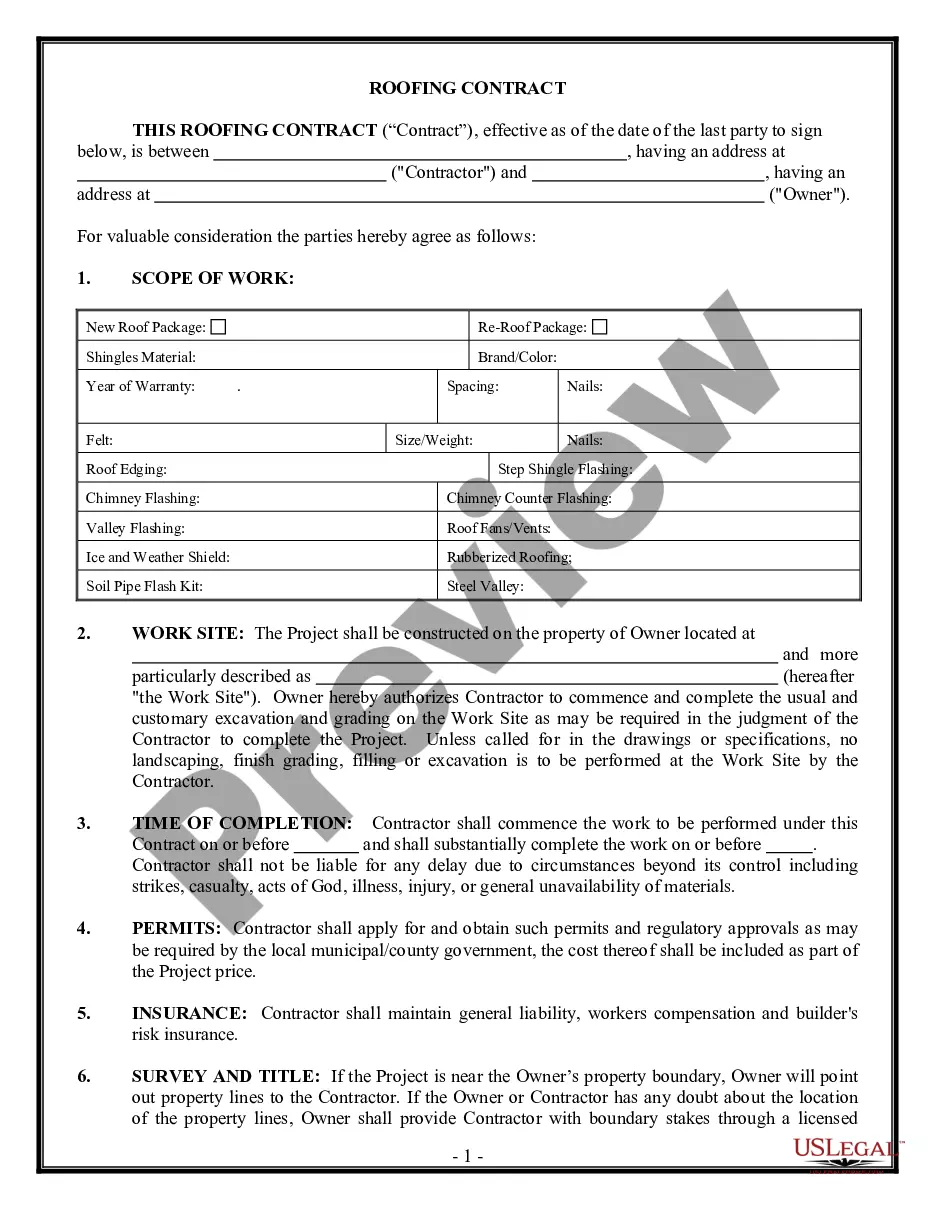

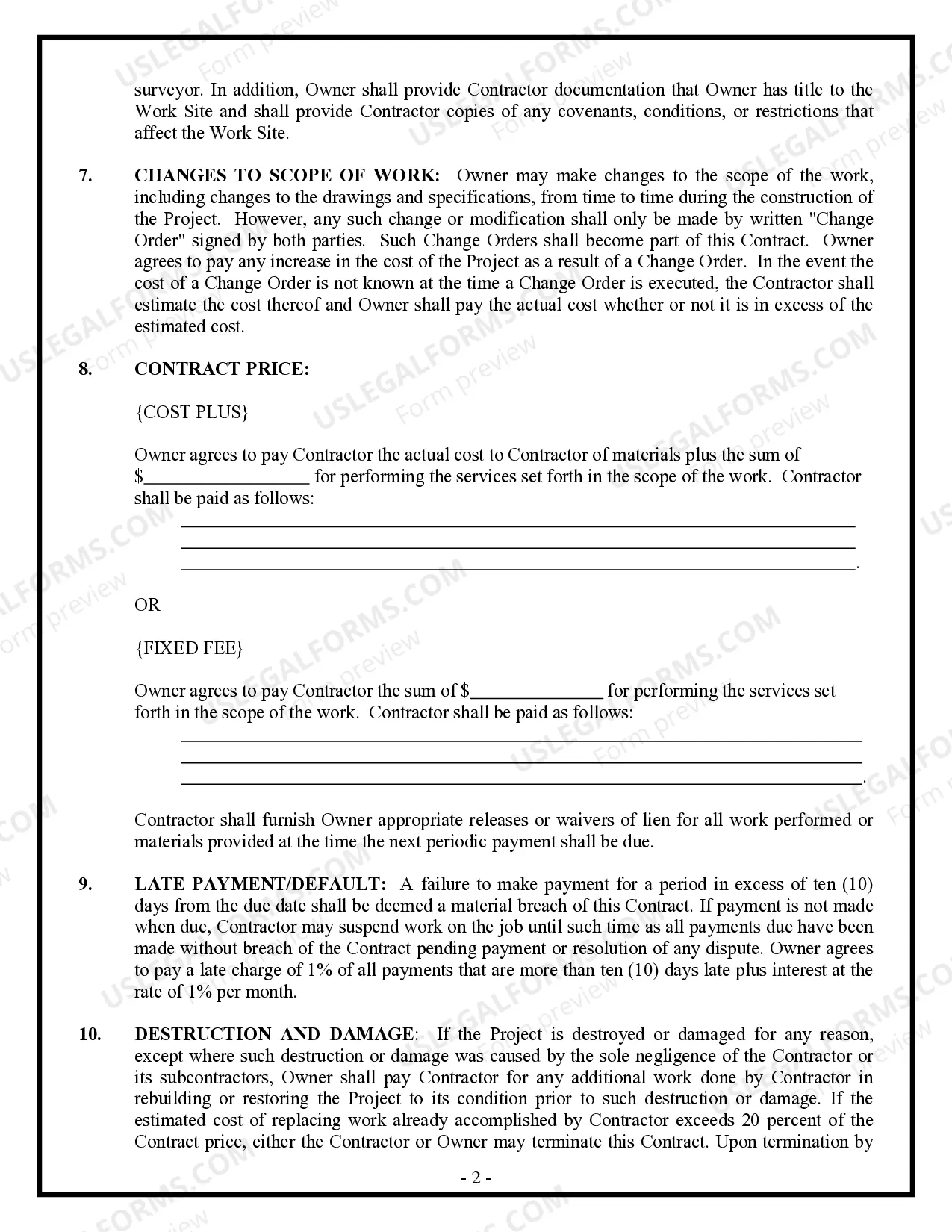

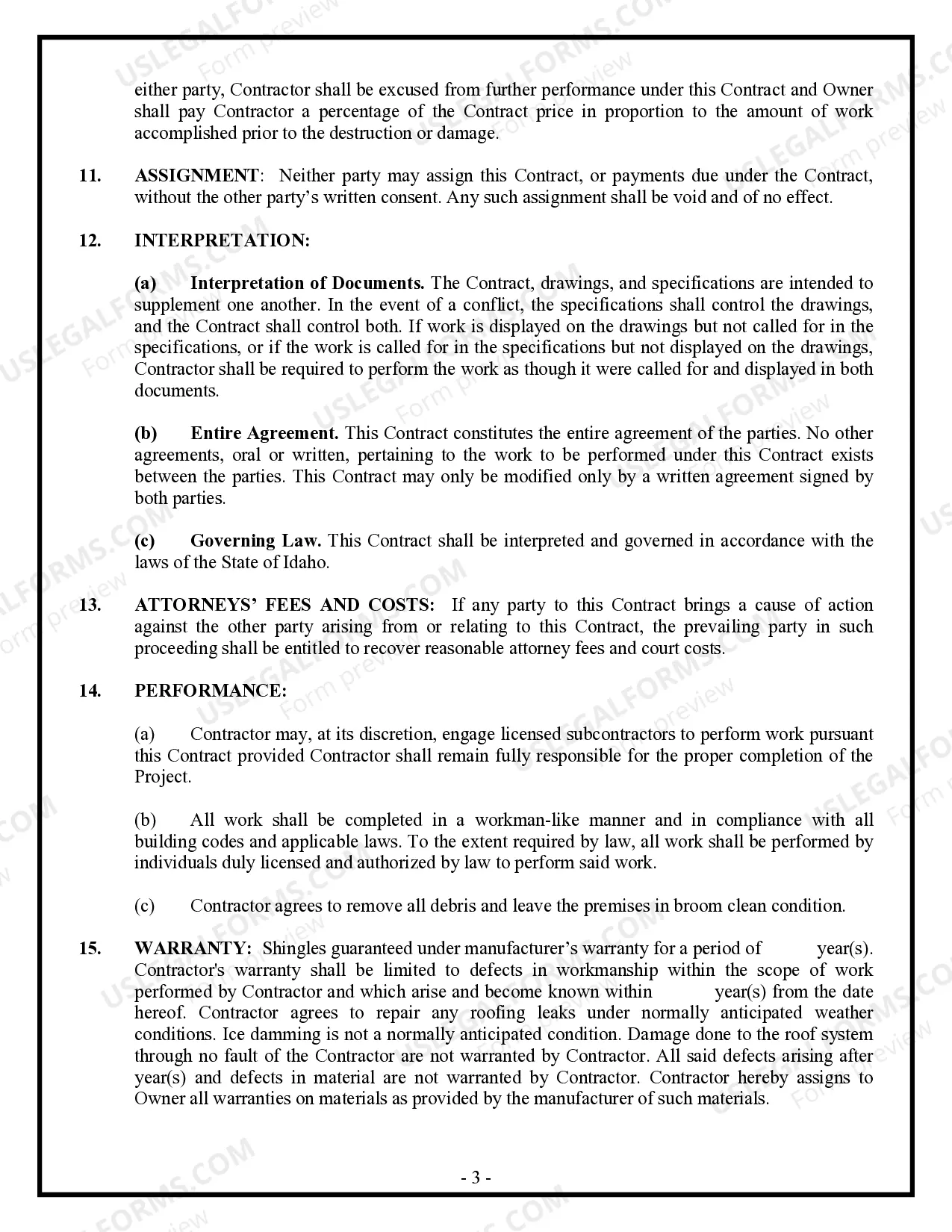

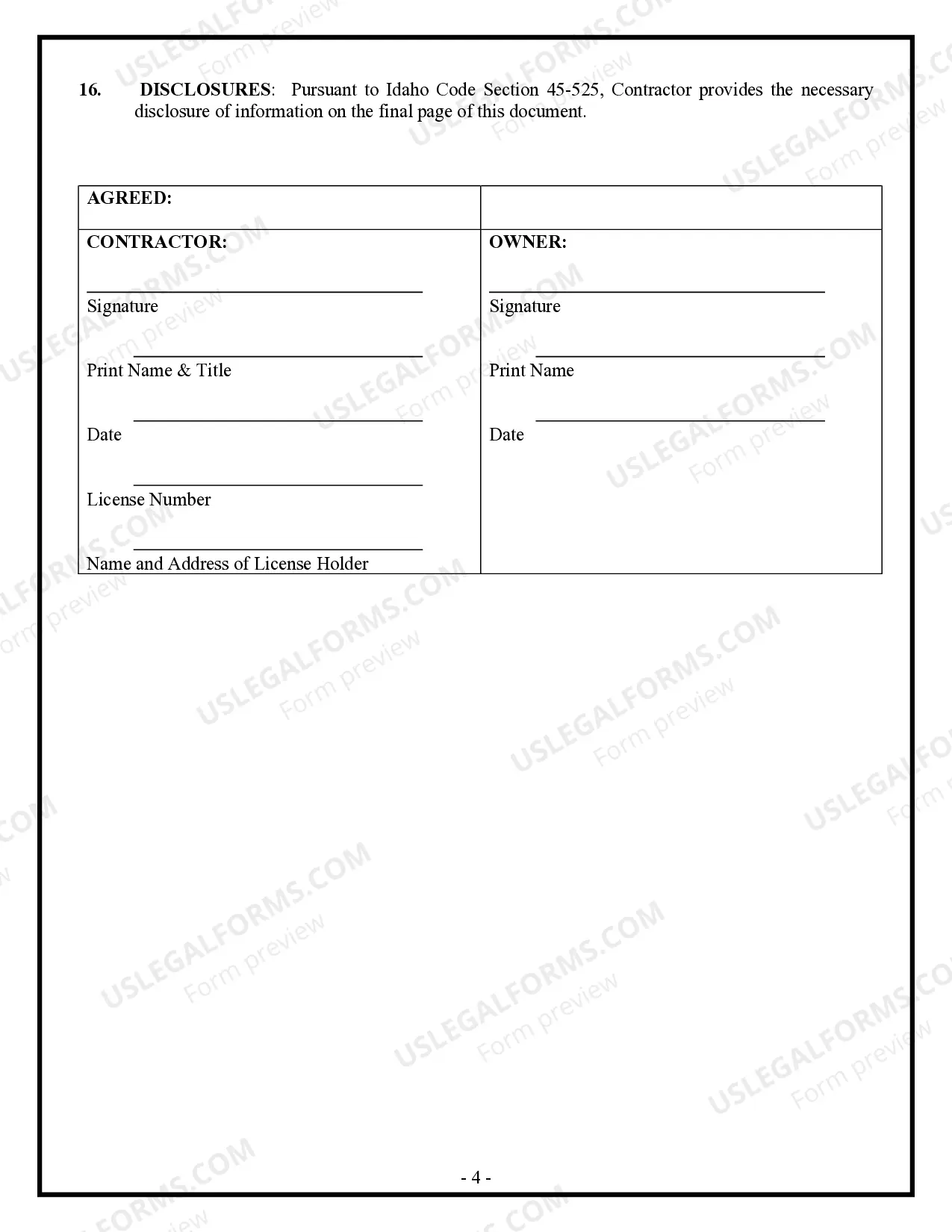

This form is designed for use between Roofing Contractors and Property Owners and may be executed with either a cost plus or fixed fee payment arrangement. This contract addresses such matters as change orders, work site information, warranty and insurance. This form was specifically drafted to comply with the laws of the State of Idaho.

Idaho Roofing Contract for Contractor

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Idaho Roofing Contract For Contractor?

Obtain entry to the most extensive collection of legal documents.

US Legal Forms is essentially a platform to locate any state-specific filing in just a few clicks, including examples of the Idaho Roofing Contract for Contractors.

There's no need to spend hours of your time searching for a court-admissible template. Our experienced professionals ensure that you receive the latest samples every time.

That's it! You need to submit the Idaho Roofing Contract for Contractor form and verify it. To ensure that everything is correct, consult your local legal advisor for assistance. Register and effortlessly browse through over 85,000 useful templates.

- To take advantage of the forms library, select a subscription and register for an account.

- If you have already completed this, simply Log In and click on the Download button.

- The Idaho Roofing Contract for Contractor example will be instantly stored in the My documents tab (a section for every form you download on US Legal Forms).

- To establish a new account, refer to the brief instructions detailed below.

- If you need to use a state-specific template, make sure to select the correct state.

- If possible, review the description to understand all of the intricacies of the form.

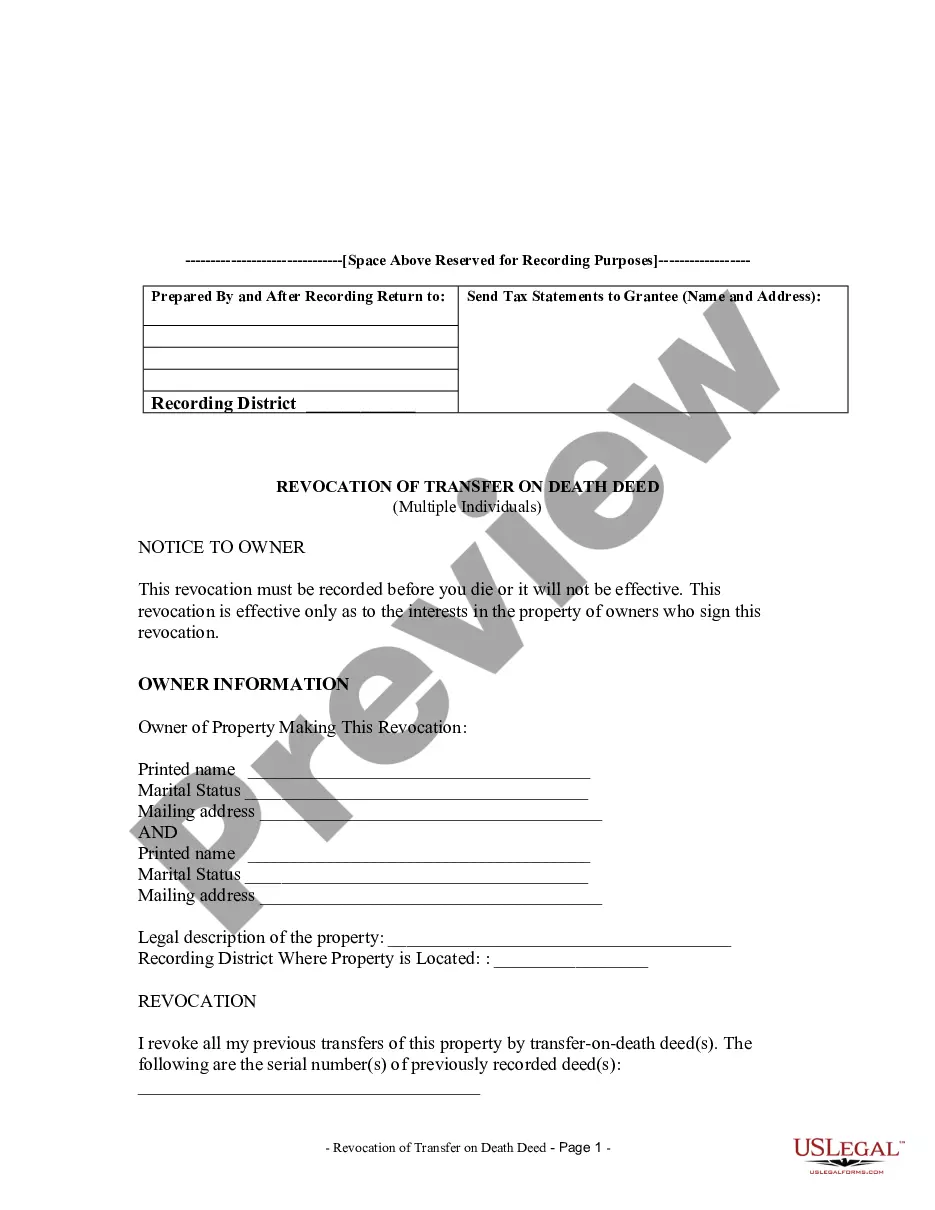

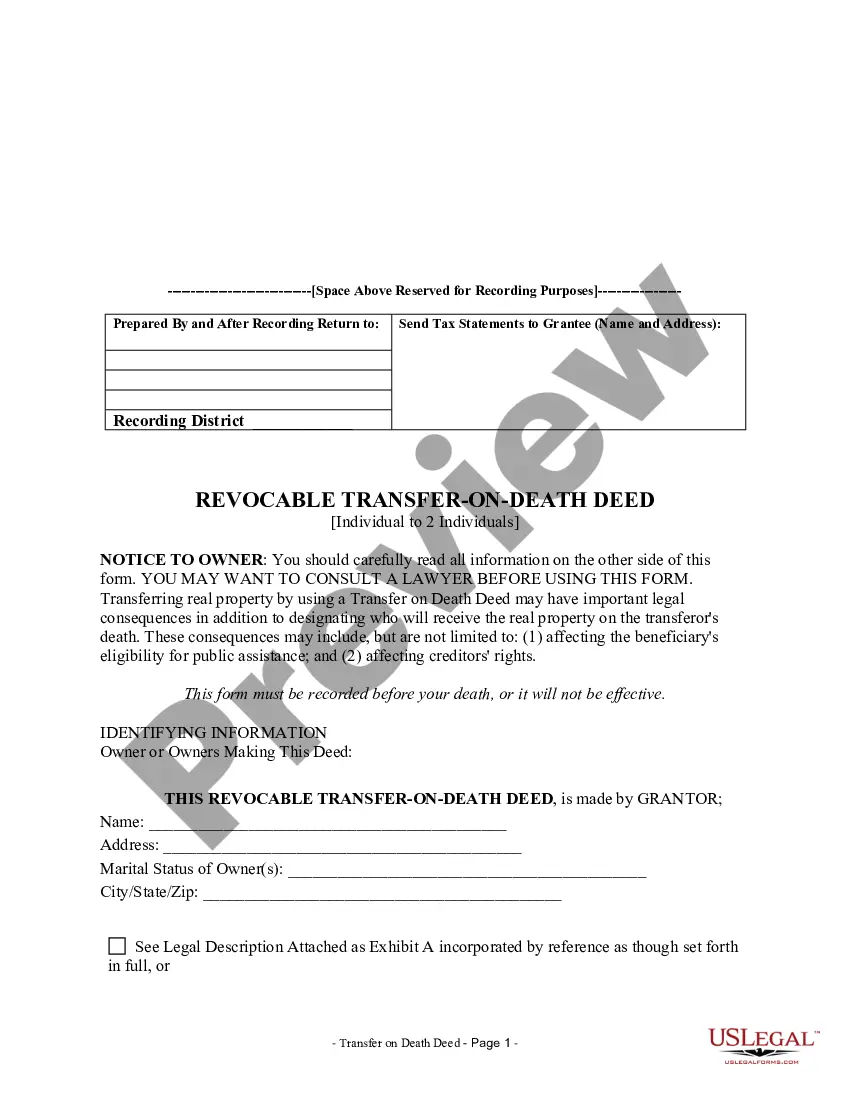

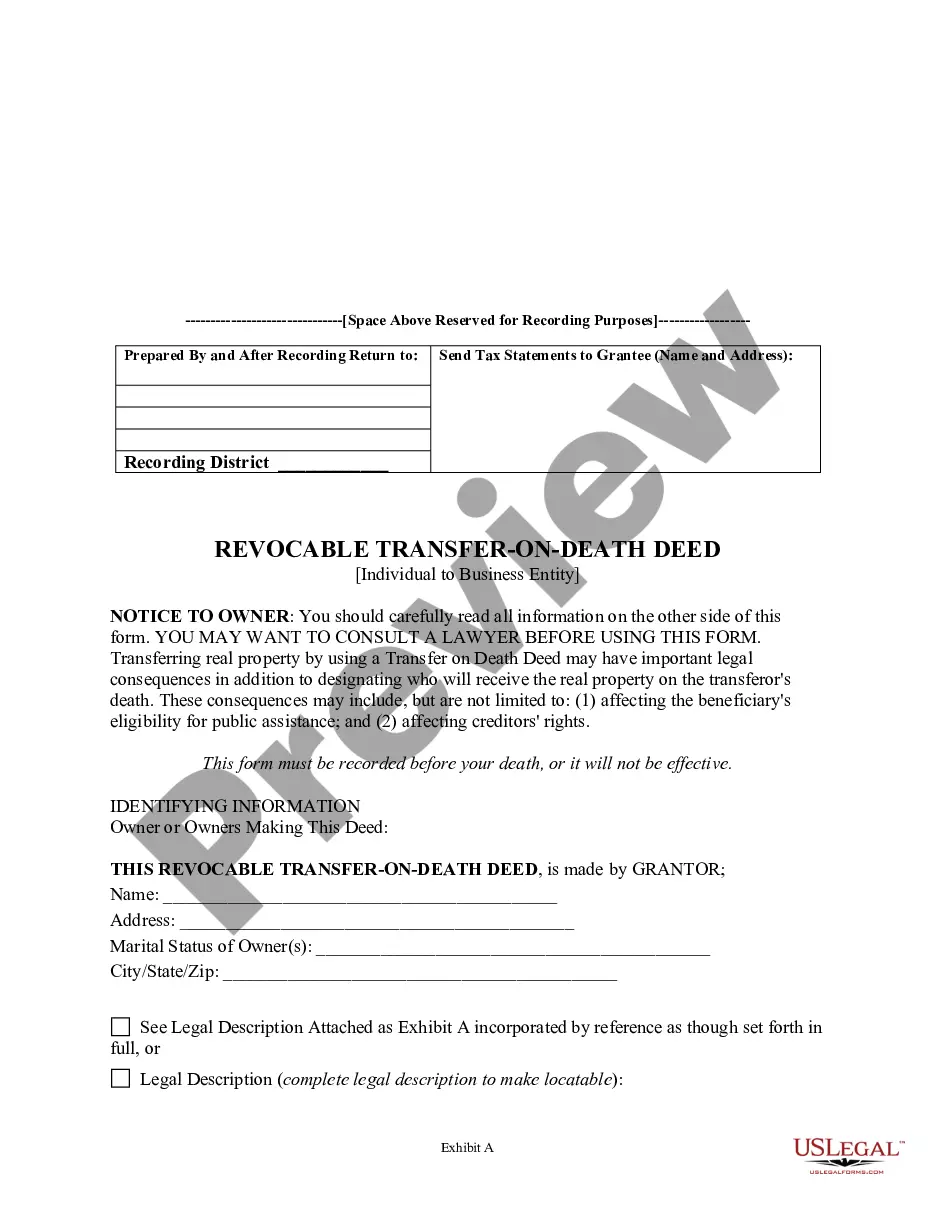

- Make use of the Preview feature if it's available to examine the document's details.

- If everything appears correct, click Buy Now.

- After choosing a pricing plan, create your account.

- Pay via card or PayPal.

- Download the document to your device by clicking on the Download button.

Form popularity

FAQ

Without a contractor's license in Idaho, you can perform minor repairs and maintenance work, but substantial projects may require a licensed contractor. By adhering to state regulations, you protect yourself and set clear expectations in any Idaho roofing contract for contractor services. For larger projects, it’s best to hire a licensed contractor to ensure quality and compliance.

Both parties should sign the contract, and both should be bound by the terms and conditions spelled out in the agreement. In general that means the contractor will be obliged to provide specified materials and to perform certain services for you. In turn, you will be required to pay for those goods and that labor.

For most types of projects you hire an independent contractor (IC) to do, the law does not require you to put anything in writing. You can meet with the IC, agree on the terms of your arrangement, and have an oral contract or agreement that is legally binding. Just because you can doesn't mean you should, however.

If you run a small business that hires 1099 contractors, also known as independent contractors, it is vital that you have them sign an independent contractor contract. This is because there is a significant gray area between who is classified as an independent contractor and who is classified as an employee.

How long have you been in business?How local is your business?Who owns your business, and for how long have they owned it?What jobs do you have that I can go see?Who, exactly, will be installing my roof?44 Questions to Ask Your Roofing Contractor Before Signing a\nwww.classicmetalroofingsystems.com > questions-ask-your-roofing-contrac...

Yes, absolutely. Starting work without a signed contract means that your position isn't clear, or even worse it's weak.It also means that the contract is legally enforceable and will be able to support you if you decide to take legal action.

Your roofing contract must include the specifics of the project including details about materials to be used (their brand, type, color, and price), and start and end date of the project. The contract must also include details about the removal of the old roof and installing the replacement.

Contractors and sales/use tax: an overviewIdaho sales tax law says contractors are the consumers (end users) of all the goods they use. As a result, they must pay sales tax on all purchases, including all the equipment, tools, and supplies they use to build, improve, repair, or alter real property.

1Step 1: Get Clear on the Scope of Work.2Step 2: Measure the Roof.3Step 3: Estimate Material Cost.4Step 4: Estimate Labor Costs.5Step 5: Calculate Your Overhead Costs.6Step 6: Tally All Roofing Costs.7Step 7: Add Your Markup for Desired Profits.8Step 8: Bid the Roofing Job.

All contractors are required by Idaho law to be registered with the Idaho Contractors Board, which is a division of the State of Idaho, Bureau of Occupational Licenses.However, if you are working on a public works project, you will also need licensing with the Idaho Division of Building Safety.