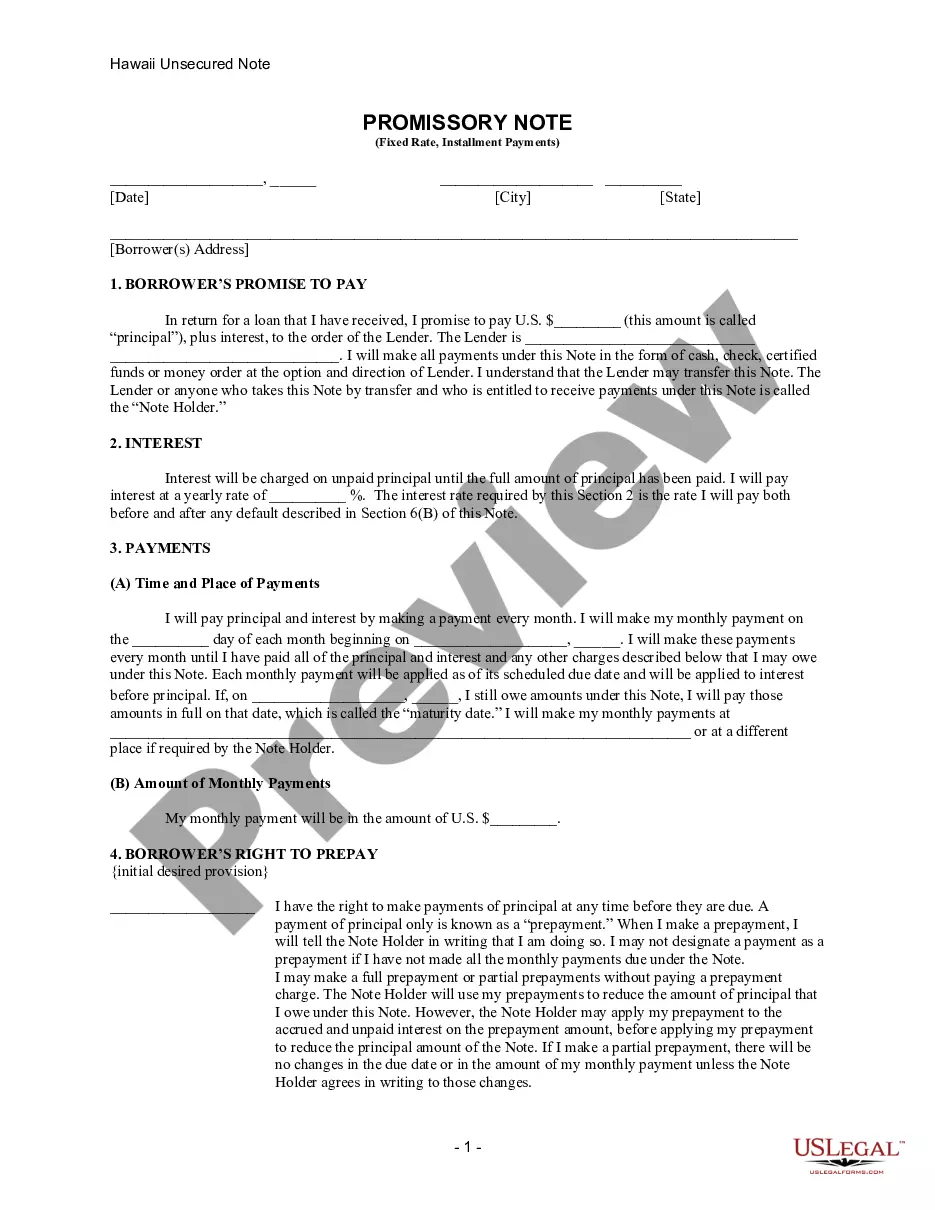

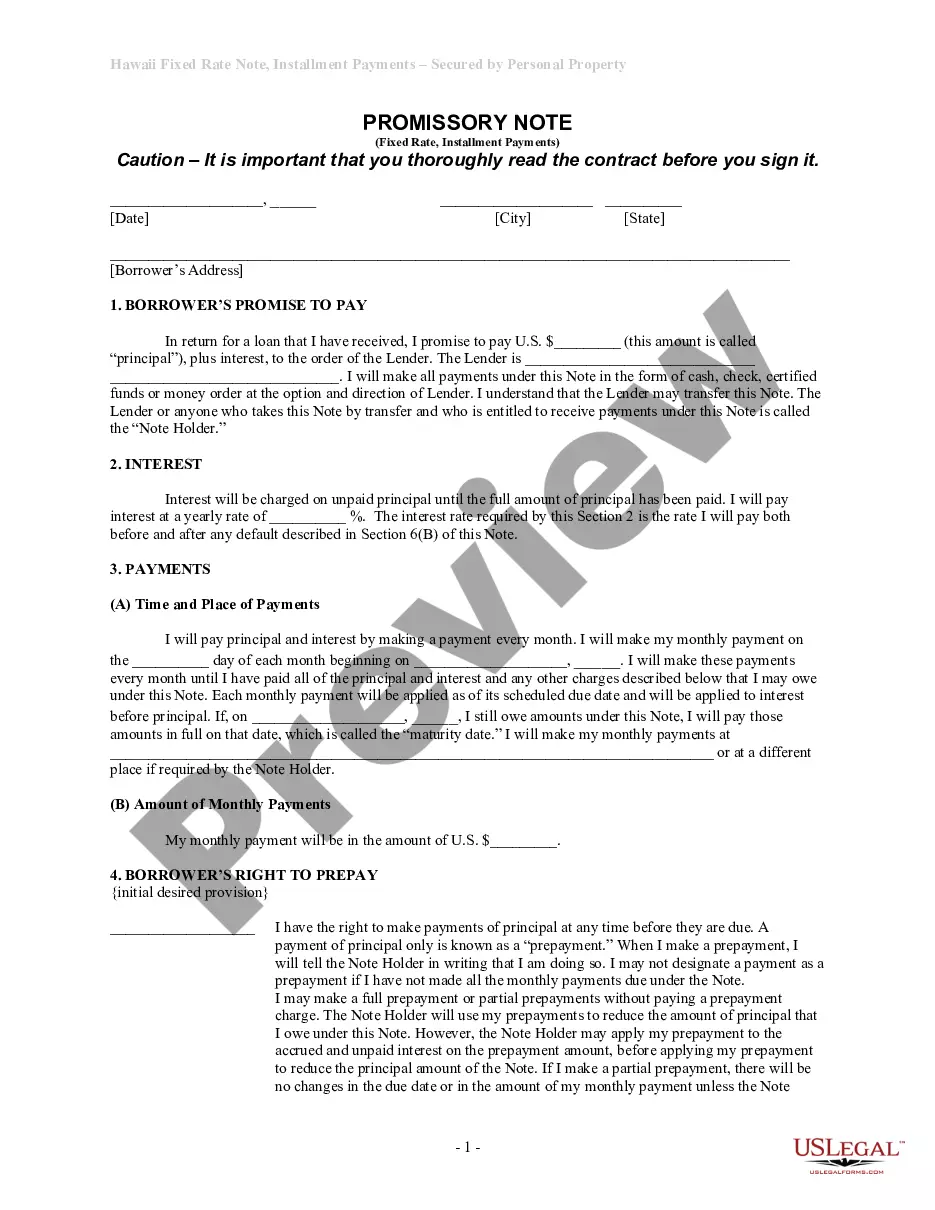

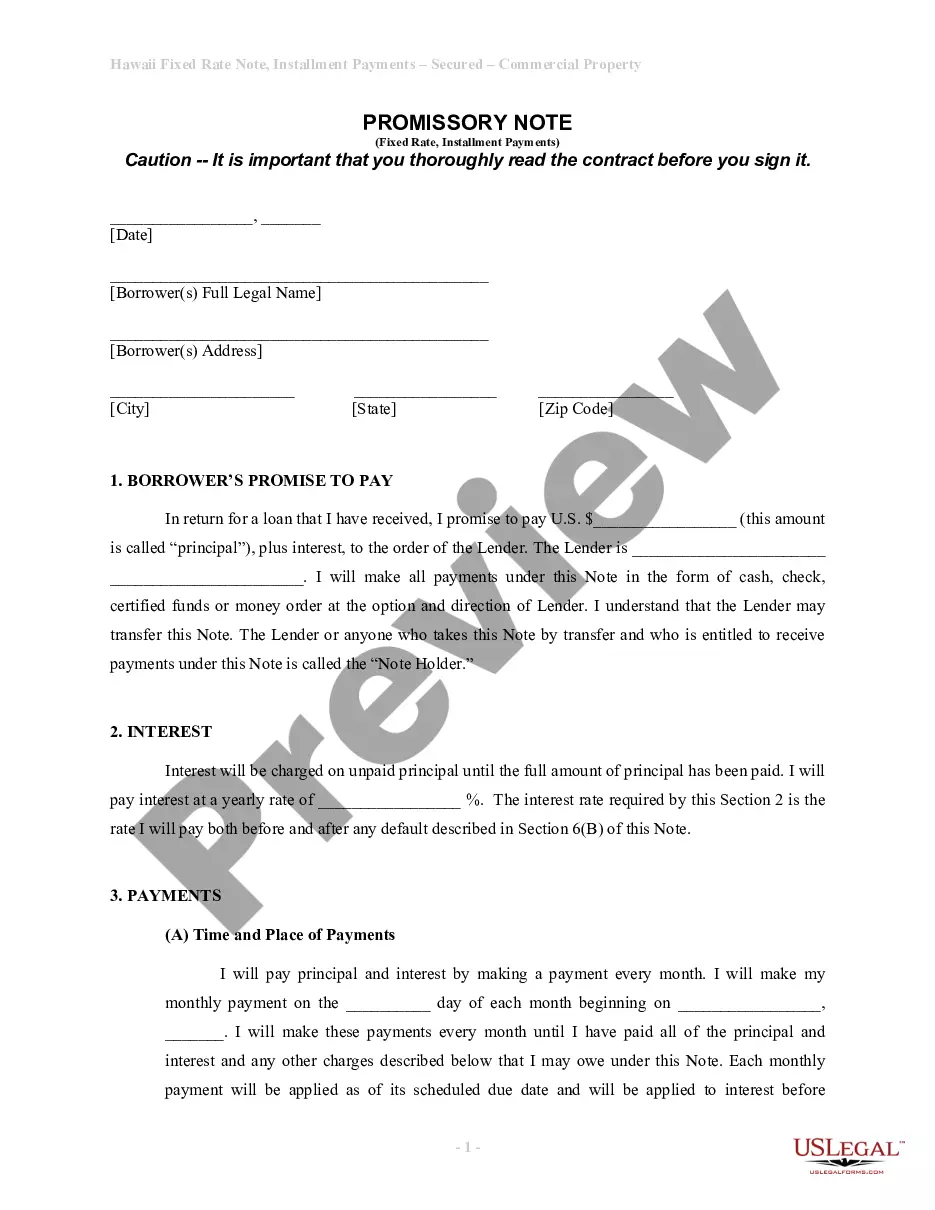

Hawaii Unsecured Installment Payment Promissory Note for Fixed Rate

Description

How to fill out Hawaii Unsecured Installment Payment Promissory Note For Fixed Rate?

Obtain the most comprehensive collection of legal documents.

US Legal Forms is a platform where you can easily locate any state-specific file with just a few clicks, including the Hawaii Unsecured Installment Payment Promissory Note for Fixed Rate samples.

There's no need to spend hours searching for an admissible sample for court.

If possible, review the description to understand all the details of the document. Utilize the Preview feature if available to examine the document's content. Once everything looks correct, click Buy Now. After choosing a pricing plan, create an account. Make the payment via card or PayPal. Download the sample to your computer by clicking Download. That's it! You should submit the Hawaii Unsecured Installment Payment Promissory Note for Fixed Rate template and verify it. To ensure accuracy, consult your local legal advisor for assistance. Sign up and effortlessly access over 85,000 beneficial forms.

- Our certified experts guarantee that you receive updated samples each time.

- To take advantage of the document library, select a subscription and create your account.

- If you have already done so, simply Log In and then click Download.

- The Hawaii Unsecured Installment Payment Promissory Note for Fixed Rate template will automatically be saved in the My documents section (a section for every document you save on US Legal Forms).

- To create a new account, follow the straightforward instructions provided below.

- When using a state-specific sample, be sure to specify the correct state.

Form popularity

FAQ

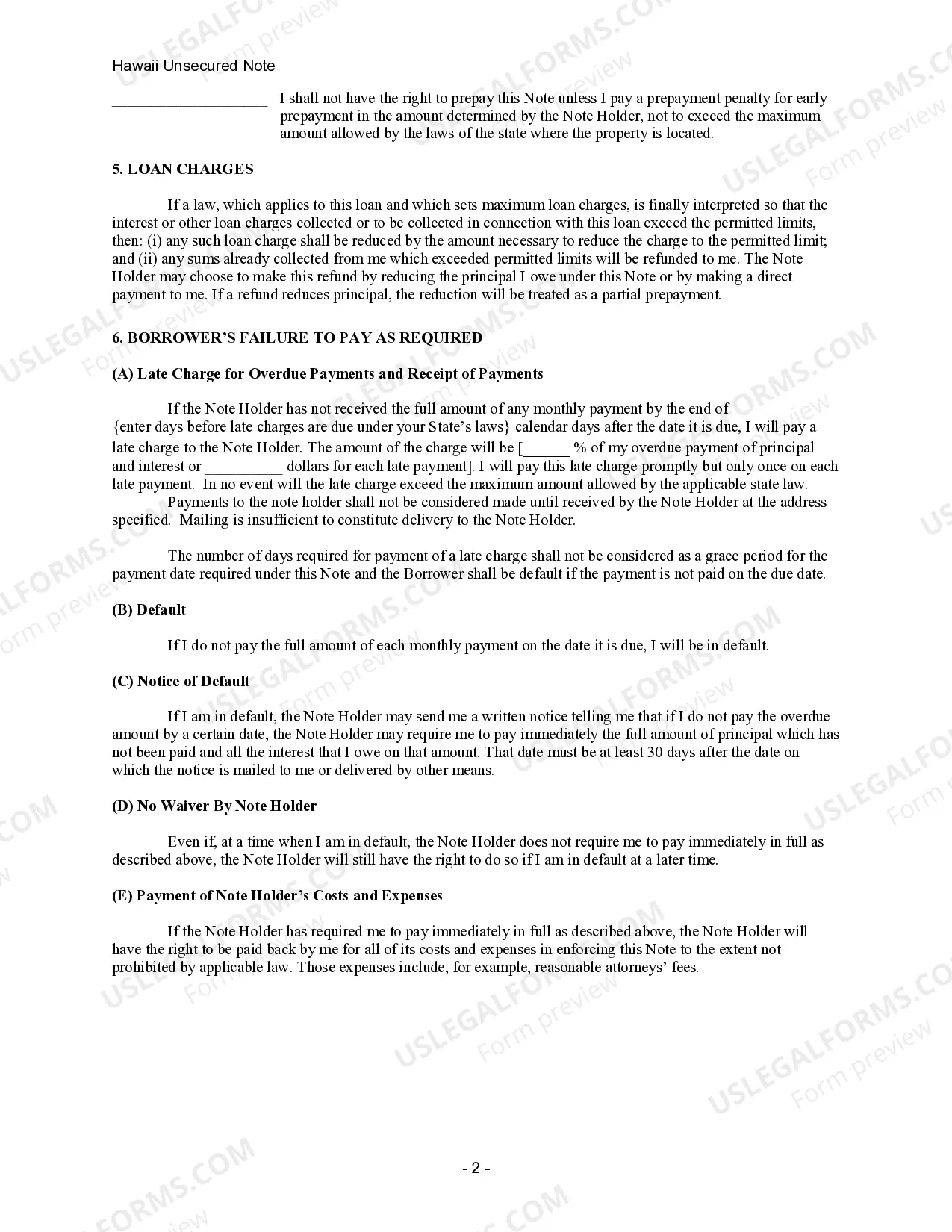

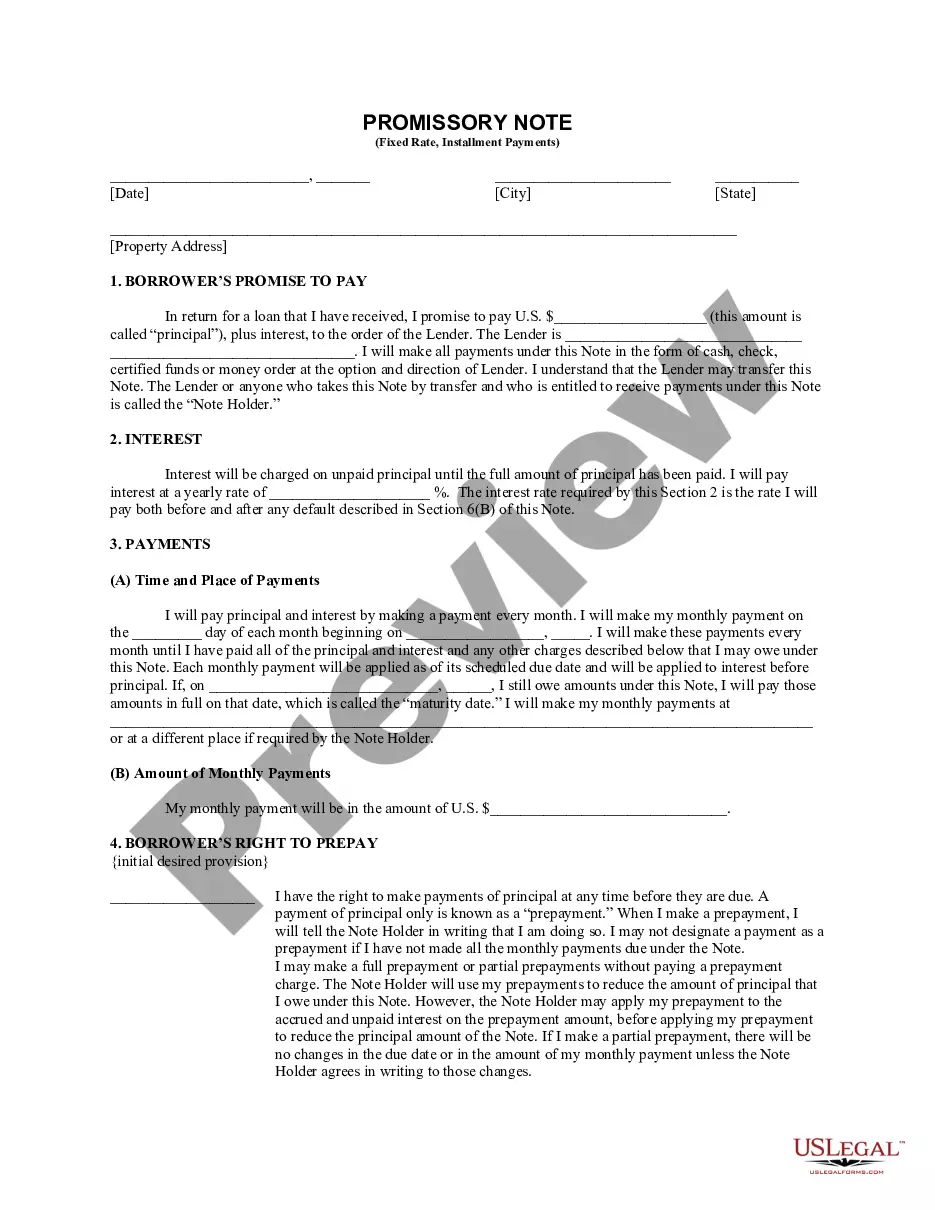

When filling out a promissory note sample, begin with the date and the parties involved. Clearly indicate the principal amount, interest rate, and payment terms. Make sure you capture the essence of a Hawaii Unsecured Installment Payment Promissory Note for Fixed Rate by ensuring it details the expectations for repayments and outlines any consequences for defaulting.

An unsecured form of promissory note is a financial instrument that does not require collateral backing. This means the lender relies solely on the borrower's promise to repay the debt. The Hawaii Unsecured Installment Payment Promissory Note for Fixed Rate falls into this category, offering flexibility for borrowers without risking their assets.

To enforce an unsecured promissory note, the lender must provide proof of the debt and the agreement terms. Legal steps may include sending a demand letter or filing a lawsuit if necessary. Utilizing a Hawaii Unsecured Installment Payment Promissory Note for Fixed Rate ensures all terms are documented, supporting your case in legal situations. You can find helpful resources on the uslegalforms platform to assist with this process.

A reasonable interest rate for a promissory note can vary based on market conditions and borrower creditworthiness. Typically, it ranges from 5% to 15%. When crafting a Hawaii Unsecured Installment Payment Promissory Note for Fixed Rate, it’s crucial to consider current rates and ensure they align with legal guidelines and expectations. As you set the rate, transparency helps build trust between the lender and borrower.

An installment is a part of a payment plan, while a promissory note is a document that outlines a borrower’s promise to repay a debt. A Hawaii Unsecured Installment Payment Promissory Note for Fixed Rate combines these concepts, allowing for fixed payments over time. This type of note specifies the terms, including payment amounts and due dates, providing clarity for both parties.

You can get a Hawaii Unsecured Installment Payment Promissory Note for Fixed Rate by using online legal form services that specialize in these documents. First, choose a reliable platform such as uslegalforms, where you can find a range of templates suited to your situation. Simply fill in your details, and you’ll have your promissory note ready to go, ensuring compliance with Hawaii's legal requirements. This method simplifies obtaining a necessary financial document and saves you time.

To obtain a Hawaii Unsecured Installment Payment Promissory Note for Fixed Rate, you can access various online resources that offer customizable templates. These templates allow you to fill in your specific terms and conditions, making the process straightforward. Platforms like uslegalforms provide comprehensive options to create a legally sound note tailored to your needs. This approach ensures that you get the appropriate document with minimal hassle.

You do not necessarily need a lawyer to create a Hawaii Unsecured Installment Payment Promissory Note for Fixed Rate. However, having legal assistance can ensure that your note meets all necessary regulations and protects your interests. If you feel uncertain about the process, consulting with a legal expert can provide valuable peace of mind. Using a trusted platform like uslegalforms can guide you through the creation of your note with ease.

Generally, a promissory note does not require collateral if it is unsecured. This can make borrowing more accessible and less daunting for individuals seeking funds. Choosing a Hawaii Unsecured Installment Payment Promissory Note for Fixed Rate allows you to pursue financing without the need for collateral, ensuring a smoother borrowing experience.

Yes, a promissory note can indeed be unsecured. This means the borrower is not required to put up collateral, which can be advantageous for both parties. A Hawaii Unsecured Installment Payment Promissory Note for Fixed Rate exemplifies this flexibility, allowing borrowers to access funds without risking their assets.