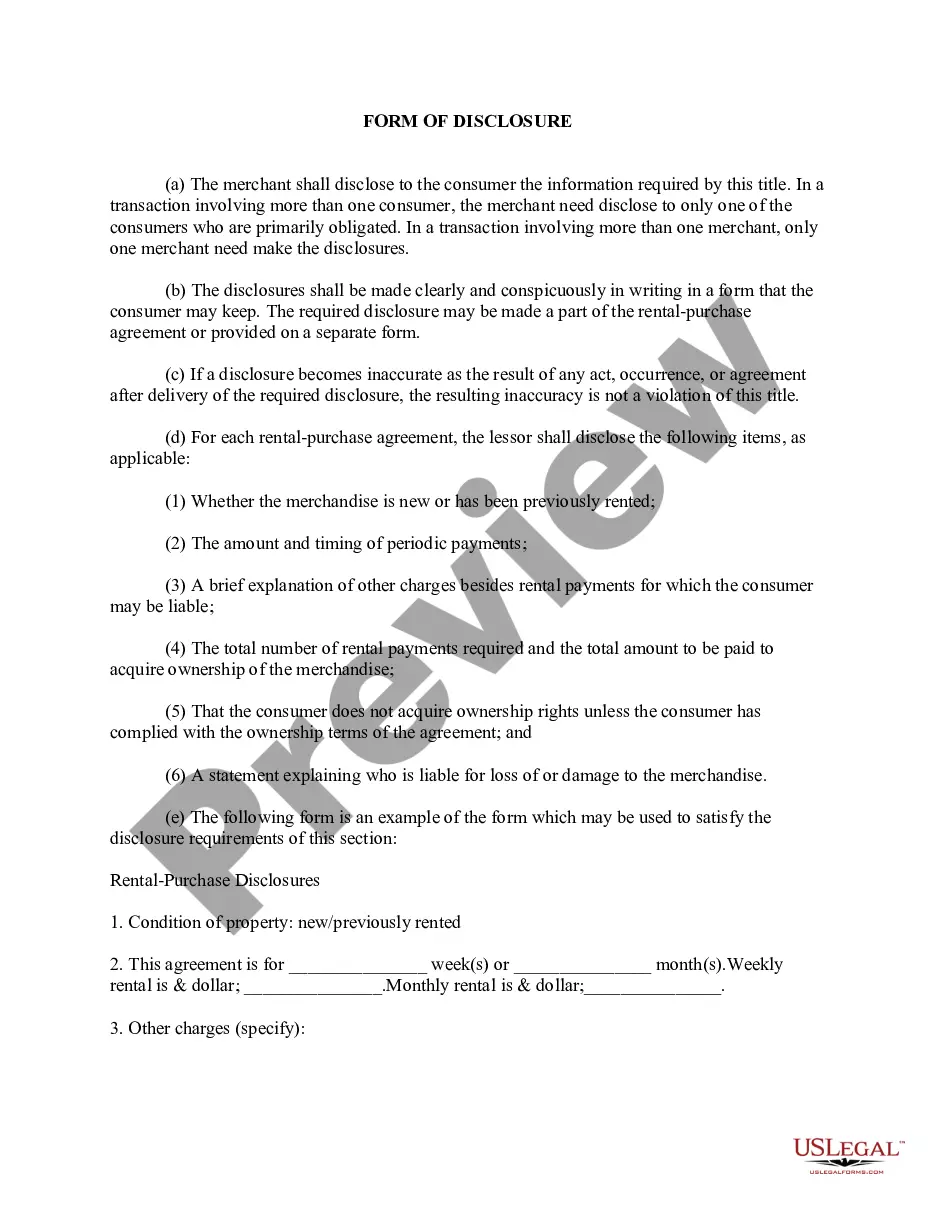

This Disclosures by Merchant to Consumer form details the disclosures by a merchant will make to a consumer as part of a rental-purchase agreement, including whether or not the merchandise is new or used, the amount of monthly payments required, and an expressed statement that the merchandise is not owned by the consumer.

Alabama Disclosures by Merchant to Consumer - Rental - Personal Property

Description

How to fill out Alabama Disclosures By Merchant To Consumer - Rental - Personal Property?

Employing Alabama Disclosures by Merchant to Consumer - Rental - Personal Property examples created by professional attorneys allows you to avoid frustrations during document submission.

Simply download the template from our site, complete it, and seek professional legal advice to review it.

This approach will save you significantly more time and expenses than hiring a lawyer to draft a document tailored to your requirements.

Select a subscription that suits your requirements. Begin using your credit card or PayPal. Choose a file format and download your document. Once you have completed all the steps above, you will be able to fill out, print, and sign the Alabama Disclosures by Merchant to Consumer - Rental - Personal Property template. Remember to double-check all entered information for accuracy prior to submission or mailing. Minimize your document preparation time with US Legal Forms!

- If you possess a US Legal Forms subscription, just Log In to your profile and revisit the sample page.

- Locate the Download button next to the templates you are reviewing.

- Once you download a document, all your saved templates will be available in the My documents section.

- If you lack a subscription, no worries. Follow the detailed instructions below to register for an account online, obtain, and finalize your Alabama Disclosures by Merchant to Consumer - Rental - Personal Property template.

- Thoroughly verify that you are downloading the correct state-specific form.

- Utilize the Preview option and review the description (if available) to ascertain if you need this specific sample, and if so, just click Buy Now.

Form popularity

FAQ

In the state of Alabama, sales tax is legally required to be collected from all tangible, physical products being sold to a consumer. Several examples of exceptions to this tax are items intended for use in agricultural pursuits or industry.

Filing a ComplaintFile a complaint online at www.dca.ca.gov or call 800.952. 5210 to have a complaint form mailed to you. California Attorney General's Office. File a complaint online at http://oag.ca.gov/.

If you cannot complete the form online or need additional assistance with where to direct your complaint, please call our OAG Help Line at (800) 771-7755. Filing a false complaint is punishable as a Class A Misdemeanor. We need complaints in writing.

If you have questions about whether you should send us a report about a particular business or would like our assistance in filling out our Consumer Assistance Request Form or Fraud Report Form, or have questions about which form to use, please call our Office at (651) 296-3353 (Twin Cities Calling Area) or (800) 657-

Consumer Use Tax DefinitionConsumer use tax (sometimes referred to as a compensating use tax) is complementary to the sales tax. It is a type of excise tax imposed by state and local governments, calculated as a percentage of the sales price of goods and certain services; but paid as a use tax.

State consumers use tax rates 4% of the gross proceeds of sales of all tangible personal property, other than that listed previously and specifically exempted by law.

The salutation of the letter should be: Dear Attorney General (last name). For the Attorney General of a State address the envelop: The Honorable/(Full name)/Attorney General of (Name of State)/(Address). The salutation of the letter should read: Dear Attorney General (last name).

The SSUT 8% flat tax applies to all sales regardless of the locality shipped to in Alabama. The collection and remittance of the simplified sellers use tax relieves the eligible seller and the purchaser from any additional state and local sales or use tax on the transaction.

Generally, if the item would have been taxable if purchased from a California retailer, it is subject to use tax. For example, purchases of clothing, appliances, toys, books, furniture, or CDs would be subject to use tax.