UCC1 - Financing Statement Addendum - Georgia - For use after July 1, 2001. This form permits you to add an additional debtor if necessary to cover collateral as specified in the statement.

Georgia UCC1 Financing Statement Addendum

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

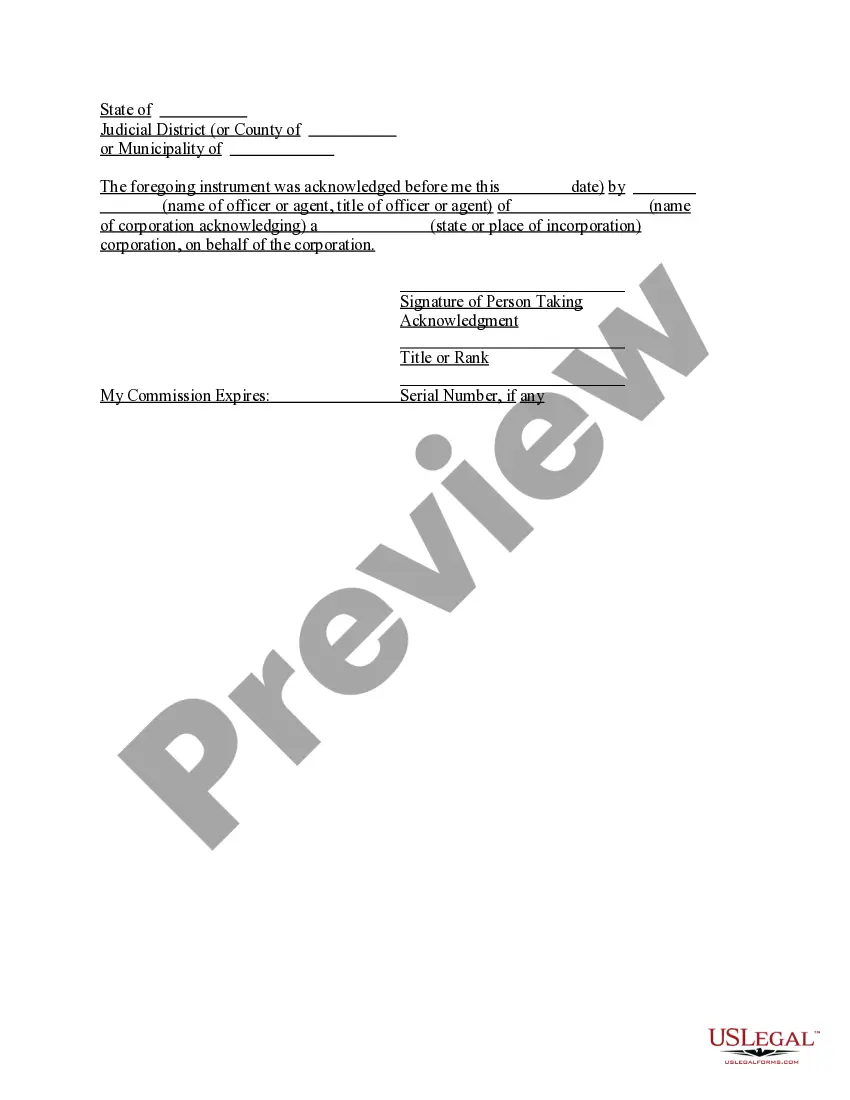

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Georgia UCC1 Financing Statement Addendum?

Obtain entry to one of the most comprehensive collections of sanctioned documents.

US Legal Forms serves as a resource to discover any document specific to a state in a few clicks, including Georgia UCC1 Financing Statement Addendum templates.

No need to waste time searching for an admissible sample.

Use the Preview option if available to verify the document's details. If all is accurate, click the Buy Now button. Following the selection of a pricing plan, create your account. Make payment via card or PayPal. Download the document by clicking the Download button. That's all! You need to submit the Georgia UCC1 Financing Statement Addendum form and verify it. To ensure accuracy, consult your local legal advisor for assistance. Sign up and conveniently browse approximately 85,000 helpful forms.

- Our experienced professionals guarantee you access to the latest documents each time.

- To utilize the forms library, select a subscription and create an account.

- If you have already established an account, simply Log In and click Download.

- The Georgia UCC1 Financing Statement Addendum template will be promptly stored in the My documents section (a tab for each form you save on US Legal Forms).

- To establish a new profile, adhere to the straightforward steps outlined below.

- When utilizing state-specific documents, ensure you specify the correct state.

- If feasible, review the details to grasp all aspects of the document.

Form popularity

FAQ

1 financial statement should be filed promptly after entering into a secured transaction. Timely filing is critical, as it establishes priority in case of debtor bankruptcy. Using the Georgia UCC1 Financing Statement Addendum can guide you through the filing process, ensuring your security interests are properly recorded.

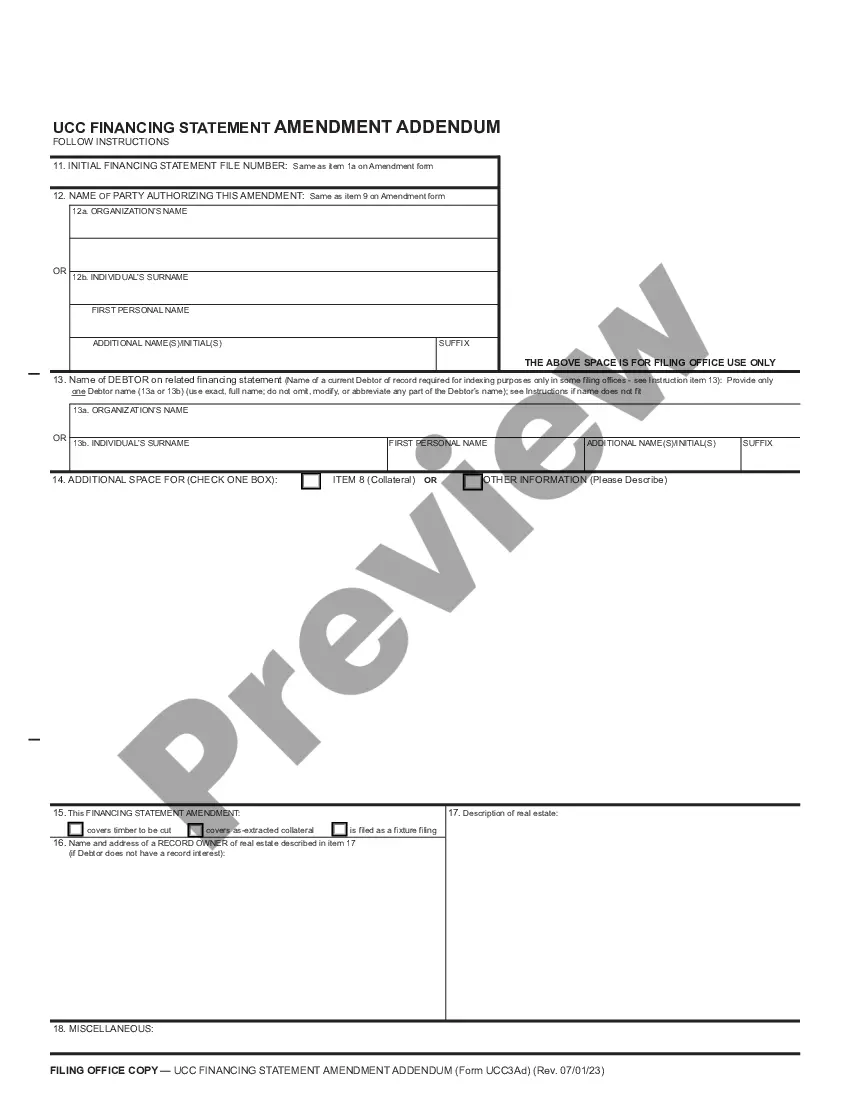

A UCC financing statement secures interest in personal property, while a fixture filing pertains to items attached to real estate. The distinction impacts how creditors can enforce their claims and the process for securing their interests. Understanding the Georgia UCC1 Financing Statement Addendum can clarify these differences and help you file appropriately.

The UCC requirements include providing accurate details in your financing statements and following filing protocols. Different states may have specific rules, so it's essential to check Georgia's guidelines. Using the Georgia UCC1 Financing Statement Addendum ensures you comply with local requirements and protect your investments.

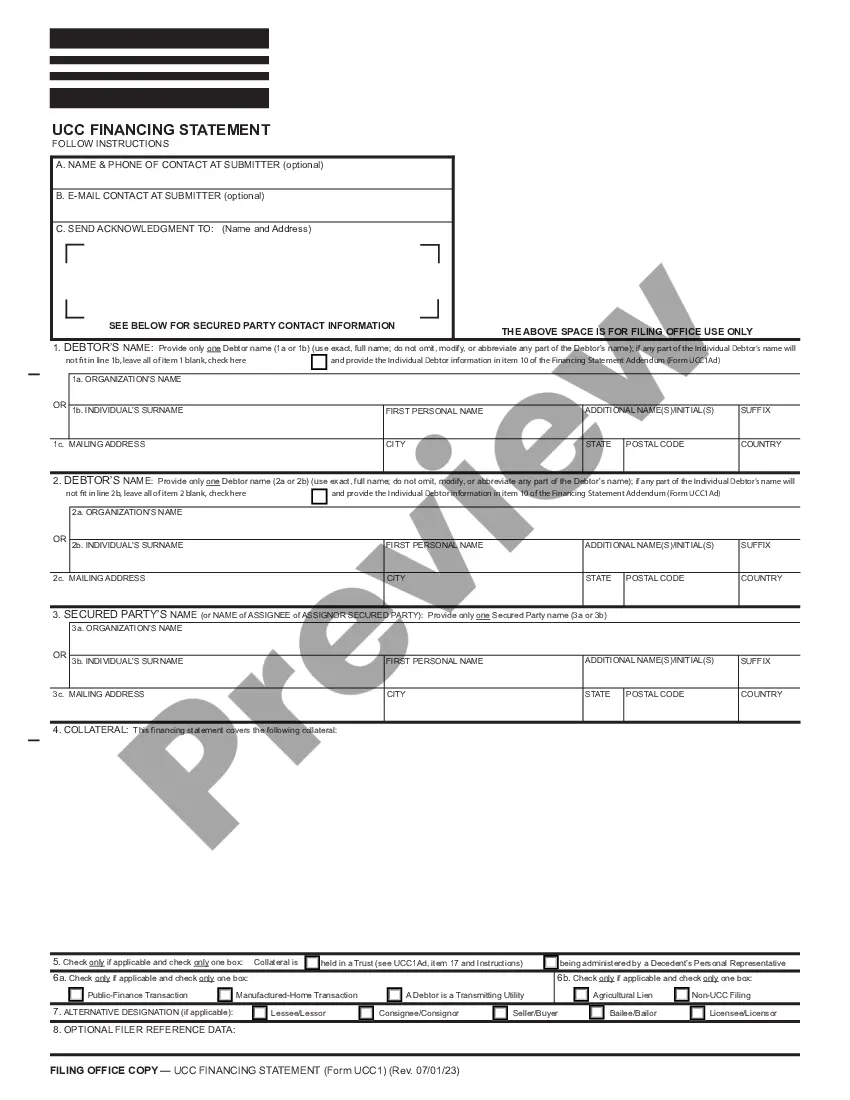

To file a UCC-1 financing statement, you need certain information such as the debtor's name, the secured party's name, and a description of the collateral. Additionally, the filing must be done through the appropriate state office. For optimal results, consider the Georgia UCC1 Financing Statement Addendum to meet these requirements efficiently.

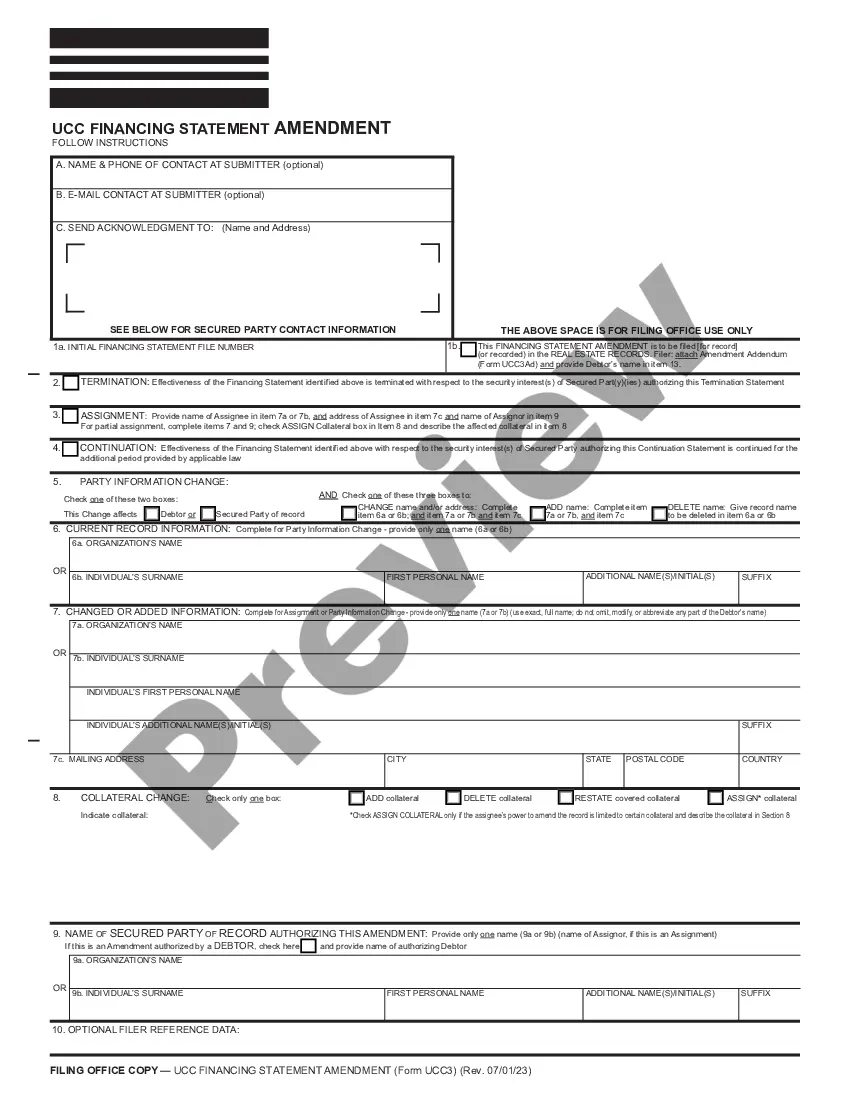

A UCC financing statement amendment modifies an existing UCC-1 financing statement. This can include adding or deleting collateral, changing the debtor's name, or updating the secured party's information. Utilizing the Georgia UCC1 Financing Statement Addendum allows you to effectively manage changes in your agreements.

1 financing statement is a legal document used to secure an interest in personal property. By filing this statement, a creditor establishes their rights to the assets described within it. In Georgia, it is crucial for protecting your financial interests when using the Georgia UCC1 Financing Statement Addendum.

Filing a UCC financing statement serves to publicly declare a lender’s security interest in a debtor’s personal property. This process establishes priority over creditors and informs potential buyers about existing claims on the property. By utilizing the Georgia UCC1 Financing Statement Addendum, you can simplify this essential process and protect your financial interests. It ensures that everyone is aware of your rights, fostering transparency in financial transactions.

The UCC financing statement amendment refers to a modification of an existing UCC filing, which includes changes to the information in the original filing. This may involve updating details about the debtor or the secured party, or the collateral being secured. When you utilize the Georgia UCC1 Financing Statement Addendum, you ensure that your filing reflects the most accurate and current information. This is essential for maintaining clear legal rights and priorities.

A UCC filing is generally considered a good tool for managing credit and securing financing. It formally protects a lender's rights to collateral, which can encourage lending and promote trust between parties. However, a Georgia UCC1 Financing Statement Addendum does reveal to the public that a lender holds a claim, which may affect the debtor's credit profile. Therefore, understanding how such filings work is crucial for making informed financial decisions.

To fill out a UCC financing statement, you need to gather essential information regarding the debtor and the secured party. Ensure that you provide accurate details about the collateral involved, as these are critical for a valid Georgia UCC1 Financing Statement Addendum. You can navigate this process easily by using platforms like uslegalforms, which offer templates and guidance tailored to meet specific state requirements. Take your time to review all entries to avoid errors that could affect your security interest.