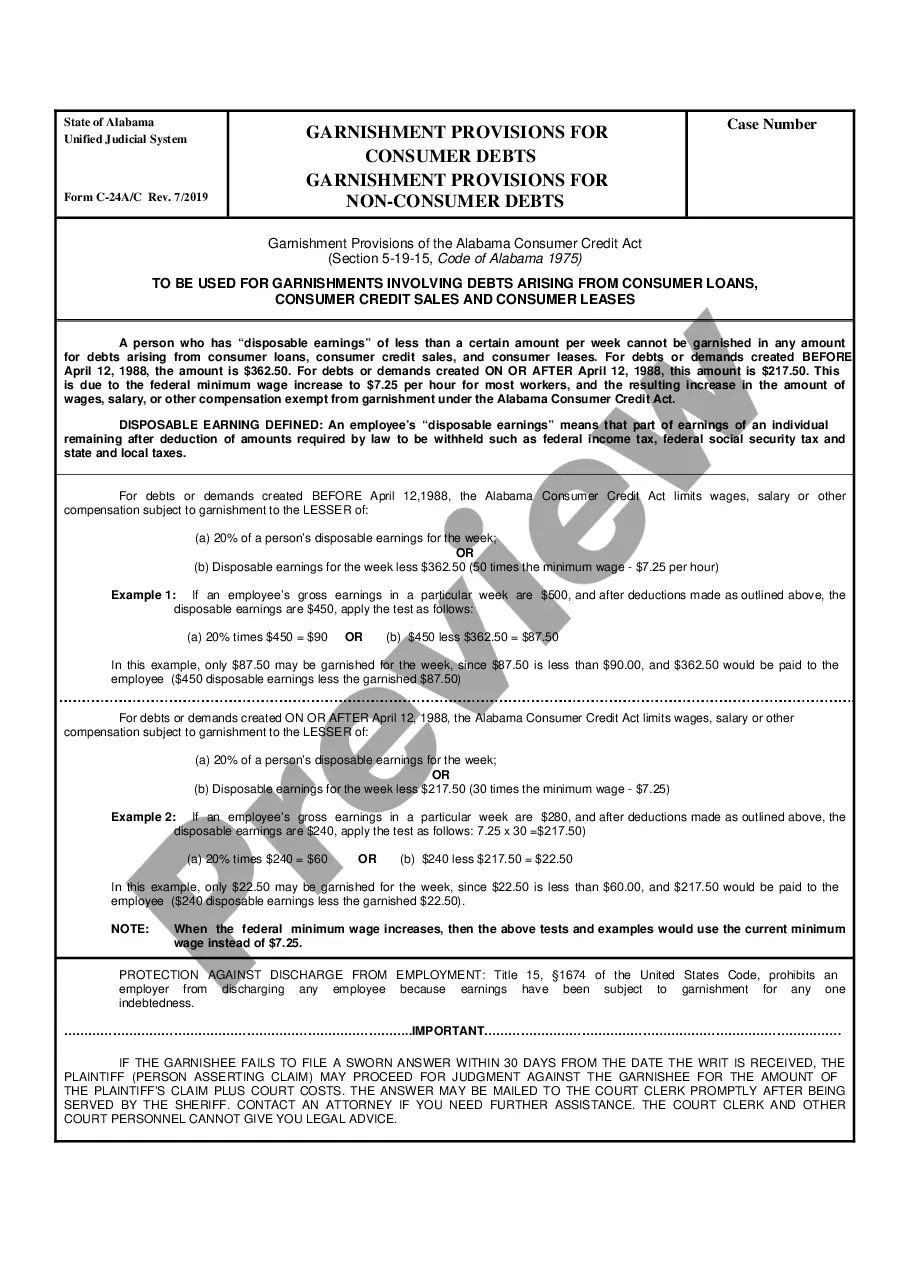

Alabama Official Form - Garnishment Provisions for Consumer Debt Pursuant to the Alabama Consumer Credit Act.

Alabama Garnishment Provisions for Consumer Debt

Description

How to fill out Alabama Garnishment Provisions For Consumer Debt?

Employing Alabama Garnishment Provisions for Consumer Debt templates created by experienced attorneys helps you avoid difficulties when filling out paperwork.

Simply download the example from our site, complete it, and ask a lawyer to validate it. Doing so can aid you in saving significantly more time and expenses than searching for a legal expert to draft a document entirely from the beginning for you.

If you possess a US Legal Forms subscription, just Log In to your account and navigate back to the form page. Locate the Download button adjacent to the templates you are reviewing.

Select a subscription that fulfills your requirements. Begin with your credit card or PayPal. Choose a file format and download your document. After you have completed all the steps above, you will be able to fill out, print, and sign the Alabama Garnishment Provisions for Consumer Debt template. Make sure to review all entered information for accuracy before submitting it or sending it out. Decrease the time you take on completing documents with US Legal Forms!

- Once you download a template, you can find all your saved samples in the My documents section.

- If you do not have a subscription, that's not a significant issue.

- Simply adhere to the following step-by-step instructions to register for your account online, acquire, and complete your Alabama Garnishment Provisions for Consumer Debt template.

- Ensure that you are obtaining the correct state-specific form.

- Utilize the Preview feature and examine the description (if available) to determine if you need this particular sample and if so, click Buy Now.

- If necessary, look for another template using the Search field.

Form popularity

FAQ

To write a letter to stop wage garnishment, begin by addressing the creditor or collector, clearly stating your intention to contest the garnishment. In the letter, reference specific Alabama Garnishment Provisions for Consumer Debt that apply to your case, and provide supporting details regarding your financial situation. Be concise, professional, and remember to include your contact information for follow-up. Utilizing platforms like USLegalForms can help you draft the appropriate legal documents effectively.

Stopping wage garnishment in Alabama involves taking legal action to contest the garnishment order or to claim exemptions. You may file a motion with the court and reference the applicable Alabama Garnishment Provisions for Consumer Debt that apply to your case. Engaging with a legal professional can help you navigate this process and ensure you present a strong argument. Effective communication with your creditors may also yield solutions to halt garnishment.

To claim exemption from wage garnishment in Alabama, first read the garnishment order to understand the grounds for exemption. Then, you can file a claim with the court, identifying the applicable Alabama Garnishment Provisions for Consumer Debt. This claim typically must include income details and any supporting documentation regarding your financial situation. It’s wise to get legal help to ensure you follow the correct procedure.

Yes, a debt collector can garnish your wages without prior notice, but certain legal protocols must be followed. Under Alabama Garnishment Provisions for Consumer Debt, creditors must obtain a court order to initiate wage garnishment. If you have been served with a judgment against you, it is essential to understand your rights and the next steps to take. It’s beneficial to stay informed and proactive about your debts to avoid surprises.

To claim exemption and stop wage garnishment in Alabama, you need to file a motion with the court that issued the garnishment. You should clearly state the specific Alabama Garnishment Provisions for Consumer Debt that apply to your situation. This typically involves demonstrating that your income falls within exempt categories. Consider seeking assistance from a legal professional to guide you through this process.

To write an objection letter for wage garnishment, you first need to clearly state your intent to object and reference the specific Alabama Garnishment Provisions for Consumer Debt that apply to your situation. Include your personal details, the garnishment notice details, and briefly explain the reasons for your objection, such as inaccuracies in the claim or financial hardship. It is important to remain professional and concise, and you may wish to seek assistance from platforms like US Legal Forms, which can provide templates and guidance tailored to your needs.

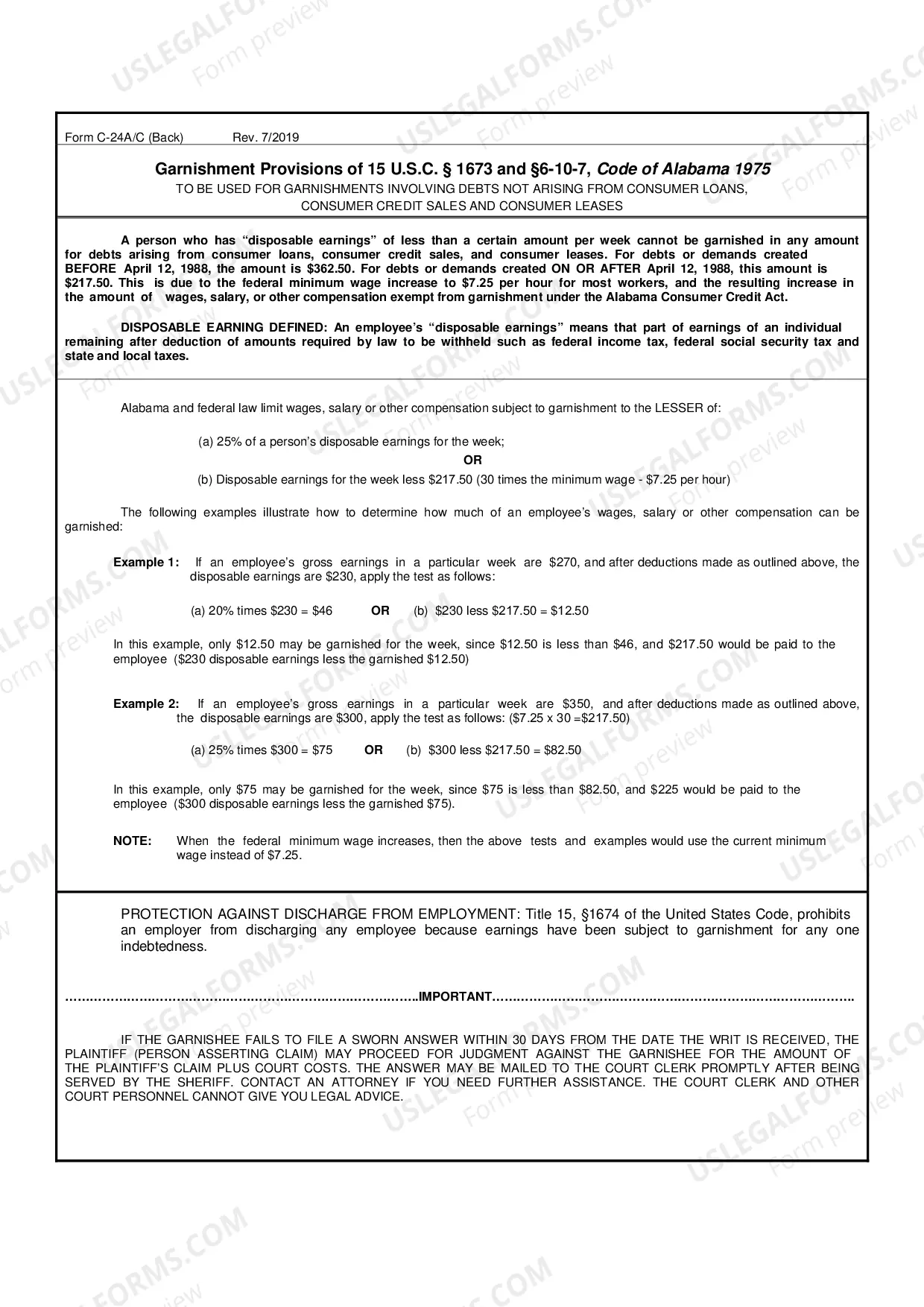

In Alabama, the maximum amount that can be garnished from wages is generally limited to 25% of disposable income or the amount by which your weekly wages exceed 30 times the federal minimum wage, whichever is less. This is stipulated under the Alabama Garnishment Provisions for Consumer Debt to protect workers from excessive deductions. Understanding these limits can help you manage your finances better during tough times. If you need assistance, consider accessing legal resources to clarify your rights.

Filling out a challenge to garnishment form involves specific steps to ensure compliance with the Alabama Garnishment Provisions for Consumer Debt. First, gather all relevant information about the debt and the garnishment. Then, clearly state your reasons for challenging the garnishment in the required sections of the form. Utilizing resources such as uslegalforms can provide you with templates and instructions to complete the process accurately.

Yes, you can stop garnishment once it has started in Alabama by filing to contest the garnishment or requesting a hearing. The Alabama Garnishment Provisions for Consumer Debt allow you to present your case in court. This process gives you an opportunity to argue your financial hardship or challenge the validity of the debt. Consider using platforms like uslegalforms to find the right forms and guidance.

After a default judgment is issued in Alabama, creditors can initiate wage garnishment immediately, under the Alabama Garnishment Provisions for Consumer Debt. Generally, you may see garnishment proceedings begin within a few weeks following the judgment. This timing emphasizes the importance of addressing any debts promptly to avoid further complications. You can consult legal resources to understand your rights in this situation.