Florida Apartment Lease Rental Application Questionnaire

What this document covers

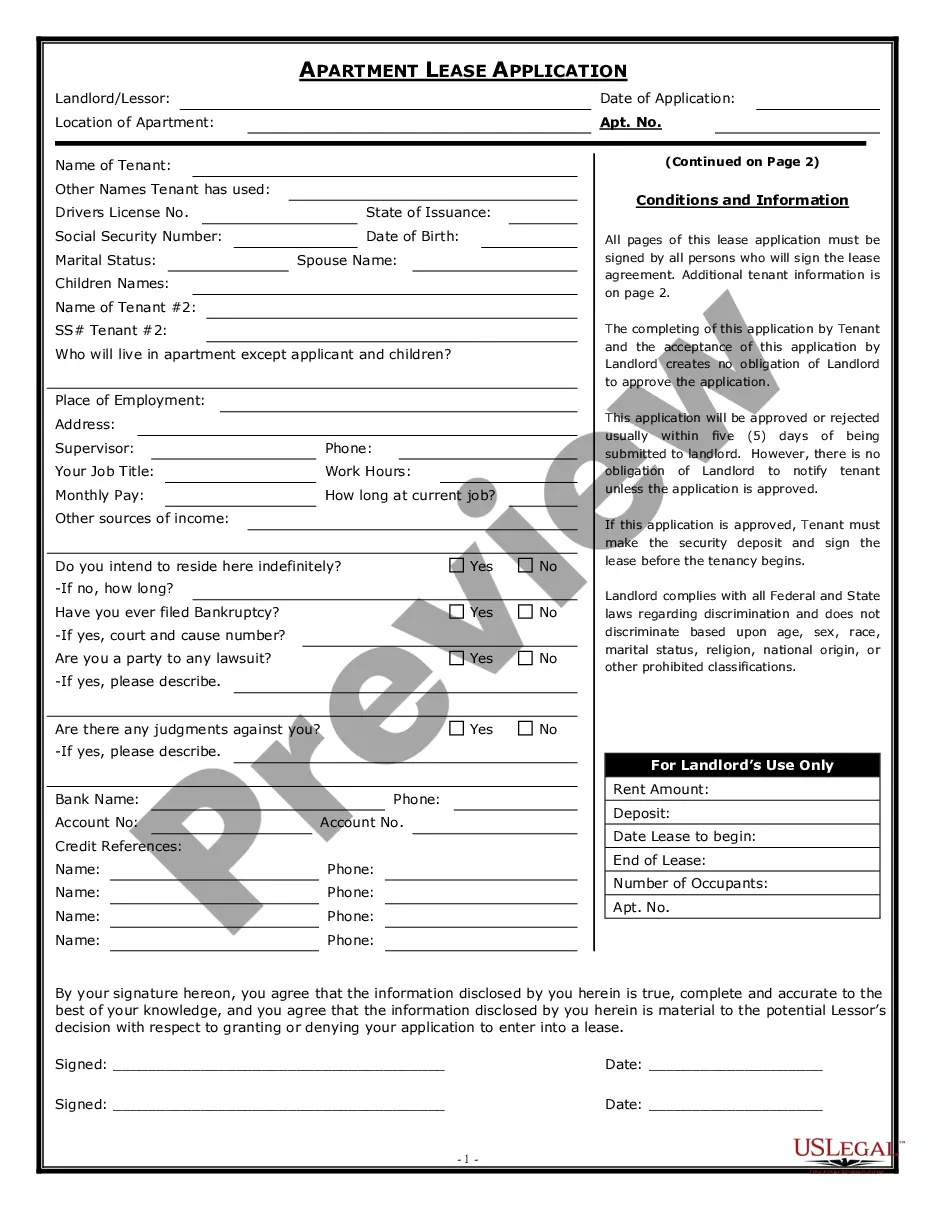

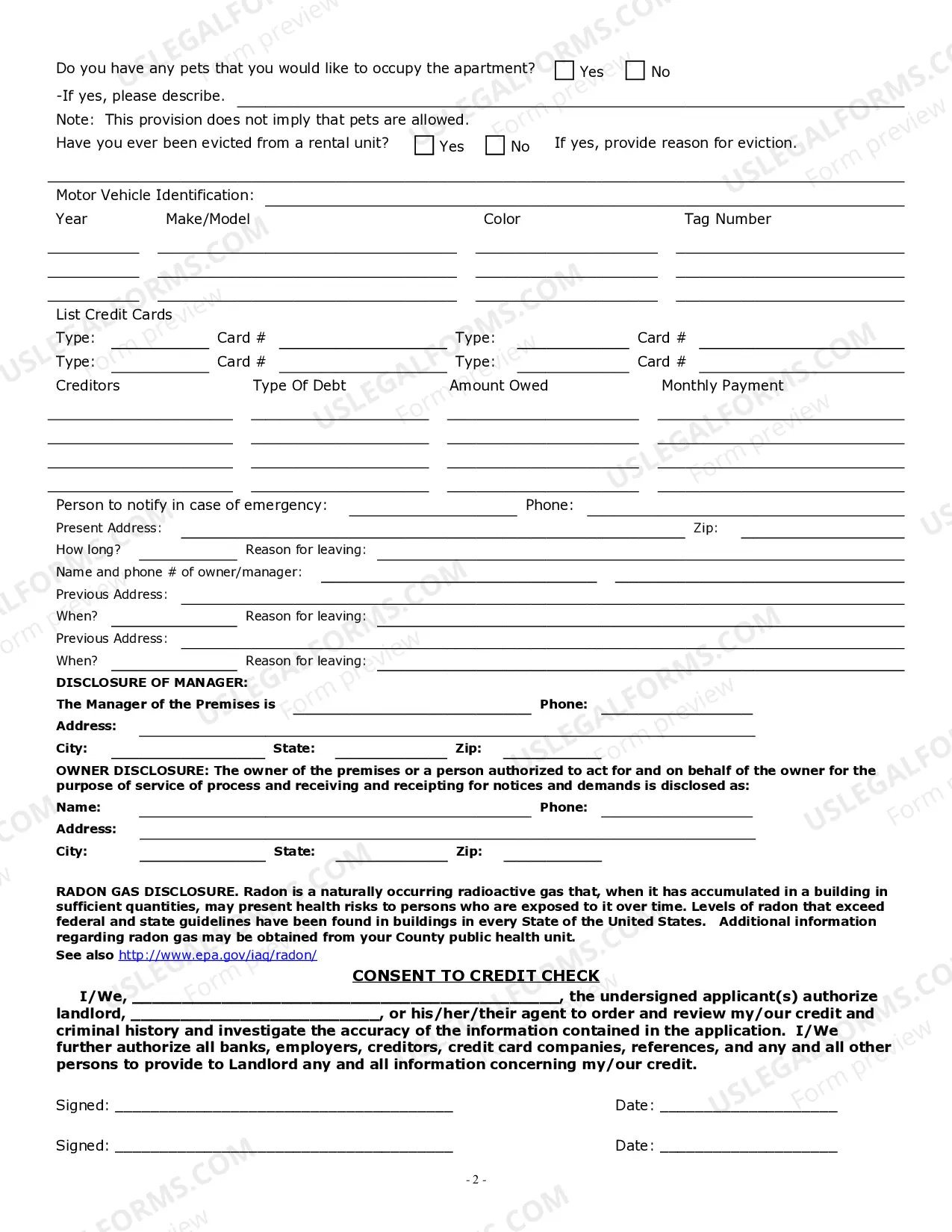

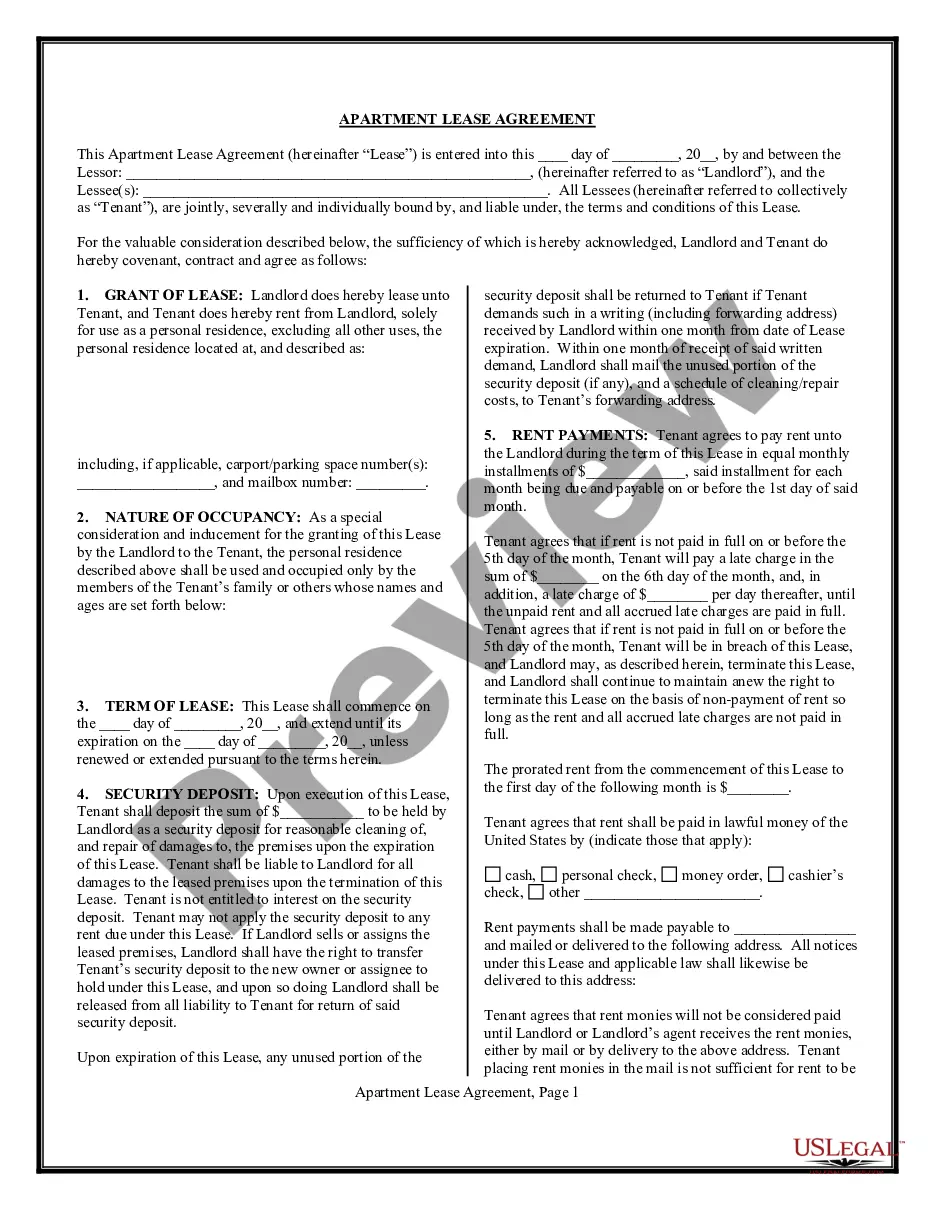

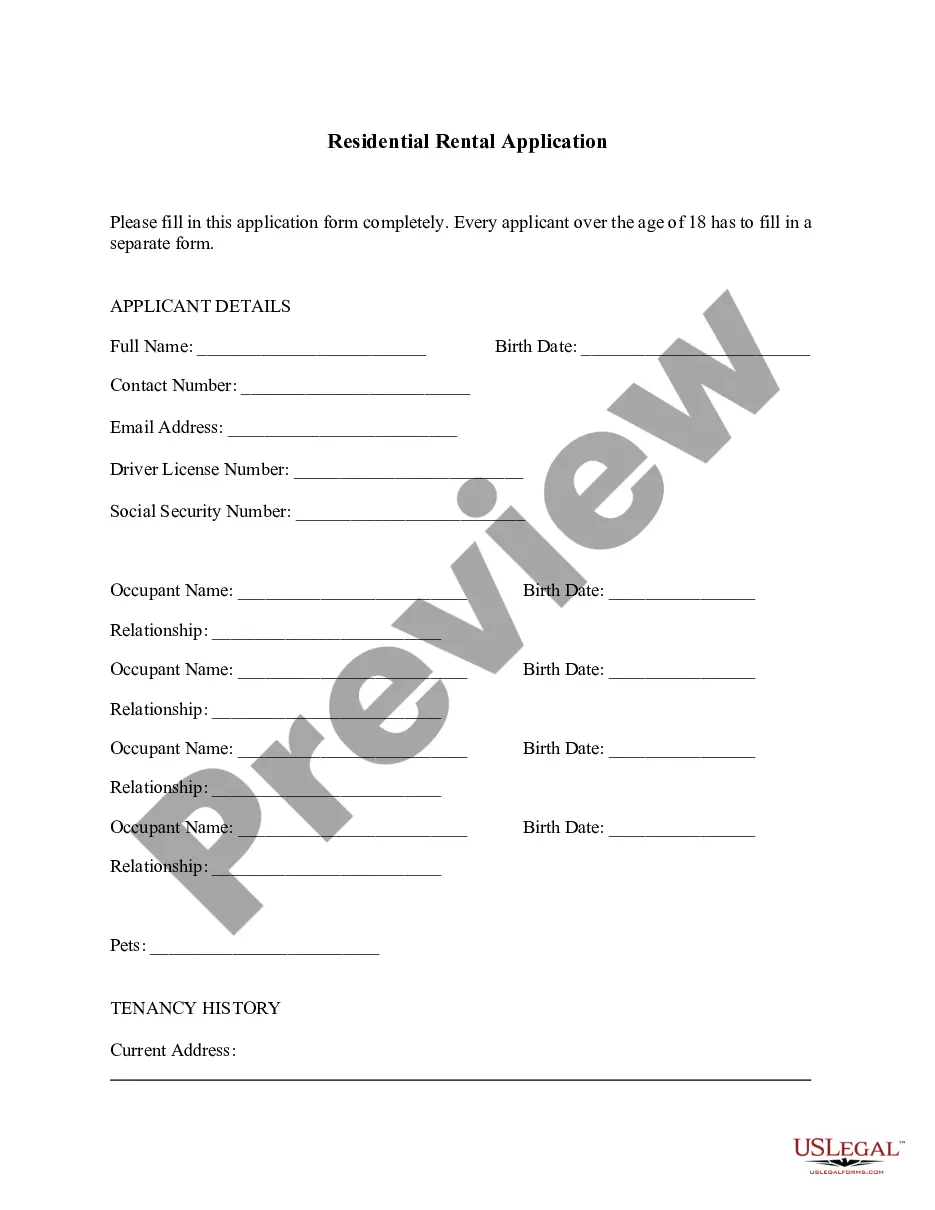

The Apartment Lease Rental Application Questionnaire is a document that prospective tenants complete to apply for an apartment lease. This form is critical for landlords, as it provides vital information needed to assess a tenant's suitability. Unlike other application forms, this questionnaire includes necessary disclosures and an authorization for the release of information, ensuring that landlords have all relevant details before making a rental decision.

Key parts of this document

- Personal information fields for the tenant, including name, contact details, and previous addresses.

- Employment and income verification sections to assess the tenant's financial stability.

- Authorization for a credit and criminal background check to ensure tenant reliability.

- Disclosure clauses to inform the tenant about the landlord's non-discrimination policy.

- Signature fields confirming the accuracy of the provided information and consent for background checks.

When this form is needed

This form should be used when a landlord is considering potential tenants for an apartment lease. It is especially important when property owners need to ensure they select a responsible tenant who meets their leasing criteria. It is typically submitted after a prospective tenant expresses interest in renting a property and before any formal lease is signed.

Who this form is for

- Landlords looking to screen potential tenants for rental properties.

- Property management professionals who handle tenant applications on behalf of property owners.

- Individuals looking to rent an apartment and needing to demonstrate their suitability to landlords.

Instructions for completing this form

- Provide your personal information, including full name, address, and contact details.

- Detail your employment history and monthly income to demonstrate financial capability.

- Sign the authorization section to allow the landlord to perform a credit background check.

- Ensure all required signatures are collected from co-applicants, if applicable.

- Review the form for accuracy and completeness before submission to the landlord.

Does this document require notarization?

This form does not typically require notarization to be legally valid. However, some jurisdictions or document types may still require it. US Legal Forms provides secure online notarization powered by Notarize, available 24/7 for added convenience.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to provide complete contact information or previous addresses.

- Not signing the authorization for a credit check.

- Leaving out information about previous rental history.

- Neglecting to clarify employment status or income sources.

Benefits of completing this form online

- Convenience of completing the form at your own pace from any location.

- Immediate access to download and print the form for submission.

- Reliable templates drafted by licensed attorneys ensuring compliance with legal standards.

- Editable fields that allow you to customize your application before finalizing it.

Looking for another form?

Form popularity

FAQ

Filling out a condition form for your apartment is a straightforward task. Begin by reviewing the Florida Apartment Lease Rental Application Questionnaire, which will guide you through the specific details required. Clearly indicate the current state of the apartment, including any damages or needed repairs. Ensure that all sections are filled out carefully to prevent any misunderstandings or issues when you submit your application.

Rental applications may get denied more frequently in certain markets or during high-demand periods. Typically, this can occur in 1 out of every 3 or 4 applications, depending on various elements highlighted in the Florida Apartment Lease Rental Application Questionnaire. Regularly reviewing and updating your application can help minimize the chances of denial. Using reliable resources, like USLegalForms, can assist in navigating this process efficiently.

Statistics indicate that a notable percentage of apartment applications may get denied, often ranging between 30% and 50%. Factors contributing to these rejections include insufficient income, adverse credit history, and incomplete Florida Apartment Lease Rental Application Questionnaires. To avoid denial, it is crucial to provide thorough and accurate information when filling out your application. This practice ensures that you stand out positively in a competitive rental market.

Getting approved for a rental depends on various factors, including your financial history and the specifics of the Florida Apartment Lease Rental Application Questionnaire. While some applicants find it challenging, others secure approval easily by presenting a strong case. Ensuring a good credit score and stable income can significantly enhance your chances. Preparation and honesty play vital roles in this process.

Rental applications often get rejected due to incomplete information, poor credit scores, or references not meeting landlord expectations. The Florida Apartment Lease Rental Application Questionnaire provides essential insights into the required criteria. When you submit all necessary documentation and address potential red flags, you increase your chances of approval. Always double-check the application before submitting it.

Landlords may refuse rent for several reasons. Commonly, it occurs when tenants fail to meet certain requirements outlined in the Florida Apartment Lease Rental Application Questionnaire. For instance, insufficient income, poor credit history, or prior eviction records can lead a landlord to make this decision. Understanding the factors affecting approval can help you prepare a stronger application.

The credit score needed to rent in Florida usually falls between 620 and 700, based on the property and landlord's criteria. Different landlords may have varying requirements, so it's important to check before applying. By using the Florida Apartment Lease Rental Application Questionnaire, you can better prepare your application and understand the expectations landlords may have regarding credit scores.

To fill out a rental verification form, begin by providing accurate personal information and details about your current rental situation. Include the landlord’s contact information and any requested references. Completing the Florida Apartment Lease Rental Application Questionnaire allows you to streamline this process, ensuring you cover all necessary details to satisfy your potential landlord's requirements.

The minimum credit score to rent in Florida often ranges from 620 to 650, though requirements can vary by landlord. A higher credit score typically indicates reliable payment behavior, making applicants more appealing. Using the Florida Apartment Lease Rental Application Questionnaire can help you present your financial information clearly, giving you a better chance at approval.

Filling out a condition of rental property checklist involves examining the rental unit's current state. Carefully document any damages or deficiencies, and take notes or photos if possible. This information is crucial when completing the Florida Apartment Lease Rental Application Questionnaire, as it protects you from being held liable for pre-existing issues. Make sure to ask your landlord for any requirements or specific questions they want answered.