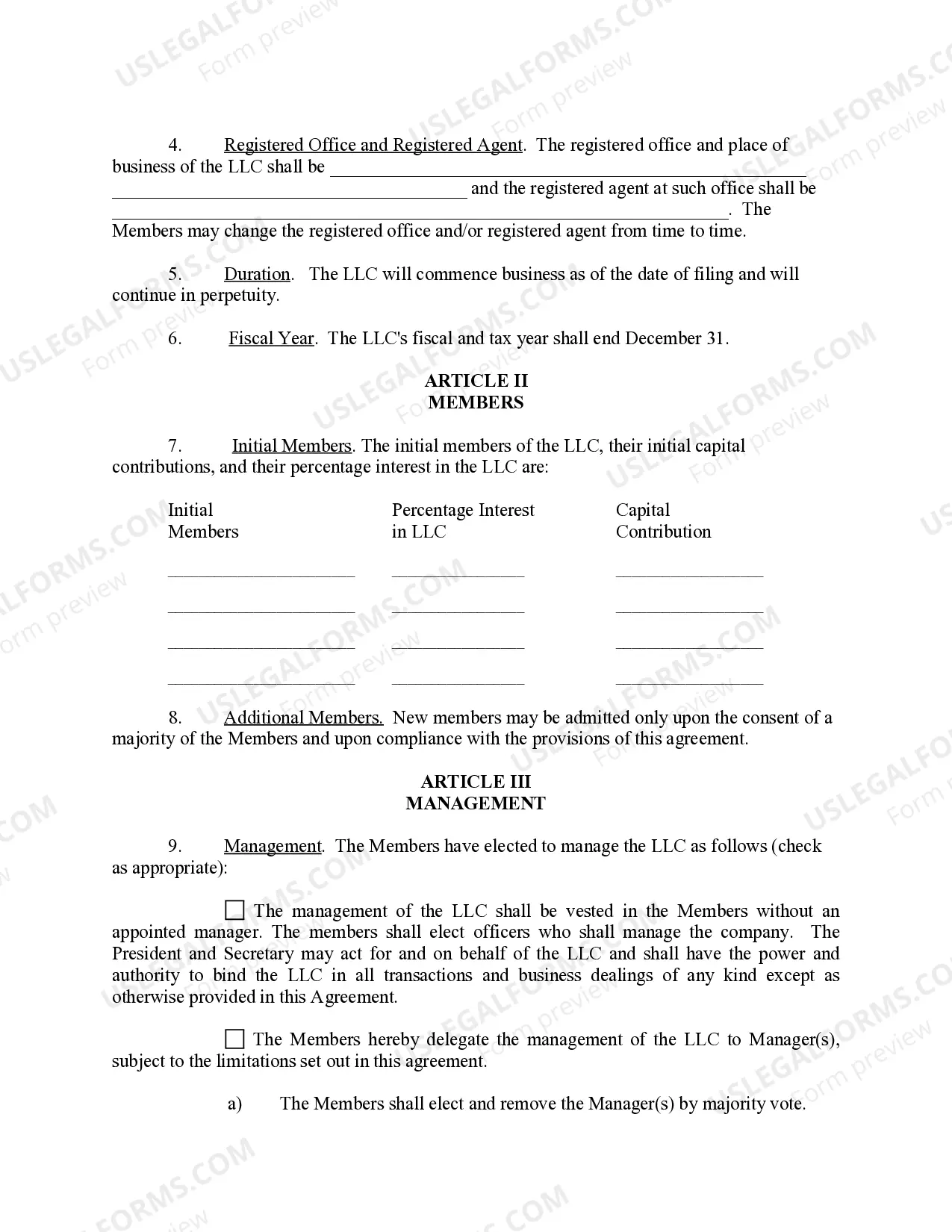

This Operating Agreement is used in the formation of any Limited Liability Company. You make changes to fit your needs and add description of your business. Approximately 10 pages. It allows for eventual adding of new Members to LLC.

Idaho Limited Liability Company LLC Operating Agreement

Description

How to fill out Idaho Limited Liability Company LLC Operating Agreement?

Gain entry to the largest collection of legal documents.

US Legal Forms is a platform where you can discover any specific state document in just a few clicks, including Idaho Limited Liability Company LLC Operating Agreement samples.

No need to waste hours searching for a court-acceptable form.

That’s it! You should complete the Idaho Limited Liability Company LLC Operating Agreement template and review it. To ensure that everything is correct, consult your local legal advisor for assistance. Sign up and effortlessly explore more than 85,000 useful templates.

- Our skilled professionals guarantee that you receive current examples every time.

- To utilize the document library, select a subscription plan and create your account.

- If you have already created an account, simply Log In and then click Download.

- The Idaho Limited Liability Company LLC Operating Agreement document will be immediately saved in the My documents section (a section for all forms you store on US Legal Forms).

- To set up a new account, review the quick tips listed below.

- If you're planning to use a state-specific document, be sure to select the correct state.

- If accessible, check the description to grasp all the details of the document.

- Utilize the Preview feature if it's offered to inspect the document's content.

- If everything is accurate, press the Buy Now button.

- After choosing a payment plan, create your account.

- Pay using a credit card or PayPal.

- Download the template to your device by clicking Download.

Form popularity

FAQ

Most states do not require LLCs to have this document, so many LLCs choose not to draft one. While it may not be a requirement to have an operating agreement, it's actually in the best interest of an LLC to draft one.

The core elements of an LLC operating agreement include provisions relating to equity structure (contributions, capital accounts, allocations of profits, losses and distributions), management, voting, limitation on liability and indemnification, books and records, anti-dilution protections, if any, restrictions on

If there is no operating agreement, you and the co-owners will not be suitably equipped to reach any settlements concerning misunderstandings over management and finances. Worse still, your LLC will be required to follow any of your state's default operating conditions.

An operating agreement is a document which describes the operations of the LLC and sets forth the agreements between the members (owners) of the business. All LLC's with two or more members should have an operating agreement. This document is not required for an LLC, but it's a good idea in any case.