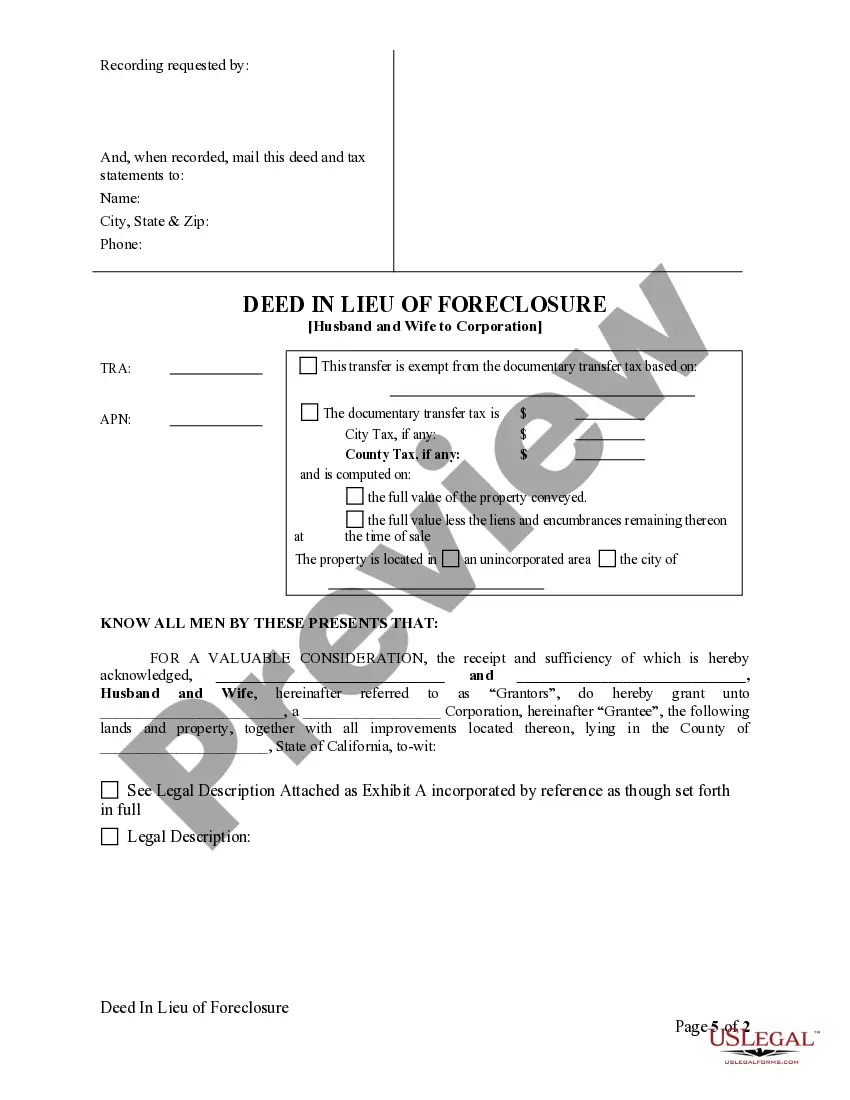

This form is a Deed in Lieu of Foreclosure from a Husband and Wife Grantors to a Corporation as Grantee. Grantor conveys and warrants the described property to the Grantee. This deed complies with all state statutory laws.

California Deed in Lieu of Foreclosure - Husband and Wife to Corporation

Description

How to fill out California Deed In Lieu Of Foreclosure - Husband And Wife To Corporation?

If you're in search of the appropriate California Deed in Lieu of Foreclosure - Spouse and Spouse to Corporation web templates, US Legal Forms is precisely what you require; find documents created and validated by state-licensed attorneys.

Utilizing US Legal Forms not only protects you from issues related to legal forms; additionally, you save effort, time, and money!

And that's it. In just a few simple clicks, you obtain an editable California Deed in Lieu of Foreclosure - Spouse and Spouse to Corporation. Once your account is established, all subsequent orders will be processed even more easily. After obtaining a US Legal Forms subscription, simply Log In to your profile and click the Download button visible on the form's page. Then, whenever you wish to use this template again, you'll always be able to find it under the My documents section. Don't waste your time searching through countless forms on different websites. Acquire professional templates from one secure service!

- Downloading, printing, and submitting a professional form is significantly more affordable than hiring legal advice to handle it for you.

- To get started, complete your registration by providing your email and creating a password.

- Follow the steps below to create an account and obtain the California Deed in Lieu of Foreclosure - Spouse and Spouse to Corporation template to meet your requirements.

- Take advantage of the Preview option or review the document description (if available) to ensure that the template is what you need.

- Verify its applicability in your jurisdiction.

- Click on Buy Now to make your purchase.

- Select a suitable pricing plan.

- Create your account and pay with a credit card or PayPal.

- Choose a convenient format and save the document.

Form popularity

FAQ

To process a deed in lieu of foreclosure, start by contacting your lender to express your interest in this option. Provide them with necessary documentation, including financial statements and the property deed. Utilizing resources like USLegalForms can help you draft the deed correctly. Once approved, you'll sign the deed, transferring ownership from you to the lender, culminating the California Deed in Lieu of Foreclosure - Husband and Wife to Corporation.

Writing a deed in lieu of foreclosure letter involves clearly stating your intent to transfer your property back to the lender. In this letter, you should include essential details like your current situation, property address, and the reasons for your decision. USLegalForms offers clear templates that guide you through the required language and structure. This process can effectively initiate a California Deed in Lieu of Foreclosure - Husband and Wife to Corporation.

To add your wife to your deed in California, you will need to prepare a new deed that includes both names. Typically, a grant deed or quitclaim deed is used for this purpose. You can find templates on platforms like USLegalForms, which make the process easier. Once you've completed the deed, file it with your county recorder’s office to make it official.

Ownership is most commonly transferred through the execution of a deed, which serves as a legal instrument confirming the change of title. In situations involving a California Deed in Lieu of Foreclosure - Husband and Wife to Corporation, this process becomes essential for those looking to reclaim financial stability. It simplifies the transition, ensuring that ownership passes seamlessly.

The granting clause of a special warranty deed typically includes the word 'grant' or a related term indicating the transfer of property rights. This clause outlines the specific rights being conveyed from the grantor to the grantee. In cases like a California Deed in Lieu of Foreclosure - Husband and Wife to Corporation, clarity in this clause is crucial to ensure that all parties understand their rights and obligations.

The most common method of transferring real property is through a deed. A deed serves as a legal document that records the change of ownership between the seller and the buyer. In the context of a California Deed in Lieu of Foreclosure - Husband and Wife to Corporation, a deed can effectively facilitate this transfer, helping couples avoid lengthy foreclosure processes.

The duration for a California Deed in Lieu of Foreclosure - Husband and Wife to Corporation can vary based on several factors. Typically, the entire process may take anywhere from a few weeks to a couple of months, depending on lender responsiveness and any potential complications in title transfer. To expedite this process, it’s advisable to maintain clear communication with your lender and consider utilizing platforms like uslegalforms, which provide guidance and forms to simplify each step.

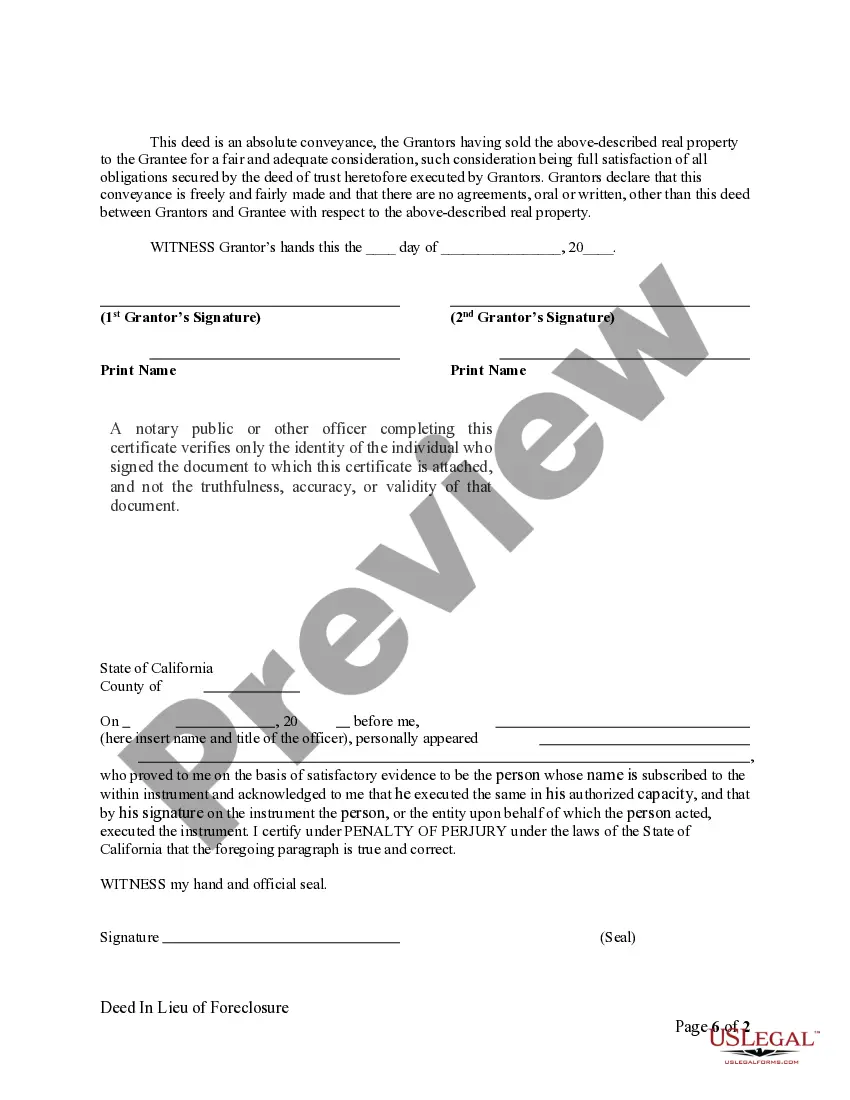

To execute a California Deed in Lieu of Foreclosure - Husband and Wife to Corporation, you need to follow several key steps. First, both spouses must agree to the transfer of property to the corporation, ensuring that all necessary documentation is prepared. Next, sign the deed in front of a notary public and file it with the appropriate county recorder's office. Lastly, ensure that any outstanding obligations such as mortgage loans are satisfied to complete the process smoothly.

A key disadvantage of a California Deed in Lieu of Foreclosure - Husband and Wife to Corporation is the likelihood of deficiency judgments. If the property value is less than the outstanding mortgage, lenders may pursue additional payments to cover the difference. This potential financial burden can impact the homeowner's finances long after the deed is executed. To avoid such situations, consulting with a legal expert on this process is advisable.

One disadvantage of a California Deed in Lieu of Foreclosure - Husband and Wife to Corporation is the impact on the homeowner's credit score. Accepting this type of deed can lead to a significant reduction in creditworthiness compared to a foreclosure, which can linger for years on credit reports. Furthermore, individuals may find it harder to obtain loans in the future due to this negative mark. It's helpful to be aware of these long-term financial consequences.