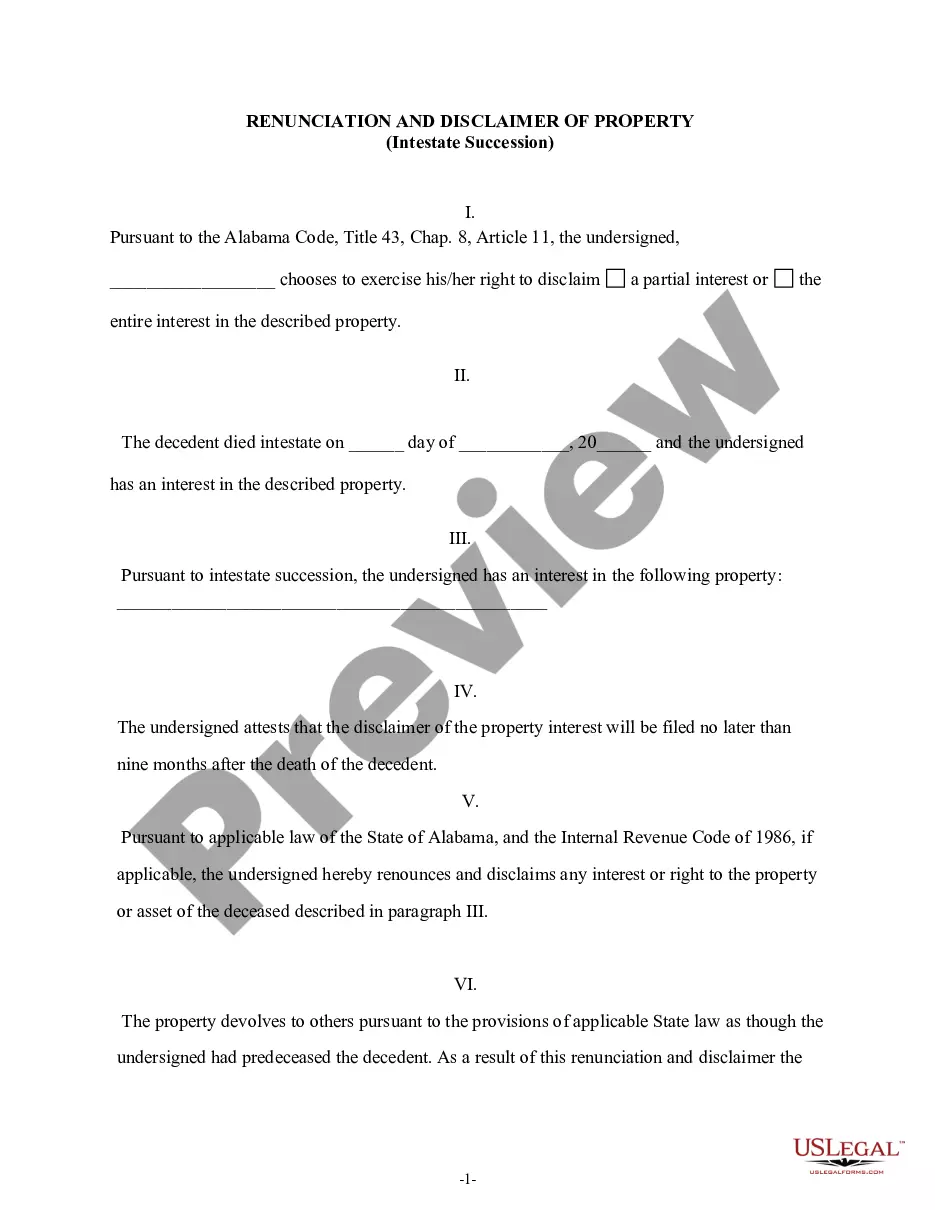

Alabama Renunciation and Disclaimer of Property received by Intestate Succession

Understanding this form

The Alabama Renunciation and Disclaimer of Property received by intestate succession is a legal document that allows a beneficiary to renounce their rights to property acquired through the intestate succession of a deceased person. This form is crucial if a decedent has passed away without a will, and the beneficiary wishes to disclaim either a partial or an entire interest in the property. It is important to understand that this disclaimer must be filed within nine months of the decedent's death, as outlined in Alabama law.

Key components of this form

- Identification of the beneficiary exercising the right to disclaim the property.

- Declaration of the date of the decedent's death.

- Specification of the property subject to the disclaimer.

- Statement confirming the disclaimer will be filed within nine months of death.

- Acknowledgment that the property will transfer as if the beneficiary had predeceased the decedent.

- Signature block for notarization and witness verification.

When to use this form

This form should be used when a beneficiary receives an inheritance from a deceased person who died without a will and wants to formally refuse any interest in that inheritance. It's especially relevant in situations where accepting the property may lead to unintended tax liabilities or other complications, such as ongoing debts associated with the property.

Intended users of this form

- Beneficiaries who receive property through intestate succession in Alabama.

- Individuals who wish to disclaim their interest to avoid inheritance tax or other financial responsibilities.

- People looking to ensure the property is distributed to other heirs in accordance with Alabama law.

Instructions for completing this form

- Provide your name as the beneficiary who is disclaiming the property.

- Enter the date of the decedent's death.

- Clearly specify the property interest you wish to renounce.

- Sign the form and date it to confirm your decision to disclaim the interest.

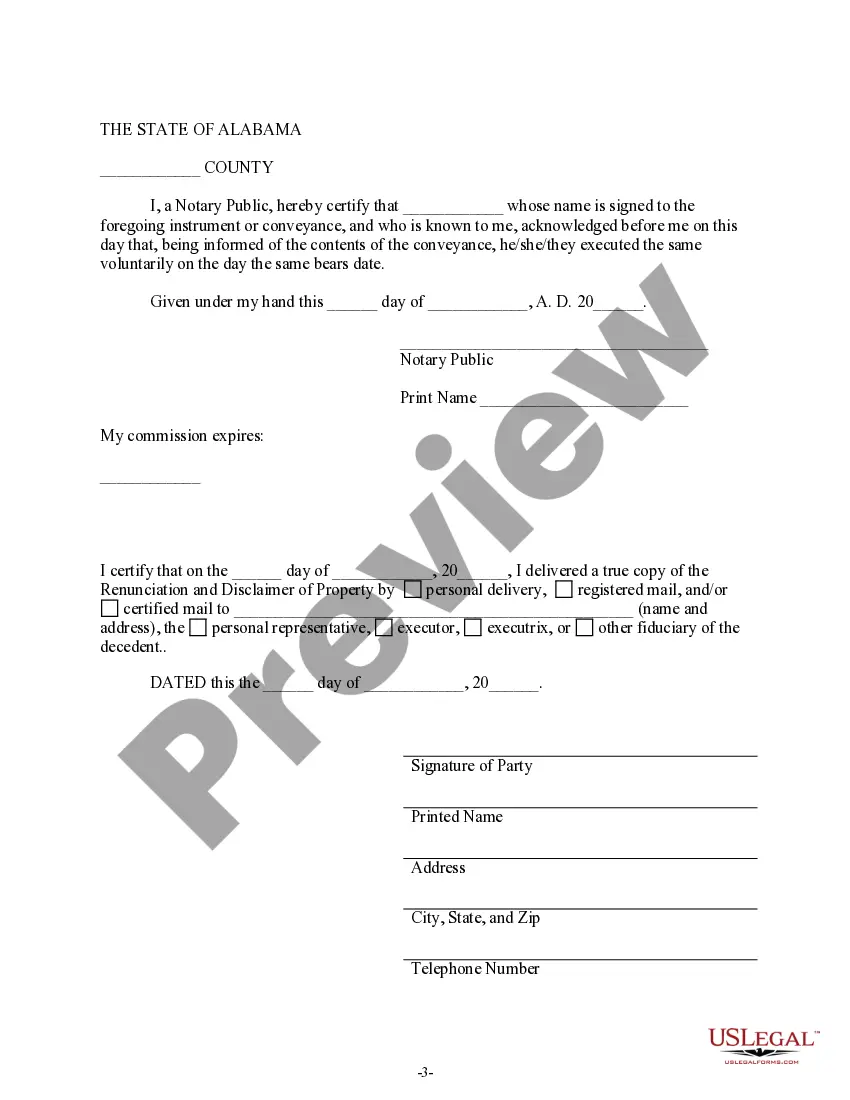

- Have the form notarized, verifying your identity and acknowledgment of the disclaimer.

- Submit the completed form to the appropriate personal representative or executor of the estate.

Does this form need to be notarized?

This document requires notarization to meet legal standards. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to file the form within the nine-month period after the decedent's death.

- Not notating the specific property interest clearly, leading to ambiguity.

- Neglecting to have the necessary signatures and notarization, which can invalidate the form.

- Improperly identifying the decedent or the beneficiary, causing legal complications.

Benefits of using this form online

- Convenient access to legal forms that can be completed and downloaded at your own pace.

- Editability allows for personalization according to your specific circumstances.

- Reliability of forms drafted by licensed attorneys, ensuring compliance with legal standards.

Looking for another form?

Form popularity

FAQ

By law, the probate of an estate in Alabama will take at least six months. This period gives creditors and others with a claim on the estate time to receive notice that the estate is being probated and to submit a claim.

How Is Next of Kin Determined? To determine next of kin in California, go down the list until someone exists in the category listed.For example, if decedent had no surviving spouse or registered domestic partner, but was survived by adult children, then the adult children would be next of kin.

If you don't, then your spouse inherits all of your intestate property. If you do, they and your spouse will share your intestate property as follows: If you die with parents but no children. Your surviving spouse inherits the first $100,000 of your intestate property, plus 1/2 of the balance.

If you die in Alabama without a will, your assets will go to your closest relatives. Not all assets are involved only those that would have passed through a will are affected by Alabama's intestate succession laws.If you die with a spouse but no children Spouse inherits everything.

Children - if there is no surviving married or civil partner If there is no surviving partner, the children of a person who has died without leaving a will inherit the whole estate. This applies however much the estate is worth. If there are two or more children, the estate will be divided equally between them.

If you die in Alabama without a will, your assets will go to your closest relatives. Not all assets are involved only those that would have passed through a will are affected by Alabama's intestate succession laws.If you die with a spouse but no children Spouse inherits everything.

Generally, an executor has 12 months from the date of death to distribute the estate. This is known as 'the executor's year'. However, for various reasons the executor may have been delayed and has not distributed the estate within this time frame.

Is Probate Required in Alabama? Probate is necessary in Alabama except when the property passes straight to another person. However, you have the possibility of a small estate probate, which is simpler than the full probate process.

If there is no surviving partner, the children of a person who has died without leaving a will inherit the whole estate. This applies however much the estate is worth. If there are two or more children, the estate will be divided equally between them.