West Virginia Form Forecast

Description

How to fill out West Virginia Employment Employee Personnel File Package?

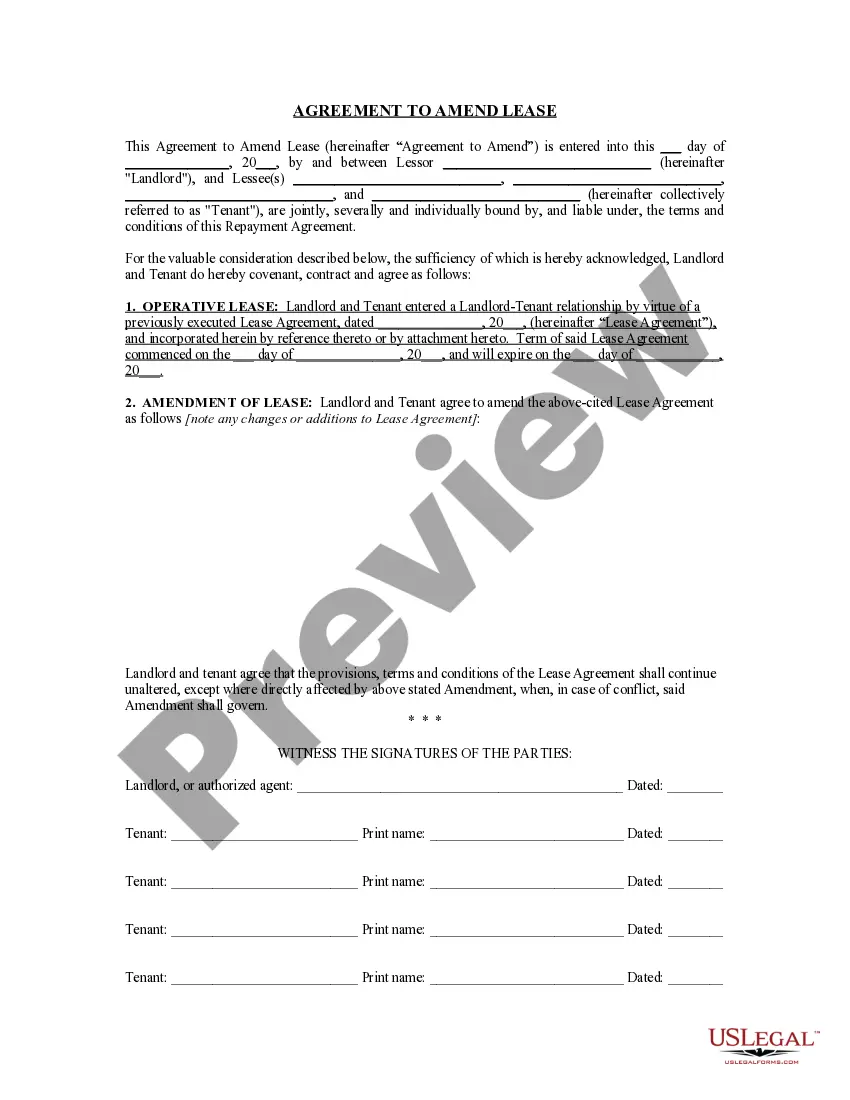

The West Virginia Form Forecast displayed on this page is a versatile legal template created by expert attorneys in accordance with federal and state laws.

For over 25 years, US Legal Forms has offered individuals, businesses, and lawyers more than 85,000 validated, state-specific documents for any business and personal situation. It’s the fastest, most direct, and most reliable method to secure the documents you need, as the service assures the utmost level of data protection and anti-malware safety.

Choose the format you desire for your West Virginia Form Forecast (PDF, Word, RTF) and download the sample onto your device. Complete and sign the document. Print the template to fill it out by hand. Alternatively, use an online versatile PDF editor to quickly and accurately complete and sign your form with a valid signature. Download your documents again whenever necessary. Access the My documents tab in your profile to redownload any previously acquired forms. Subscribe to US Legal Forms to have verified legal templates for all of life’s situations at your fingertips.

- Search for the document you require and review it.

- Browse through the sample you searched for and preview it or check the form description to ensure it meets your needs. If it doesn’t, utilize the search bar to find the right one. Click Buy Now when you have located the template you require.

- Subscribe and Log In.

- Select the pricing option that fits you and create an account. Use PayPal or a credit card to make a swift payment. If you already possess an account, Log In and check your subscription to proceed.

- Obtain the fillable template.

Form popularity

FAQ

In West Virginia, the personal exemption allows taxpayers to reduce their taxable income. This exemption can vary based on your filing status and the number of dependents you claim. Understanding how the personal exemption works is crucial for maximizing your tax benefits. By using a West Virginia form forecast, you can better assess how these exemptions apply to your situation.

The WV IT 104 form is the West Virginia Personal Income Tax Return specifically designed for non-residents of the state. This form allows those who earn income in West Virginia but live elsewhere to report their earnings appropriately. It is important to complete this form accurately to avoid issues with state tax authorities. A West Virginia form forecast can assist you in understanding how this form fits into your overall tax strategy.

The percentage for tax withholding varies depending on your income level and personal circumstances. Generally, West Virginia residents should refer to the state’s withholding tables to determine the appropriate percentage. Using a West Virginia form forecast can help you estimate your tax liability, allowing you to make informed decisions about your withholding rate.

Yes, you can file your West Virginia state taxes online. Many taxpayers prefer this method for its convenience and speed. Several platforms, including USLegalForms, offer a user-friendly interface to help you navigate the filing process smoothly. By using the West Virginia form forecast feature, you can ensure you have all necessary documents ready before submission.

The IT40 form is the standard individual income tax return used in West Virginia. This form allows residents to report their income and claim deductions and credits. When you complete the IT40 form, you provide vital information about your earnings during the year, making it essential for accurate tax filing. For the most efficient experience, consider utilizing a West Virginia form forecast to guide your preparation.

Seniors in West Virginia typically stop paying property taxes at the age of 65, provided they meet specific income guidelines and local criteria. It’s essential to check with local authorities to confirm your eligibility for any exemptions. The West Virginia form forecast can help clarify these rules and provide guidance. US Legal Forms can also assist you in applying for these benefits to ensure you receive the support you deserve.

Currently, there are discussions regarding the potential elimination of personal property taxes in West Virginia, but no definitive changes have been made. Such legislative changes can impact many residents and businesses, so staying informed is crucial. The West Virginia form forecast can provide updates on this topic. To prepare for any changes, consider utilizing services like US Legal Forms to stay compliant.

Several factors can delay your West Virginia state tax refunds, such as incorrect information, missing documentation, or discrepancies between state and federal filings. If you claim certain deductions or credits, it may also take longer for your refund to process. Reviewing your return against the West Virginia form forecast can help you understand what to expect. Resources from US Legal Forms can assist in ensuring your submission is accurate.

To avoid errors on your West Virginia tax returns, ensure that all your information is accurate and complete. Double-check your calculations and make use of tax preparation tools that can guide you through the process. The West Virginia form forecast can also help you identify common pitfalls. Additionally, US Legal Forms offers resources to help streamline your filing and reduce mistakes.

West Virginia taxes can have a significant impact on retirees, especially concerning income and property taxes. Many retirees may experience lower income tax rates and property tax exemptions if they meet specific criteria. Understanding these implications is essential for financial planning, and the West Virginia form forecast can provide valuable insights. Utilizing tools from US Legal Forms can simplify your tax preparation process.