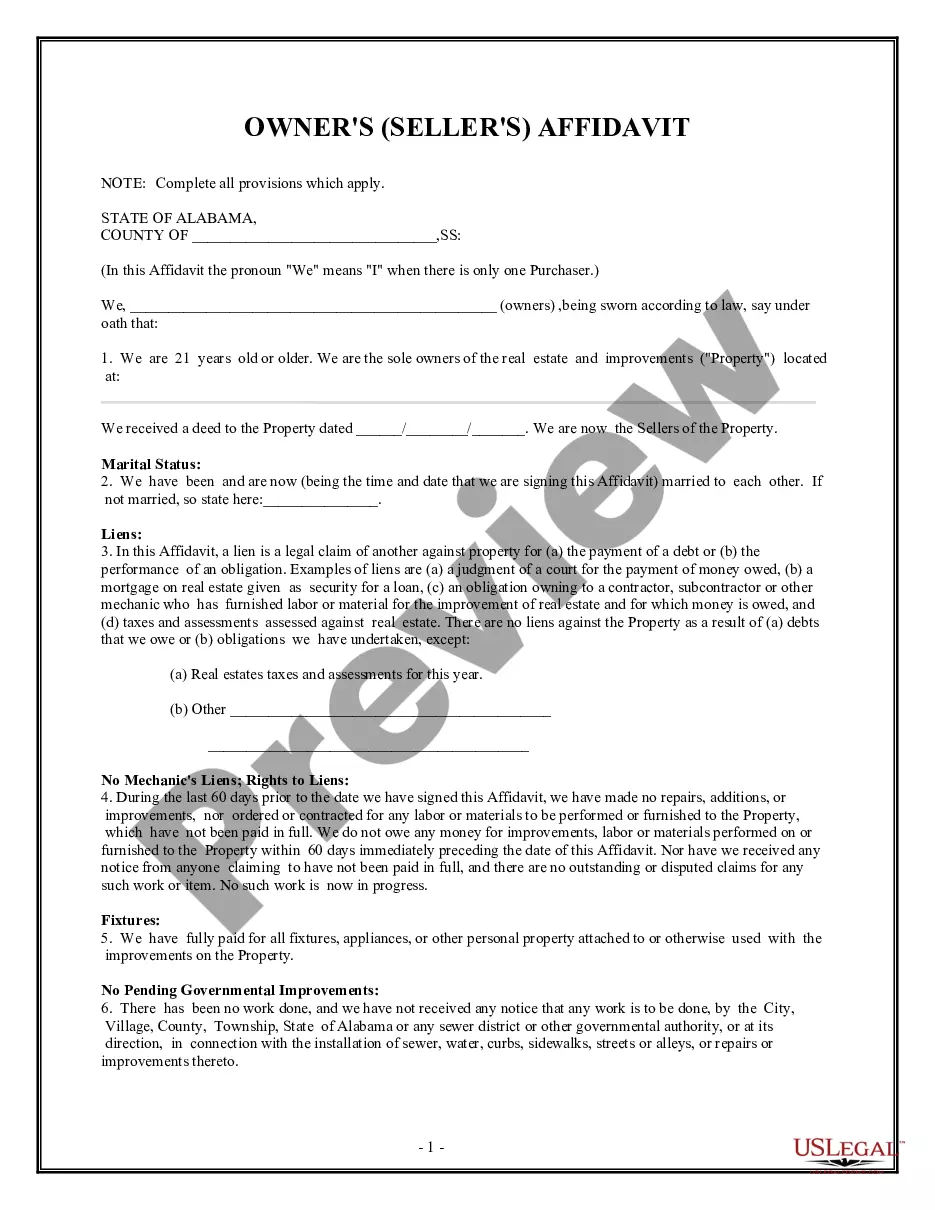

This Owner/Seller Affidavit form is for seller(s) to sign at the time of closing certifying that, among other assurances, there are no liens on the property being sold, that they are the owners of the property, that there are no mechanic liens on the property and other certifications. This form must be signed and notarized.

Alabama Owner's or Seller's Affidavit of No Liens

Description

How to fill out Alabama Owner's Or Seller's Affidavit Of No Liens?

Utilizing templates of Alabama Owner's or Seller's Affidavit of No Liens crafted by skilled attorneys provides you the chance to avert issues when completing paperwork.

Simply download the sample from our site, complete it, and seek legal advice to confirm it.

Doing so can save you considerably more time and expenses than attempting to find a lawyer to create a document from the ground up for you.

Utilize the Preview function and examine the description (if available) to determine if you need this specific template, and if so, click Buy Now. Seek another sample using the Search bar if needed. Select a subscription that fits your needs. Begin using your credit card or PayPal. Choose a file type and download your document. Once you have performed all the steps above, you will be able to fill out, print, and sign the Alabama Owner's or Seller's Affidavit of No Liens template. Remember to double-check all entered information for accuracy before submitting or mailing it. Reduce the time spent on document completion with US Legal Forms!

- If you possess a US Legal Forms subscription, simply Log Into your account and navigate back to the form webpage.

- Locate the Download button adjacent to the templates you're reviewing.

- Upon downloading a document, you will find all of your saved samples in the My documents section.

- If you lack a subscription, that’s not an issue.

- Just follow the instructions below to register for an account online, obtain, and finalize your Alabama Owner's or Seller's Affidavit of No Liens template.

- Verify and confirm that you’re downloading the correct state-specific document.

Form popularity

FAQ

A simple estate with just a few, easy-to-find assets may be all wrapped up in six to eight months. A more complicated affair may take three years or more to fully settle.

By Stephanie Kurose, J.D. Closing a person's estate after they die can often be a long, detailed process. This includes paying off debts, filing final tax returns, and, finally, distributing the estate's assets according to the wishes of the deceased.

Notify all creditors. File tax returns and pay final taxes. File the final accounting with the probate court. Distribute remaining assets to beneficiaries. File a closing statement with the court.

If an estate is not properly probated and closed in a timely manner, there may be a number of consequences that can jeopardize the estate: The statute of limitations for creditors' claims is extended. Assets may lose value or be lost altogether. The state may claim the assets.

When the Estate Closes An executor cannot simply gather assets, pay bills and expenses and then distribute the remaining assets to the beneficiaries. She needs court approval for closing the estate, and in most states, this involves giving a full accounting of everything on which she spent money.

If an estate is not properly probated and closed in a timely manner, there may be a number of consequences that can jeopardize the estate: The statute of limitations for creditors' claims is extended. Assets may lose value or be lost altogether. The state may claim the assets.

File the Will and Probate Petition. Secure Personal Property. Appraise and Insure Valuable Assets. Cancel Personal Accounts. Determine Cash Needs. Remove Estate Tax Lien. Determine Location of Assets and Secure "Date of Death Values" Submit Probate Inventory.

Closing the bank account typically is the last step after the court or beneficiaries have approved the executor's accounting and the estate is ready to close. There may be a few final bills requiring payment, such as compensation to the executor for her services.

An executor acts until the estate administration is completed or if they resign, die or are removed for cause.

If no one moves to open or settle an estate, all assets in the estate could be lost, instead of being distributed to loved ones or other beneficiaries. Probate is not an automatic process. When a loved one dies, a family member or other interested party must petition the probate court to open an estate.