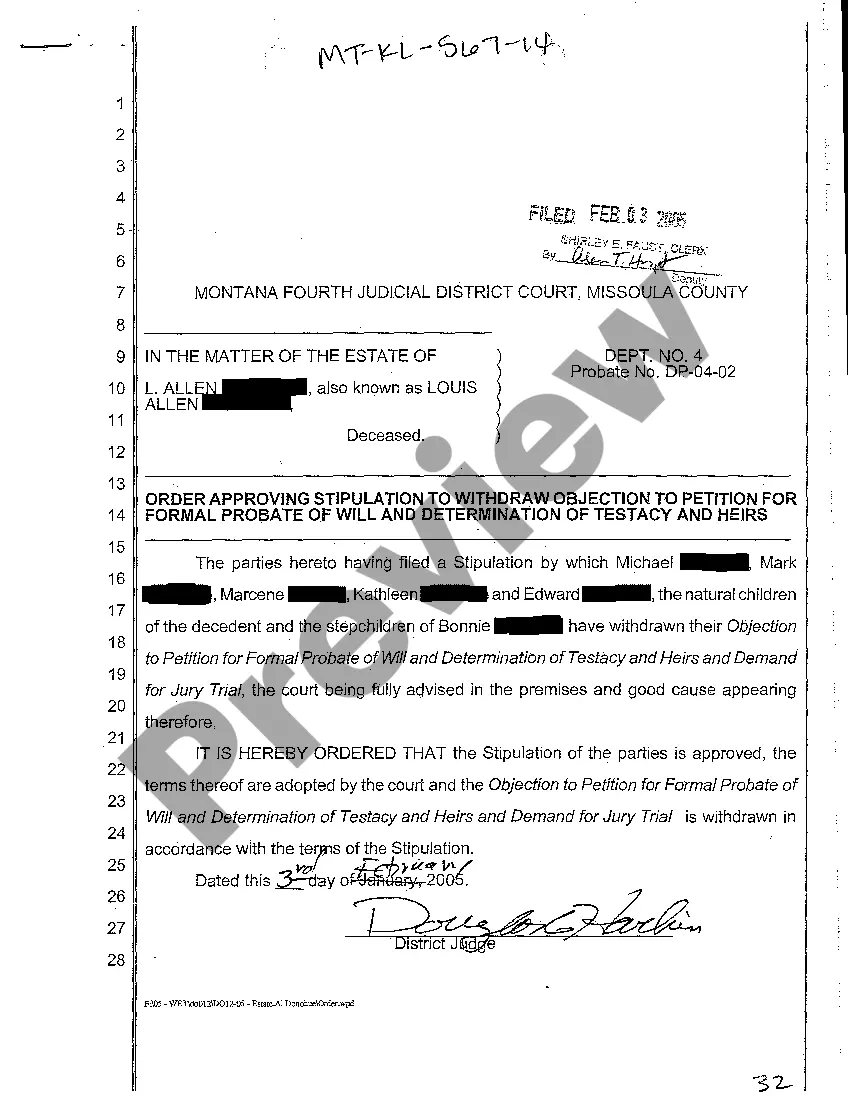

Montana Objection to Petition for Formal Probate of Will and Determination of Testacy and Heirs and Demand for Jury Trial

Description

How to fill out Montana Objection To Petition For Formal Probate Of Will And Determination Of Testacy And Heirs And Demand For Jury Trial?

Get a printable Montana Objection to Petition for Formal Probate of Will and Determination of Testacy and Heirs and Demand for Jury Trial in just several mouse clicks from the most comprehensive catalogue of legal e-documents. Find, download and print professionally drafted and certified samples on the US Legal Forms website. US Legal Forms has been the Top supplier of affordable legal and tax templates for US citizens and residents on-line starting from 1997.

Customers who already have a subscription, must log in into their US Legal Forms account, download the Montana Objection to Petition for Formal Probate of Will and Determination of Testacy and Heirs and Demand for Jury Trial and find it stored in the My Forms tab. Customers who do not have a subscription must follow the steps listed below:

- Ensure your template meets your state’s requirements.

- If available, look through form’s description to learn more.

- If readily available, review the shape to discover more content.

- When you’re sure the form fits your needs, click Buy Now.

- Create a personal account.

- Choose a plan.

- Pay out through PayPal or credit card.

- Download the form in Word or PDF format.

Once you’ve downloaded your Montana Objection to Petition for Formal Probate of Will and Determination of Testacy and Heirs and Demand for Jury Trial, you can fill it out in any online editor or print it out and complete it manually. Use US Legal Forms to to access 85,000 professionally-drafted, state-specific documents.

Form popularity

FAQ

If you are named in someone's will as an executor, you may have to apply for probate. This is a legal document which gives you the authority to share out the estate of the person who has died according to the instructions in the will. You do not always need probate to be able to deal with the estate.

Forcing the probate will be easy. This is done by filing a petition to probate the estate as a creditor, which you do have a right to do. The family, will probably object but if a family member is awarded Letters, then you will be able to file a creditor...

In Montana, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

When someone dies without a will, it's called dying intestate. When that happens, none of the potential heirs has any say over who gets the estate (the assets and property). When there's no will, the estate goes into probate.Legal fees are paid out of the estate and it often gets expensive.

In California, estates valued over $150,000, and that don't qualify for any exemptions, must go to probate.If a person dies and owns real estate, regardless of value, either in his/her name alone or as a "tenant in common" with another, a probate proceeding is typically required to transfer the property.

Appoint an Executor. When there's no will, there's no named executor. Decide Who Inherits Property. State law governs who inherits property when someone dies intestate. Meet Survivorship Requirements.

A will generally names an executor to administer the estate. If the decedent's estate has no valid will, you must file a petition with the probate court to administer the estate, and other folks who feel they're just as qualified may file a petition as well.

Generally, only spouses, registered domestic partners, and blood relatives inherit under intestate succession laws; unmarried partners, friends, and charities get nothing. If the deceased person was married, the surviving spouse usually gets the largest share.

Children - if there is no surviving married or civil partner If there is no surviving partner, the children of a person who has died without leaving a will inherit the whole estate. This applies however much the estate is worth. If there are two or more children, the estate will be divided equally between them.