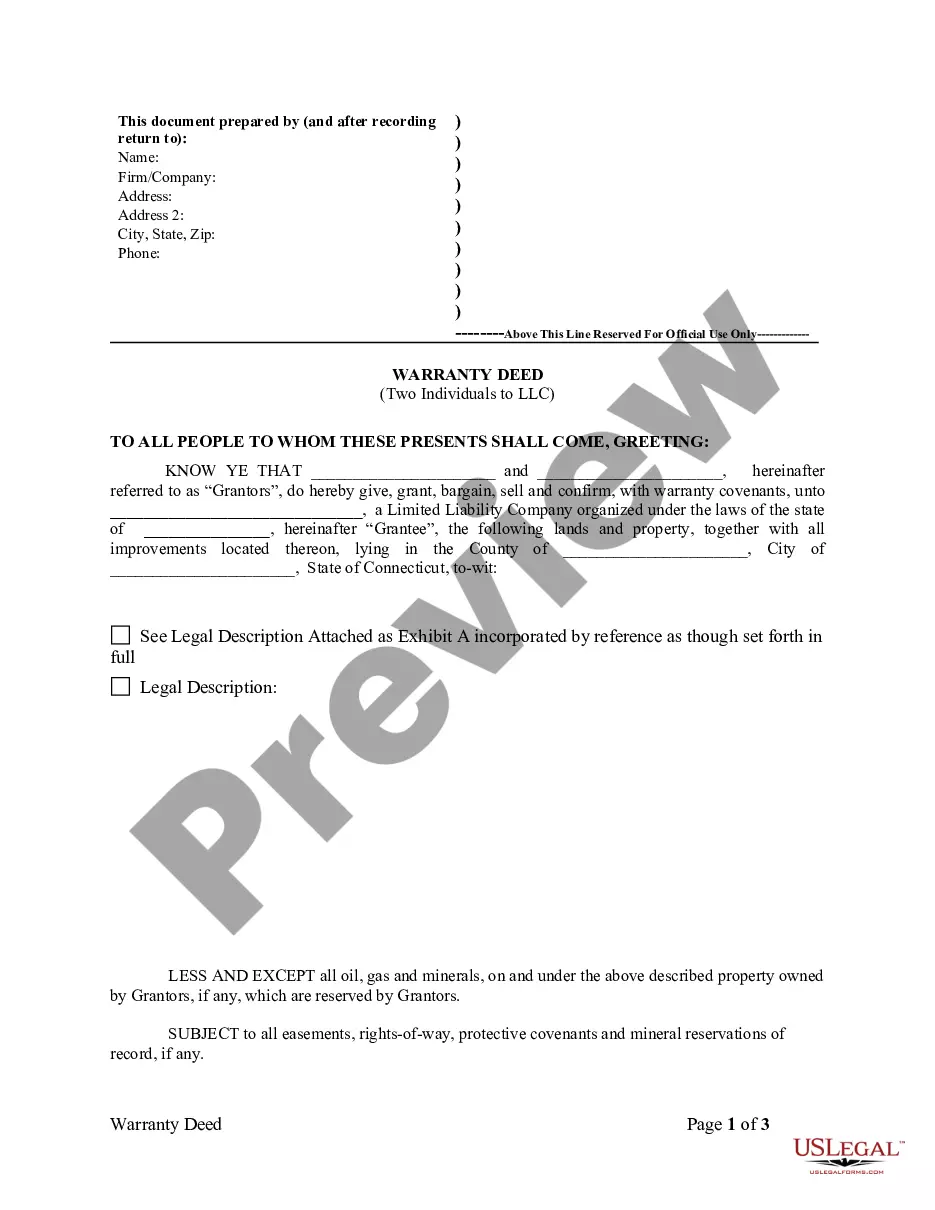

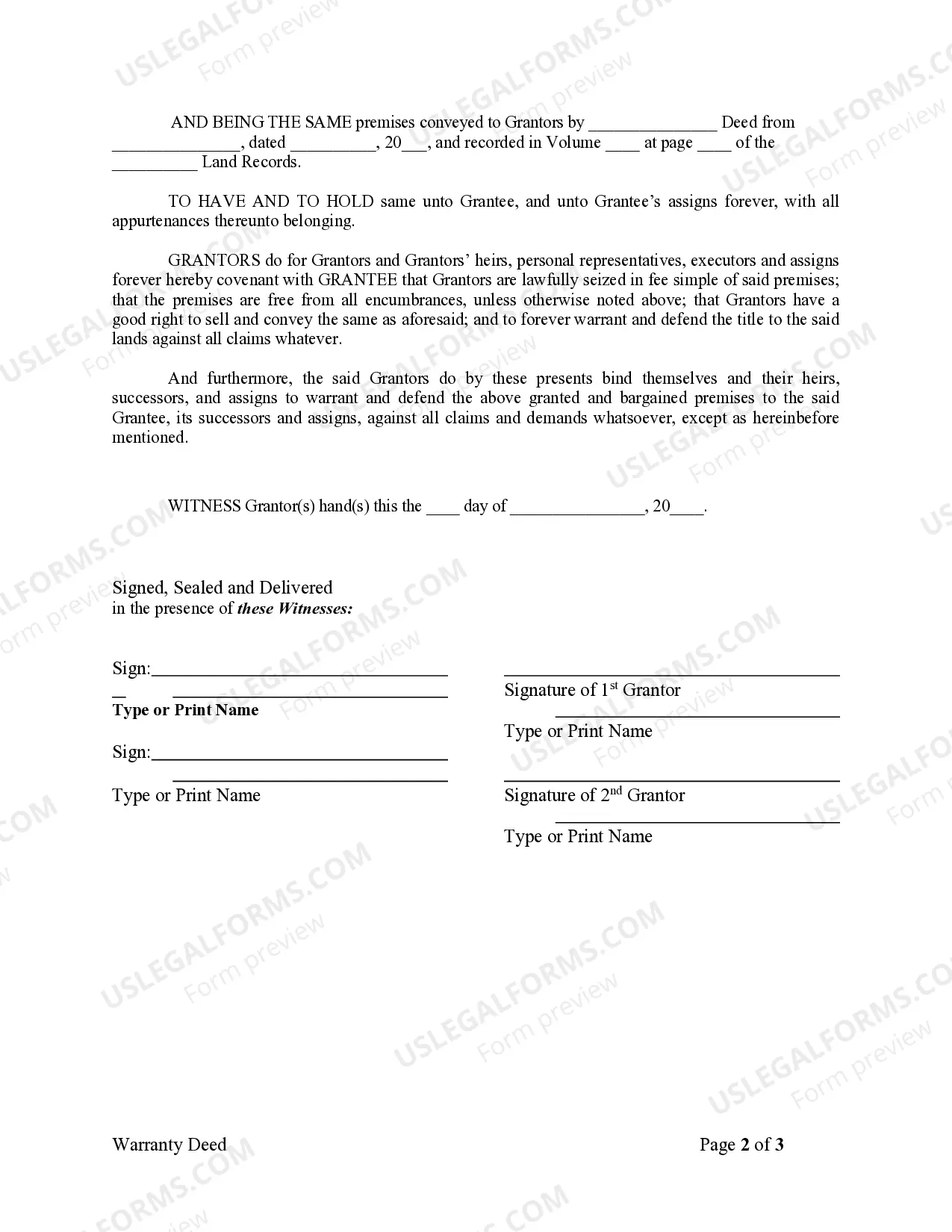

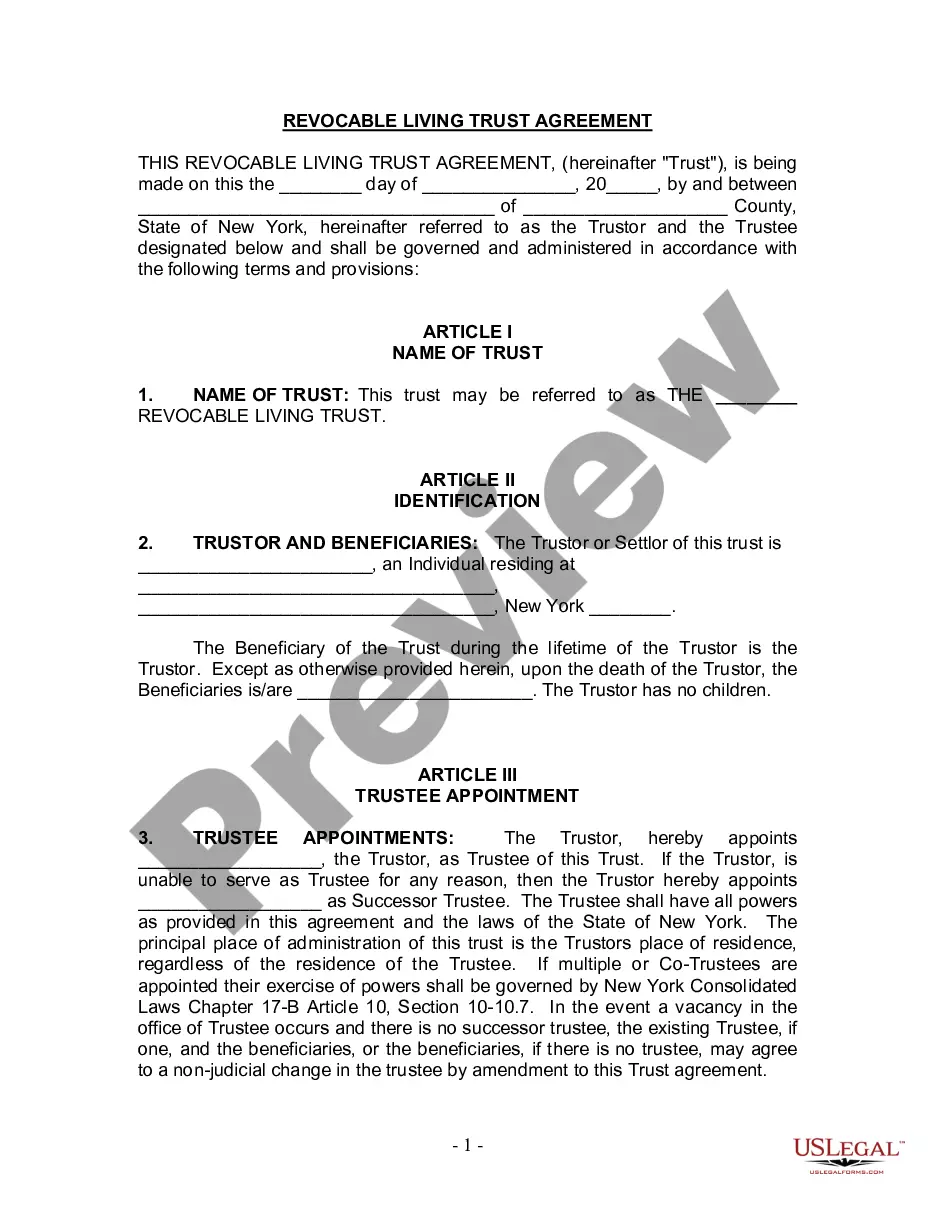

This Warranty Deed from two Individuals to LLC form is a Warranty Deed where the Grantors are two individuals and the Grantee is a limited liability company. Grantors convey and warrant the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

Connecticut Warranty Deed from two Individuals to LLC

Description

How to fill out Connecticut Warranty Deed From Two Individuals To LLC?

The more documentation you have to produce - the more nervous you become.

You can locate a vast array of Connecticut Warranty Deed from two Individuals to LLC templates online, however, you are unsure which to trust.

Eliminate the inconvenience and simplify the process of locating samples by using US Legal Forms.

Take advantage of cost-effective solutions with US Legal Forms!

- Obtain precisely crafted documents that are prepared to comply with state regulations.

- If you possess a US Legal Forms subscription, Log In to your account, and you will see the Download button on the Connecticut Warranty Deed from two Individuals to LLC’s page.

- If you have not used our platform before, complete the registration process by following these steps.

- Verify that the Connecticut Warranty Deed from two Individuals to LLC is applicable in your state.

- Confirm your selection by reviewing the description or by utilizing the Preview mode if available for the chosen form.

Form popularity

FAQ

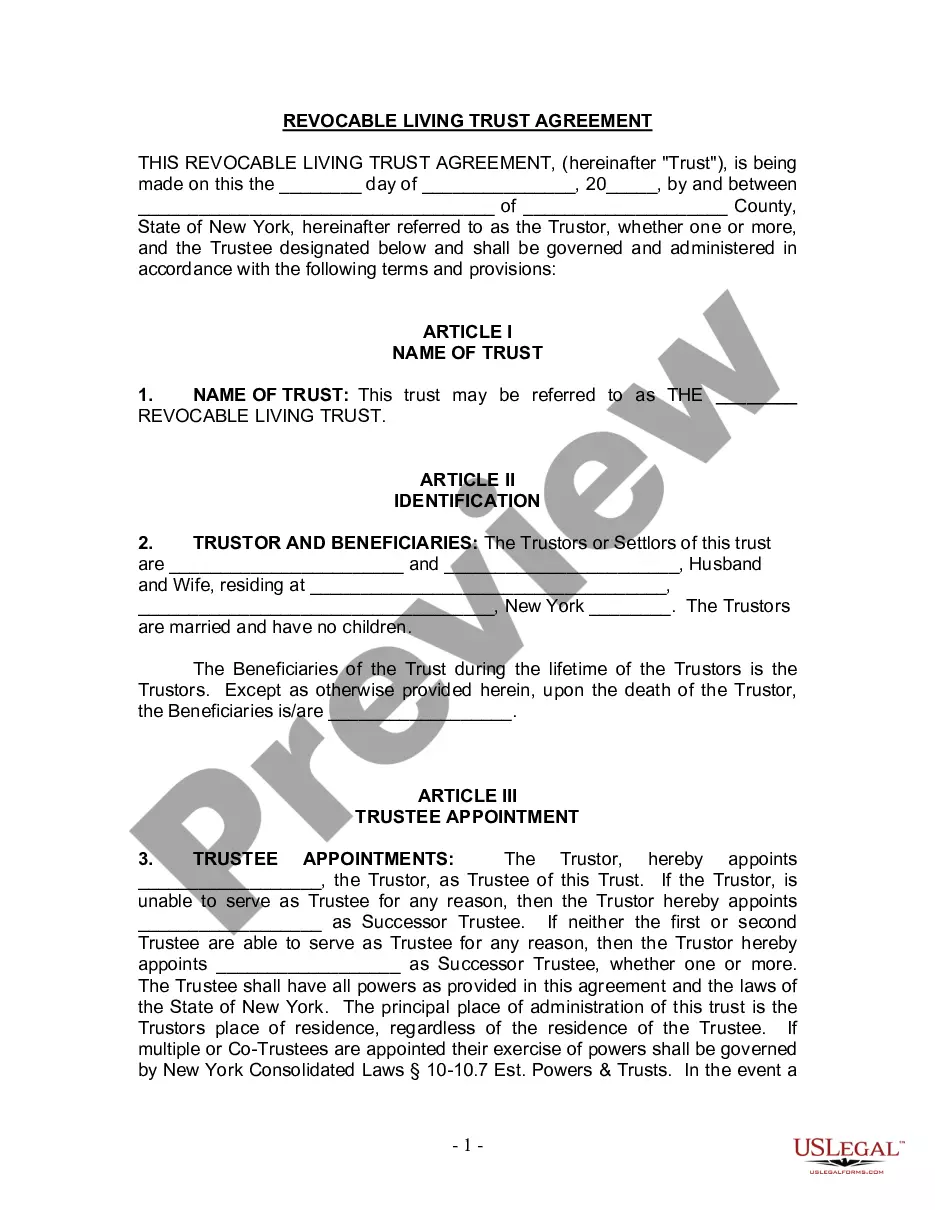

People often choose to put their property in an LLC for several reasons, including liability protection and tax benefits. By transferring ownership with a Connecticut Warranty Deed from two Individuals to LLC, individuals can separate their personal assets from their business assets. This structure limits personal liability and can simplify estate planning. Additionally, using an LLC can provide flexibility in managing property and potential tax advantages.

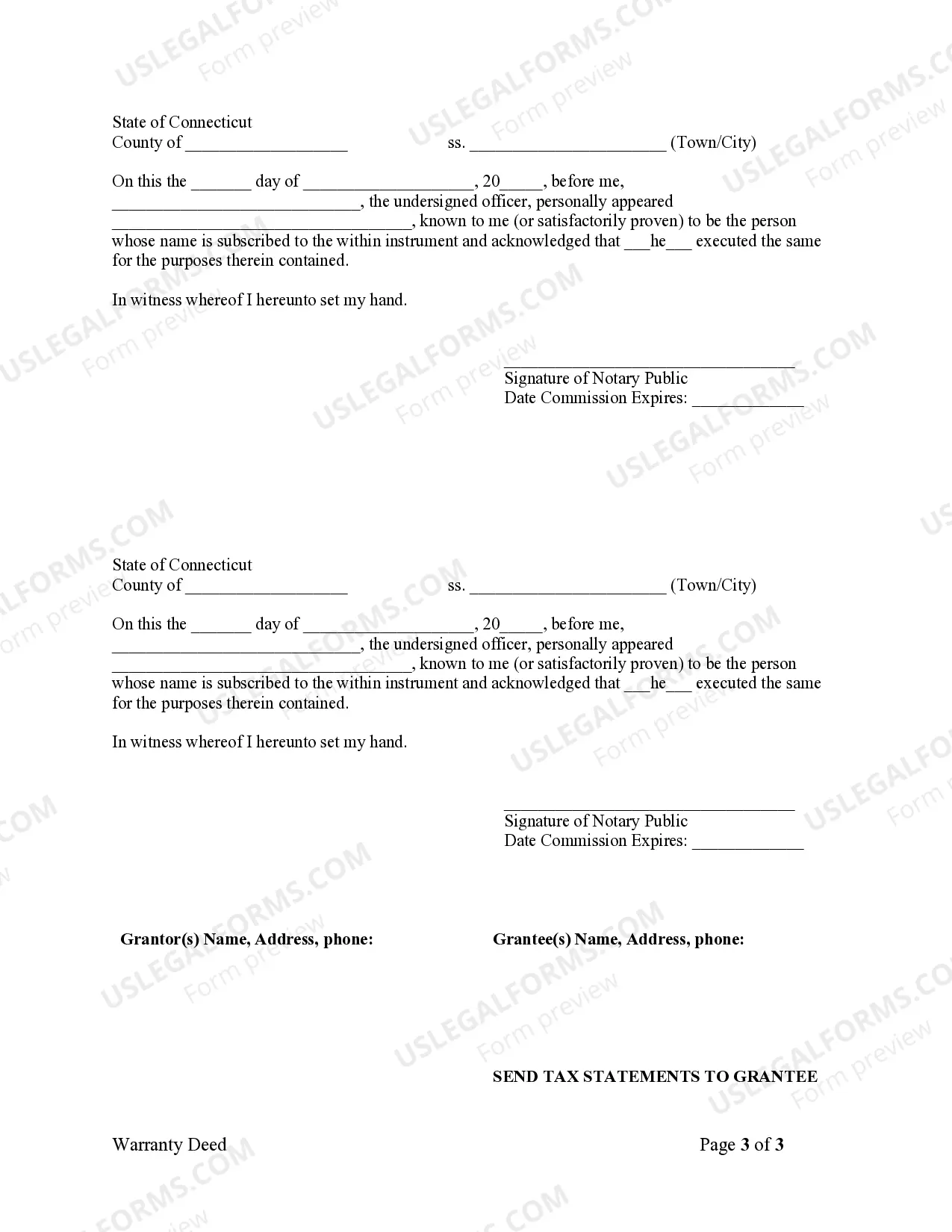

To transfer a title from an individual to an LLC, you should execute a Connecticut Warranty Deed from two Individuals to LLC. This deed must be properly filled out, including details such as the names of current owners and the LLC, and it should be notarized. Once completed, file the deed with your local land records office for the transfer to be recorded. Completing this process ensures your property is held under the LLC's name.

Transferring a deed to an LLC involves drafting a Connecticut Warranty Deed from two Individuals to LLC. You must fill out the deed, including the legal description of the property, and sign it before a notary. After that, you will record the deed with the local government office to make the transfer official. This step not only changes ownership but also aligns your property under the LLC's legal protections.

To put your property in an LLC, start by forming the LLC through your state’s regulations. Once the LLC is established, you will need to execute a Connecticut Warranty Deed from two Individuals to LLC, transferring ownership of the property. Ensure you file the warranty deed with your county’s land records office. This process protects your personal assets and simplifies the management of the property.

To transfer assets from personal to business, begin by assessing what assets you want to transfer. Create the appropriate legal documents, such as a Connecticut Warranty Deed for real estate, and file them in accordance with your state laws. It's crucial to maintain thorough records of these transactions for future reference. Engaging a service like uslegalforms can provide valuable assistance in completing this process efficiently.

Transferring personal assets to an LLC requires a straightforward process. Start by identifying the assets you wish to transfer and prepare the necessary documentation, such as a Connecticut Warranty Deed for real estate. Then, execute the transfer while ensuring that all paperwork is filed with the relevant government agencies. Using a platform like uslegalforms can simplify this process, guiding you through the essential steps.

One disadvantage of placing property in an LLC is losing certain tax benefits, like the primary residence exclusion. Additionally, transferring property can involve costs, such as legal fees and transfer taxes. However, many find that the protection from liability outweighs these drawbacks. Weighing these factors carefully can help you determine the best course for your situation.

Putting personal assets in an LLC can provide liability protection and potential tax benefits. By creating a legally distinct entity, you can safeguard your personal assets from business liabilities. However, consider your business needs and consult with a legal professional to weigh the pros and cons. This careful assessment can help you make a more informed decision.

To transfer a deed from an individual to an LLC, you must prepare a Connecticut Warranty Deed. This deed should include the names of both individuals and the LLC, along with a legal description of the property. After completing the deed, you must file it with the appropriate county recorder's office. This legally documents your asset transfer, ensuring clear ownership for the LLC.

Yes, you can transfer personal assets to an LLC. This often requires executing a Connecticut Warranty Deed from two Individuals to LLC for real estate or other asset-specific documentation for different types of property. Properly transferring assets protects your personal holdings and enhances the LLC's value. Always consider consulting a legal professional to ensure the transfer complies with regulations.