Connecticut Single Member Limited Liability Company LLC Operating Agreement

Understanding this form

The Single Member Limited Liability Company (LLC) Operating Agreement is a legal document created for a single-member LLC. It outlines the structure, management, and operational guidelines of the company. This agreement serves a crucial purpose, providing clarity on how the business will operate, especially if the member plans to expand by adding new members in the future. Unlike general business agreements, this agreement specifically caters to a single-member LLC, making it essential for individuals starting their own business.

What’s included in this form

- Formation of the LLC: Details how the LLC is established and its registered office.

- Member Information: Outlines the initial member's responsibilities and provisions for adding additional members.

- Management Structure: Specifies that the initial member has complete management authority.

- Profit and Loss Distribution: Describes how profits and losses will be allocated to the single member, and potential future members.

- Voting Rights: Establishes how decisions will be made by the member or members, if applicable.

- Dissolution Process: Details the conditions under which the LLC may be dissolved.

When to use this document

This form should be used when an individual establishes a single-member LLC and needs a structured plan for operating the business. It is particularly important during initial setup or when considering the possibility of expanding the company by admitting new members in the future. Use this agreement to ensure clarity in operations and obligations to avoid conflicts down the road.

Who can use this document

- Entrepreneurs looking to start a business as a single-member LLC.

- Business owners who plan to manage their LLC and want a professional structure for future growth.

- Individuals seeking to formalize their business operations while minimizing personal liability.

- Anyone considering the addition of new members to the LLC in the future.

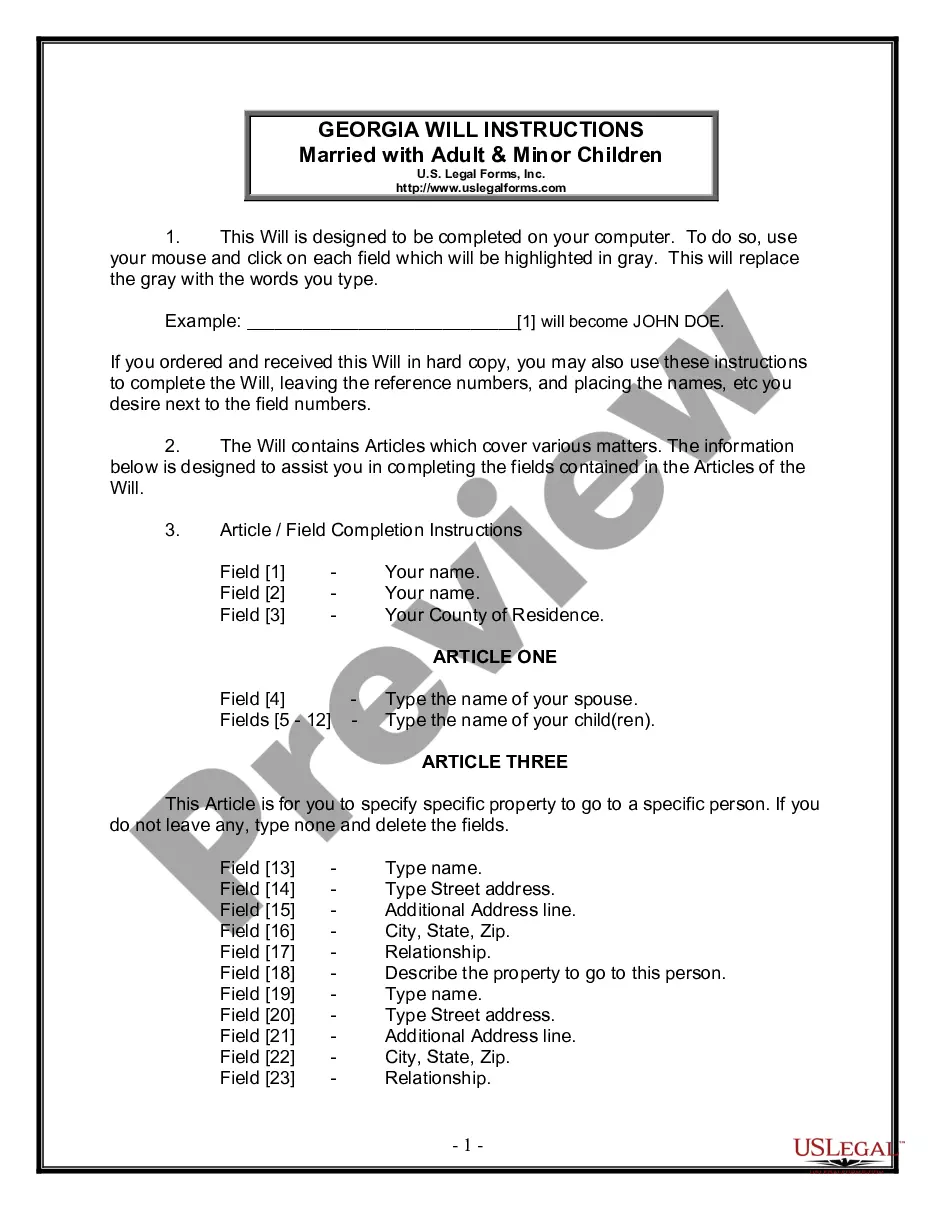

Instructions for completing this form

- Begin by entering the name of the LLC and the initial member's details.

- Define the business purpose and the scope of operations for the LLC.

- Specify the registered office address and the registered agent's information.

- Outline how profits and losses will be allocated and identify the management structure.

- Review the agreement for accuracy, and ensure all necessary sections are completed.

Is notarization required?

This form does not typically require notarization to be legally valid. However, some jurisdictions or document types may still require it. US Legal Forms provides secure online notarization powered by Notarize, available 24/7 for added convenience.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to provide complete member information or business details.

- Not outlining the process for admitting new members clearly.

- Overlooking the tax implications of single vs. multi-member LLCs.

- Neglecting to review the agreement for compliance with state laws.

Why use this form online

- Convenient access to a legal document designed specifically for single-member LLCs.

- Edit and customize the document to meet your specific business needs.

- Reliable templates drafted by licensed attorneys, ensuring compliance and accuracy.

- Instant downloads, allowing for quick setup of your LLC agreements.

Main things to remember

- The Single Member LLC Operating Agreement structure is vital for ensuring legal and operational clarity.

- This document allows for future expansion by enabling the addition of new members.

- Completing the agreement accurately helps protect your personal assets and define management roles.

Looking for another form?

Form popularity

FAQ

To find an appropriate Connecticut Single Member Limited Liability Company LLC Operating Agreement, you can start by searching online legal document services like US Legal Forms. These platforms offer readily available templates that you can download and modify. If you prefer a more personalized approach, consider hiring an attorney who specializes in business law to help draft your agreement.

Typically, a Connecticut Single Member Limited Liability Company LLC Operating Agreement is not a public document. This means that it does not need to be filed with the state, allowing you to maintain privacy regarding your business's internal operations. However, certain information related to your LLC, such as the name and registered agent, may be publicly accessible.

You can obtain a template for a Connecticut Single Member Limited Liability Company LLC Operating Agreement from various online legal platforms, like US Legal Forms. Many resources provide customizable templates that cater to your specific business needs. Additionally, you may consider consulting with a lawyer to create a tailored operating agreement that ensures compliance with Connecticut law.

While not required by law, having a Connecticut Single Member Limited Liability Company LLC Operating Agreement is highly recommended. This document outlines the structure and rules of your LLC, helping to clarify ownership and management. It can also protect your limited liability status and prevent misunderstandings among members. Ultimately, an operating agreement serves as a vital tool for smooth business operations.

Creating a single-member LLC operating agreement involves drafting a document that sets clear expectations for your business operations. First, define the LLC's name, address, and purpose. Then, include management roles, decision-making procedures, and provisions for amendments. For a streamlined approach, consider utilizing resources from uslegalforms to ensure a comprehensive and compliant operating agreement.

To write an operating agreement for your Connecticut Single Member Limited Liability Company LLC, start by outlining the purpose of your business. Include details about your management structure, decision-making processes, and how profits will be distributed. Using templates from platforms like uslegalforms can simplify the process, ensuring you cover all essential elements in your agreement.

Yes, an LLC can have only one member, and this is commonly referred to as a single-member LLC. This structure offers simplicity and flexibility for individual business owners. In Connecticut, a single-member LLC enjoys the same liability protections as multi-member LLCs, making it an attractive option for many entrepreneurs.

An operating agreement is crucial even for a single-member LLC because it outlines the business structure and operations. It helps to clarify management duties, protect your limited liability status, and avoid default state rules. By having a clear document, you ensure that you have a solid foundation for your Connecticut Single Member Limited Liability Company LLC.

Most states in the US, including Connecticut, allow single-member LLCs. This structure offers flexibility and simplicity for business owners. While each state has its own regulations and requirements, you can generally expect similar treatment in terms of liability protection. Therefore, understanding these state-specific regulations is vital when establishing your Connecticut Single Member Limited Liability Company LLC.

Yes, you can write your own operating agreement for your Connecticut Single Member Limited Liability Company LLC. However, creating a comprehensive document can be challenging. It’s essential to ensure that your operating agreement covers all aspects of your LLC’s management and operations. You might consider using platforms like uslegalforms to guide you in drafting a well-structured agreement.