Alabama Notice of Dishonored Check - Civil and Criminal - Keywords: bad check, bounced check

What this document covers

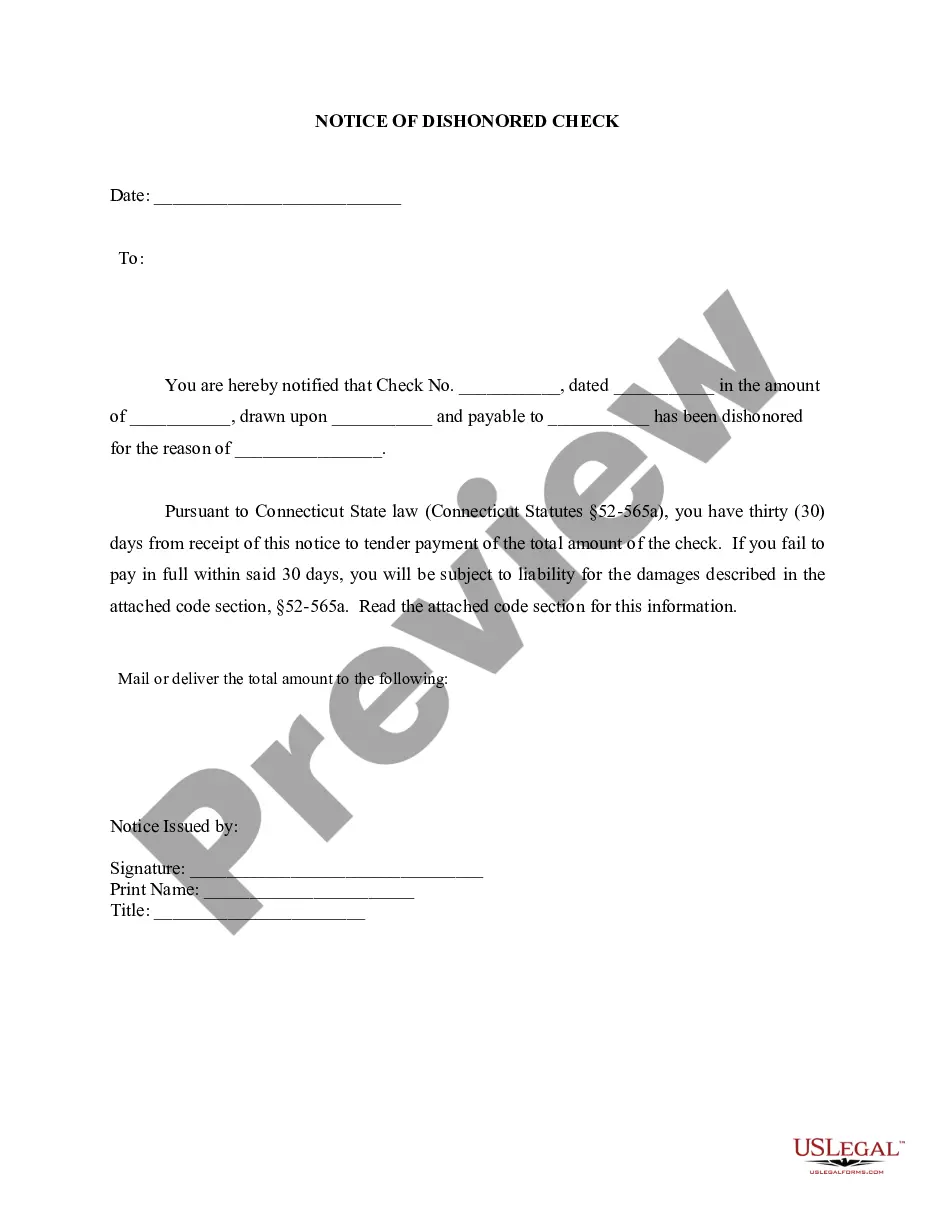

This is a Notice of Dishonored Check, commonly referred to as a bad check or bounced check. This form serves to notify the issuer of a check that their payment has not been honored by the bank due to insufficient funds or the absence of an account. The purpose of the notice is to facilitate repayment and establish a record of communication, which can be essential in pursuing further recovery efforts, either through civil action or potential criminal prosecution.

Key components of this form

- Notification date: The date you send the notice.

- Check details: The number of the dishonored check and issuing bank name.

- Payee information: The name of the person or entity to whom the check was written.

- Payment terms: The amount of the check, a service charge, and the total amount due.

- Deadline for payment: A specific date by which the payment must be fulfilled to avoid further action.

- Consequences: Information on potential criminal prosecution for non-payment.

When to use this document

You should use this form when a check you accepted has been returned by the bank as dishonored. This scenario arises when the issuer has either insufficient funds to cover the check amount or the account is non-existent. Sending this notice is often a prerequisite for further legal action to recover the owed amount or to inform the issuer of potential criminal charges if the payment is not made within the specified timeframe.

Who should use this form

- Business owners who have received a dishonored check for goods or services.

- Individuals who have accepted a check that has bounced.

- Any person or entity seeking to recover funds from a check that was not honored by the bank.

How to prepare this document

- Enter the date you are sending the notice.

- Fill in the check number and the date it was issued.

- Specify the name of the bank on which the check is drawn.

- Provide the name of the individual or business to whom the check was payable.

- Calculate and write the total amount due, including any service charges.

- Sign the notice to certify its validity.

Does this form need to be notarized?

In most cases, this form does not require notarization. However, some jurisdictions or signing circumstances might. US Legal Forms offers online notarization powered by Notarize, accessible 24/7 for a quick, remote process.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to include accurate check and bank details.

- Not specifying the total amount due correctly.

- Sending the notice without verifying the issuer's information.

- Overlooking the necessity to include a deadline for payment.

Why use this form online

- Convenient access to legal templates tailored to your needs.

- Easy to fill out and edit according to specific circumstances.

- Drafted by licensed attorneys to ensure legal compliance.

- Quick download so you can issue the notice without delay.

Looking for another form?

Form popularity

FAQ

Writing a bad check refers to the action taken by the check writer, whereas a bounced check is the consequence of that action. When a check is deemed bad due to insufficient funds, it results in the check bouncing back to the payee. This can create various problems for both parties involved, including legal issues. Understanding the ins and outs of an Alabama Notice of Dishonored Check is key for resolving such situations effectively.

While a bad check and a bounced check often imply the same event, the terms slightly differ in context. A bad check refers to the action of writing a check without sufficient funds, while a bounced check emphasizes the result—it fails to clear at the bank. Both terms indicate legal implications and harms for the payee. Familiarizing yourself with an Alabama Notice of Dishonored Check can clarify the potential legal outcomes.

Yes, a bad check and a bounced check generally refer to the same situation. Both terms describe a check that cannot be cashed due to insufficient funds in the account of the writer. This can lead to serious consequences, including legal actions. If you find yourself dealing with a bounced check, knowing more about an Alabama Notice of Dishonored Check can help you navigate the process.

A dishonored check gets the term 'bounced' because it fails to clear at the bank, causing it to be returned to the payee. This occurs when the check writer lacks sufficient funds in their account. When this happens, financial institutions often describe the check as having bounced. Understanding the implications of an Alabama Notice of Dishonored Check is crucial for both parties involved.

Disputing a bounced check requires prompt action. First, review your records to ensure that you did not make an error in payment. Next, contact the person or business that issued the bad check to discuss the situation. If the issue isn't resolved amicably, you may consider filing an Alabama Notice of Dishonored Check - Civil and Criminal to pursue the matter legally.

In Alabama, the statute of limitations for prosecuting cases related to bad checks is generally three years. This means that if a bad check is not addressed within this timeframe, you may lose the ability to pursue legal action. Understanding this timeframe is vital when dealing with a bounced check, as it impacts the options available for recovery. Knowing your rights through resources like USLegalForms can help you take appropriate action.

Yes, it is illegal to write a bad check in Alabama. This offense falls under criminal law and can lead to severe consequences, including fines and imprisonment. The law categorizes bad checks based on the amount and intent, offering different outcomes for various scenarios. It is essential to be informed about the Alabama Notice of Dishonored Check to prevent legal issues.

Yes, you can face trouble if someone writes you a bad check. While the person who wrote the check primarily holds liability, receiving a bounced check can lead to complications in your financial transactions. Moreover, depending on circumstances, you might find yourself involved in legal matters concerning the collection of those funds. Using a service like USLegalForms can help you navigate these situations effectively.

The bad check law in Alabama refers to the legal consequences of issuing a check without sufficient funds. This law outlines both civil liabilities and potential criminal charges. Individuals who issue bad checks can face fines, restitution, and even jail time, depending on the amount. Familiarizing yourself with this law is essential for anyone managing personal or business finances.

Yes, there is a statute of limitations on bounced checks. In Alabama, this period is typically three years, meaning you must initiate any legal claim within that timeframe. Failing to act within this period may limit your ability to recover funds. Therefore, understanding the statute of limitations on bounced checks is vital for safeguarding your rights.