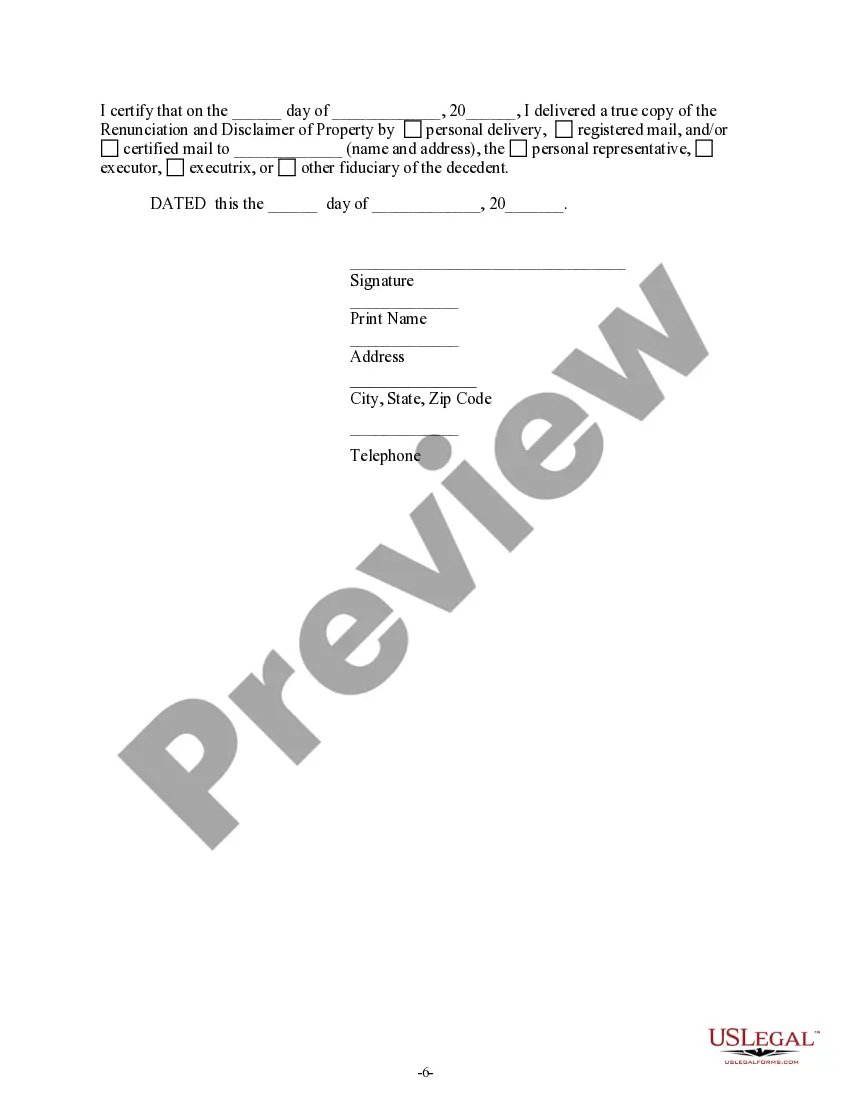

This form is a Renunciation and Disclaimer of Property acquired by the beneficiary through the last will and testament of the decedent. Pursuant to the Iowa Code Chapter 633E, the beneficiary will disclaim a portion of or the entire interest in the described property. The renunciation will relate back to the date of the decedent's death and will serve as a refusal to accept the property. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Iowa Renunciation and Disclaimer of Property from Will by Testate

Description

How to fill out Iowa Renunciation And Disclaimer Of Property From Will By Testate?

Access one of the most extensive collections of legal documents.

US Legal Forms is a platform where you can locate any state-specific template in just a few clicks, including Iowa Renunciation and Disclaimer of Property from Will by Testate forms.

No need to spend countless hours searching for a court-acceptable example. Our certified experts guarantee that you receive the most current samples consistently.

After selecting a pricing option, establish your account. Make the payment via credit card or PayPal. Download the form to your device by clicking Download. That's it! You need to complete the Iowa Renunciation and Disclaimer of Property from Will by Testate form and submit it. To ensure everything is correct, consult your local legal advisor for assistance. Sign up and easily browse approximately 85,000 valuable forms.

- To utilize the document collection, select a subscription plan and create your account.

- If you have already registered, simply Log In and then select Download.

- The Iowa Renunciation and Disclaimer of Property from Will by Testate form will be saved instantly in the My documents section (a space for all forms you retain on US Legal Forms).

- To set up a new account, review the brief guidelines below.

- If you are planning to use a state-specific template, make sure to specify the correct state.

- If possible, examine the description to understand all the nuances of the document.

- Utilize the Preview feature if it is available to review the specifics of the document.

- If everything appears accurate, click Buy Now.

Form popularity

FAQ

To write a disclaimer of inheritance, clearly state your intention to refuse the bequest in question. Specify the property you are disclaiming and identify yourself as the beneficiary. Once completed, deliver your disclaimer to the executor of the estate, following the guidelines provided by the Iowa Renunciation and Disclaimer of Property from Will by Testate for a seamless process.

An example of a disclaimer of inheritance rights is when a named beneficiary states they do not wish to inherit property due to tax consequences or personal reasons. The beneficiary may prefer the estate to pass directly to other heirs instead. This process can be formally addressed in line with the Iowa Renunciation and Disclaimer of Property from Will by Testate to ensure the renunciation is legally valid.

To write an inherited disclaimer letter, begin with a clear statement expressing your intention to disclaim your inheritance. Include identifying details such as your name and the deceased's name, along with a description of the property. Ensure to date and sign the letter before submitting it to the executor, referencing the Iowa Renunciation and Disclaimer of Property from Will by Testate for proper formatting.

A disclaimer clause in a will is a provision that allows a beneficiary to refuse their inheritance voluntarily. This clause clarifies that the beneficiary is not obligated to accept any property or assets from the estate. Understanding this clause is crucial for those considering the Iowa Renunciation and Disclaimer of Property from Will by Testate, as it outlines the rights and options available.

In Iowa, a beneficiary typically has nine months from the date of the decedent’s death to file a disclaimer. This timeframe can vary depending on the specifics of the estate and the property involved. It's important to act swiftly and refer to the Iowa Renunciation and Disclaimer of Property from Will by Testate for guidance on the formal process.

In Iowa, a valid will must be in writing and signed by the testator, or by someone at their direction. The testator must be at least 18 years old and of sound mind. Additionally, the will needs two witnesses who must sign it in the presence of the testator, thereby affirming the authenticity of the Iowa Renunciation and Disclaimer of Property from Will by Testate.

To write a simple disclaimer for the Iowa Renunciation and Disclaimer of Property from Will by Testate, state your intention to refuse the inheritance clearly. Include your name, the name of the deceased, and a description of the property you wish to disclaim. Sign and date the document, ensuring it is delivered to the executor or personal representative of the estate.

A disclaimer is classified as qualified when it adheres to specific IRS regulations, which include being made voluntarily, in writing, and meeting the filing time frame of nine months. It must also effectively convey the disclaimant's intention to renounce the property without conditions. By ensuring that these criteria are met, the property can seamlessly transfer to the next beneficiary, preserving its tax-advantaged status. For further assistance, refer to US Legal Forms, which offers in-depth guidance on Iowa Renunciation and Disclaimer of Property from Will by Testate.

An example of a qualified disclaimer might be an individual who inherits a family property but decides not to accept it. They file a disclaimer within nine months of the decedent's passing, clearly stating their intention to renounce the property. As a result, the property passes to the next eligible heir without tax implications. For comprehensive resources on executing a qualified disclaimer, checking out US Legal Forms can provide essential information.

In Iowa, several types of assets may be exempt from probate, including jointly owned property and assets that have designated beneficiaries, such as life insurance policies and retirement accounts. Additionally, accounts that have payable-on-death (POD) designations are also typically exempt. Exempt assets streamline the transition of property without lengthy probate proceedings, which can save time and reduce stress for beneficiaries. Using the Iowa Renunciation and Disclaimer of Property from Will by Testate effectively can help in handling these assets.