Arizona Living Trust for individual, Who is Single, Divorced or Widow or Widower with Children

What this document covers

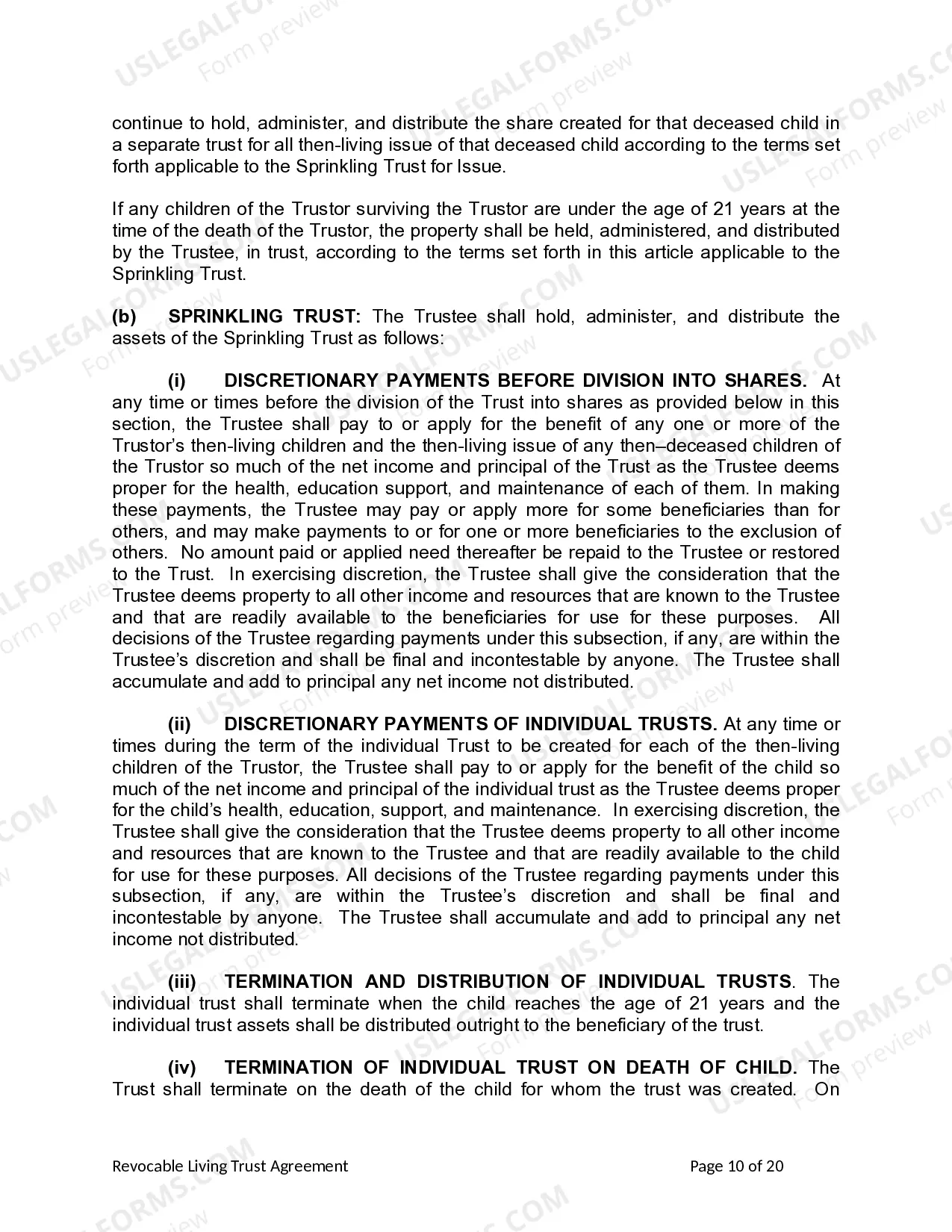

This Living Trust form is designed for individuals who are single, divorced, or widowed and have children. It serves as a legal document that establishes a trust for asset management and estate planning purposes during the creator's lifetime. Unlike a Last Will and Testament, which goes through probate after death, a living trust allows for the immediate transfer of assets to beneficiaries without the need for court intervention, providing a more streamlined and efficient estate settlement process.

Key parts of this document

- Identification of the Trustor and beneficiaries, including children.

- Appointment of the Trustee and any Successor Trustees.

- Detailed description of Trust assets and property management provisions.

- Trustee powers and duties, including provisions for asset management and distribution.

- Instructions on distributions to beneficiaries upon the Trustor's death.

Common use cases

This form is ideal when a person wishes to manage their assets while alive and ensure a seamless transfer to their children upon death. It is suitable for individuals who want to avoid the probate process, maintain privacy regarding their assets, and provide specific instructions for how their assets should be handled before and after their passing.

Who should use this form

- Individuals who are single, divorced, or widowed.

- Parents with one or more minor children or adult children.

- People looking for a flexible way to manage their assets during their lifetime.

- Those wanting to avoid probate and simplify asset distribution after death.

How to prepare this document

- Identify the Trustor and enter personal information, including residency.

- List all beneficiaries, ensuring all children are named.

- Appoint a Trustee and, if desired, Successor Trustees for future management.

- Detail the assets to be transferred into the Trust, utilizing Schedule A for specifics.

- Sign and date the document in the presence of a Notary Public as required.

Notarization requirements for this form

This document requires notarization to meet legal standards. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Not including all intended beneficiaries, particularly minor children.

- Failing to appoint a Successor Trustee, which can complicate management if the original Trustee is unavailable.

- Omitting specific details about Trust assets or failing to update the Schedule A when assets change.

- Neglecting to have the document notarized, if required by local laws.

Why use this form online

- Convenience of completing and handling legal documents from home.

- Editability allows for easy updates and modifications to the Trust.

- Access to reliable and attorney-drafted forms tailored to your needs.

- Quick download and immediate access to your completed form.

Looking for another form?

Form popularity

FAQ

A paralegal can assist in preparing a living trust under the supervision of an attorney in Arizona. They can help gather information and draft documents for an Arizona Living Trust for individuals who are single, divorced, or widowed with children. However, the final document must be reviewed and finalized by an attorney to ensure it meets all legal requirements.

In Arizona, a paralegal can assist attorneys with a variety of legal tasks, including drafting documents and conducting research. They can help prepare materials for an Arizona Living Trust for individuals who are single, divorced, or widowed with children. However, while a paralegal provides valuable support, they cannot offer legal advice or represent clients in court.

The best person to set up a trust is typically an estate planning attorney. They have the knowledge and experience to create a comprehensive Arizona Living Trust for individuals who are single, divorced, or widowed with children. An attorney can ensure that the trust meets legal requirements and reflects your specific wishes, providing peace of mind for you and your family.

In Arizona, an Arizona Living Trust for individuals who are single, divorced, or widowed with children does not need to be recorded with the state. However, it is important to keep the trust document accessible for your beneficiaries. They must be aware of its existence and contents, particularly to access assets. A reliable platform like US Legal Forms can assist you in maintaining proper documentation, ensuring your trust is effective and your desires are met.

While you can set up an Arizona Living Trust for individuals who are single, divorced, or widowed with children without an attorney, having legal guidance is beneficial. An attorney can help ensure that the trust is legally sound and that your wishes are accurately represented. They can also navigate any complex situations, especially when it comes to legal requirements and tax implications. However, platforms like US Legal Forms can provide valuable resources if you choose to handle it independently.

Registering an Arizona Living Trust for individuals who are single, divorced, or widowed with children can be straightforward. You typically need to complete a trust document and may need to transfer ownership of assets into the trust. While you do not have to file the trust document with the state, it is wise to keep it in a safe place and inform your children about its location. Using a dedicated platform like US Legal Forms can simplify this process, offering user-friendly templates tailored for your needs.

One of the biggest mistakes parents make when establishing an Arizona Living Trust for individuals who are single, divorced, or widowed with children is not clearly outlining their wishes. This lack of clarity can lead to confusion and disputes among beneficiaries. It is crucial to specify how assets should be divided and ensure that the fund aligns with your family’s needs. Taking the time to plan thoroughly can prevent potential conflicts and provide peace of mind.

In Arizona, beneficiaries generally do have the right to see the trust document, especially after the trustor's death. This right helps ensure transparency in how assets will be distributed. If you are a beneficiary, you should expect to receive information regarding the trust and its terms. Understanding this aspect is vital for individuals who are single, divorced, or widowed while navigating an Arizona Living Trust.

Yes, you can set up a living trust without an attorney in Arizona, especially with the help of online platforms like uslegalforms. These services provide templates and guidance, allowing you to create a trust tailored to your needs as an individual, whether you're single, divorced, or widowed. However, while DIY options are available, consulting an attorney can help ensure all legal aspects are correctly addressed for your peace of mind.

To obtain a copy of a living trust in Arizona, you need to request it from the trustee, who is responsible for managing the trust. If you are a beneficiary, you typically have the right to see the trust's terms. If there's any difficulty accessing the document, consider mediation or legal advice to clarify your rights. For individuals who are single, divorced, or widowed, knowing your rights within an Arizona Living Trust is essential.