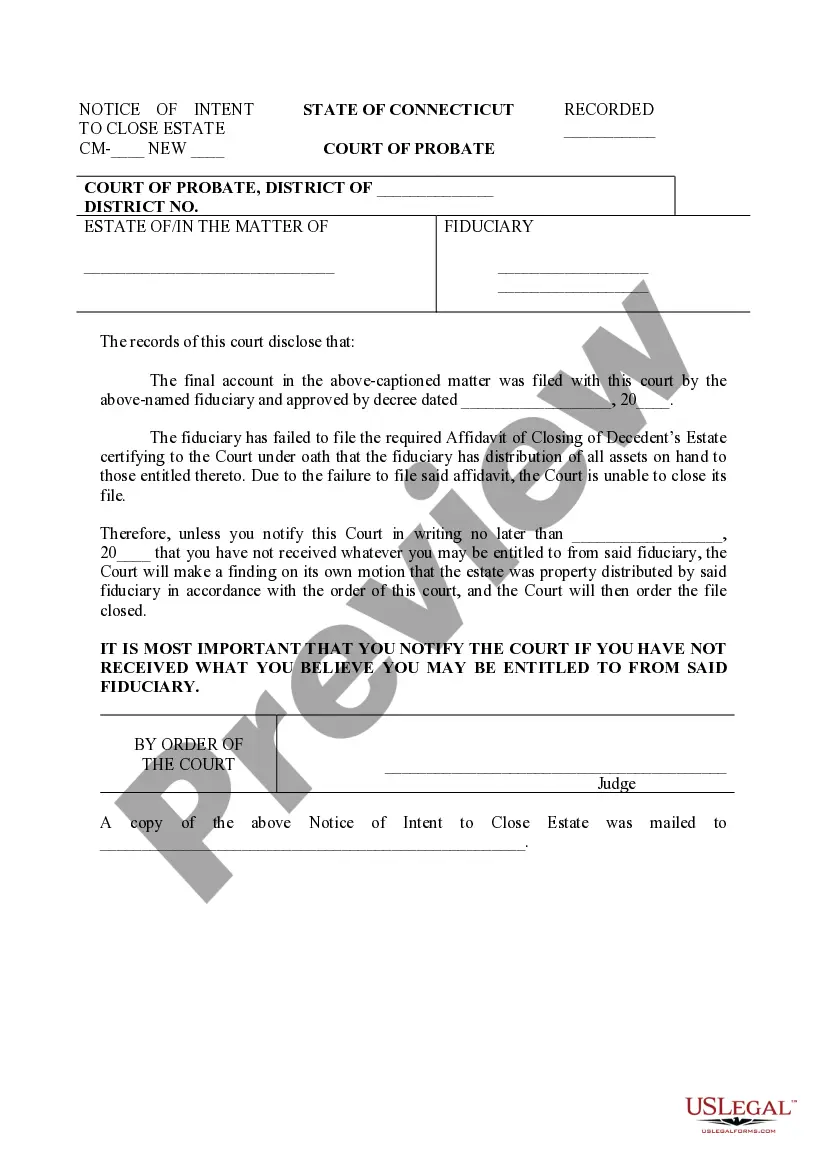

Connecticut Notice of Intent to Close Estate

Description

How to fill out Connecticut Notice Of Intent To Close Estate?

Utilize US Legal Forms to secure a printable Connecticut Notice of Intent to Conclude Estate.

Our court-acceptable forms are crafted and routinely refreshed by experienced attorneys.

Ours is the most comprehensive Forms library online and offers affordable and precise samples for clients, legal professionals, and small to medium-sized businesses.

Hit Buy Now if it’s the form you seek. Establish your account and make a payment through PayPal or by card|credit card. Download the template to your device and feel free to use it repeatedly. Employ the Search function if you need to locate another document template. US Legal Forms provides thousands of legal and tax templates and packages for business and personal requirements, including the Connecticut Notice of Intent to Conclude Estate. Over three million users have successfully used our platform. Choose your subscription plan and acquire high-quality documents in just a few clicks.

- Organized into state-specific categories, some templates may be viewed prior to downloading.

- To access samples, users must have a subscription and need to sign into their account.

- Click Download next to any template you wish to access and locate it in My documents.

- For users without a subscription, follow these steps to swiftly locate and download the Connecticut Notice of Intent to Conclude Estate.

- Ensure you select the correct form according to the state required.

- Examine the document by reviewing the description and utilizing the Preview feature.

Form popularity

FAQ

Yes, placing a notice for a deceased estate is often a necessary step in the probate process. It serves to inform creditors and interested parties about the estate's closure. By incorporating a Connecticut Notice of Intent to Close Estate in your proceedings, you can effectively meet legal requirements and facilitate the communication of important information.

In Connecticut, an estate must be worth at least $40,000 to require probate. However, estates below this threshold may still need to go through the probate process if specific conditions apply. Utilizing the Connecticut Notice of Intent to Close Estate can help simplify matters, even for smaller estates, and guide you through necessary legal procedures.

If you fail to file probate in Connecticut, the estate may face numerous issues, such as the inability to legally distribute assets. Creditors can make claims against the estate, which may lead to financial penalties for beneficiaries. Additionally, if you do not file for probate, the Connecticut Notice of Intent to Close Estate remains unfiled, complicating matters when it comes to managing estate affairs. Addressing probate matters promptly is critical to ensuring a smooth transition for beneficiaries.

Yes, Connecticut law sets a time limit for probating a will, usually within six months after the deceased's date of death. If probate is not initiated within this timeframe, complications may arise, potentially affecting the validity of the will. Therefore, it is advisable to act quickly and efficiently, including filing your Connecticut Notice of Intent to Close Estate, to avoid difficulties down the line.

In Connecticut, you typically have six months from the date of death to file for probate. However, it is advisable to start the process sooner to ensure timely management of the estate. By filing promptly, you can also better prepare for possible claims against the estate and properly handle the Connecticut Notice of Intent to Close Estate. Ensuring adherence to this timeline can simplify matters for the beneficiaries.

To initiate probate in Connecticut, first, you need to file the necessary documents with the probate court. This includes submitting the will, if there is one, along with the Connecticut Notice of Intent to Close Estate. Next, you will publish a notice to inform creditors potentially owed by the estate. Lastly, the executor must inventory and distribute the estate's assets according to the state's laws and the will's directives.

A notice to close estate is a formal declaration made by the executor to notify the probate court and beneficiaries of the intent to finalize the estate's affairs. This notice ensures that all parties are informed and provides a timeline for any objections or claims. Utilizing a Connecticut Notice of Intent to Close Estate not only fulfills requirements but also enhances accountability. Platforms like uslegalforms can assist you in preparing this notice accurately.

An executor in Connecticut generally has 18 months to settle an estate, similar to the overall estate settlement timeframe. However, this period can be affected by the estate's complexity or any legal challenges. It's crucial for executors to maintain organization and communication with beneficiaries. Submitting a Connecticut Notice of Intent to Close Estate can help demonstrate compliance with this timeline.

Assets like life insurance policies, retirement accounts, and property held in joint ownership typically do not go through probate. These assets often pass directly to designated beneficiaries. Understanding which of your assets are exempt can simplify your estate planning. You may also utilize a Connecticut Notice of Intent to Close Estate to clarify your estate's status.

To avoid probate fees in Connecticut, you can use strategies such as establishing living trusts or transferring assets jointly. These methods often help bypass the probate process entirely. Additionally, preparing a Connecticut Notice of Intent to Close Estate early in the process can streamline your efforts and possibly minimize costs. Consulting with uslegalforms can provide the necessary resources to navigate this efficiently.