Form Wyoming Corporation Withdrawal

Description

How to fill out Form Wyoming Corporation Withdrawal?

Red tape requires exactness and detail.

If you do not manage the task of completing documents like Form Wyoming Corporation Withdrawal regularly, it can result in some misunderstanding.

Choosing the correct template from the start will ensure that your paperwork submission goes smoothly and avert any complications of having to resubmit a document or starting the same task entirely anew.

Obtaining the proper and current templates for your documents is a matter of minutes with an account at US Legal Forms. Eliminate the bureaucratic uncertainties and enhance your efficiency with paperwork.

- Find the document using the search bar.

- Verify that the Form Wyoming Corporation Withdrawal you’ve found is suitable for your state or territory.

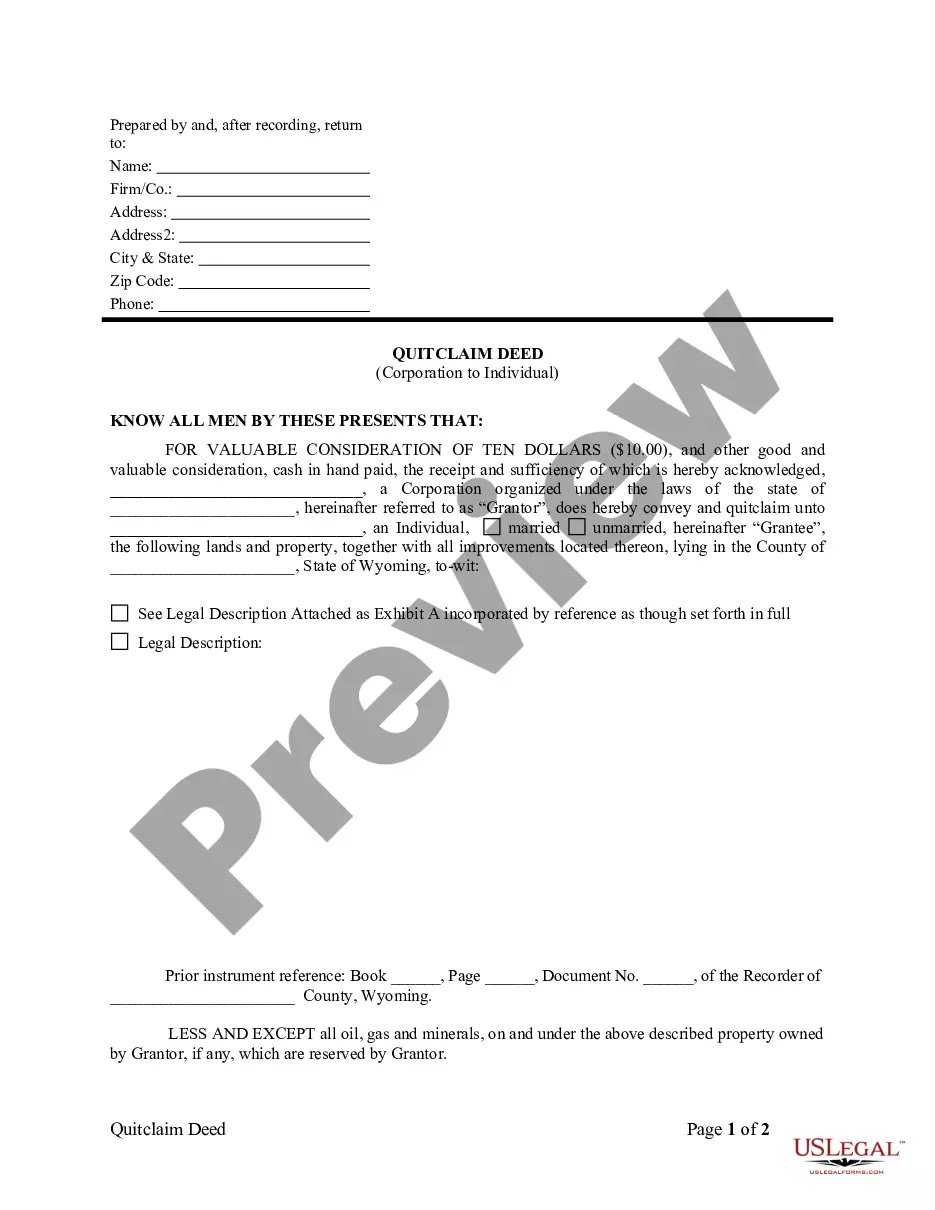

- Examine the preview or read the description that provides the details on utilizing the template.

- If the outcome fits your search, click the Buy Now button.

- Select the appropriate option among the proposed subscription plans.

- Log Into your account or sign up for a new one.

- Complete the transaction using a credit card or PayPal as a payment method.

- Download the document in the file format of your preference.

Form popularity

FAQ

To close a Wyoming company, you must first file the necessary paperwork with the Wyoming Secretary of State. This includes submitting the 'Form Wyoming Corporation Withdrawal' to officially cease business operations. You should also settle any outstanding obligations and notify stakeholders, ensuring a smooth transition. Following these steps carefully will help you comply with state regulations and successfully close your company.

The close corporation statute in Wyoming allows a more flexible approach to the management and operations of corporations, especially for family or small businesses. This statute enables owners to operate with fewer formalities, simplifying decision-making processes. If you decide to utilize this statute, it can specifically benefit your strategy when preparing a 'Form Wyoming Corporation Withdrawal' for the dissolution of your close corporation.

Yes, you can dissolve your Wyoming LLC online by submitting the appropriate forms on the Wyoming Secretary of State's website. The process is straightforward, and you can complete it without needing to visit an office. By using the 'Form Wyoming Corporation Withdrawal', you can officially close your LLC and ensure all obligations are settled. This online method is efficient and convenient for managing your dissolution.

The processing time for the Secretary of State in Wyoming can vary based on several factors. Typically, once you submit your Form Wyoming Corporation Withdrawal, you can expect a processing period of around 10 to 14 business days. However, for quicker handling, you may consider expedited services, which could shorten the timeframe. Utilizing U.S. Legal Forms can streamline your experience by providing accurate forms and guidance, ensuring your withdrawal process proceeds smoothly.

Yes, you can form an LLC in Wyoming even if you do not reside there. Many non-residents choose Wyoming for its favorable business laws and lower taxes. However, you must have a registered agent in Wyoming to receive legal documents on behalf of your LLC. To simplify this process, US Legal Forms provides tools and resources for non-residents looking to establish their LLCs efficiently.

To form an S Corp in Wyoming, first establish your corporation by filing Articles of Incorporation with the Secretary of State. After your corporation is formed, you must file Form 2553 with the IRS to elect S Corporation status. Ensure that you meet all eligibility criteria before filing. For ease, US Legal Forms can help streamline the process and provide the necessary forms.

To close your Wyoming corporation, you need to file a Certificate of Withdrawal with the Secretary of State. This process formally dissolves your corporation and signals your intent to no longer operate. Make sure to settle any outstanding debts and obligations, and also inform relevant tax authorities. If you need assistance, consider using the US Legal Forms platform for guidance in form wyoming corporation withdrawal.