Tod Beneficiary Two For Life

Description

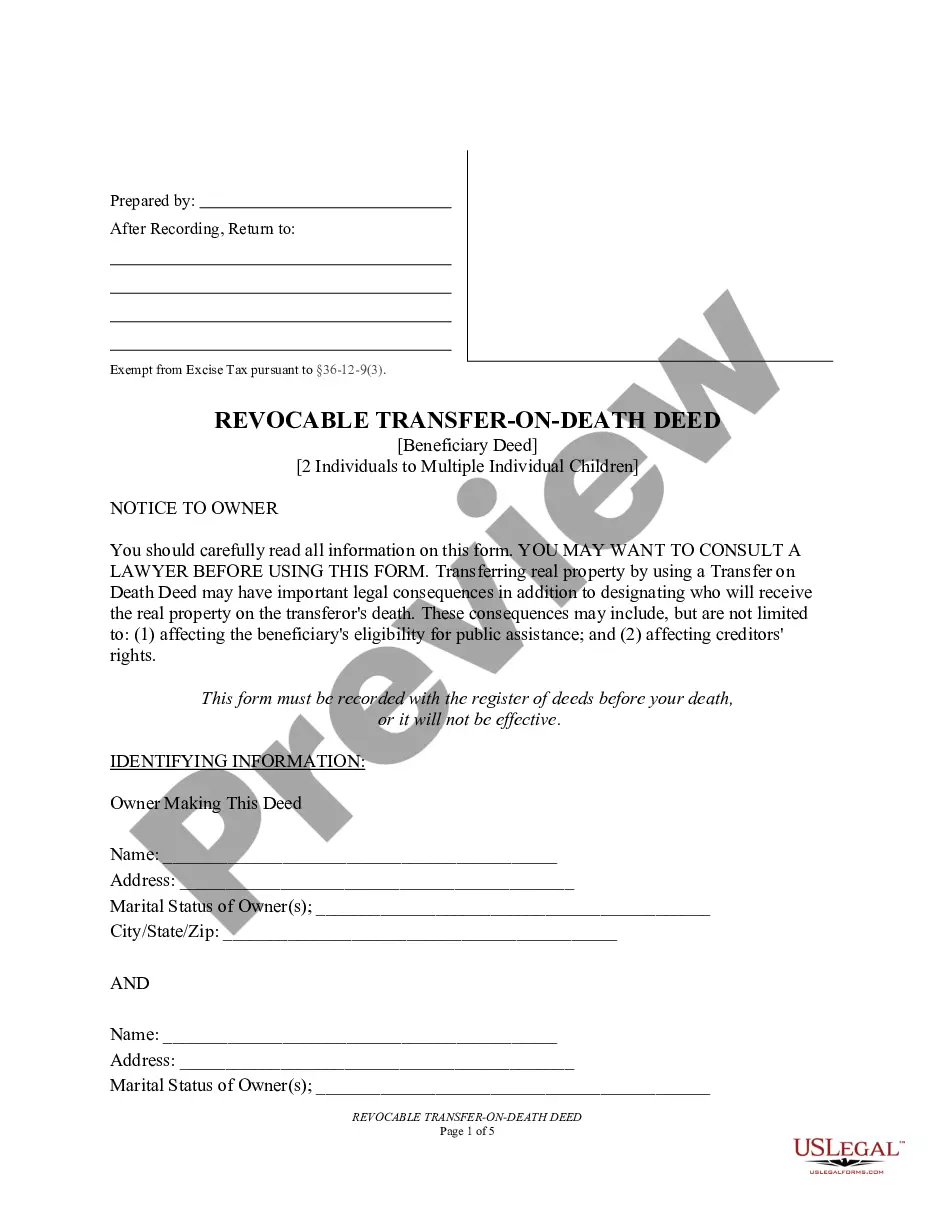

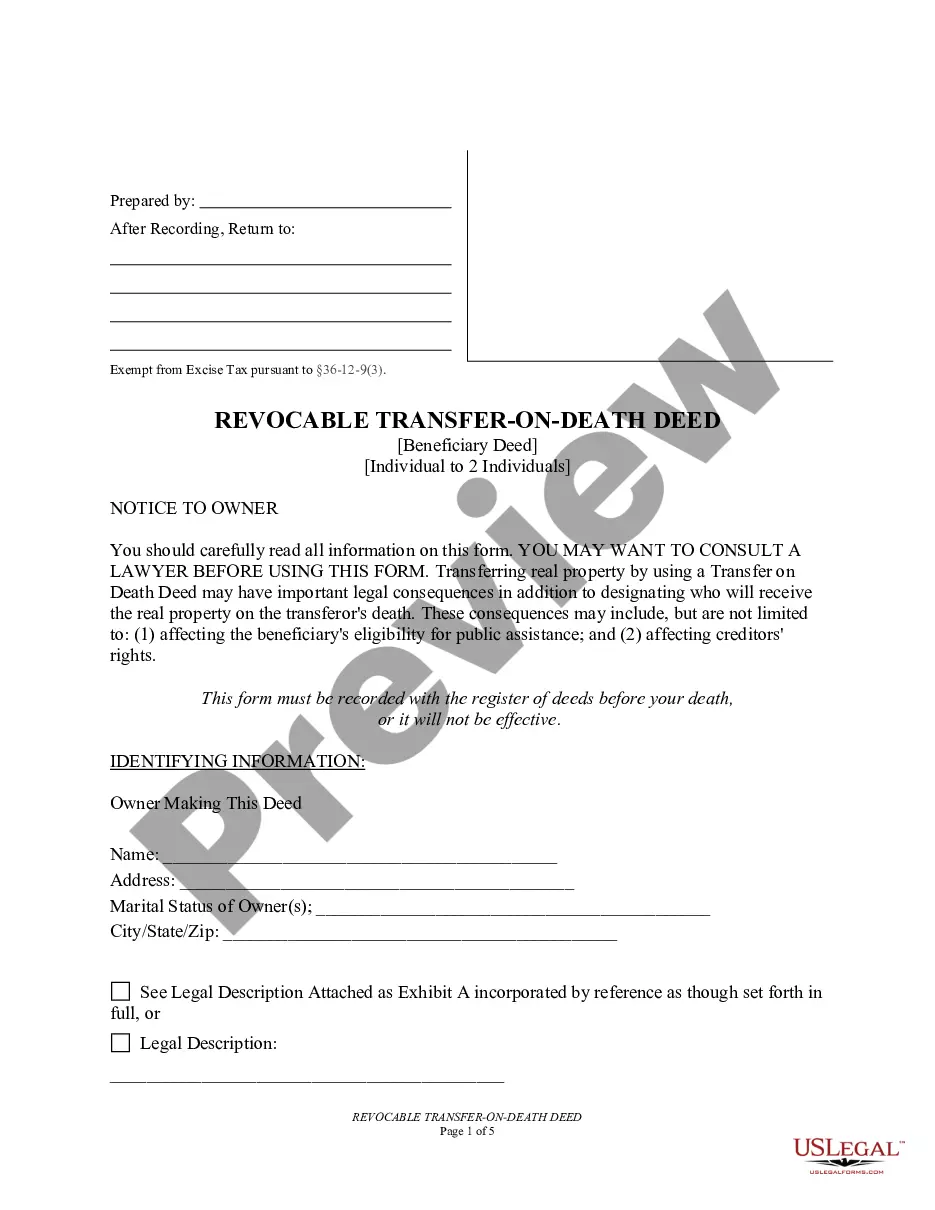

How to fill out West Virginia Transfer On Death Deed Or TOD - Beneficiary Deed For Two Individuals To Multiple Individuals?

- If you're a returning user, log in to your account and verify your subscription status before proceeding to download the necessary form.

- For new users, start by exploring the available templates. Check the Preview mode and read the form description to ensure it matches your needs and jurisdiction.

- If you don’t find the right document, use the Search feature to locate another template that fits your requirements.

- Once you've identified the correct form, select the Buy Now button, choose a suitable subscription plan, and create an account to access the resource library.

- Proceed with your purchase by entering your payment details or using your PayPal account.

- After completing your purchase, download the form and save it on your device. You'll find it conveniently listed under the My Forms section of your profile.

In conclusion, US Legal Forms empowers users with a vast selection of legal documents and the support of premium experts. With this step-by-step guide, you're equipped to obtain your Tod beneficiary two for life form quickly and efficiently.

Don’t hesitate—visit US Legal Forms today to streamline your legal paperwork!

Form popularity

FAQ

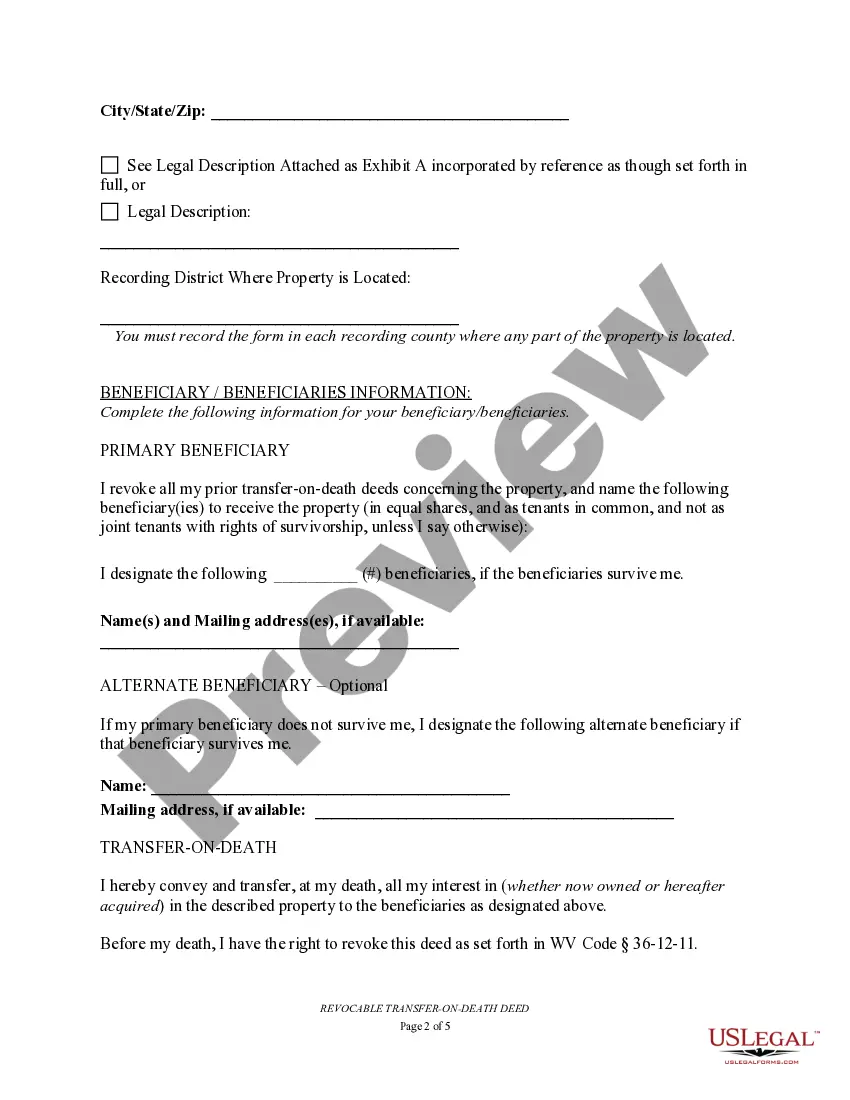

One potential disadvantage of a TOD account is the lack of control over asset distribution once you pass away. Your Tod beneficiary two for life will receive the assets directly, which may not align with your wishes if circumstances change. Additional risks include potential disputes among beneficiaries or issues if a beneficiary predeceases you. It is wise to evaluate these factors carefully.

A TOD account can help avoid probate, but it does not necessarily eliminate inheritance tax. While your Tod beneficiary two for life will receive the assets without going through probate, state laws regarding inheritance tax will still apply depending on where you live. It is beneficial to consult a tax professional to understand potential implications for your estate.

Yes, you can have multiple beneficiaries on a TOD (Transfer on Death) account. This allows you to specify more than one Tod beneficiary two for life. When you pass away, your assets will be distributed among your designated beneficiaries according to your instructions. This flexibility can help ensure that your loved ones receive their fair share.

While you do not need a lawyer to file a beneficiary deed, consulting one can be beneficial. A legal professional can guide you through the process, ensuring you comply with your state’s regulations. Using a clear understanding of a Tod beneficiary two for life helps in drafting the deed correctly, which may ultimately save you and your heirs from future complications.

While transfer on death deeds offer certain advantages, they come with their own set of disadvantages. The Tod beneficiary two for life option can limit your ability to change beneficiaries once established, unless you follow specific formalities. Furthermore, if the asset's value increases substantially, it may lead to higher taxes for the beneficiaries. Understanding these factors is vital, and uslegalforms can guide you in making informed decisions.

Tod beneficiary two for life accounts can be an effective estate planning tool, offering a straightforward way to transfer assets. They help avoid probate and provide a seamless transition of ownership. However, it’s crucial to evaluate your specific circumstances, as the benefits vary depending on individual needs. Consulting with a legal expert, like those at uslegalforms, can ensure that this option suits your estate planning goals.

When considering a Tod beneficiary two for life, it's essential to understand the potential downsides. One significant concern is that assets may not pass through probate, but this can complicate estate management if the beneficiary is not prepared. Additionally, if the beneficiary faces financial issues, creditors may claim these assets. Lastly, improper setup can lead to unintended tax implications.

When there are two beneficiaries on a life insurance policy, the insurance payout is usually split according to your specified terms. You can designate equal shares or different percentages for each beneficiary based on your wishes. This arrangement can provide financial support to multiple loved ones at the same time. To ensure clarity, consider using US Legal Forms to help document your intentions clearly.

One downside of a Tod account is that it may limit your control over assets while you are alive. If you name a beneficiary, they may have access to the assets upon your death, which could create disputes among family members. Additionally, Tod accounts do not offer protection from creditors. Be sure to review these aspects thoroughly with resources like US Legal Forms to make informed decisions.

To fill out a beneficiary designation for life insurance, begin by gathering the necessary information about your chosen beneficiaries. You will need their full names, dates of birth, and relationships to you. Carefully complete all sections of the form to avoid any delays. Additionally, using platforms like US Legal Forms can ensure you follow the correct procedure and meet legal standards.