Georgia Affidavit of Seller's Residence

Description

Definition and meaning

The Georgia Affidavit of Seller's Residence is a legal document utilized during the sale of a property in Georgia. This affidavit is meant to verify the residency status of the seller, ensuring that the appropriate tax withholding laws are adhered to. It establishes whether the seller qualifies as a resident or nonresident under Georgia law.

Who should use this form

This form is intended for individuals or entities selling property in Georgia. Both resident and nonresident sellers should complete this affidavit to clarify their tax obligations related to the sale. Specifically, it is applicable to:

- Homeowners selling their primary residence.

- Property owners selling commercial real estate.

- Entities such as corporations or partnerships engaged in property transactions.

How to complete a form

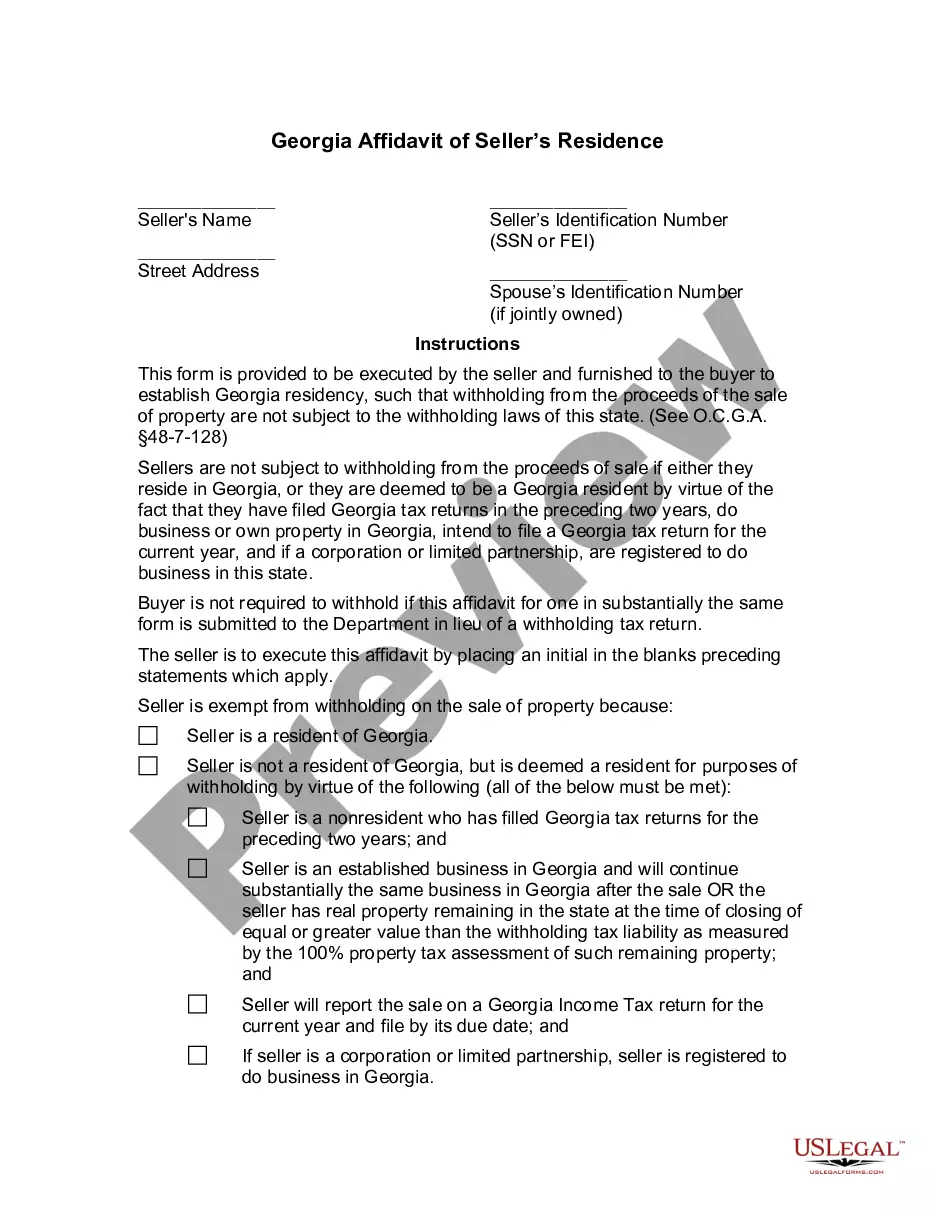

Completing the Georgia Affidavit of Seller's Residence involves several key steps. Firstly, the seller needs to fill in their name and street address accurately. Next, the seller must provide their identification number, which could be a Social Security Number (SSN) or a Federal Employer Identification Number (FEI). If applicable, the seller’s spouse's identification number should also be noted.

After this information has been completed, the seller indicates their residency status by initializing the relevant statements in the affidavit. Lastly, the form must be signed and dated in the designated areas.

Key components of the form

The Georgia Affidavit of Seller's Residence consists of several critical components, including:

- Seller's Information: Includes the seller's name, address, and identification numbers.

- Residency Status: A section that outlines the criteria for being classified as a Georgia resident or nonresident.

- Signature Lines: Spaces for the seller’s signatures, indicating the form's authenticity.

- Notary Acknowledgment: A section for a notary public to verify the affidavit.

Common mistakes to avoid when using this form

Users often make several mistakes when filling out the Georgia Affidavit of Seller's Residence. To prevent these errors, consider the following:

- Failing to provide accurate identification numbers, which can lead to processing delays.

- Not initializing the correct statements about residency, potentially causing misunderstandings regarding tax liabilities.

- Inadequate signatures; ensure all required parties sign the document where necessary.

- Neglecting to have the form notarized, which is essential for legal validation.

What documents you may need alongside this one

When preparing the Georgia Affidavit of Seller's Residence, you may need to gather several supporting documents, including:

- Proof of identity, such as a government-issued ID.

- Tax returns from the past two years, particularly for nonresident sellers.

- Any relevant property documents that verify ownership or residency.

What to expect during notarization or witnessing

When finalizing the Georgia Affidavit of Seller's Residence, notarization is required. During this process, you can expect:

- To present the affidavit along with valid identification to the notary public.

- The notary will verify your identity and witness your signature on the document.

- Once notarized, the notary will affix their seal, providing an official endorsement that validates the affidavit.

How to fill out Georgia Affidavit Of Seller's Residence?

Managing legal paperwork demands focus, accuracy, and utilizing well-structured templates. US Legal Forms has been assisting individuals nationwide for 25 years, so when you select your Georgia Affidavit of Seller's Residence template from our platform, you can trust it complies with federal and state laws.

Engaging with our service is straightforward and rapid. To obtain the necessary document, all you require is an account with an active subscription. Here’s a quick guide for you to retrieve your Georgia Affidavit of Seller's Residence in no time.

All documents are created for versatile use, like the Georgia Affidavit of Seller's Residence you see on this page. If you need them in the future, you can fill them out without re-payment - simply access the My documents tab in your profile and complete your document whenever you require it. Try US Legal Forms and complete your business and personal documentation swiftly and in full legal compliance!

- Ensure to thoroughly review the form's content and its alignment with general and legal standards by previewing it or examining its description.

- Seek an alternative official template if the previously accessed one does not fit your circumstances or state regulations (the option for that is in the top page corner).

- Log in to your account and save the Georgia Affidavit of Seller's Residence in your preferred format. If it’s your first interaction with our service, click Buy now to proceed.

- Sign up for an account, choose your subscription plan, and pay using your credit card or PayPal account.

- Decide the format in which you wish to receive your form and click Download. Print the blank document or add it to a professional PDF editor for a paperless preparation.

Form popularity

FAQ

Nonresidents who sell or transfer Georgia real property are subject to a 3% withholding tax. The withholding tax is to be computed by applying the 3% rate to the purchase price.

Am I a Georgia Nonresident. Nonresidents are individuals who are not residents of Georgia at any time during the year but have income subject to taxation in Georgia. In the residency status section of the Georgia individual tax return (Georgia Form 500), the taxpayer will indicate they are a Nonresident.

Withholding on Sales or Transfer of Real Property and Associated Tangible Personal Property by Nonresidents.

Out-of-state sellers must collect tax on all sales of tangible personal property made at a convention or trade show in this state. Additionally, these sellers must collect the tax on all sales made as the result of orders taken at a convention or trade show attended in this state.

Non-residents who work in Georgia or receive income from Georgia sources and are required to file a Federal income tax return are required to file a Georgia Form 500 Individual Income Tax Return.

What taxes do you pay when you sell your house in Georgia? The seller is typically responsible for paying real estate transfer taxes in Georgia, which are $1 for every $1,000 of the sale price. So, if you sell your home for $600,000, your tax bill for transferring ownership will be $6,000.

An affidavit of ownership to record in the real property records indicating that the remaining co-owner(s) of real property in Georgia hold the deceased co-owner's property interest due to a right of survivorship.

Georgia capital gains tax rates Tax rateSingleMarried filing separately2.00%$751 to $2,250$501 to $1,5003.00%$2,251 to $3,750$1,501 to $2,5004.00%$3,751 to $5,250$2,501 to $3,5005.00%$5,251 to $7,000$3,501 to $5,0002 more rows