This Limited Liability Company Formation Package is specifically designed to create an LLC for the practice of a state-licesnsed profession in Alaska.

Alaska Professional Limited Liability Company PLLC Formation Package

Description

How to fill out Alaska Professional Limited Liability Company PLLC Formation Package?

Leveraging Alaska Professional Limited Liability Company PLLC Formation Package instances crafted by experienced attorneys enables you to evade complications when preparing paperwork.

Simply download the sample from our website, complete it, and request a lawyer to review it.

By doing this, you can save significantly more time and expenses compared to seeking legal advice to draft a document from the beginning tailored to your needs.

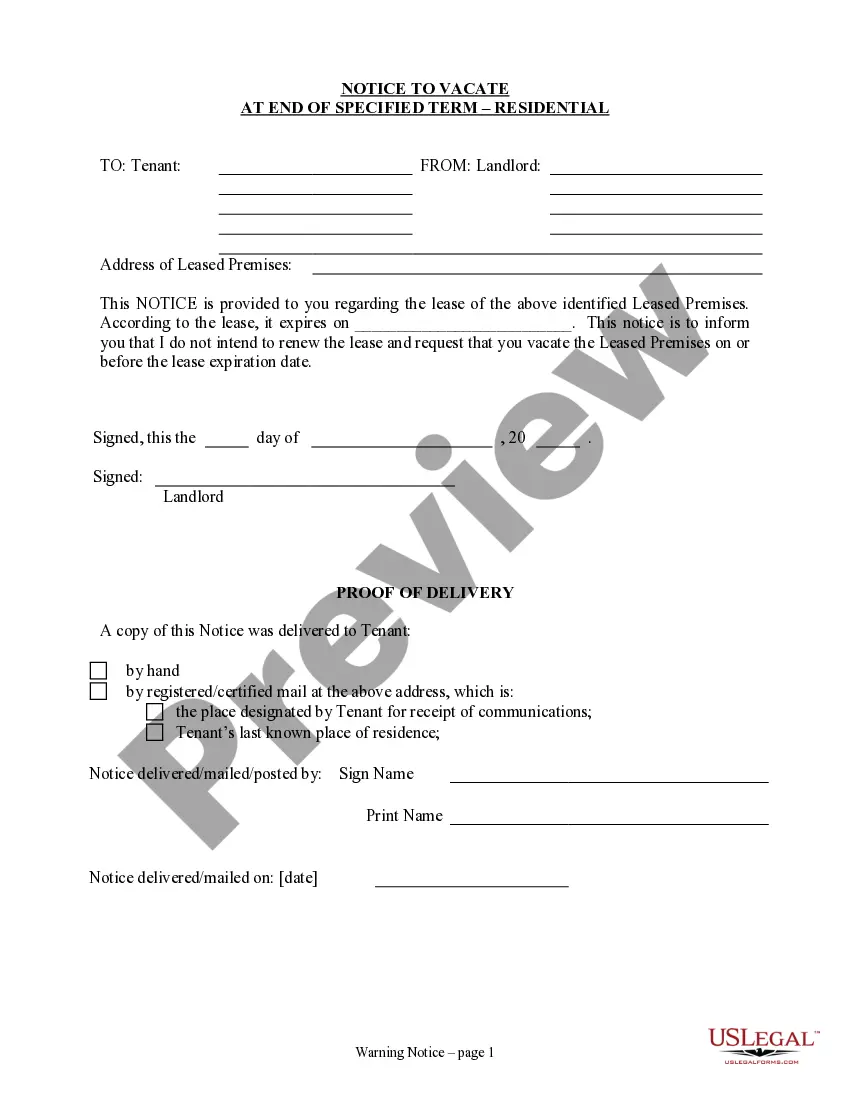

Use the Preview option and review the description (if available) to ascertain if you need this particular template, and if you do, simply click Buy Now.

- If you possess a US Legal Forms subscription, simply Log In to your account and revisit the form page.

- Locate the Download button adjacent to the template you are examining.

- Upon downloading a template, you will find all your saved instances in the My documents section.

- If you lack a subscription, there's no issue.

- Just adhere to the step-by-step instructions below to register for an account online, acquire, and finalize your Alaska Professional Limited Liability Company PLLC Formation Package template.

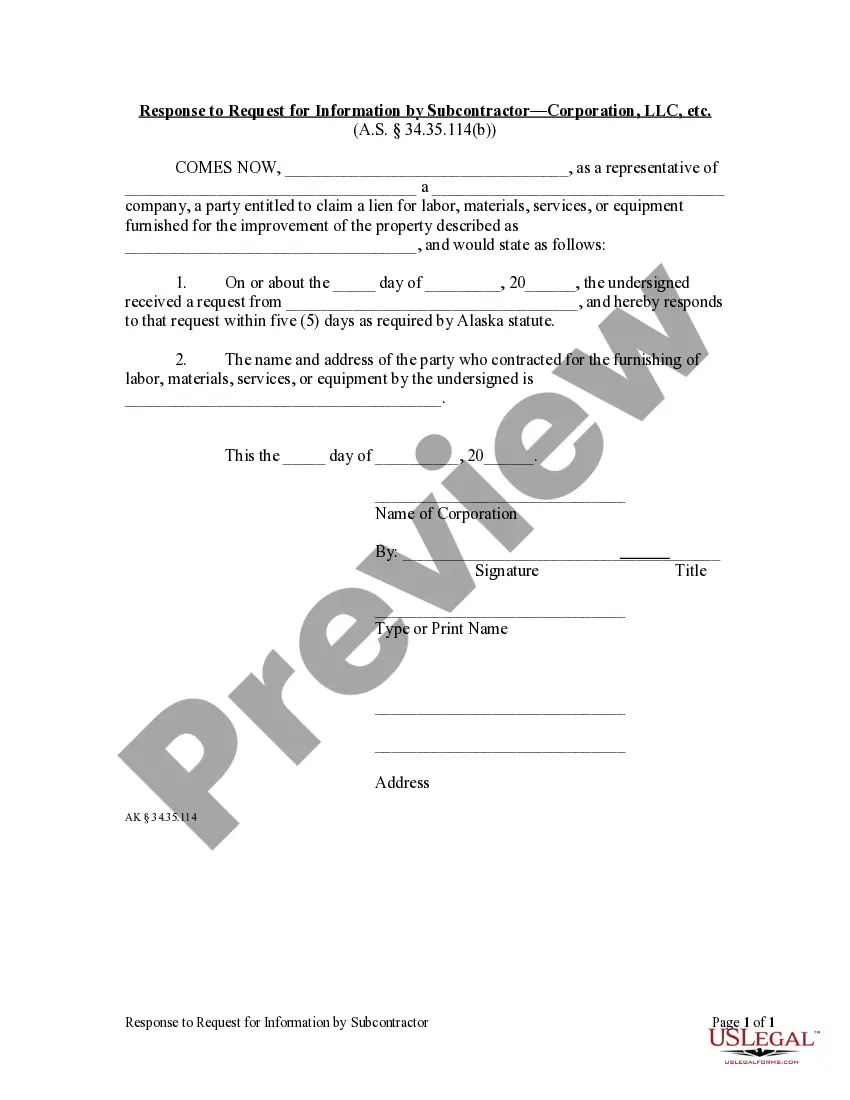

- Double-check and ensure you are downloading the correct state-specific document.

Form popularity

FAQ

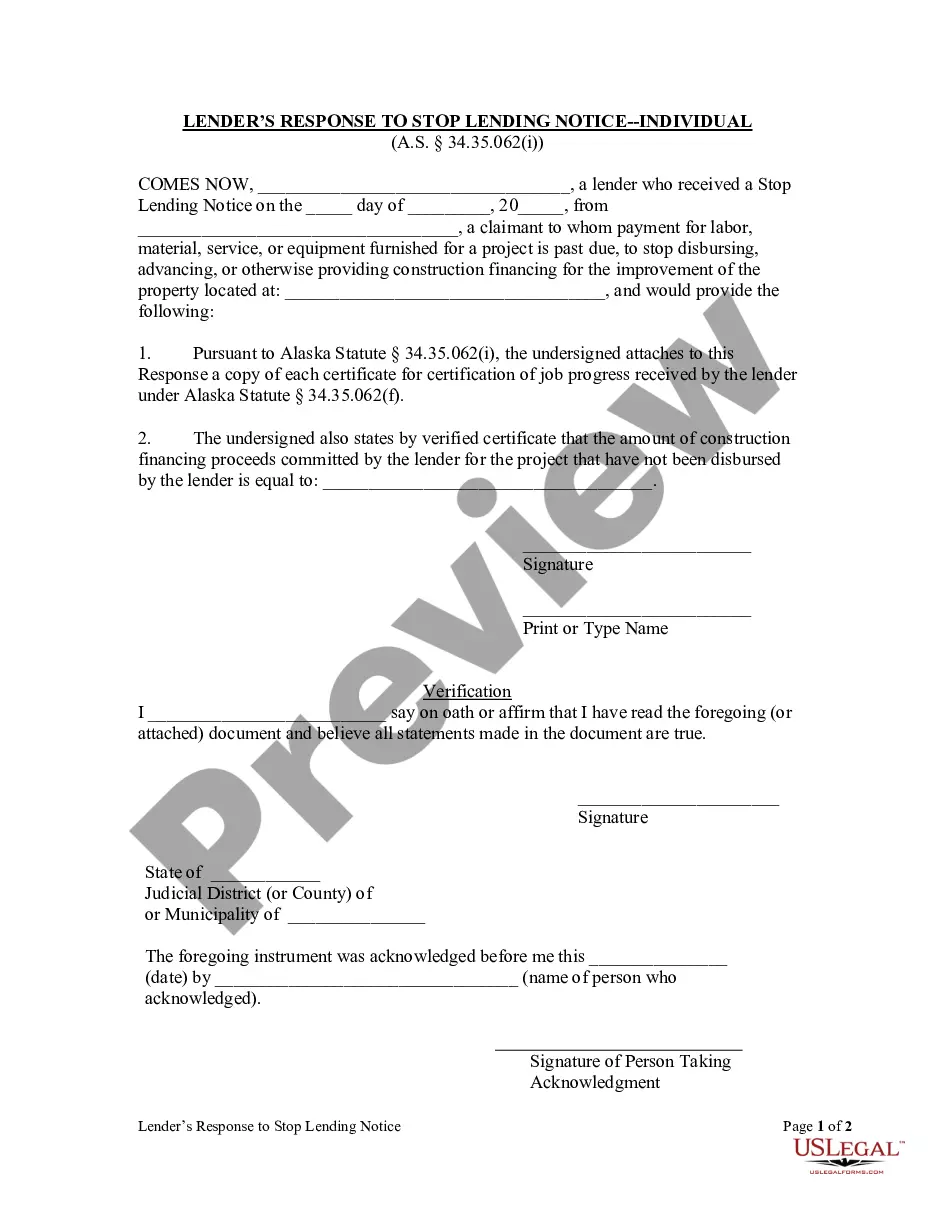

Regarding the management flexibility and taxation, a PLLC has the same advantages of an LLC. The difference between the two is that the PLLC has some restrictions on who may be a member of the PLLC and the limitation of liability of the members. With an LLC, anyone can be a member, or owner, of the business.

A professional limited liability company (PLLC) is a business entity that offers tax benefits and limited liability for professionals, such as lawyers, accountants, and doctors.

Members of a PLLC aren't personally liable for the malpractice of any other member. PLLC members are not personally liable for business debts and lawsuits, such as unpaid office rent. The PLLC can choose to be taxed as a pass-through entity or as a corporation.

Professional LLCs PLLCs offer the same benefits as LLCs. The main difference between a LLC and a PLLC is that only professionals recognized in a state through licensing, such as architects, medical practitioners and lawyers, can form PLLCs.

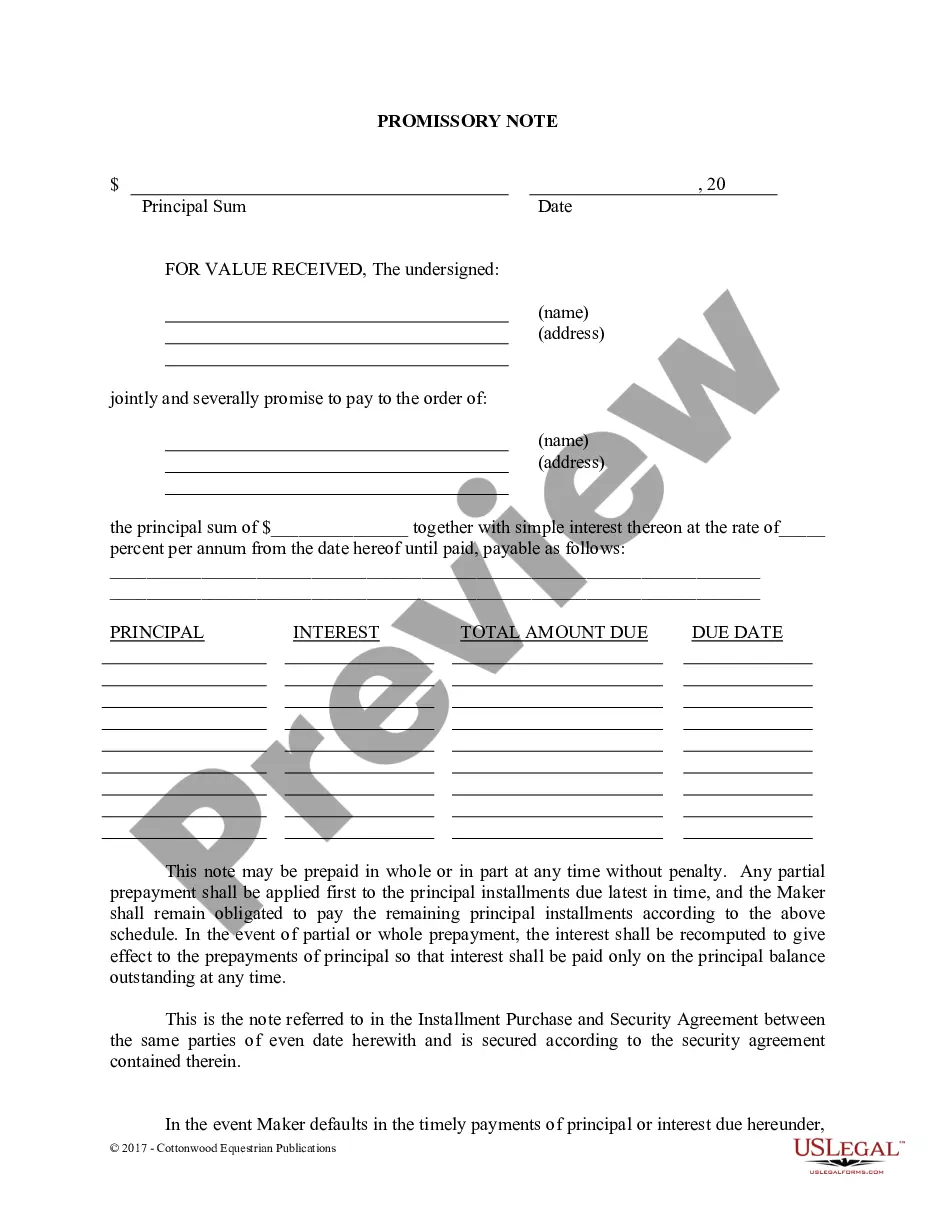

The PLLC files a standard Form 1120, Corporate Income Tax Return, and pays taxes at the regular corporate tax rate. It retains earnings as a corporation, however, and doesn't distribute them to members for personal taxation.

File Articles of Organization and pay the $250 fee. File an Initial Report. Get an Alaska Business License. Apply for an EIN (federal tax ID) Write an operating agreement. Open a bank account for your Alaska LLC.

The owners of a PLLC are called members, and they have an operating agreement that governs how they work together and divide profits and losses. Many professionals start a PLLC because they want to separate their individual liability from their liability as a member of the business or practice.

Choose a Name for Your LLC. Appoint a Registered Agent. File Articles of Organization. Prepare an Operating Agreement. File Initial and Biennial Reports. Obtain an EIN.