Colorado Installments Fixed Rate Promissory Note Secured by Commercial Real Estate

Description

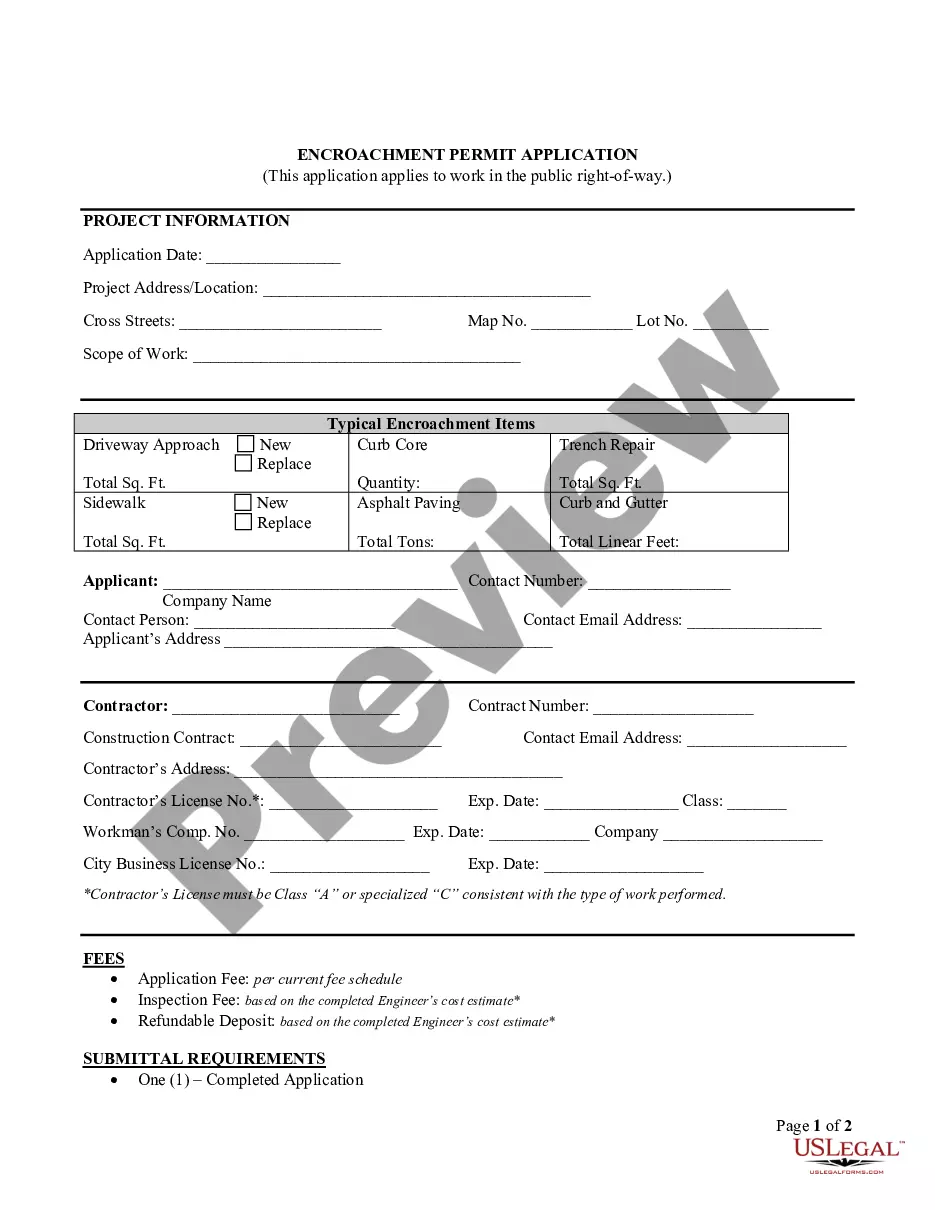

How to fill out Colorado Installments Fixed Rate Promissory Note Secured By Commercial Real Estate?

The larger quantity of documents you are required to produce - the more anxious you become.

You can find a vast array of Colorado Installments Fixed Rate Promissory Note Secured by Commercial Real Estate templates online, yet you are uncertain which ones to trust.

Eliminate the confusion and simplify the process of locating samples with US Legal Forms. Acquire expertly crafted forms that are designed to comply with state regulations.

Enter the necessary information to create your account and settle your order using PayPal or your credit card. Select a convenient file format and receive your copy. Locate all documents in the My documents section. Simply navigate there to create a new version of your Colorado Installments Fixed Rate Promissory Note Secured by Commercial Real Estate. Even when relying on professionally drafted forms, it remains crucial to consider seeking advice from a local attorney to review the completed template to ensure your document is filled out correctly. Achieve more for less with US Legal Forms!

- If you already have a subscription with US Legal Forms, Log In to your account, and you will see the Download button on the page of the Colorado Installments Fixed Rate Promissory Note Secured by Commercial Real Estate.

- If this is your first time using our service, follow these steps to complete the registration process.

- Verify that the Colorado Installments Fixed Rate Promissory Note Secured by Commercial Real Estate is applicable in your state.

- Confirm your selection by reviewing the description or by utilizing the Preview option if available for the selected document.

- Click on Buy Now to initiate the registration process and choose a pricing plan that suits your needs.

Form popularity

FAQ

One disadvantage of a promissory note is the obligation it creates for the borrower to repay the debt. In the case of a Colorado Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, failing to meet the repayment terms can lead to foreclosure on the secured property. Additionally, if the market value of the real estate decreases, the borrower may owe more than the property is worth. Understanding these risks is crucial for borrowers when considering financing options.

To secure a promissory note with real property, the lender must create a legal agreement that ties the note to the property. This often involves a mortgage or deed of trust that grants the lender a claim to the property if the borrower defaults. By utilizing a Colorado Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, the lender enhances their security and can pursue the property in case of default.

Yes, promissory notes can indeed be backed by collateral, which adds protection for the lender. This collateral typically comes in the form of real property or assets. For a Colorado Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, the commercial property itself serves as the collateral to ensure that lenders have recourse if the borrower defaults.

A secured promissory note is backed by collateral, providing the lender with added security in case the borrower defaults. In contrast, an unsecured promissory note relies solely on the borrower's creditworthiness. Choosing a Colorado Installments Fixed Rate Promissory Note Secured by Commercial Real Estate allows lenders to have recourse to the property in case of non-payment.

To fill out a promissory note, start by entering the full names and addresses of both the borrower and lender. Then, specify the amount being borrowed, the interest rate, and the repayment plan. If the note is secured, describe the collateral such as in a Colorado Installments Fixed Rate Promissory Note Secured by Commercial Real Estate. Double-check all the information for accuracy to ensure a smooth transaction.

Yes, a promissory note can be secured. When a promissory note is secured by collateral, such as Colorado Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, it reduces the risk for lenders. If the borrower defaults, the lender can claim the collateral to recover losses. This added security can make securing loans easier for borrowers.

To secure a promissory note means that you identify some specific property and attach it to the note. Then, if the borrower defaults on the loan, you will be able to repossess the collateral as compensation for the loan.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

Keep the original promissory note. Once a lender executes a promissory note, he keeps the original of the promissory note. Accept full payment of the loan. Mark paid in full on the promissory note. Place a signature beside the paid in full notation. Mail the original promissory note to the borrower.

Write the date of the writing of the promissory note at the top of the page. Write the amount of the note. Describe the note terms. Write the interest rate. State if the note is secured or unsecured. Include the names of both the lender and the borrower on the note, indicating which person is which.