Iowa Unsecured Installment Payment Promissory Note for Fixed Rate

About this form

The Iowa Unsecured Installment Payment Promissory Note for Fixed Rate is a legal document that outlines a borrower's promise to repay a loan under specified terms. This form is unsecured and establishes a fixed interest rate, incorporating provisions for making installment payments. Unlike secured notes, it does not require collateral, making it suitable for borrowers who need flexible borrowing options without putting up assets at risk.

Main sections of this form

- Borrower's Promise to Pay: The borrower agrees to repay the principal and interest to the lender.

- Interest Rate: Specifies the annual interest rate applicable to the unpaid principal.

- Payment Schedule: Details the monthly payment amount and the due date for payments.

- Borrower's Right to Prepay: Allows the borrower to make extra payments towards the principal without a penalty.

- Late Charges: Outlines conditions and fees in case of late payment.

- Notice of Default: Procedure for notifying the borrower if they default on the loan.

Situations where this form applies

This form is typically used when an individual borrows money from a lender and wants to formalize the terms of the repayment. It is appropriate in situations where the borrower does not wish to secure the loan with collateral and the lender agrees to a fixed interest rate. Common scenarios include personal loans for expenses like medical bills, vehicle purchases, or other needs where immediate funds are required.

Who needs this form

- Individuals borrowing money from friends, family, or financial institutions.

- Lenders seeking to formalize the terms of a loan without requiring collateral.

- Anyone looking for a clear and legally binding document to outline repayment terms.

Steps to complete this form

- Identify the parties involved: Fill in the names and addresses of the borrower(s) and lender.

- Specify the loan amount: Enter the principal amount that the borrower is receiving.

- Set the interest rate: Input the fixed annual interest rate that will apply to the loan.

- Detail the payment schedule: Include the amount of monthly payments and the start date for these payments.

- Include late payment terms: Specify any late charges or penalties that will apply if payments are overdue.

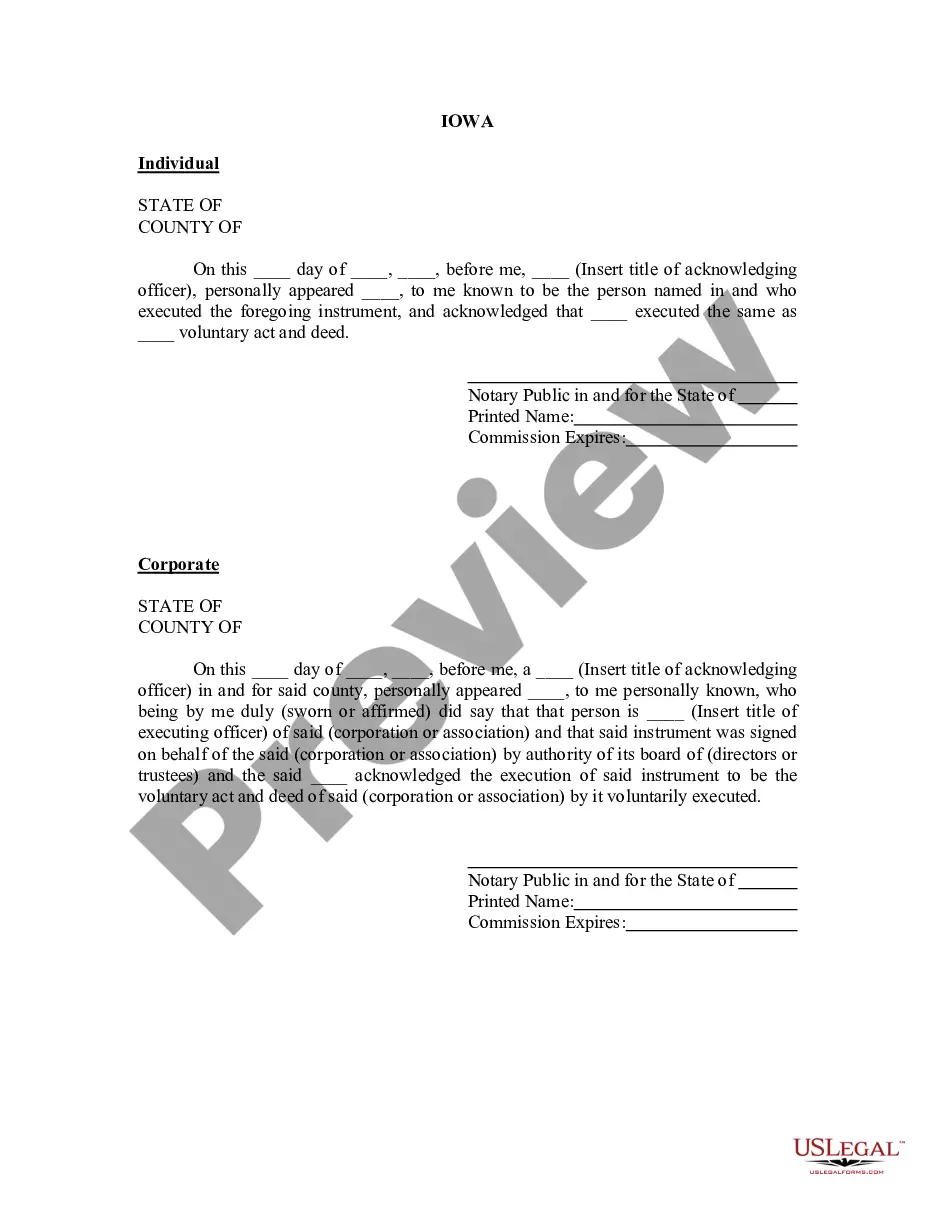

Notarization guidance

Notarization is not commonly needed for this form. However, certain documents or local rules may make it necessary. Our notarization service, powered by Notarize, allows you to finalize it securely online anytime, day or night.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to clearly state the interest rate or leaving it blank.

- Not specifying the payment date or amount clearly.

- Overlooking the requirement for both parties to sign the document.

- Not understanding the implications of default or late payment terms.

Advantages of online completion

- Convenient access to legal documents from the comfort of your home.

- Editable templates allow for quick customization to fit individual needs.

- Reliability of forms drafted by licensed attorneys, ensuring legal compliance.

Looking for another form?

Form popularity

FAQ

An unsecured promissory note is an obligation for payment without any property securing the payment. If the payor fails to pay, the payee must file a lawsuit and hope that the payor has sufficient assets that can be seized to satisfy the loan.

In general, under the Securities Acts, promissory notes are defined as securities, but notes with a maturity of 9 months or less are not securities.The US Supreme Court in Reves recognizes that most notes are, in fact, not securities.

A commercial note is the type of promissory note that is signed between a borrower and a financial institution. A real estate note is when a borrower uses an immovable asset as collateral for the credit. Investment note is used by firms and businesses when procuring funds for the enterprise.

Promissory notes are a valuable legal tool that any individual can use to legally bind another individual to an agreement for purchasing goods or borrowing money. A well-executed promissory note has the full effect of law behind it and is legally binding on both parties.

Commercial Promissory note A commercial promissory note is used when borrowing money from a commercial lender such as a bank or loan agency. In the event the borrower is unable to make required payments, the lender may demand full payment of the loan including interest.

The first step in enforcing an unsecured promissory note is to file a petition with the courts and get a judgment in your favor. Although this is a powerful legal enforcement of your rights under the promissory note, it does not in and of itself guarantee repayment of the note.

So, what's the difference between secured and unsecured promissory notes? It's actually quite simple. A secured note is any debt collateralized with real property like a first deed of trust or car title. Conversely, an unsecured note is any debt not secured by collateral (or uncollateralized).