Filing A Lien For Nonpayment

Description

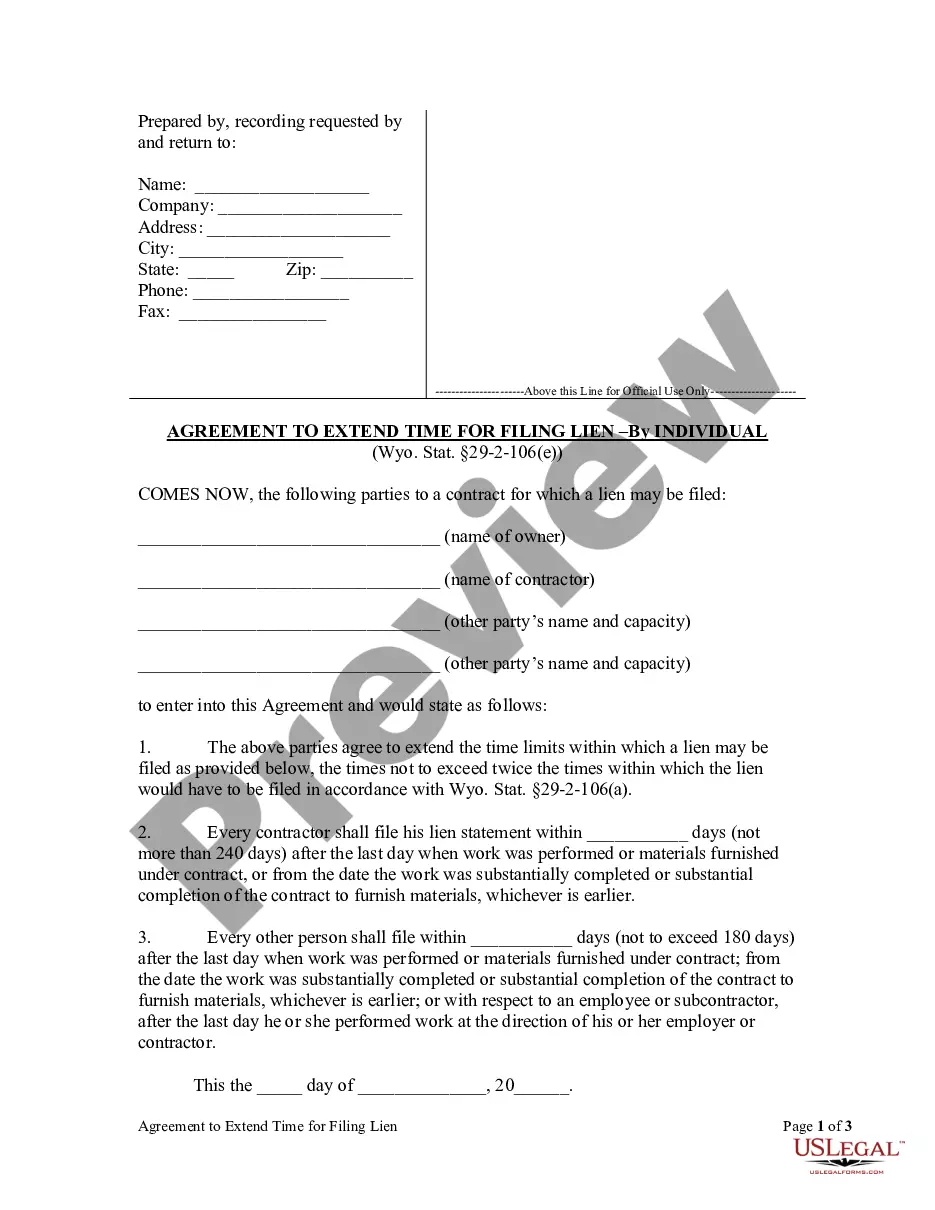

How to fill out Wyoming Agreement To Extend Time For Filing Lien - Individual?

- Log in to your US Legal Forms account if you have used our service before. Confirm your subscription is active, or renew it if it has expired.

- If you’re new to US Legal Forms, start by reviewing our extensive collection of form options. Use the Preview feature and check the form description to ensure it suits your needs and complies with your local jurisdiction.

- Should you find inconsistencies, make use of the Search function to look for alternative templates that better fit your requirements.

- Once you've identified the right form, click the 'Buy Now' button and select your preferred subscription plan. Create an account to unlock our library’s resources.

- Complete your purchase using your credit card or PayPal, and ensure you save the transaction details for your records.

- Finally, download your lien form to your device, giving you immediate access to fill it out. You can also find it later in the 'My Forms' section of your profile.

By utilizing US Legal Forms, you gain access to a vast database of over 85,000 legal documents, allowing for quick and efficient filing. Our robust collection offers more forms than competitors, ensuring you find exactly what you need.

Take charge of your legal matters today. Start your journey with US Legal Forms and simplify your lien filing process!

Form popularity

FAQ

In Georgia, a lien generally lasts for one year from the date it is filed. However, if you take further action, you can extend this period by renewing the lien before it expires. Understanding the duration of your lien is crucial, especially when filing a lien for nonpayment. US Legal Forms provides resources to help you track and manage your liens effectively.

To file a lien in Georgia, you must provide essential details such as the property description, the owner's name, and the amount owed. Additionally, you need to complete a lien form and file it with the local county clerk's office. Filing a lien for nonpayment serves as a legal claim against the property, ensuring you can seek payment if disputes arise. Using US Legal Forms can simplify this process, offering templates and guidance tailored to your needs.

The minimum amount to file a lien can vary depending on state laws and specific circumstances. Generally, you can file a lien for any amount owed, but there may be thresholds set by your state that dictate the filing process. Consulting with a platform like US Legal Forms can help you navigate these requirements smoothly. They offer resources for understanding the necessary steps and guidelines for filing a lien.

Yes, you should be concerned about a lien on your house because it can hinder your ability to sell or refinance. Filing a lien for nonpayment creates a legal claim that must be resolved before you can transfer ownership. Moreover, ignoring a lien may lead to foreclosure or other severe consequences. Therefore, it is wise to consult a professional if you receive notice of a lien.

When a lien is placed on you, it signifies that someone has claimed a legal right to your property due to unpaid debts. This act can restrict your options, including refinancing your home or transferring title. Additionally, the presence of a lien can lead to legal actions from the creditor if the debt remains unpaid. It's important to address the situation promptly to avoid further complications.

Filing a lien for nonpayment can lead to several negative consequences for both parties involved. For the debtor, it may result in a damaged credit score and restrict their ability to sell or refinance their property. For the creditor, this action may prompt legal battles or less favorable business relationships. Therefore, understanding these effects is vital before taking any steps.

While filing a lien for nonpayment can empower you as a creditor, it also comes with challenges. A lien can impact the debtor’s credit, which may result in a strained relationship. Additionally, enforcing a lien can involve legal fees and time, and you may not always see the debt recovered. Thus, it is crucial to consider other avenues before proceeding.

Filing a lien for nonpayment can have both positive and negative implications. On one hand, a lien can protect your financial interests by ensuring you receive the payment you are owed. On the other hand, it can complicate relationships with clients or contractors. It's essential to understand the context and weigh the benefits against potential drawbacks.

You generally cannot file a lien against your own property to secure repayment of your debts. However, if you have a legitimate claim against another party, you can file a lien for nonpayment against their property. Should you need guidance, platforms like US Legal Forms can simplify the process.

In Virginia, you typically have six months to file a lien for nonpayment after the last work was completed or goods were supplied. This timeframe is critical to remember, as failing to file within this period may forfeit your right to claim the debt. It is advisable to take timely action and consult resources for assistance.