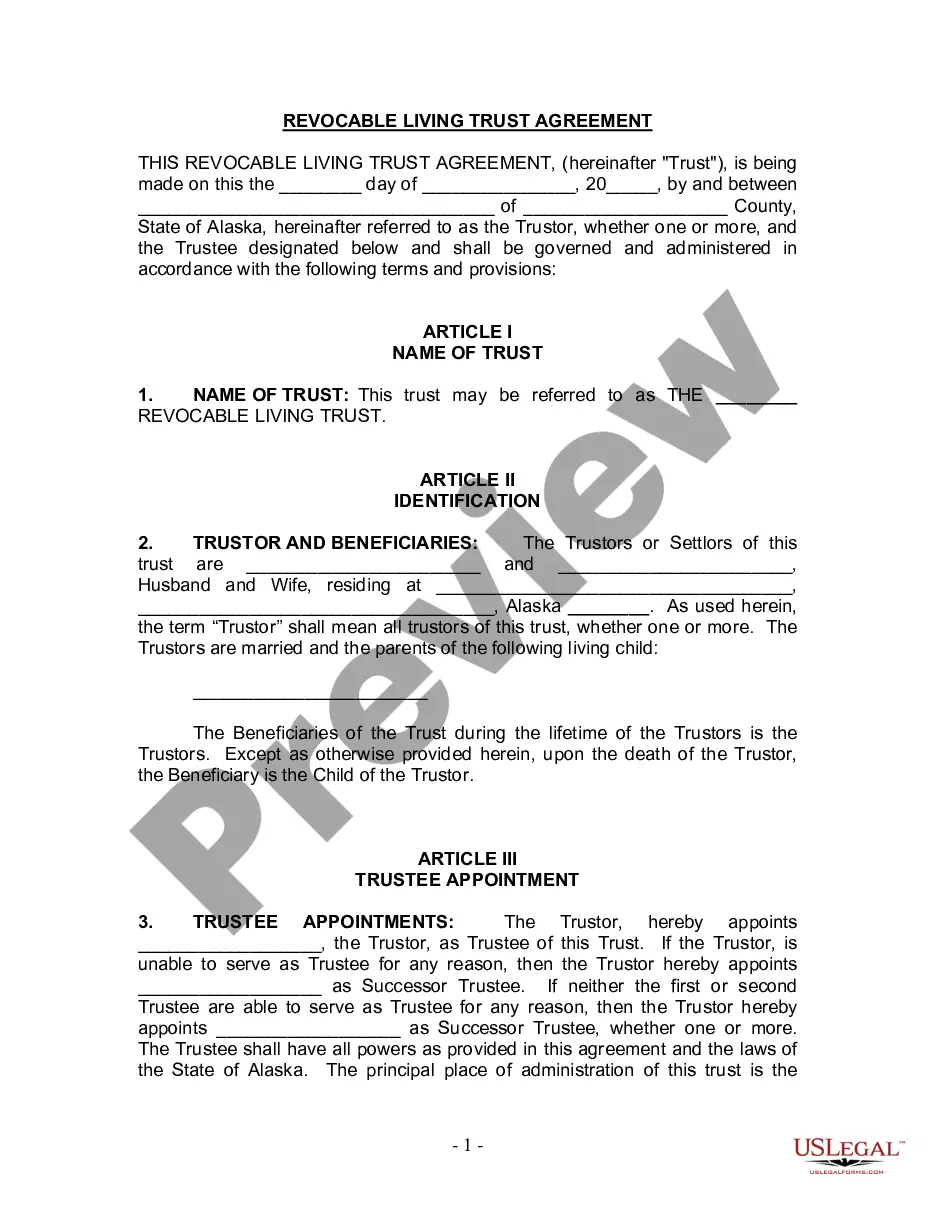

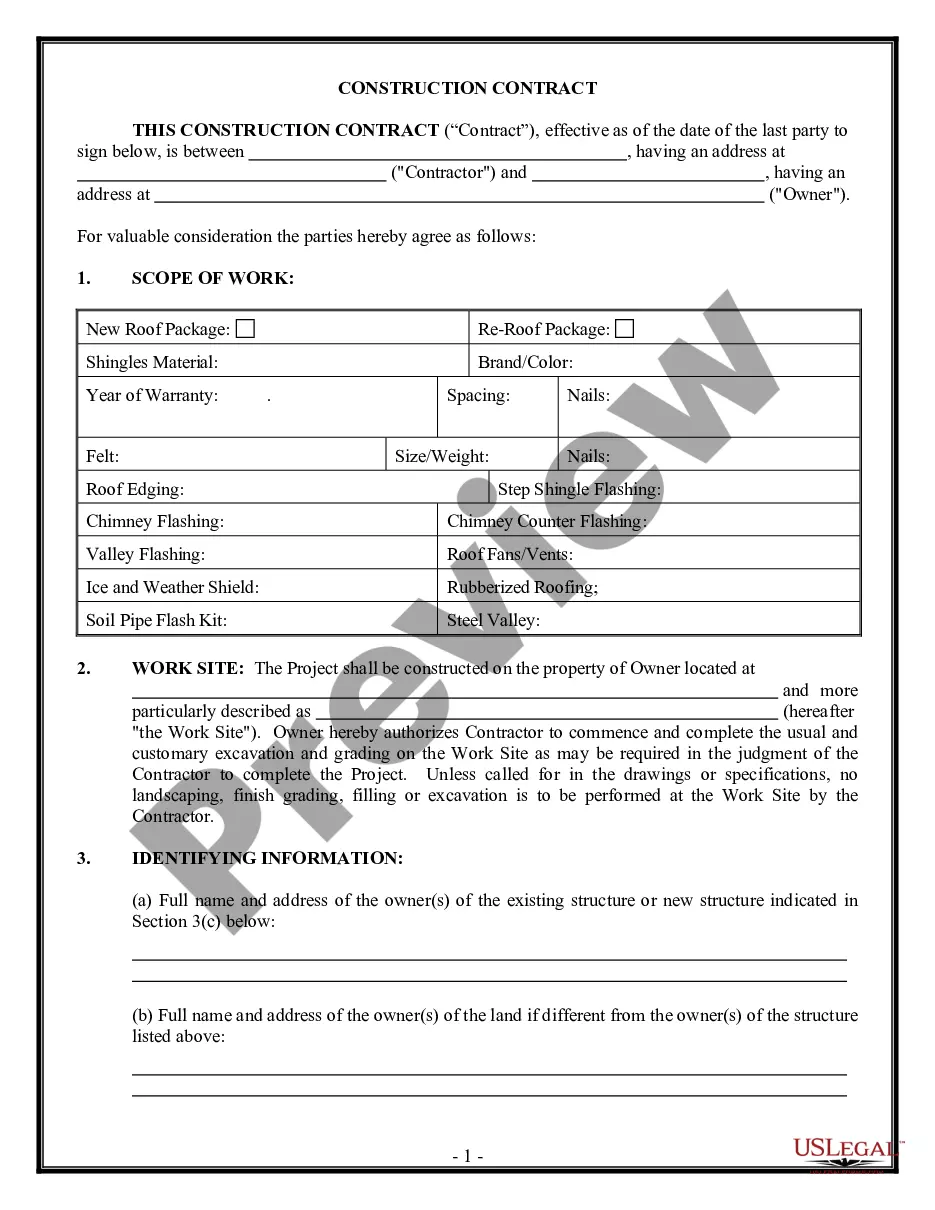

This living trust form was prepared for your State. It is for a Husband and Wife with one child. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Alaska Living Trust for Husband and Wife with One Child

Description

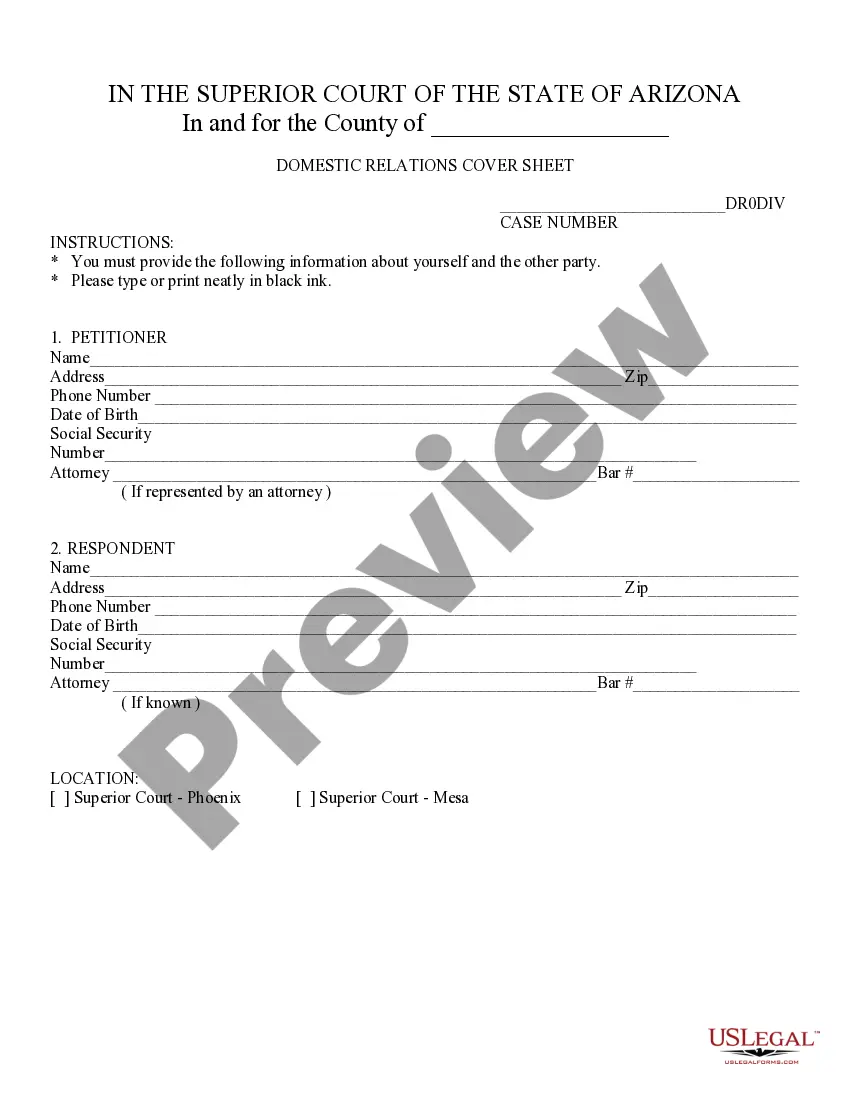

How to fill out Alaska Living Trust For Husband And Wife With One Child?

Utilizing Alaska Living Trust for Spouses with One Child examples crafted by skilled attorneys helps you avoid hassles when filing paperwork.

Easily download the example from our site, complete it, and have a legal expert review it.

This can substantially reduce the time and expenses compared to having a lawyer draft a document from scratch to meet your specifications.

Once you have completed all the steps above, you'll be able to finalize, print, and sign the Alaska Living Trust for Spouses with One Child example. Remember to thoroughly check all entered information for accuracy before submitting it or sending it out. Minimize the time you invest in preparing documentation with US Legal Forms!

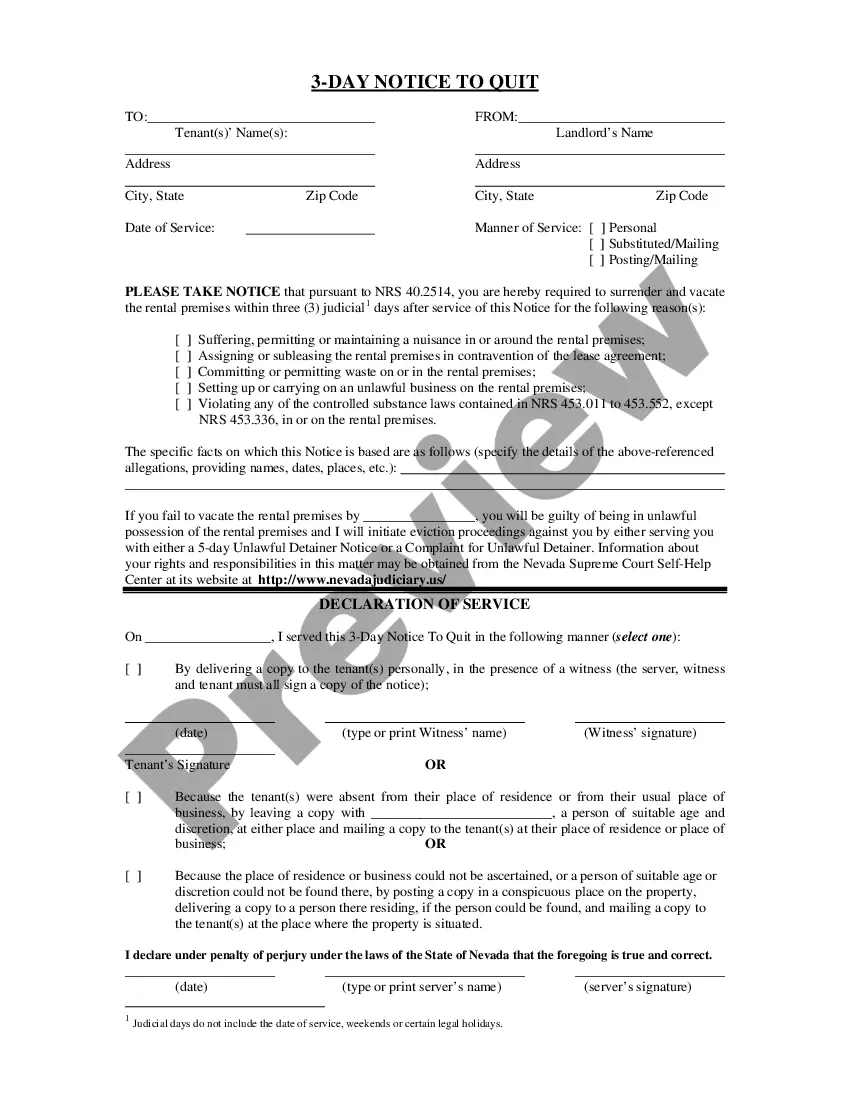

- If you have previously purchased a US Legal Forms subscription, simply Log In to your account and revisit the sample webpage.

- Locate the Download button near the templates you're viewing.

- After downloading a document, you'll find all your saved templates in the My documents section.

- If you don't possess a subscription, don’t worry. Just follow the steps below to register for your account online, obtain, and fill out your Alaska Living Trust for Spouses with One Child template.

- Verify and ensure that you’re obtaining the correct state-specific form.

- Utilize the Preview feature and review the description (if provided) to determine if you need this specific example and if you do, select Buy Now.

Form popularity

FAQ

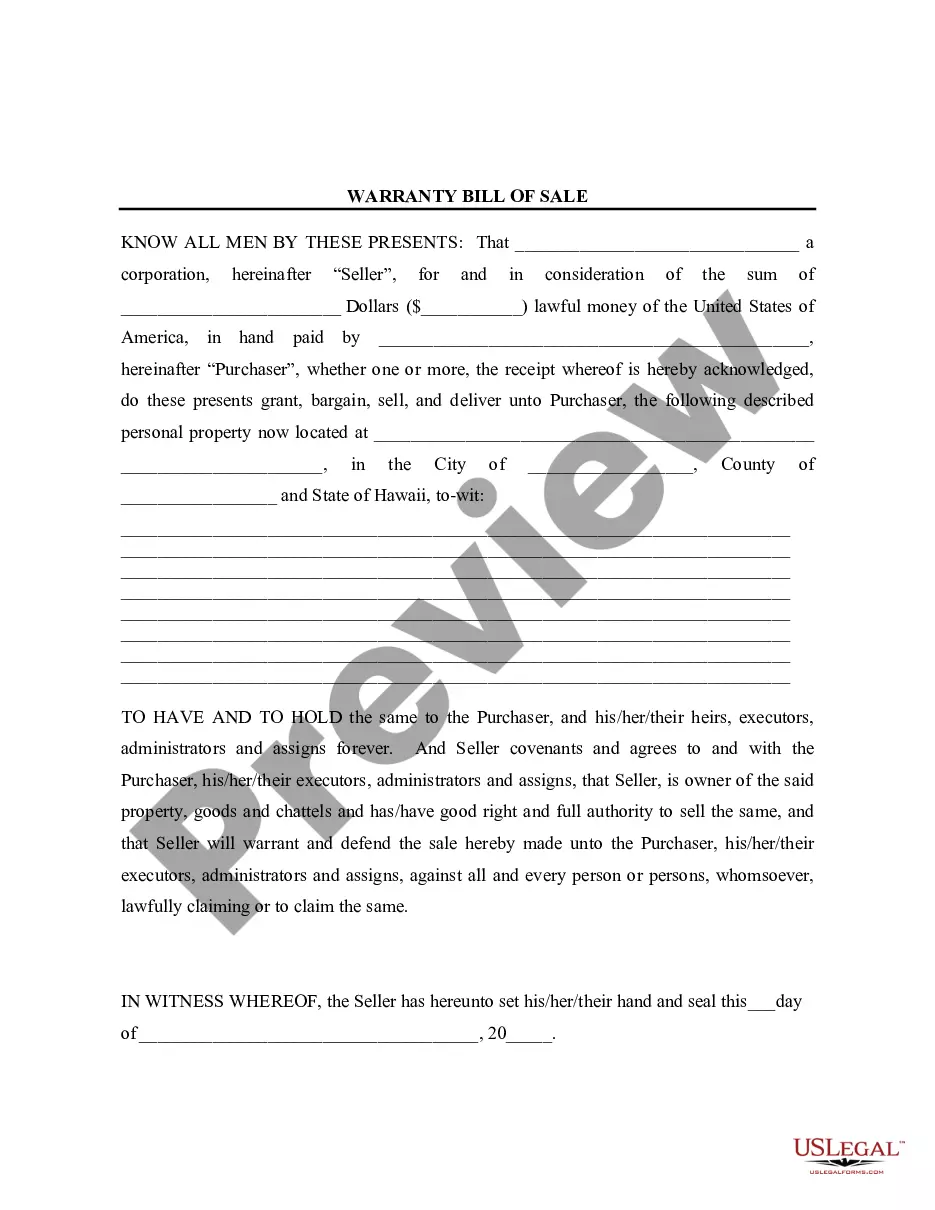

If you own the property as Tenants in Common and there is a Declaration of Trust document that states the division of shares, the trust deed is still valid after marriage but it will be considered alongside other important factors by the courts.

With a shared trust, property left by one grantor to the survivor stays in the living trust when the first grantor dies; no transfer is necessary.You can transfer all of it to the trust, and each spouse can name beneficiaries (including each other) to receive his or her separate property.

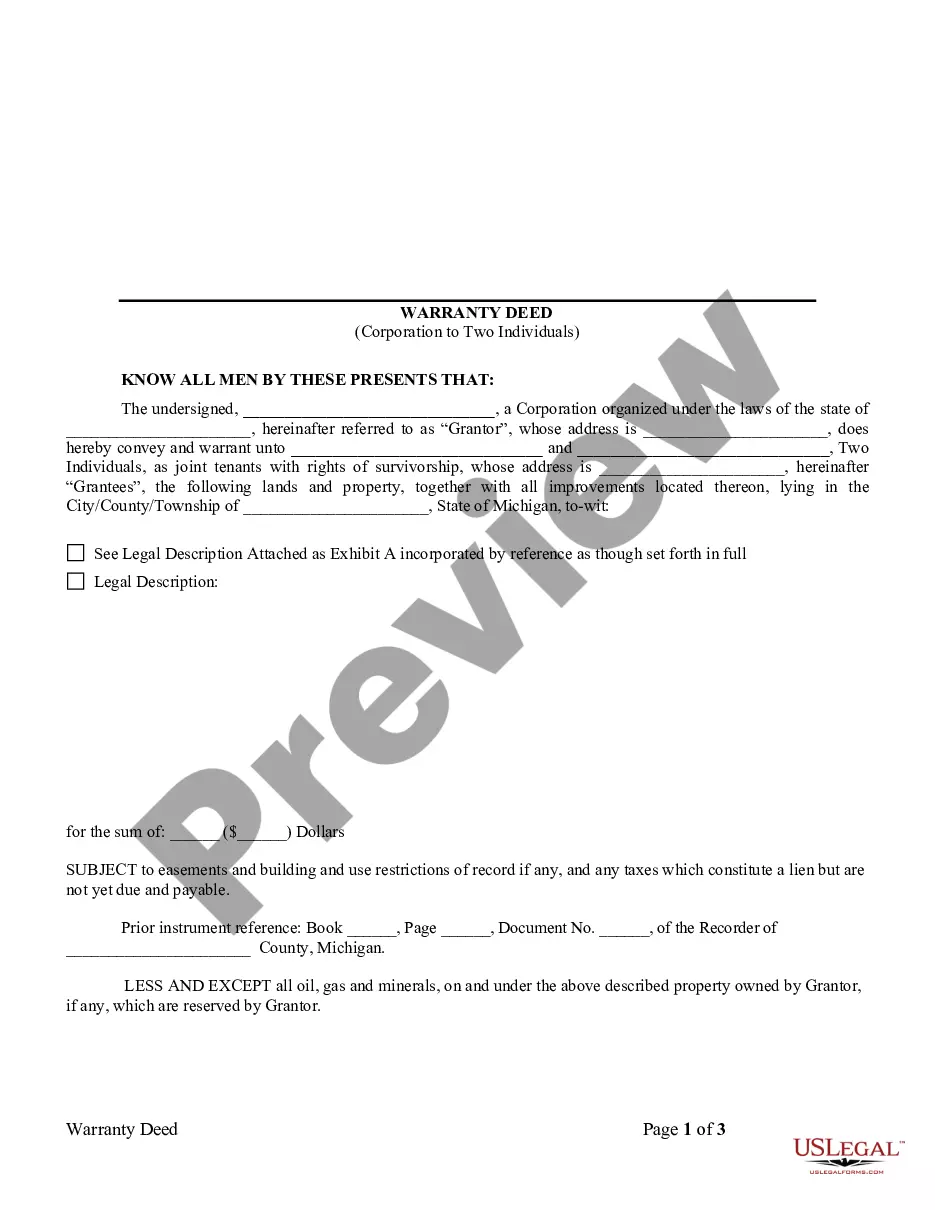

Joint trusts are easier to fund and maintain.In a joint trust, after the death of the first spouse, the surviving spouse has complete control of the assets. When separate trusts are used, the deceased spouses' trust becomes irrevocable and the surviving spouse has limited control over assets.

As the grantor or creator of an irrevocable trust, if you place assets into one before your marriage, these are never marital property and are never at risk in a divorce.You can't get these assets back later if you decide you don't mind sharing them with your spouse or after you divorce.

Under California law, a marriage automatically invalidates any pre-existing will or trust as to the new spouse's inheritance rights, unless the documents provide for a new spouse, or clearly indicate a new spouse will receive nothing.

Yes, and no. Yes, a spouse can be disinherited.The laws vary from state to state, but in a community property state like California, your spouse will have a legal right to one-half of the estate assets acquired during the marriage, otherwise known as community property.

Q: Can a person have more than one trust? A: Yes, it is not that uncommon for a person to be the beneficiary of multiple trusts. However, caution should be used. Trusts come in many shapes and sizes and can serve multiple purposes and can be established by you or by someone else for your benefit.

Typically, when a married couple utilizes a Revocable Living Trust based estate plan, each spouse creates and funds his or her own separate Revocable Living Trust. This results in two trusts. However, in the right circumstances, a married couple may be better served by creating a single Joint Trust.

Under California law, a marriage automatically invalidates any pre-existing will or trust as to the new spouse's inheritance rights, unless the documents provide for a new spouse, or clearly indicate a new spouse will receive nothing.