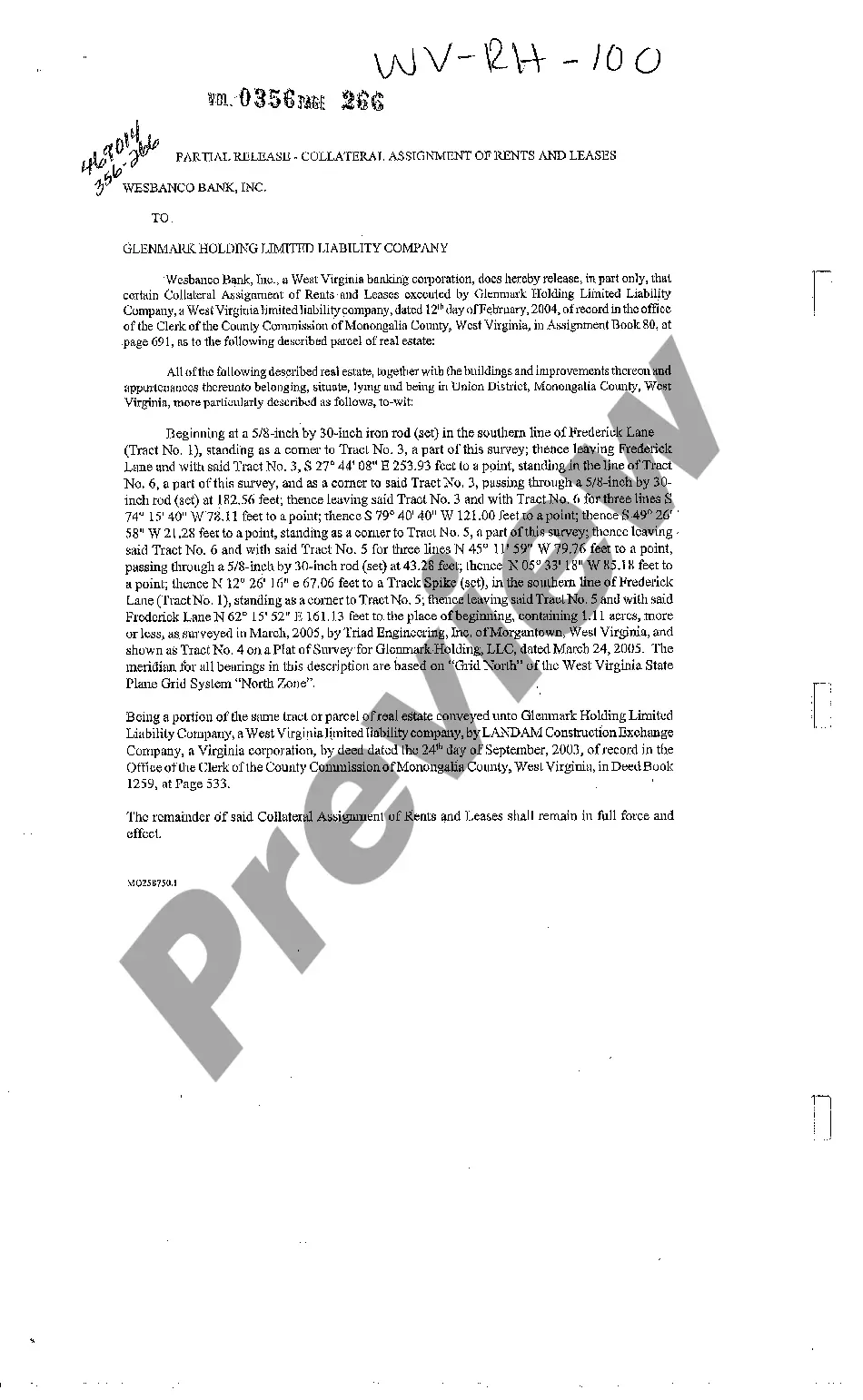

Partial Release Of Collateral For Sba Loan

Description

How to fill out West Virginia Partial Release - Collateral Assignment Of Rents And Leases?

Regardless of whether you handle documentation frequently or need to file a legal report from time to time, it is crucial to have a resource of information where all the samples are pertinent and current.

The first step you must take with a Partial Release Of Collateral For Sba Loan is to confirm that it is indeed the most recent version, as this determines its submitability.

If you wish to streamline your search for the most recent examples of documents, look for them on US Legal Forms.

Use the search bar to locate the form you need. Review the preview and outline of the Partial Release Of Collateral For Sba Loan to ensure it is precisely what you are searching for. After confirming the form, simply click Buy Now. Select a subscription plan that suits you. Create an account or Log In to your existing one. Use your credit card information or PayPal account to complete the transaction. Select the file format for download and confirm it. Eliminate the confusion of dealing with legal documents. All your templates will be organized and verified with a US Legal Forms account.

- US Legal Forms is a collection of legal documents that includes nearly every sample you might need.

- Search for the templates you seek, verify their relevance immediately, and learn more about their applications.

- With US Legal Forms, you have access to over 85,000 document templates across various sectors.

- Obtain the Partial Release Of Collateral For Sba Loan samples within a few clicks and save them anytime in your profile.

- A US Legal Forms account provides you access to all the samples you need with added convenience and less difficulty.

- You merely need to click Log In on the website header and navigate to the My documents section where all the necessary forms are readily available at your fingertips, saving you time searching for the correct template or verifying its authenticity.

- To acquire a form without an account, follow these steps.

Form popularity

FAQ

In most cases, the best path to removal is making an Offer In Compromise which resolves the SBA subordinate lien for pennies on the dollar, and once that is settled the lien will be released, and the offer value of the property returned to the owner.

This is a standard form of release of collateral letter. A release letter is typically given by a lender to a borrower after repayment of the borrower's outstanding loans to the lender under a secured loan agreement.

What are the collateral requirements? Economic Injury Disaster Loans of over $25,000 require collateral. The SBA takes real estate as collateral when it is available. The SBA will not decline a loan for lack of collateral but requires borrowers to pledge what is available.

Collateral includes assets such as real estate and office or manufacturing equipment. Accounts receivable and inventory may be pledged as collateral. Collateral may also include personal assets and commonly, a second mortgage on a home.