Wyoming Corporation Form Withdrawal

Description

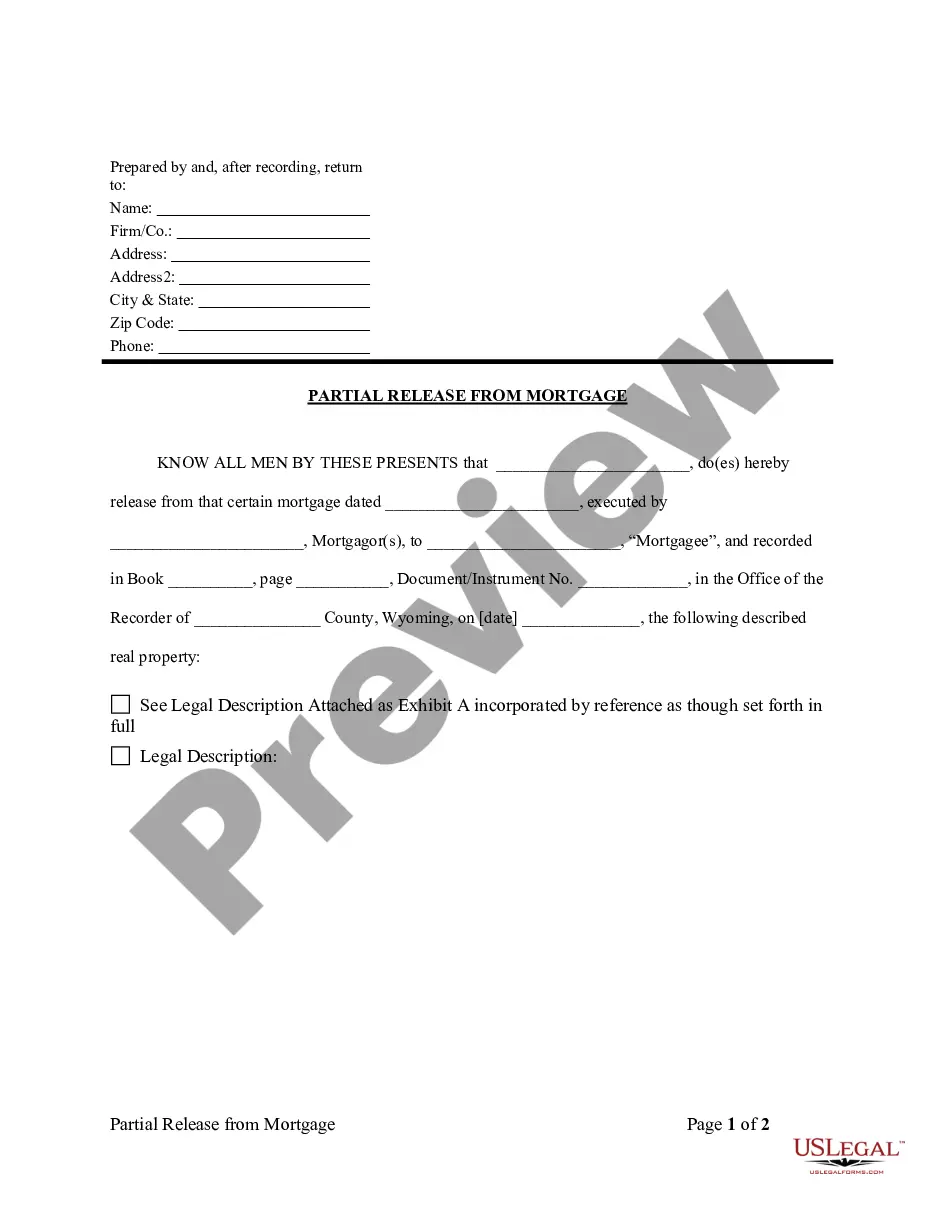

How to fill out Wyoming Satisfaction, Release Or Cancellation Of Deed Of Trust By Corporation And Release Of Mortgage?

How to locate professional legal documents that conform to your state regulations and complete the Wyoming Corporation Form Withdrawal without hiring an attorney.

Many online services provide templates for various legal situations and requirements.

However, it might require time to determine which available samples meet both your needs and legal standards.

Download the Wyoming Corporation Form Withdrawal using the corresponding button adjacent to the file name. If you lack an account with US Legal Forms, follow the instructions below: Review the webpage you’ve accessed and ensure the form meets your requirements. To assist, utilize the form description and preview options if they are available. Look for an alternative template in the header with your state if needed. Click the Buy Now button once you identify the correct document. Select the most appropriate pricing plan, then either Log In or register for an account. Choose your payment method (by credit card or via PayPal). Alter the file format for your Wyoming Corporation Form Withdrawal and click Download. The acquired templates will remain yours: you can always return to them in the My documents section of your profile. Become a part of our library and prepare legal documents independently like a seasoned legal professional!

- US Legal Forms is a reliable platform that aids you in finding legal documents crafted in compliance with the most recent state law changes and helps you save on legal services.

- US Legal Forms is not a conventional web library.

- It consists of over 85,000 validated templates for various business and personal situations.

- All documents are organized by field and state to expedite and simplify your search.

- Furthermore, it integrates with powerful PDF editing and eSignature tools, enabling users with a Premium subscription to swiftly complete their paperwork online.

- It requires minimal time and effort to obtain the necessary documentation.

- If you already possess an account, Log In and confirm that your subscription is active.

Form popularity

FAQ

Yes, using a virtual address for your LLC in Wyoming is permitted. This option allows you to maintain privacy and flexibility while meeting state requirements for a physical address. However, make sure the virtual address service you choose meets the legal criteria, especially if you plan to go through the Wyoming corporation form withdrawal process later.

To form a close LLC in Wyoming, you need to follow the standard LLC formation process but specify that you want a close LLC in your articles of organization. This structure limits ownership to a certain number of members, typically suitable for small groups or family-owned businesses. Utilizing platforms like uslegalforms can help streamline this process and ensure you correctly navigate the requirements for your Wyoming corporation form withdrawal.

While a Wyoming LLC has many benefits, there are some disadvantages to consider. The state imposes annual fees and requires the filing of reports, which may involve additional costs and administrative efforts. Moreover, if you do business in other states, you may need to register in those states too, leading to potential complexities during the Wyoming corporation form withdrawal process.

Absolutely, you can form an LLC in Wyoming even if you don't reside in the state. Wyoming laws allow non-residents to create an LLC without needing to be physically present. Many entrepreneurs choose Wyoming for its business-friendly environment, making it a favorable option for your Wyoming corporation form withdrawal.

Yes, you can dissolve a Wyoming LLC online. The process is straightforward on the Wyoming Secretary of State's website. Simply fill out the appropriate form for Wyoming corporation form withdrawal, make the required payment, and submit your application. This method saves you time and ensures your dissolution is processed efficiently.

Opening as a corporation in Wyoming involves several simple steps. First, file your Articles of Incorporation online or by mail with the State of Wyoming. You'll also need to designate a registered agent and set up your corporate bylaws. Once established, if you ever need to withdraw your corporation, the Wyoming corporation form withdrawal will guide you through the appropriate steps.

To start a corporation in Wyoming, you need to file the Articles of Incorporation with the Secretary of State. Ensure you have a registered agent with a physical address in Wyoming. Next, prepare bylaws for your corporation and conduct the first board meeting to appoint directors. Additionally, keep in mind that if you decide to terminate your corporation later, you will need to follow the Wyoming corporation form withdrawal process.

One disadvantage of an LLC in Wyoming is the potential for self-employment taxes on the owner's income. While Wyoming offers significant benefits, such as no state income tax, owners must accurately navigate these tax responsibilities. Additionally, annual compliance and maintenance requirements might add complexity for some business owners. Using a resource like uslegalforms can simplify the process.

Generally, a Wyoming LLC does not need to file a state tax return, as Wyoming does not impose any corporate income tax. However, if your LLC has federal tax obligations, you must still comply with those rules. It's essential to remain aware of any local tax regulations that may apply. For specific guidance, consider utilizing platforms like uslegalforms to ensure compliance.

To close your Wyoming corporation, you must file a Wyoming corporation form withdrawal to formally dissolve it. Start by notifying stakeholders and resolving any pending transactions. After that, submit the dissolution documents and any required fees to the Wyoming Secretary of State. This keeps your records clear and prevents unexpected liabilities.