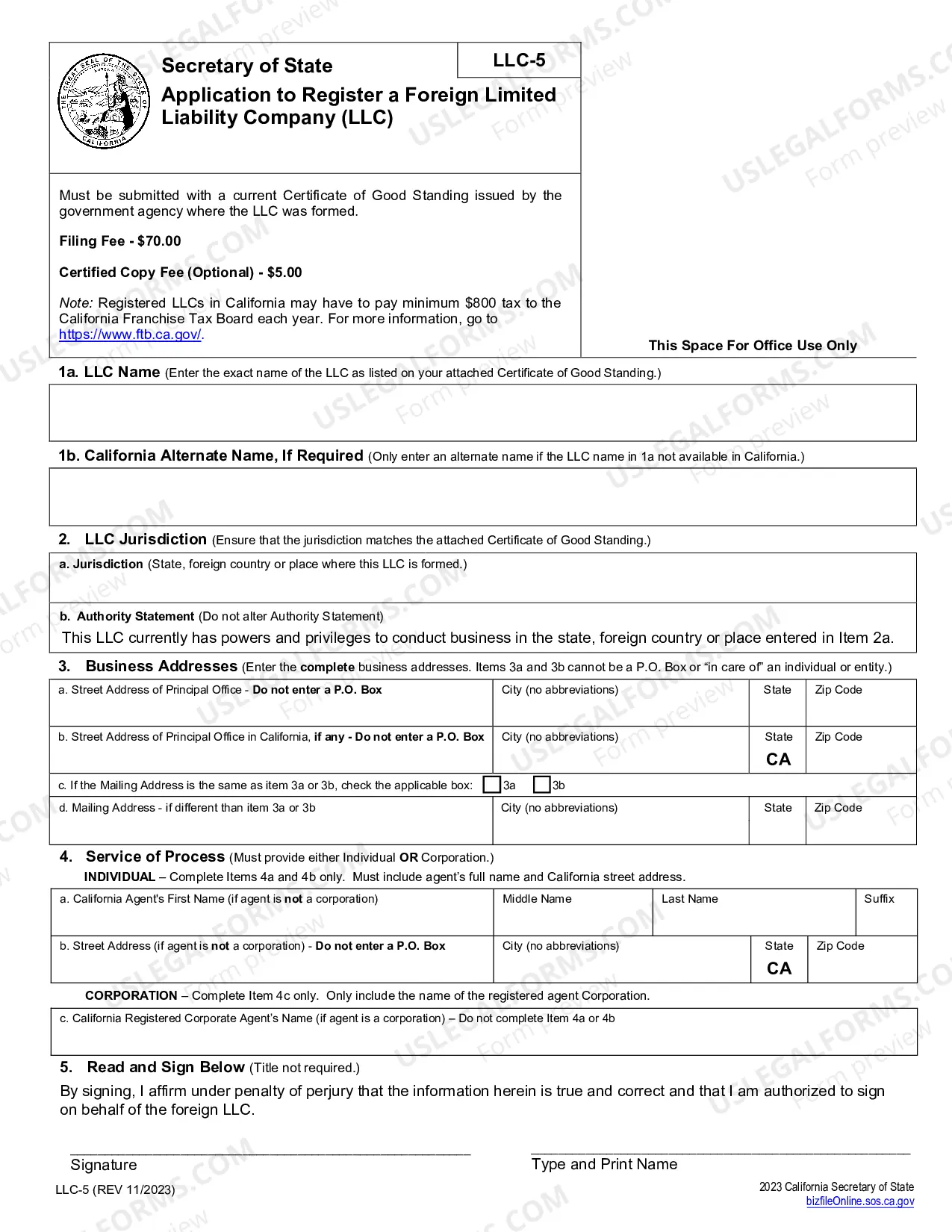

Includes instructions and forms required to register a non-California corporation in California.

California Registration of Foreign Corporation

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

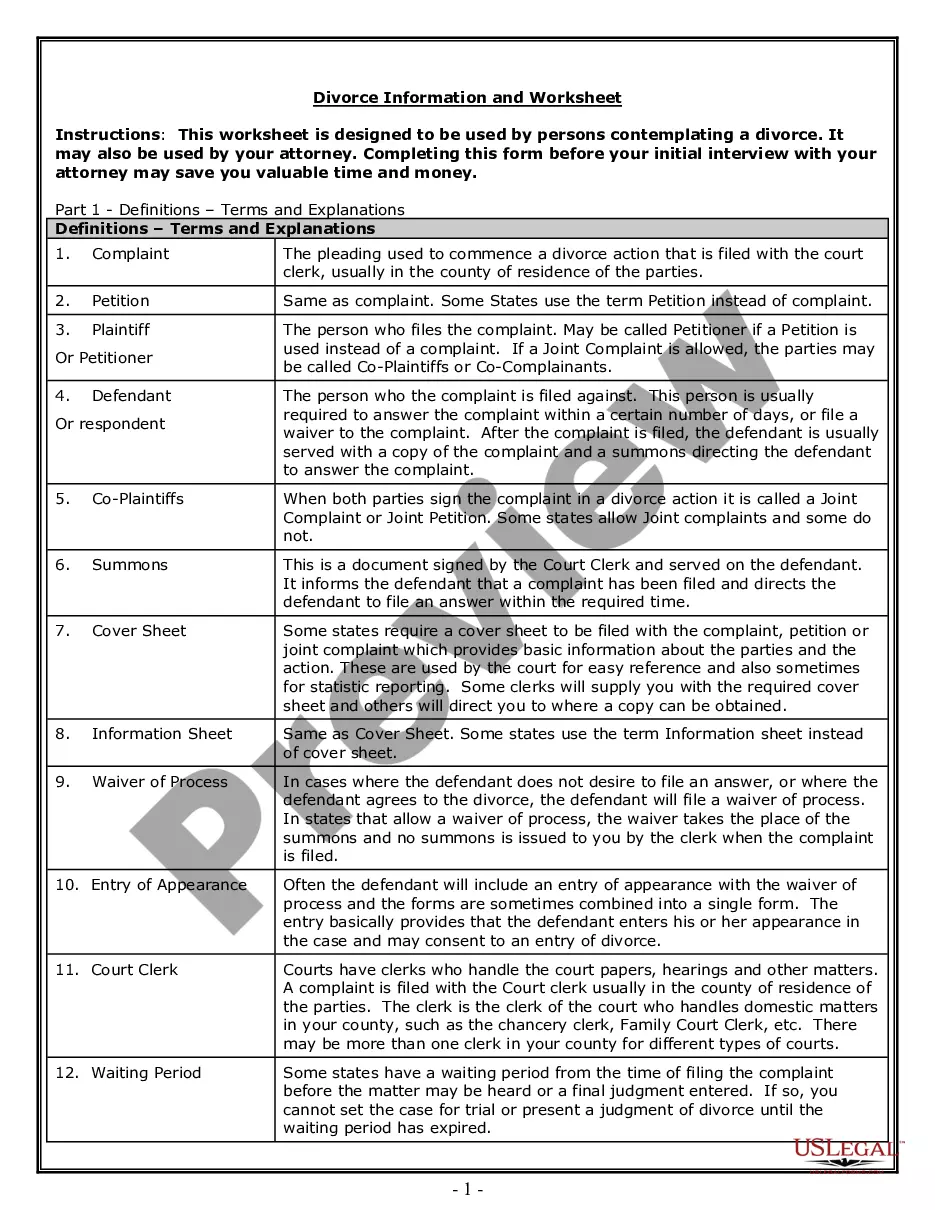

Key Concepts & Definitions

California Registration of Foreign Corporation: This process involves a non-California corporation registering with the California Secretary of State to conduct business legally in California. Foreign Corporation refers to any business entity formed outside California but operating within. Limited Liability pertains to the protection from personal liability for business debts, provided to business owners. Statement of Information: A document that foreign corporations must file periodically with the California Secretary of State containing essential details about the business.

Step-by-Step Guide

- Determine Eligibility: Assess whether your business classifies as a foreign corporation under California law.

- Prepare Required Documents: Gather necessary documents including a certified copy of your original articles of incorporation.

- File Statement of Information: Complete and submit the Statement of Information to the California Secretary of State using online platforms such as bizfileonline.sos.ca.gov.

- Appoint a Registered Agent: Designate an agent in California for service of process.

- Filing Taxes: Register with the California Department of Tax and Fee Administration to handle state taxes and compliance.

- Compliance: Ensure ongoing compliance with all California state requirements to avoid legal issues.

Risk Analysis

- Non-Compliance Risks: Failure to register can result in penalties, fines, and inability to enforce contracts in California courts.

- Tax Implications: Incorrectly handling filing taxes can lead to audits, penalties, and damage to business reputation.

- Legal Vulnerabilities: Without proper registration, a business's limited liability protection might be compromised in California.

Key Takeaways

Key Takeaways: Registering as a foreign corporation in California is essential for operating legally and maintaining liability protections. Utilizing online resources such as bizfileonline.sos.ca.gov can streamline the registration and compliance processes.

Common Mistakes & How to Avoid Them

- Delay in Filing: Avoid delays in the registration process which can create legal repercussions and loss of business opportunities. Ensure timely submission of all required documents.

- Inaccurate Information: Submitting incorrect or outdated information can lead to legal challenges. Regularly review and update your Statement of Information.

- Ignoring State-specific Requirements: Each state, including California, has unique business laws. Consult with legal experts to ensure full compliance.

How to fill out California Registration Of Foreign Corporation?

If you're seeking accurate California Registration of Foreign Corporation copies, US Legal Forms is what you require; find documents created and verified by state-approved legal professionals.

Utilizing US Legal Forms not only spares you from concerns about official forms; it also conserves your time, effort, and finances! Downloading, printing, and filling out a professional form is significantly less costly than hiring a lawyer to do it for you.

And that's it! With a few simple steps, you have an editable California Registration of Foreign Corporation. Once your account is created, all future transactions will be processed even more smoothly. When you have a US Legal Forms subscription, simply Log In to your profile and click the Download button you see on the form’s webpage. Then, when you need to use this blank again, you'll always be able to find it in the My documents menu. Don’t waste your time and effort searching through countless forms on various platforms. Purchase accurate documents from a trusted platform!

- To start, complete your registration process by entering your email and setting a password.

- Follow the instructions below to create your account and locate the California Registration of Foreign Corporation template to address your needs.

- Use the Preview option or review the file description (if available) to ensure that the template is the one you require.

- Verify its validity in your residing state.

- Click Buy Now to place your order.

- Select a preferred pricing plan.

- Establish your account and pay using your credit card or PayPal.

Form popularity

FAQ

Yes, a foreign corporation must register in California if it intends to conduct business within the state. This process is known as California Registration of Foreign Corporation. Without proper registration, your business may face legal issues, including fines and restrictions. By registering, you can take advantage of the opportunities available in California's vibrant market.

Yes, foreign corporations must register in California if they intend to do business there. This registration enables them to legally operate and comply with state regulations. The process for California registration of foreign corporation includes submitting specific documents and meeting state requirements. This step is crucial for protecting your business's legal standing in California.

To register a foreign corporation in California, you must first obtain a certificate of good standing from your home state. Next, you will complete the appropriate registration forms and submit them along with applicable fees to the California Secretary of State. After that, you will receive a certified copy of the California registration of foreign corporation. Using platforms like US Legal Forms can help simplify this process by providing you with the necessary forms and guidance.

Yes, you can register a foreign company in the US. Each state has its own requirements for registering foreign corporations. If you wish to conduct business in California, you will need to follow the regulations outlined for California registration of foreign corporation. This registration allows foreign entities to operate legally within the state.

While you can start a business without registering it in California, this approach has risks. Unregistered businesses may face legal complications and lack the protections that come with formal registration. If you wish to conduct business in California, you will eventually need to complete a California Registration of Foreign Corporation to ensure compliance and protect your assets. Using platforms like uslegalforms can simplify this registration process and help you understand your obligations.

In California, most businesses do need a business license to operate legally, but the requirements can vary depending on the city and type of business. It's important to check local regulations, as some areas have specific licensing criteria. Failure to obtain the necessary licenses can lead to legal issues and hinder your California Registration of Foreign Corporation process. Therefore, ensure you understand all requirements before starting your business.

Yes, you can live in California and operate an LLC registered in another state. However, if your business engages in activities in California, you must comply with California laws. This typically involves California Registration of Foreign Corporation, which allows you to legally conduct business in the state. Additionally, consider local regulations and taxes that may apply to your situation.

Yes, you can file a California Statement of Information online through the California Secretary of State’s website. The online filing system is designed for ease and efficiency, guiding you through each step. Utilizing this digital platform helps streamline your registration process, ensuring compliance with California registration of foreign corporation requirements.

To register a foreign company in the USA, start by choosing the state where you will operate and familiarize yourself with its registration requirements. Each state, including California, has its own specific forms and fees, so understanding these regulations is essential. Consider using USLegalForms for comprehensive guidance on the registration process and necessary documentation.

Yes, California generally taxes out-of-state businesses that earn income from California sources. If your foreign corporation actively conducts business within the state, you will be subject to California's taxation. It is important to accurately report your income and comply with tax regulations to avoid future liabilities.