Iowa Farm Lease- Cash of Crop Shares

Description

Definition and meaning

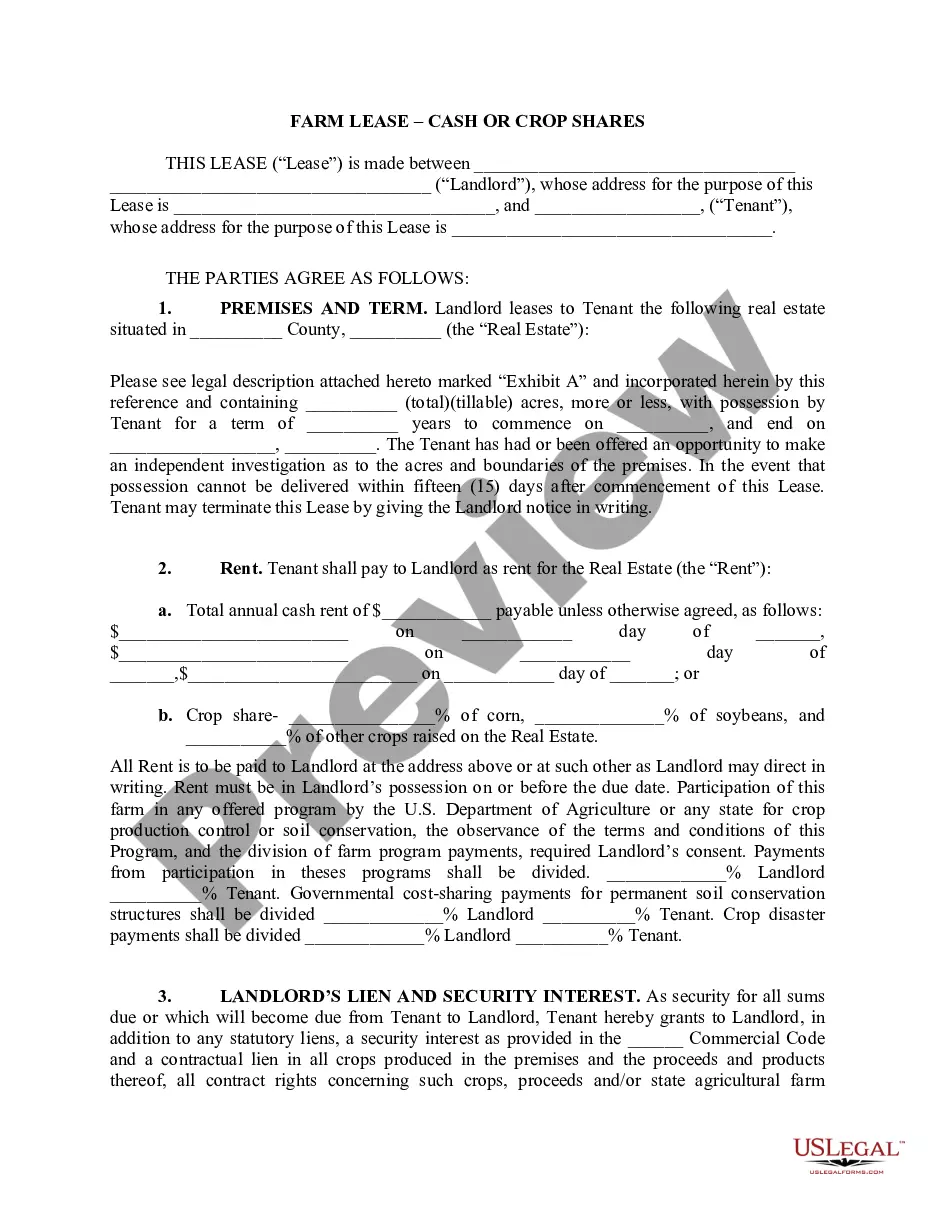

The Iowa Farm Lease - Cash or Crop Shares is a legal document used by landlords and tenants to outline the terms of leasing farmland in Iowa. This lease specifies whether the rent will be paid in cash or through a share of the crops produced on the land. It serves to protect the rights of both parties and provides clarity on their obligations during the lease term.

Key components of the form

The lease includes several important sections that govern the landlord-tenant relationship:

- Premises and Term: This section describes the leased property, including its location and the duration of the lease.

- Rent Payment: Details the amount and method of rent payment, whether as cash or crop shares.

- Landlord's Lien: Outlines the landlord's security interest in the crops grown on the property.

- Environmental Obligations: Conditions under which environmental laws must be followed by the tenant.

- Termination Clause: Specifies the terms for ending the lease.

How to complete a form

Completing the Iowa Farm Lease - Cash or Crop Shares involves the following steps:

- Fill in the Parties' Information: Enter the names and addresses of both the landlord and tenant at the top of the form.

- Describe the Premises: Provide a legal description of the land being leased, which can often be found in property records.

- Specify Lease Terms: Clearly state the rental amount and whether it is paid in cash or crops.

- Sign and Date: Both parties should sign the lease and date it at the bottom.

It is advisable to consult with a legal professional to ensure all details are accurate and legally binding.

Who should use this form

This form is intended for:

- Farmers who want to lease land for crop production.

- Landowners looking to lease agricultural land.

- Individuals seeking to establish a clear legal agreement regarding rental terms.

It facilitates a mutual agreement on the responsibilities and expectations of both parties.

Benefits of using this form online

Accessing the Iowa Farm Lease - Cash or Crop Shares form online provides several benefits:

- Convenience: Users can fill out and download the form at their convenience from anywhere.

- Time-Saving: Immediate access to the latest version of the form saves time compared to obtaining a physical copy.

- Cost-Effective: Downloading the form reduces costs associated with printing and mailing.

- Easy Access to Legal Advice: Many online platforms offer accompanying resources and legal support to assist users in completing the form correctly.

How to fill out Iowa Farm Lease- Cash Of Crop Shares?

Utilize US Legal Forms to acquire a printable Iowa Farm Lease - Cash of Crop Shares.

Our legally admissible forms are crafted and frequently updated by experienced lawyers.

Ours is the most extensive collection of forms available online and offers budget-friendly and precise templates for clients, attorneys, and small to medium-sized businesses.

Examine the form by reading its description and utilizing the Preview feature. If it’s the document you require, click Buy Now. Create your account and complete payment via PayPal or by credit card. Download the template to your device and feel free to reuse it multiple times. Use the Search engine if you need to locate another document template. US Legal Forms provides thousands of legal and tax examples and packages for business and personal requirements, including Iowa Farm Lease - Cash of Crop Shares. Over three million users have successfully used our platform. Choose your subscription plan and access high-quality forms in just a few clicks.

- The templates are organized into state-specific categories.

- Several templates can be viewed prior to downloading.

- To retrieve templates, users must hold a subscription and sign in to their account.

- Click Download next to any form you require and locate it in My documents.

- For users without a subscription, adhere to the following instructions to swiftly find and download Iowa Farm Lease - Cash of Crop Shares.

- Confirm that you have the correct form for the required state.

Form popularity

FAQ

Iowa's cash rents declined from a high of $260 per acre in 2014 to $235 per acre in 2016. The 2020 average state rent is $230 per acre.

Agricultural communities developed approximately 10,000 years ago when humans began to domesticate plants and animals. By establishing domesticity, families and larger groups were able to build communities and transition from a nomadic hunter-gatherer lifestyle dependent on foraging and hunting for survival.

Tenant farming is a system of agriculture whereby farmers cultivate crops or raise livestock on rented lands.A tenant farmer typically could buy or owned all that he needed to cultivate crops; he lacked the land to farm. The farmer rented the land, paying the landlord in cash or crops.

Crop-share arrangements refer to a method of leasing crop land where the production (crop) is shared between the landowner and the operator. Other income items, such as government payments and crop residue, are also often shared as are some of the production expenses.

In a share farming arrangement, a landowner will extend their land to another farmer. From there, they will share the expenses and profits all while still operating as separate businesses. This could be a really great way to scale your farming activities, but it's important to make sure you're doing it right.

Under a crop share agreement, the landlord and tenant agree that rent will be paid in the form of a percentage of income derived from the subject property. For example, parties may agree that the land owner will receive 25% of the income from the land as rent payment.

Farm Land Leases In a typical cash rent lease, the tenant is obligated to pay a set price per acre or a set rate for the leased land. With this form of lease, the tenant bears certain economic risks, and the landlord is guaranteed a predictable return, regardless of commodity prices.