Connecticut Dissolution Package to Dissolve Limited Liability Company LLC

What is this form?

The Connecticut Dissolution Package to Dissolve Limited Liability Company (LLC) is a comprehensive set of forms designed specifically for the voluntary dissolution of an LLC or PLLC in Connecticut. This package includes necessary filings, step-by-step instructions, and additional resources to ensure a smooth dissolution process. It differs from other forms in that it focuses solely on voluntary dissolution rather than other methods such as forfeiture or judicial dissolution.

Key parts of this document

- Articles of Dissolution: The primary document needed to officially dissolve the LLC.

- Resolution of Members: A consent form required from the LLC members agreeing to the dissolution.

- Transmittal Letter: A document to accompany the Articles of Dissolution when filing with the Secretary of State.

- Notices to Claimants: Forms to notify potential creditors about the dissolution and the claims process.

- Winding Up Procedures: Guidelines to help manage the assets and liabilities during the dissolution process.

When to use this document

You should use the Connecticut Dissolution Package when your LLC has met the conditions for voluntary dissolution as outlined in your articles of organization or operating agreement. This form is essential if your company has decided to cease operations and wind up its affairs, ensuring that all legal obligations are settled and assets are properly distributed to members.

Who should use this form

- Members of an LLC in Connecticut who wish to dissolve their business voluntarily.

- Managers or legal representatives authorized to act on behalf of the LLC during dissolution.

- Individuals responsible for managing the winding up process after dissolution, including settling debts and distributing assets.

How to prepare this document

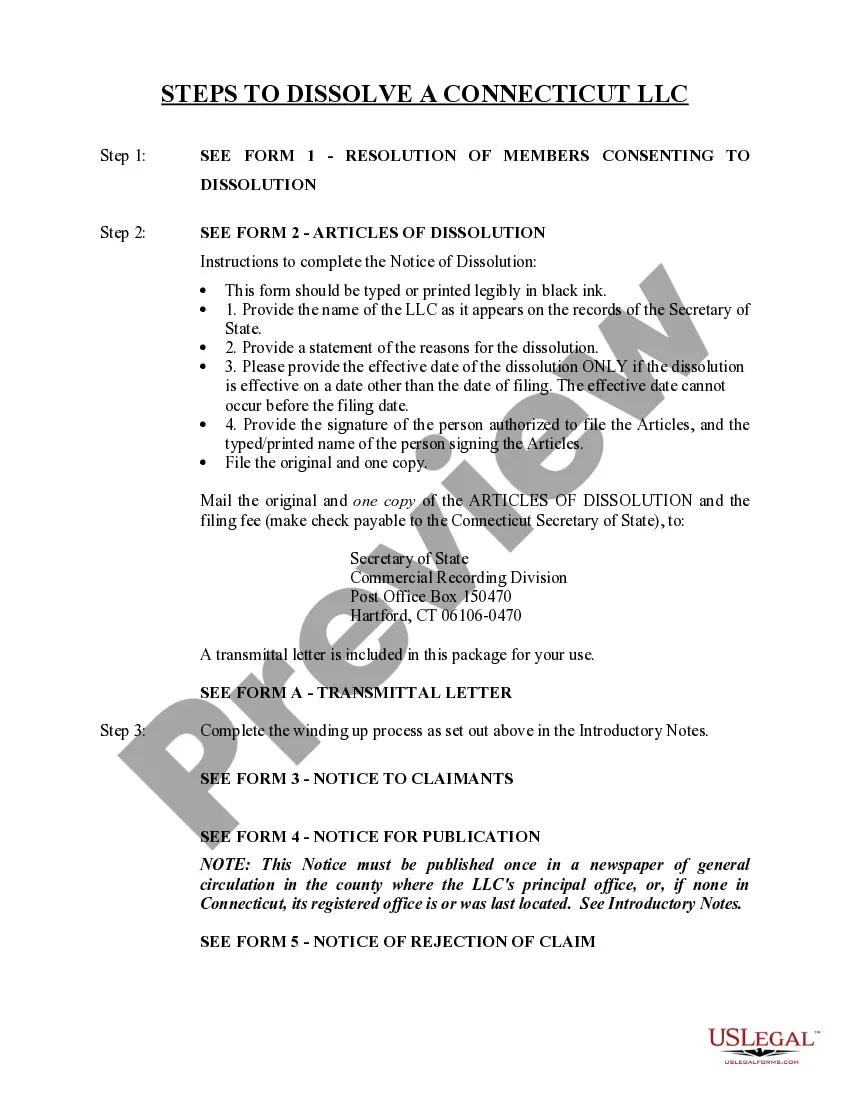

- Step 1: Complete the Resolution of Members form to indicate consent for dissolution.

- Step 2: Fill out the Articles of Dissolution with relevant details such as the name of the LLC and effective date.

- Step 3: Prepare a transmittal letter to accompany the Articles of Dissolution during filing.

- Step 4: Notify all claimants by sending notices as detailed in the included procedures.

- Step 5: Publish a notice of dissolution in a local newspaper if required by statute.

Notarization guidance

In most cases, this form does not require notarization. However, some jurisdictions or signing circumstances might. US Legal Forms offers online notarization powered by Notarize, accessible 24/7 for a quick, remote process.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to obtain unanimous consent from all LLC members before proceeding with dissolution.

- Not including the correct filing fee when submitting documents to the Secretary of State.

- Neglecting to notify all claimants within the statutory deadlines, which can bar claims.

Why complete this form online

- The convenience of downloading forms instantly from anywhere, saving time and effort.

- Access to attorney-drafted templates ensures compliance with state regulations.

- Editability allows you to customize documents to fit your specific LLC's circumstances.

Legal use & context

- The dissolution package ensures compliance with state law governing LLCs in Connecticut.

- Following the dissolution process protects members from future liabilities associated with the business.

- Proper documentation helps provide a legal record of the dissolution in case of future claims.

Quick recap

- The Connecticut Dissolution Package is essential for formally ending an LLC.

- All members must consent to the dissolution process.

- Properly following the steps outlined minimizes the risk of legal issues after dissolution.

Looking for another form?

Form popularity

FAQ

Dissolving an LLC can have various tax implications, including the need to report any gains or losses on your final tax return. Additionally, personal liability may arise if corporate formalities were not adhered to. A Connecticut Dissolution Package to Dissolve Limited Liability Company LLC can help clarify these consequences and ensure you fulfill all tax requirements.

Once your LLC is dissolved, you should notify creditors, settle remaining debts, and distribute any assets. It's also crucial to keep records of the dissolution for your personal files and tax records. Using a Connecticut Dissolution Package to Dissolve Limited Liability Company LLC can assist you in managing these post-dissolution tasks effectively.

Yes, you must notify the IRS when you close your LLC. This includes filing your final tax return and marking it as such. A Connecticut Dissolution Package to Dissolve Limited Liability Company LLC will provide guidance on these vital steps, ensuring you meet your tax obligations upon dissolution.

Dissolving an LLC can be straightforward if you follow the correct procedures. The process typically involves filing the necessary paperwork and paying any fees. With a Connecticut Dissolution Package to Dissolve Limited Liability Company LLC, you gain access to resources that can assist you in navigating the process with ease.

To dissolve a Limited Liability Partnership (LLP) in Connecticut, file a Statement of Withdrawal with the Connecticut Secretary of State. Make sure to clear all financial obligations and notify all partners of the decision. Using a Connecticut Dissolution Package to Dissolve Limited Liability Company LLC can help streamline these steps and ensure all legal requirements are met.

Before dissolving your LLC, review your operating agreement and state regulations to ensure compliance. You should also settle any outstanding debts and obligations to prepare for the dissolution. Consider using a Connecticut Dissolution Package to Dissolve Limited Liability Company LLC to simplify this process and guide you through the necessary steps.

To get your LLC undissolved, start by contacting the state’s Secretary of State office to obtain the necessary reinstatement forms. You will need to provide information about your LLC, along with any outstanding fees. The Connecticut Dissolution Package to Dissolve Limited Liability Company LLC can assist you in navigating this process and help you gather all required documentation, making reinstatement straightforward.

The process to dissolve an LLC varies by state, but in Connecticut, it generally takes a few weeks after filing the necessary documents. This timeline can be affected by how quickly the state processes your request. To ensure a smooth and timely dissolution, utilizing the Connecticut Dissolution Package to Dissolve Limited Liability Company LLC is advisable, as it provides the required forms and guidance.

If you never dissolve your LLC, it remains legally active, even if it is not conducting business. This can lead to ongoing tax obligations and legal liabilities. Not addressing the dissolution can also incur additional fees, making it essential to consider a Connecticut Dissolution Package to Dissolve Limited Liability Company LLC to manage these responsibilities effectively.

To undissolve an LLC, you typically need to file specific paperwork with the state where your LLC was formed. This process involves submitting a reinstatement application along with any outstanding fees. Using the Connecticut Dissolution Package to Dissolve Limited Liability Company LLC can simplify this process, guiding you through the necessary steps and ensuring compliance with state regulations.