Tod Husband Beneficiaries With A Child

Description

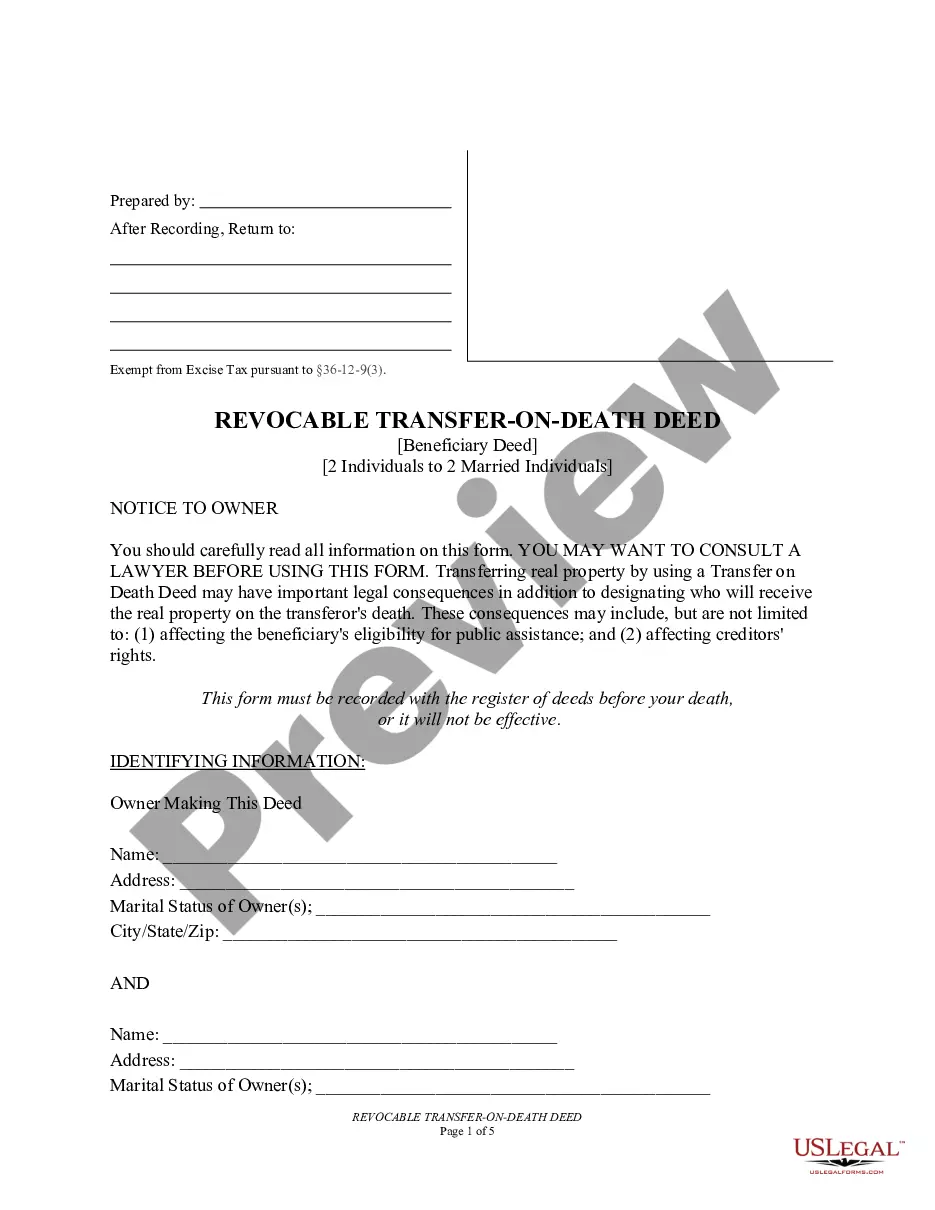

How to fill out West Virginia Transfer On Death Deed Or TOD - Beneficiary Deed For Two Individuals To Husband And Wife Beneficiaries?

- Log into your US Legal Forms account if you’ve previously used the service. Verify your subscription to ensure you can access the necessary forms.

- If you are new to the service, begin by searching for the specific TOD form for husbands with beneficiaries. Use the Preview mode and read the description to confirm it meets your requirements.

- Should you need a different template, utilize the Search feature to find a more suitable option that adheres to your jurisdiction's legal needs.

- Purchase the form by selecting your desired subscription plan and registering for an account to access the extensive library of legal documents.

- Complete your payment using your credit card or PayPal for a seamless transaction.

- Download the selected form and save it to your device for easy access. You can also retrieve it anytime through the My Forms section in your profile.

By following these steps, you can efficiently complete your TOD planning process with the assistance of US Legal Forms, which offers a broad range of legal documents and expert help.

Get started today to ensure your legal documents are both accurate and compliant. Visit US Legal Forms now!

Form popularity

FAQ

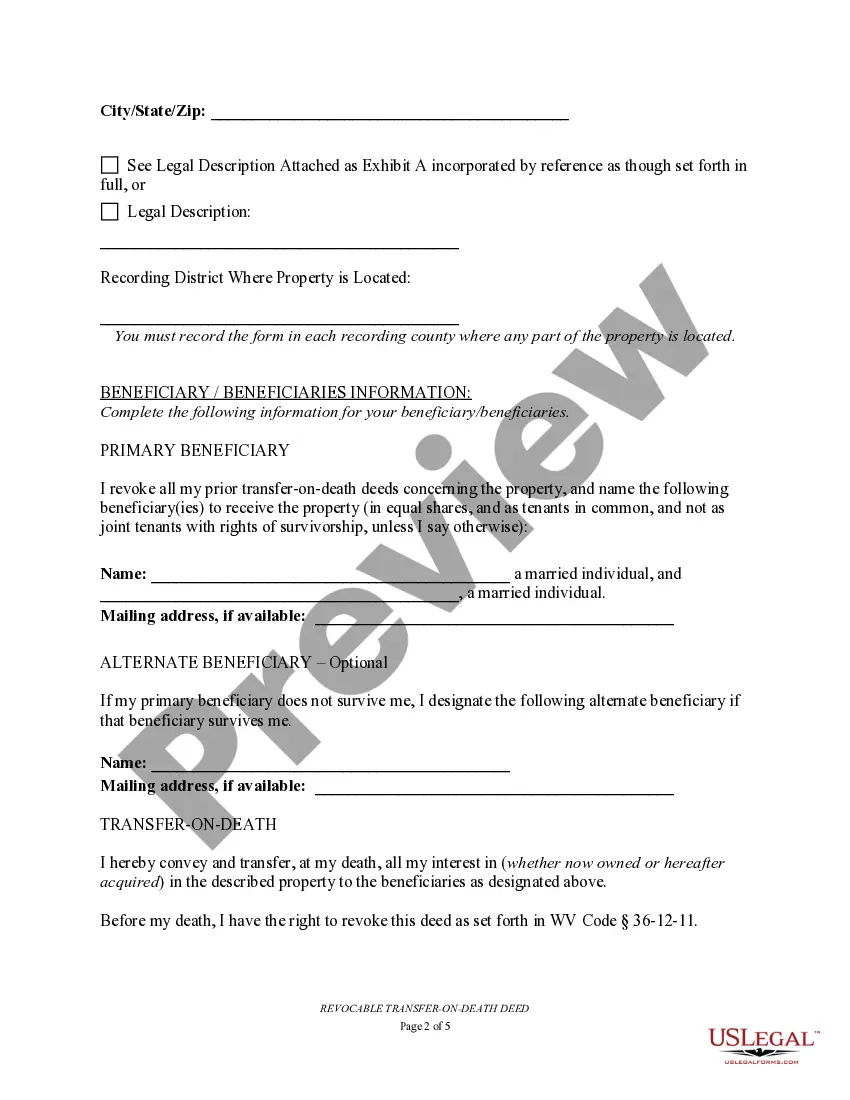

Dividing inheritance between your spouse and children involves understanding both state laws and your family needs. You might want to create a plan that fairly reflects your family's dynamics. Utilizing options like trust or direct distribution can help facilitate this process smoothly. With the right guidance on Tod husband beneficiaries with a child, you can craft a fair division that honors the wishes of all family members.

Choosing between your spouse and child as a beneficiary depends on your financial situation and family dynamics. If you wish to provide immediate security for your spouse, naming them as a beneficiary may be beneficial. Alternatively, considering your child in this decision can establish a long-term inheritance strategy. With Tod husband beneficiaries with a child, you can ensure that both your spouse and child receive the support they need.

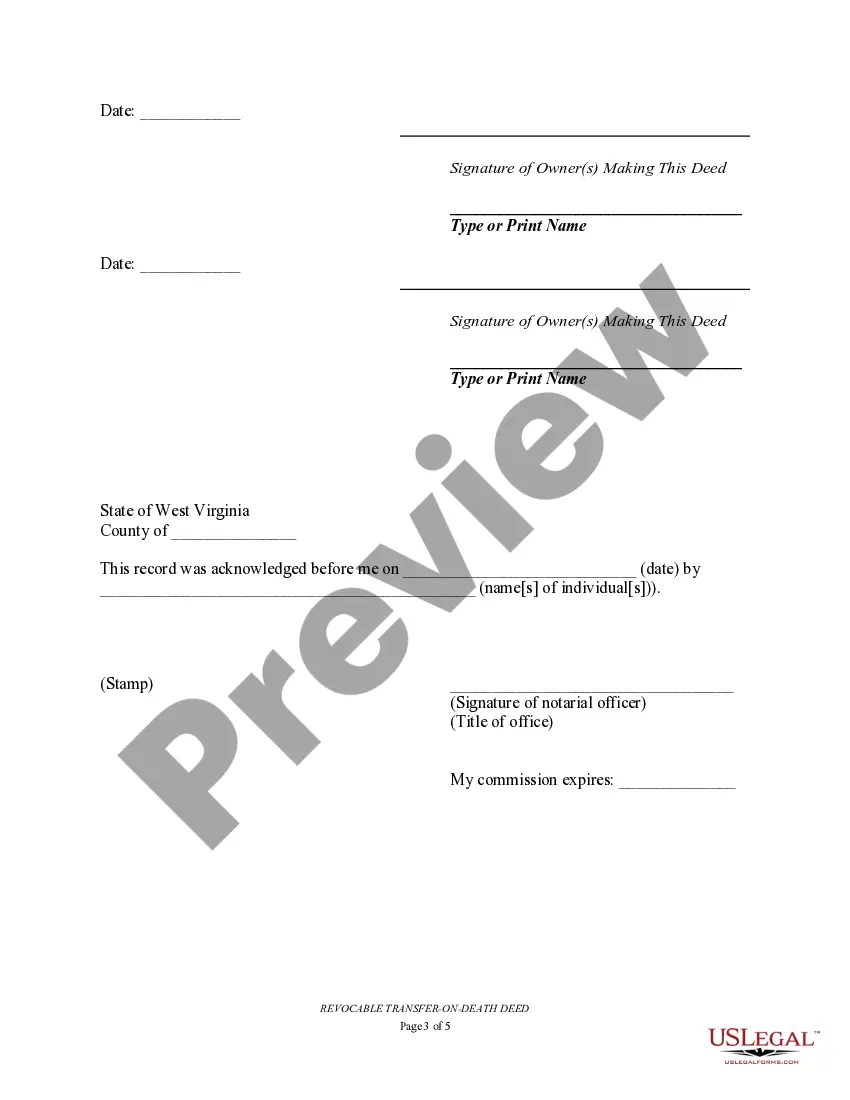

While it is not strictly necessary to hire a lawyer for a Tod deed, seeking legal advice can help navigate the complexities involved. Having a professional can ensure your wishes align with the law, especially in cases of Tod husband beneficiaries with a child. Additionally, a lawyer can identify potential pitfalls in your estate planning, ultimately saving you time and stress. Using platforms like USLegalForms can also provide the necessary documents without the lawyer's fees.

Choosing a beneficiary in Tod husband beneficiaries with a child situations depends on your family dynamics and financial goals. Many people opt to include both a spouse and a child to ensure equitable distribution of assets. However, it is crucial to consider your unique circumstances, including your relationship status and the child's needs. Making informed decisions will help secure your family’s financial future.

A Tod deed can override the rights of a spouse under certain conditions. If your assets list a specific beneficiary, such as a child, the Tod remains effective even if the spouse has expectations. This can create issues in blended families, where inheritance might not reflect your wishes. It is essential to communicate your intentions clearly to avoid confusion.

The downside of a Tod for husband beneficiaries with a child involves the potential for challenges during probate. If the asset passes directly to a beneficiary, it may lead to disputes among heirs, especially if other family members feel overlooked. Furthermore, if not set up correctly, a Tod deed might not align with your overall estate plan. Consulting a professional can provide clarity on this issue.

In the case of Tod husband beneficiaries with a child, assets do not always transfer automatically to a spouse. While many assets will flow to the surviving spouse, it depends on how they are titled and the presence of any joint ownership. Additionally, if a beneficiary is named specifically, that asset may not be included in the spouse's inheritance. Understanding this can help you plan your estate effectively.

A TOD can offer advantages over a will, particularly regarding the transfer of assets quickly. For husbands with children, a TOD can streamline the process without going through probate. Unlike a will, which may take time to enact, a TOD transfers directly to beneficiaries upon death. However, the best choice depends on individual circumstances, so considering both options is wise.

While you can set up a TOD on your own, having a lawyer can be beneficial, particularly if your situation is complex. A lawyer can help ensure that your designations, especially for husband beneficiaries with a child, align with your overall estate plan. They can review your documents for accuracy and compliance with state laws. Their guidance can help avoid potential disputes among heirs in the future.

Leaving property through a TOD account can be an efficient option, especially for husband beneficiaries with a child. It allows the asset to transfer outside of probate, which can save time and reduce costs. This method also offers flexibility, as you can change beneficiaries at any time during your lifetime. Consider evaluating your assets to determine if a TOD is the best fit for your situation.