Filing Lien On Property

Description

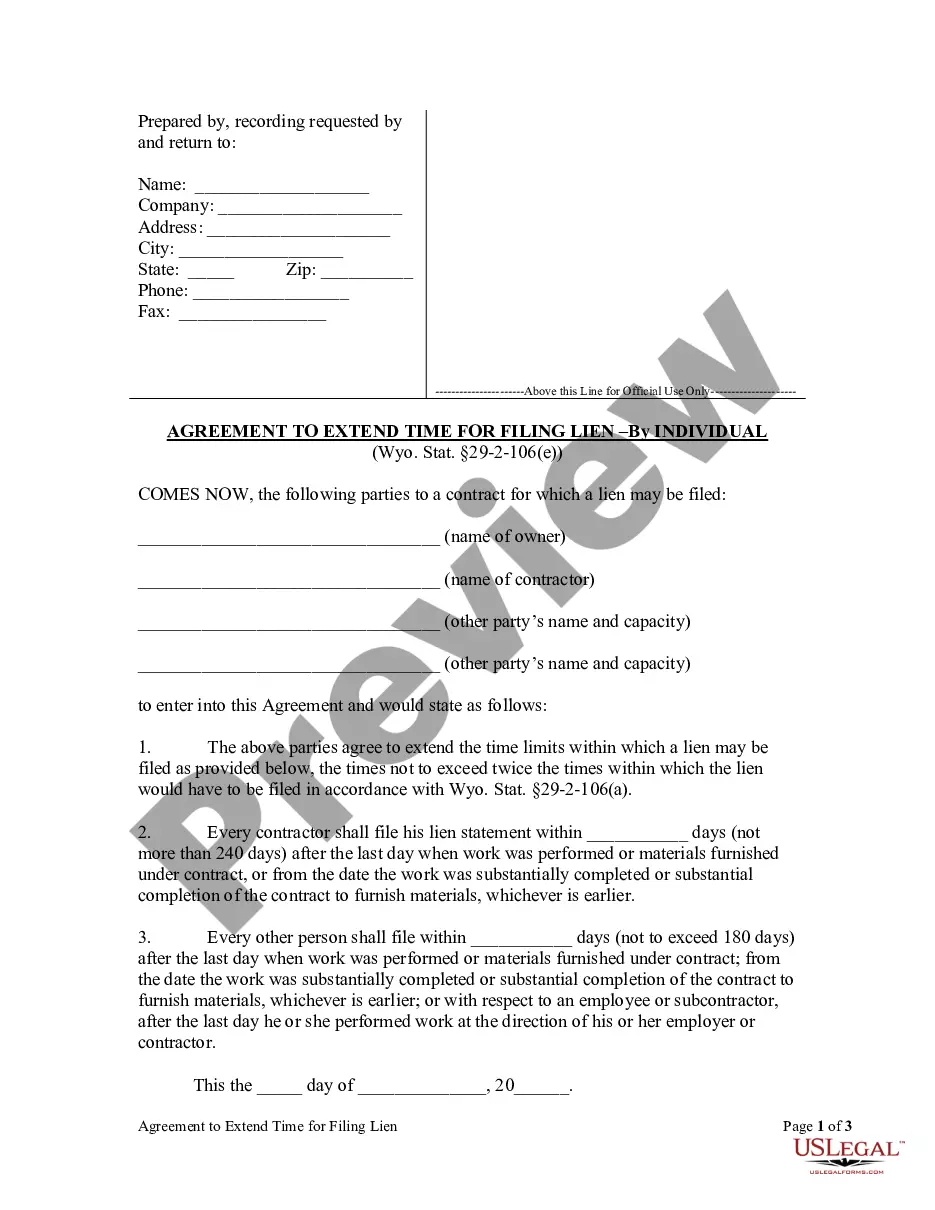

How to fill out Wyoming Agreement To Extend Time For Filing Lien - Individual?

- Log in to your US Legal Forms account if you are a returning user, or create an account if this is your first time.

- Search for the lien form you need by utilizing the Preview mode and checking the form description.

- If you do not find the suitable template, use the Search tab to locate the correct form that aligns with your legal requirements.

- Select the Buy Now option, choosing your preferred subscription plan, and register for access to the extensive library.

- Provide payment information, either with your credit card or via PayPal, to complete your purchase.

- Once purchased, download the form directly to your device and access it anytime under the My Forms section of your account.

With US Legal Forms, you benefit from a robust selection of legal templates and access to premium support that ensures your documents are complete and compliant. This service empowers users by making legal processes straightforward, fast, and effective.

Start your legal journey confidently by utilizing US Legal Forms today—get access to the resources you need to file a lien on property with ease!

Form popularity

FAQ

You generally have a limited period to file a lien on property in Indiana, dependent on the lien type. For example, mechanics' liens must be filed within 60 days post-completion of the work. Adhering to these timelines is critical to ensuring your claim remains legitimate. Keep records and set reminders to avoid missing important deadlines.

Yes, Indiana imposes a statute of limitations on property liens, meaning you must act within a specific time frame. For mechanics' liens, you typically have one year from the completion of the project to file. Understanding these time limits is vital to protect your rights. Consulting with legal experts can clarify how these limitations may apply to your situation.

To put a lien on property in Indiana, you need to prepare the necessary documents, ensuring they comply with state laws. This process typically involves filing the lien with your local county recorder’s office. Additionally, providing proper notice to the property owner is essential for validity. Utilizing platforms like USLegalForms can guide you through these steps effectively.

In Indiana, the time frame for filing a lien on property generally depends on the type of lien. For instance, mechanics' liens must be filed within 60 days after the project completion. Understanding these deadlines is crucial, as missing them may forfeit your right to claim the lien. Staying organized can help in timely filing.

In Indiana, the relevant lien statute outlines the rules for filing a lien on property, including procedures and requirements. It governs various types of liens, such as mechanics' liens and judgment liens. By following this statute, you can ensure that your interests are protected when filing a lien on property. It’s beneficial to consult specific legal resources or professionals for detailed information.

The minimum amount to file a lien on property varies by state. In Indiana, there is no specific minimum amount, but the lien must be based on a valid claim or debt. It is essential to ensure that the amount reflects legal obligations. Understanding the requirements for filing a lien on property can help you navigate this process smoothly.

To file a lien on property in Texas, you need to gather several essential documents. First, you must have the completed lien form, which details information such as the property owner's name, a description of the property, and the amount owed. Next, you must file the form with the county clerk's office in the county where the property is located. Using US Legal Forms can simplify this process by providing the necessary templates and guidance to ensure that you file a lien on property correctly and efficiently.

In Rhode Island, a lien typically remains on your property for a period of 10 years, although it can be renewed. This duration gives creditors time to enforce their claims if necessary. If you find yourself in a situation involving a lien, understanding the lifeline of liens will be crucial when deciding whether to proceed with filing a lien on property or resolving the issue.

Generally, the property lien with the highest priority is a mortgage lien, followed by tax liens. Mortgage lenders have first claim when it comes to unpaid debts, but tax liens must be settled first if the owner sells the property. Knowing the priority of liens is important when considering filing a lien on property to protect your investment.

Yes, there is typically a minimum amount required to file a lien on a property, which can vary by state. This minimum ensures that only significant claims are considered, preventing frivolous liens. It's advisable to consult a legal resource or platform like uslegalforms for detailed information on the filing process and any associated costs.