Georgia Quitclaim Deed from Individual to LLC

What this document covers

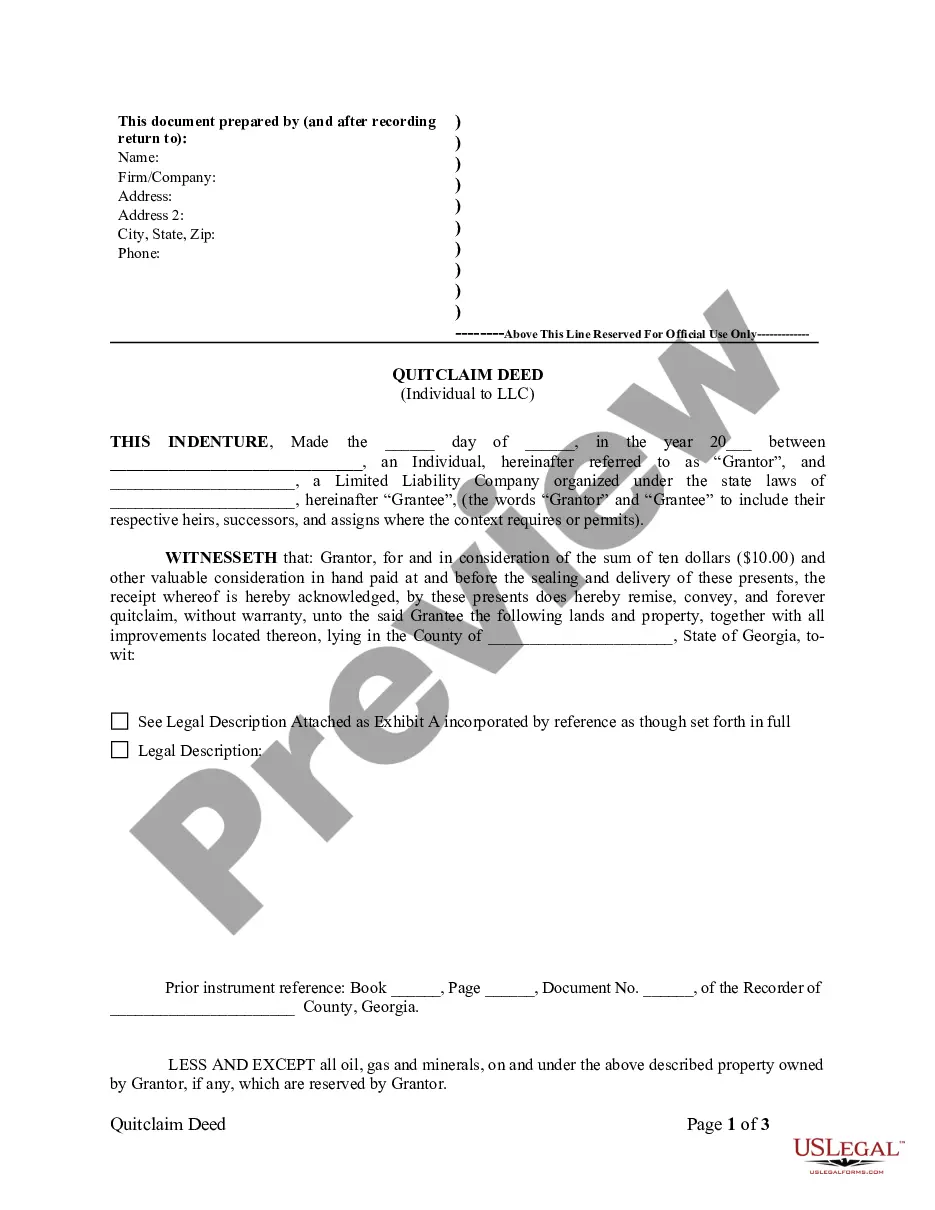

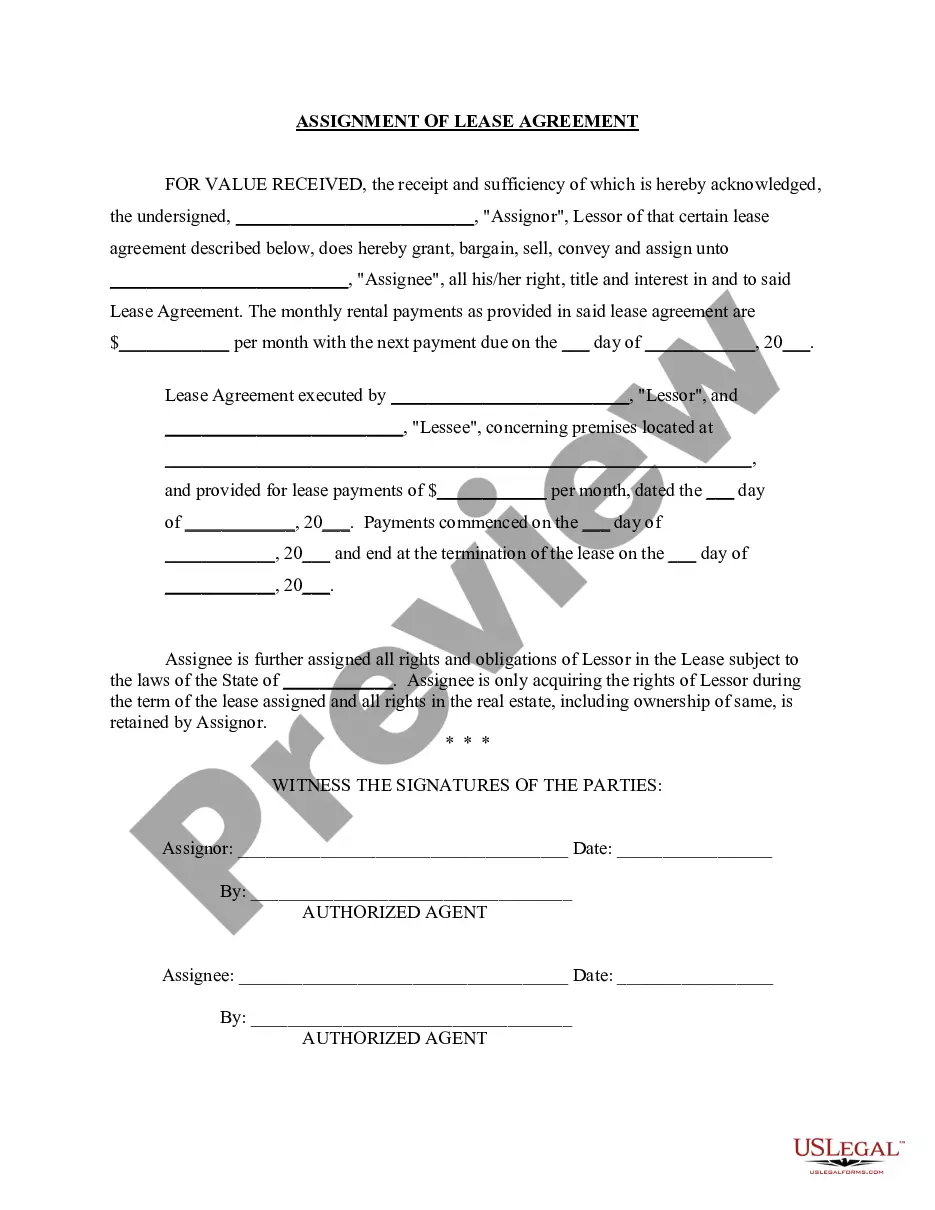

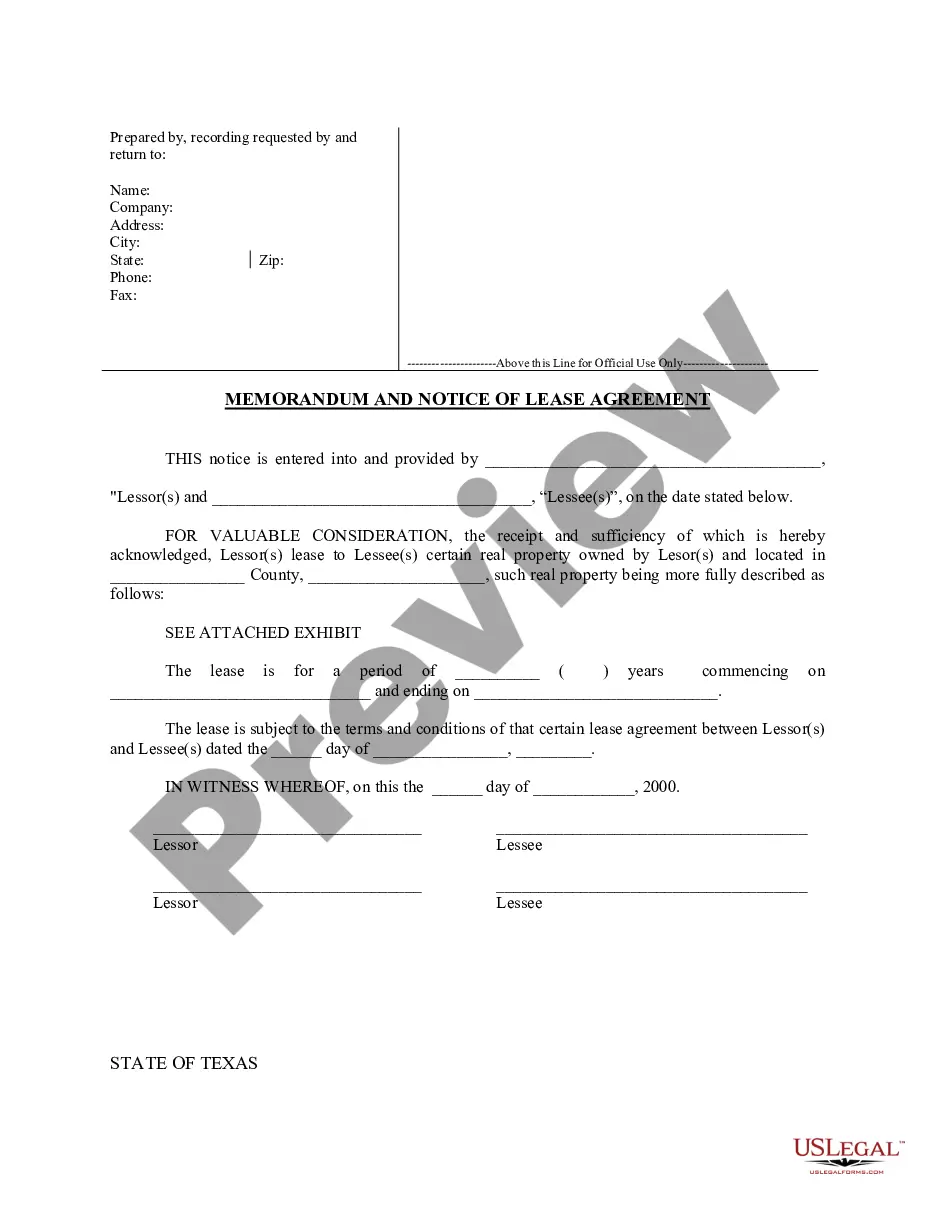

The Quitclaim Deed from Individual to LLC is a legal document that allows an individual (the grantor) to transfer ownership of a property to a Limited Liability Company (the grantee). Unlike a warranty deed, this form does not guarantee that the title is clear of debts or liens. It is specifically designed for individuals who wish to convey their interest in real estate to an LLC without making any warranties about the property's condition or title.

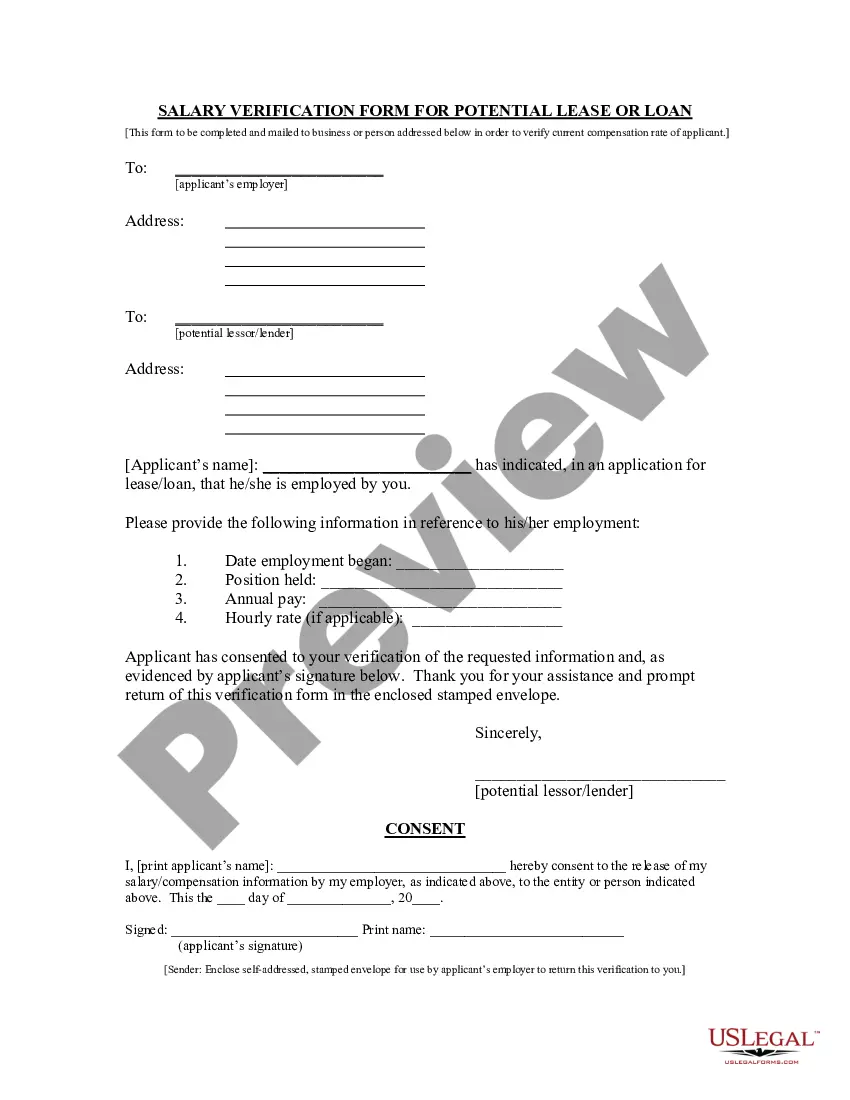

Form components explained

- Identification of the grantor (individual) and grantee (LLC).

- Consideration clause, stating the payment (usually a nominal amount).

- Description of the property being conveyed.

- Reservation clause for oil, gas, and minerals under the property.

- Statement of subject to existing zoning ordinances and easements.

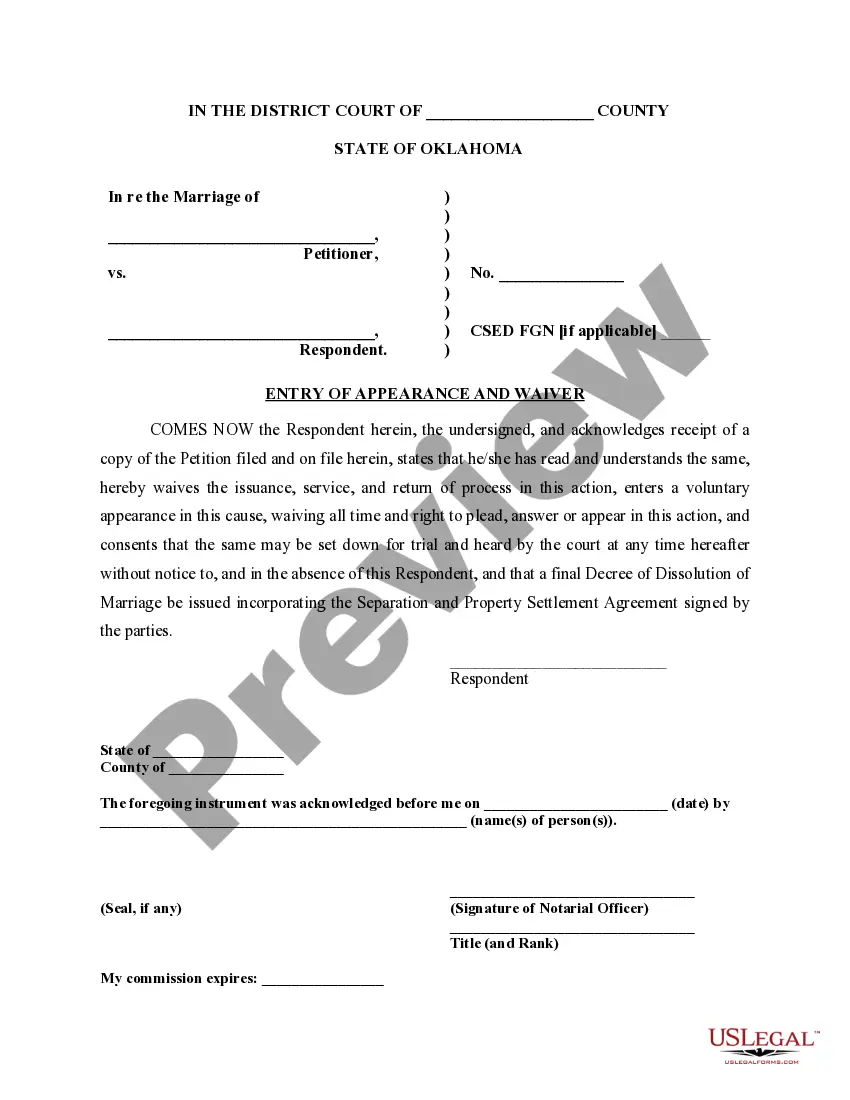

- Signature lines for grantor and any witnesses, if required.

When to use this form

This form is typically used when an individual wants to transfer property to an LLC, often for reasons such as limited liability protection, asset management, or estate planning. It may be suitable when the property is being used for business purposes, or if the owner is converting personal real estate into business assets.

Who should use this form

- Individuals who own property and wish to transfer it to their LLC.

- Business owners looking to formalize their property ownership structure.

- Real estate investors who want to manage their holdings through an LLC.

How to complete this form

- Identify the full names and addresses of the grantor (individual) and grantee (LLC).

- Enter a legal description of the property being conveyed.

- Complete the consideration section, typically noting the amount of ten dollars.

- Indicate any reservations for minerals and resources if applicable.

- Ensure signatures are obtained from the grantor, and if required, any witnesses.

Does this document require notarization?

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Common mistakes to avoid

- Not providing a complete property description.

- Failing to accurately state the consideration for the transfer.

- Omitting signatures from the grantor or witnesses if required.

- Not checking local legal requirements for additional filings or actions.

Why complete this form online

- Convenient access to legal forms that can be easily downloaded.

- Editability to customize the form to fit specific needs.

- Reliable templates drafted by licensed attorneys.

Quick recap

- The Quitclaim Deed from Individual to LLC is used to transfer property without warranties.

- It is important to accurately complete all sections to ensure the transfer is valid.

- Check specific state laws for additional requirements or considerations.

Form popularity

FAQ

To file a Georgia Quitclaim Deed from Individual to LLC, you need to start by obtaining the correct form, which you can find online or through a legal document service. Fill out the form with accurate details about the property and the owners involved. After that, you must sign the document in front of a notary public. Finally, file the completed quitclaim deed with the county clerk's office to make it an official public record.

You cannot transfer a mortgage directly to your LLC using a Georgia Quitclaim Deed from Individual to LLC. Lenders usually require you to keep the mortgage in your name, as short of a formal assumption agreement, they may not recognize the LLC as a viable borrower. You can explore other options, such as refinancing the mortgage in the LLC’s name. Additionally, consult with a legal expert to understand the implications of transferring property to your LLC.

Moving a property into an LLC typically involves preparing a Georgia Quitclaim Deed from Individual to LLC. After completing the deed, sign it in front of a notary and file it at your local county office for public record. It's advisable to seek assistance from professionals or platforms like US Legal Forms to streamline the process and ensure all legal requirements are met.

Yes, you can place your house in an LLC and rent it to yourself, but it involves specific legal and financial considerations. By doing a Georgia Quitclaim Deed from Individual to LLC, you may create a perceived separation of assets. However, consult with a tax professional or attorney to understand any tax implications and ensure compliance with local laws.

While an LLC can offer liability protection, there are disadvantages to consider. First, transferring property using a Georgia Quitclaim Deed from Individual to LLC could trigger tax consequences. Additionally, operating an LLC involves ongoing costs and regulatory requirements, which may not be ideal for everyone managing a single property.

Filling out a quitclaim deed in Georgia requires accurate information about the property and the parties involved. Start with the legal description of the property, followed by the names of the grantor and grantee. You can find templates online or through platforms like US Legal Forms, which offer step-by-step guidance to ensure compliance with state laws.

To transfer property to an LLC in Georgia, begin by drafting a Georgia Quitclaim Deed from Individual to LLC. Ensure you include essential details, such as the property description and names of all parties involved. Once the quitclaim deed is complete, you must sign it and have it notarized, then file it with the county clerk's office to officially record the transfer.

To transfer your property to an LLC in Georgia, the first step is to create a Georgia Quitclaim Deed from Individual to LLC. Fill this form out correctly, making sure to names all parties involved. Once signed and notarized, submit the deed to the appropriate county office for recording. This ensures that the property is legally owned by the LLC, thereby enhancing your asset protection.

To transfer a deed from an individual to an LLC, you will need to prepare a Georgia Quitclaim Deed, ensuring you fill in all required information accurately. Both the grantor (individual) and the grantee (LLC) must be clearly identified on the deed. After signing the document in front of a notary, file it with the local county office for proper recording. This process formalizes the ownership change and exposes the property to potential advantages.

Many people place their property in an LLC to limit personal liability and protect assets from lawsuits. By structuring property ownership this way, individuals can separate their personal assets from business risks. Additionally, transferring property through a Georgia Quitclaim Deed from Individual to LLC can provide tax benefits and facilitate property management. This strategy often strengthens financial stability.