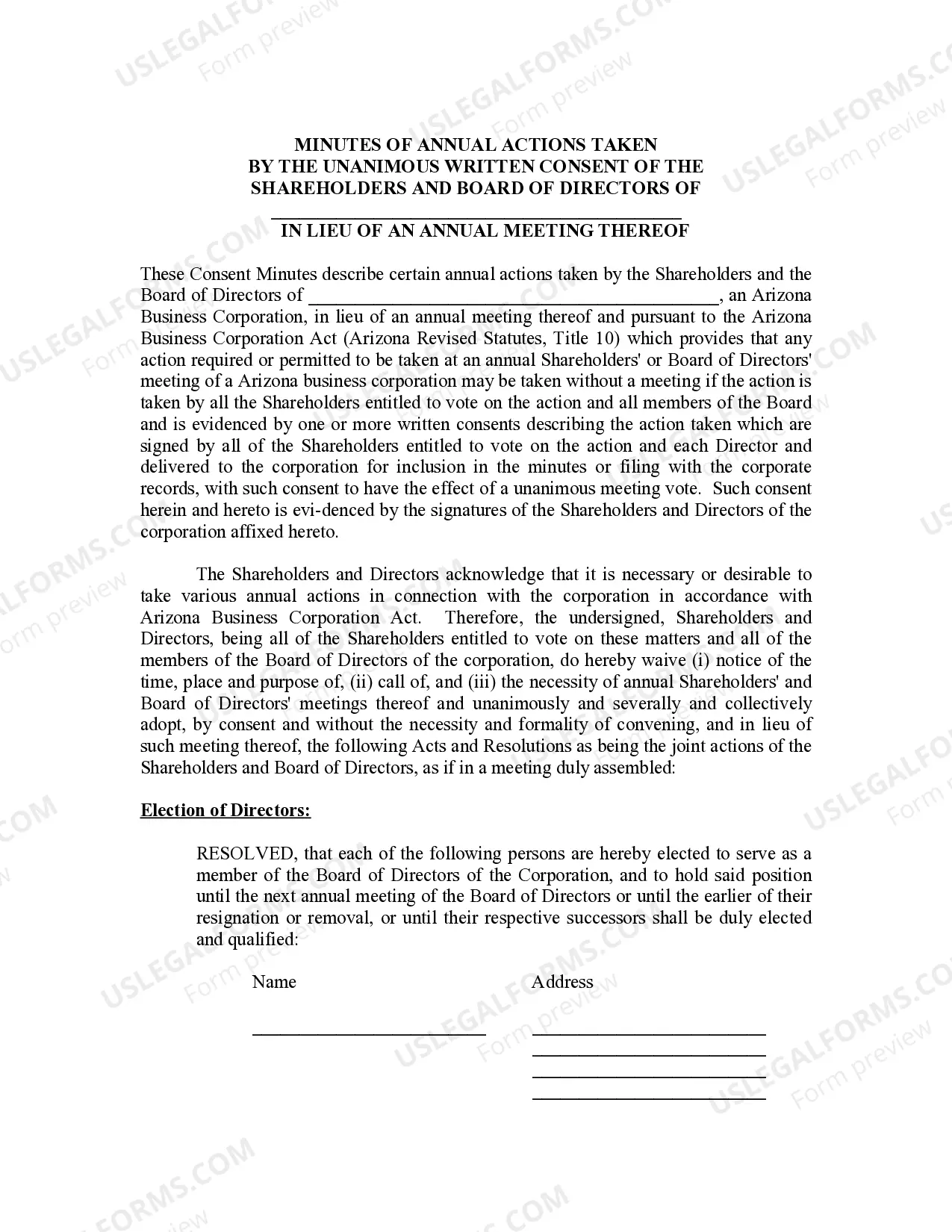

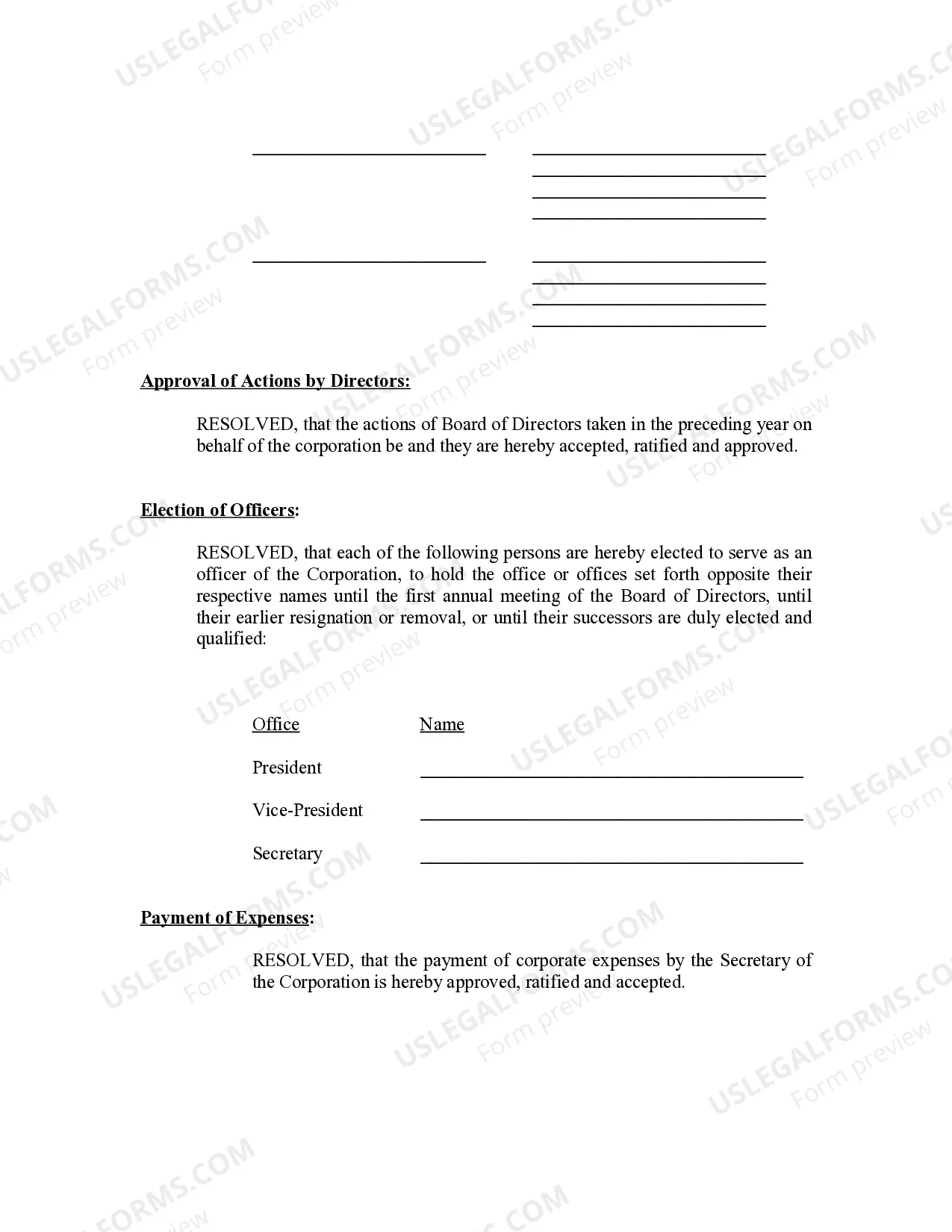

The Annual Minutes form is used to document any changes or other organizational activities of the Corporation during a given year.

Arizona Annual Minutes

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Arizona Annual Minutes?

If you're looking for accurate Annual Minutes - Arizona examples, US Legal Forms is exactly what you require; access documents crafted and verified by state-certified legal professionals.

Using US Legal Forms not only saves you from concerns regarding legal paperwork; you also conserve time and effort, as well as money! Downloading, printing, and completing a professional template is indeed more cost-efficient than hiring an attorney to draft it for you.

And that's it. Within a few simple steps, you have an editable Annual Minutes - Arizona. When you create an account, all future purchases will be processed even more smoothly. If you have a US Legal Forms subscription, just Log In to your profile and then click the Download button available on the form's page. Then, when you need to use this template again, you'll always be able to find it in the My documents section. Don't waste your time and effort looking through countless forms on various websites. Purchase professional documents from one secure platform!

- To begin, complete your registration process by entering your email and creating a password.

- Follow the instructions provided below to set up your account and obtain the Annual Minutes - Arizona template to meet your requirements.

- Utilize the Preview feature or review the file description (if available) to ensure that the form is the one you need.

- Verify its legitimacy in your state.

- Click on Buy Now to place your order.

- Select a preferred payment plan.

- Create an account and pay with your credit card or PayPal.

- Choose a convenient file format and save the form.

Form popularity

FAQ

To determine if someone has passed away in Arizona, you can check public death records through the Arizona Department of Health Services. You may also search local obituaries or contact county vital records offices. Such information can often intersect with issues regarding Arizona Annual Minutes if the deceased was connected to a business, making it relevant for legal documentation.

To obtain a certificate of Good Standing in Arizona, you can request it through the Arizona Corporation Commission. Prepare to provide your business name and any relevant identification details. This certificate confirms your business complies with state regulations, including the maintenance of Arizona Annual Minutes. Using platforms like US Legal Forms can streamline the application process.

Yes, Arizona is an open record state, which means that most public records are accessible to the public. This transparency allows citizens to inspect documents such as Arizona Annual Minutes, government contracts, and more. However, certain records are exempted due to privacy laws or other regulations. It’s important to understand these nuances when seeking information.

In Arizona, public records are open to the general public, meaning anyone can request to inspect them. However, some records may have restrictions based on privacy laws. It's beneficial to familiarize yourself with these laws, especially if you are looking into Arizona Annual Minutes or similar documents. This knowledge will empower you to navigate the inspection process effectively.

You can obtain public records in Arizona through various methods, including online portals or by direct request to state departments. Many agencies have specific forms that need to be filled out and submitted. Additionally, having a clear idea of what you need, including references to Arizona Annual Minutes if applicable, can make this process much easier for you.

To request public records from the Arizona Attorney General, you can submit a written request via mail or email. Include specific details about the records you seek, such as the type of document and the time period it covers. This will help expedite the process. Remember, understanding your rights regarding Arizona Annual Minutes can also guide you in accessing related public documents.

To complete your Arizona Annual Minutes, you should first gather all the necessary documents related to your company. Draft a document that outlines the key activities of your organization over the past year, including decisions made and any major events. It’s advisable to record these minutes in a way that meets Arizona's legal requirements. Utilizing resources like US Legal Forms can simplify this process, ensuring compliance with state laws.

To obtain a tax clearance certificate in Arizona, you must apply through the Arizona Department of Revenue. Ensure that all your tax filings and obligations are current. Aligning your tax documentation with your Arizona Annual Minutes can improve your chances of a swift approval.

To obtain a certificate of good standing in Arizona, you need to submit a request to the Arizona Secretary of State. You will need to provide specific details about your business entity. Reviewing your Arizona Annual Minutes will help ensure that your request includes all necessary compliance information.

In the USA, you can usually request a certificate of good standing through the Secretary of State's office in your state. This document often verifies that your company has met all statutory requirements. Make sure your business documentation aligns with Arizona Annual Minutes to avoid any discrepancies.