Georgia Closing Statement

What this document covers

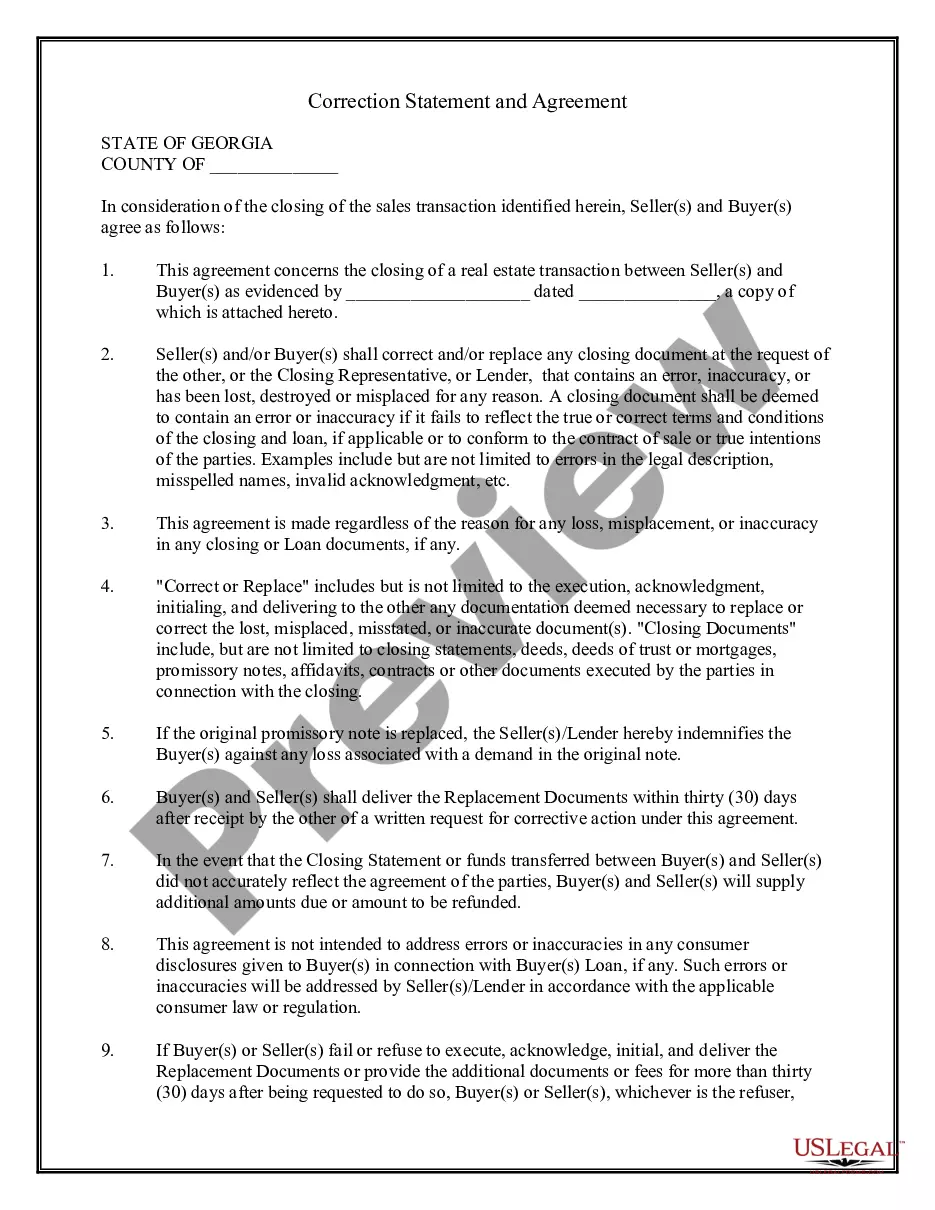

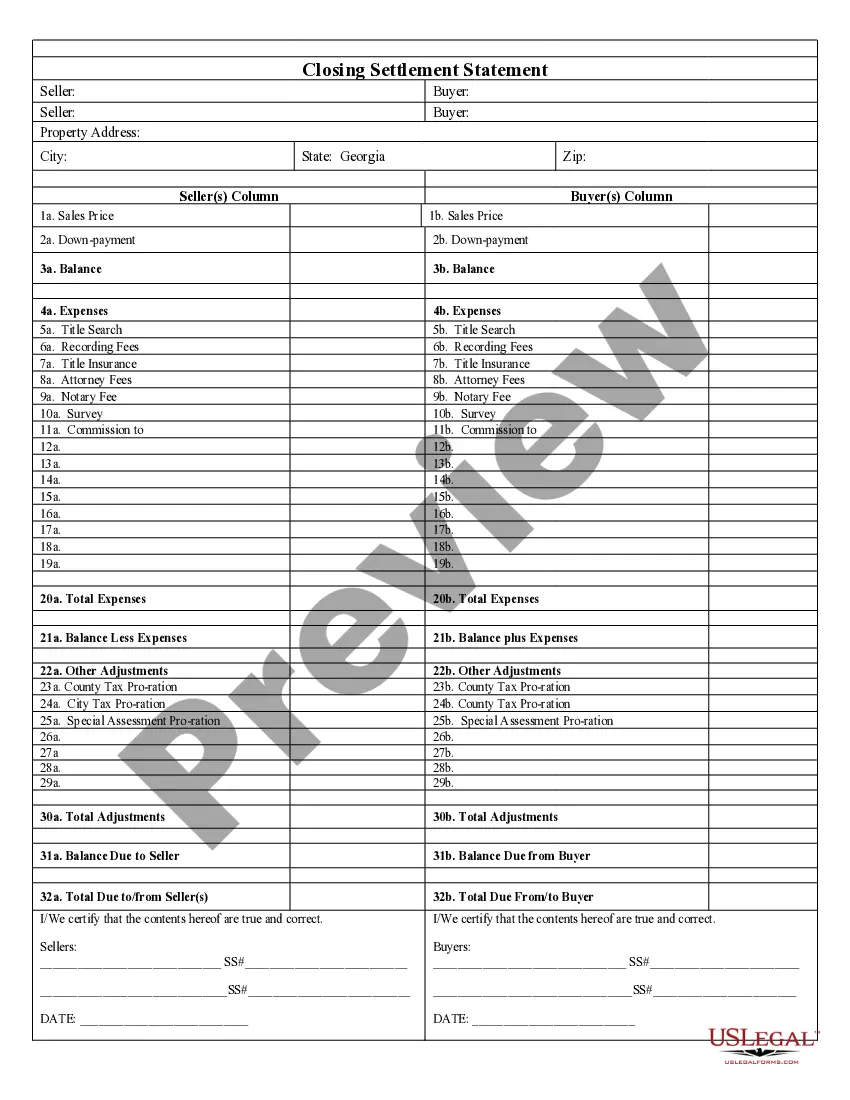

The Closing Statement is a crucial document in real estate transactions, specifically for cash sales or owner financing scenarios. This form details the financial aspects of the transaction, ensuring that both the buyer and seller have a clear understanding of all expenses, balances, and the final amounts exchanged. This form is distinct from other settlement statements as it provides a comprehensive overview of all costs associated with the sale, verified and signed by both parties.

Key components of this form

- Balance: Shows the total financial balance of the transaction.

- Expenses: Lists all costs incurred during the transaction, including title search, recording fees, and attorney fees.

- Total Expenses: Summarizes all expenses related to the transaction.

- County Tax Pro-ration: Details tax adjustments based on property sale dates.

- Certification Sections: Includes signatures and dates from the seller and buyer, affirming the accuracy of the information provided.

When to use this form

This Closing Statement should be used in any cash sale real estate transaction or when owner financing is involved. It is necessary during the closing process to provide an accurate account of all costs and settlements between the buyer and seller. By using this form, both parties can ensure clarity and prevent potential disputes regarding financial commitments in the transaction.

Who needs this form

- Real estate buyers who are purchasing property through cash or owner financing.

- Real estate sellers involved in a transaction requiring detailed financial reporting.

- Real estate agents overseeing the sale to facilitate the closing process.

- Legal professionals or paralegals handling real estate transactions.

Steps to complete this form

- Identify the parties involved: Clearly list the names of the buyer and seller in the designated fields.

- Specify the property: Enter the details of the property being sold, including the address and legal description.

- List all expenses: Document all fees associated with the transaction, including title searches and attorney fees.

- Calculate total amounts: Total the expenses and adjust for taxes and other considerations.

- Sign and date: Ensure that both the buyer and seller sign and date the statement to confirm its accuracy.

Notarization guidance

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to include all relevant expenses, which can lead to disputes later.

- Not obtaining the necessary signatures from both parties.

- Inaccurate calculations of totals or adjustments.

Advantages of online completion

- Convenience: Download and complete the form at your own pace.

- Editability: Easily modify details as needed before finalizing.

- Reliability: Access forms that are drafted by licensed attorneys, ensuring legal compliance.

Key takeaways

- The Closing Statement is vital for ensuring a clear understanding of financial obligations in real estate transactions.

- Accurate completion of all sections helps prevent disputes post-transaction.

- Always review state-specific requirements to ensure compliance.

Looking for another form?

Form popularity

FAQ

At closing, you should receive a copy of your title, often referred to as the title deed. This document establishes your ownership of the property in Georgia. Make sure to verify that you receive all relevant paperwork during the closing process. For any missed documents, use services like USLegalForms to help you obtain copies efficiently.

If you need a copy of your Georgia closing statement, start by contacting the party who handled your closing, such as your attorney or title company. They can provide you with duplicate copies upon request. Additionally, USLegalForms offers resources to help you secure the necessary documents, making the retrieval process faster and more efficient.

To obtain a Georgia closing statement, you should reach out to the closing attorney or title company involved in your transaction. They typically prepare and provide this document during the closing process, detailing all settlement charges. If you require access afterward, platforms like USLegalForms can assist you in retrieving it, ensuring you have the information you need.

A closing statement reveals the complete financial picture of a real estate transaction, detailing costs and funds exchanged at closing. It shows the buyer’s and seller’s responsibilities, including taxes, fees, and any adjustments made. Understanding the Georgia Closing Statement is essential for ensuring that both parties are aware of their financial commitments and can prevent any disputes post-closing.

In Atlanta, a Georgia Closing Statement generally follows a structured layout that itemizes all financial transactions related to the property sale. Your closing statement will likely include sections for buyer and seller information, a detailed breakdown of costs, and final figures showing what each party owes or receives. This organized format helps facilitate a smooth closing process by providing clarity on all financial aspects.

Typically, the final closing statement is prepared by the closing attorney or a title company involved in the transaction in Georgia. This professional is responsible for gathering all necessary financial data from both the buyer and the seller. By doing so, they ensure that the Georgia Closing Statement is accurate and comprehensive, providing reassurance to all parties.

Although a closing statement is different from a cover letter, it’s important to include key elements in both documents. In the context of a Georgia Closing Statement, the essential information includes payment details, responsibility for closing costs, and escrow arrangements. This clarity helps all parties understand their financial commitments before finalizing the transaction.

The closing statement is usually prepared by your closing attorney or title company. They have the expertise to accurately calculate all final costs and financial obligations in the transaction. Additionally, using services like US Legal Forms can aid you in understanding how to prepare a proper Georgia Closing Statement if you ever find yourself needing to do so.

To get your closing statement, reach out to your lender or the closing attorney managing your transaction. They are responsible for providing you with this essential document. Alternatively, if you need a blank template, US Legal Forms has resources to help you create a Georgia Closing Statement quickly and efficiently.

You can obtain a closing statement from your closing attorney or title company, as they typically prepare this document for you. If you prefer a DIY approach, consider using US Legal Forms, where you can find templates for the Georgia Closing Statement that cater to your specific needs.