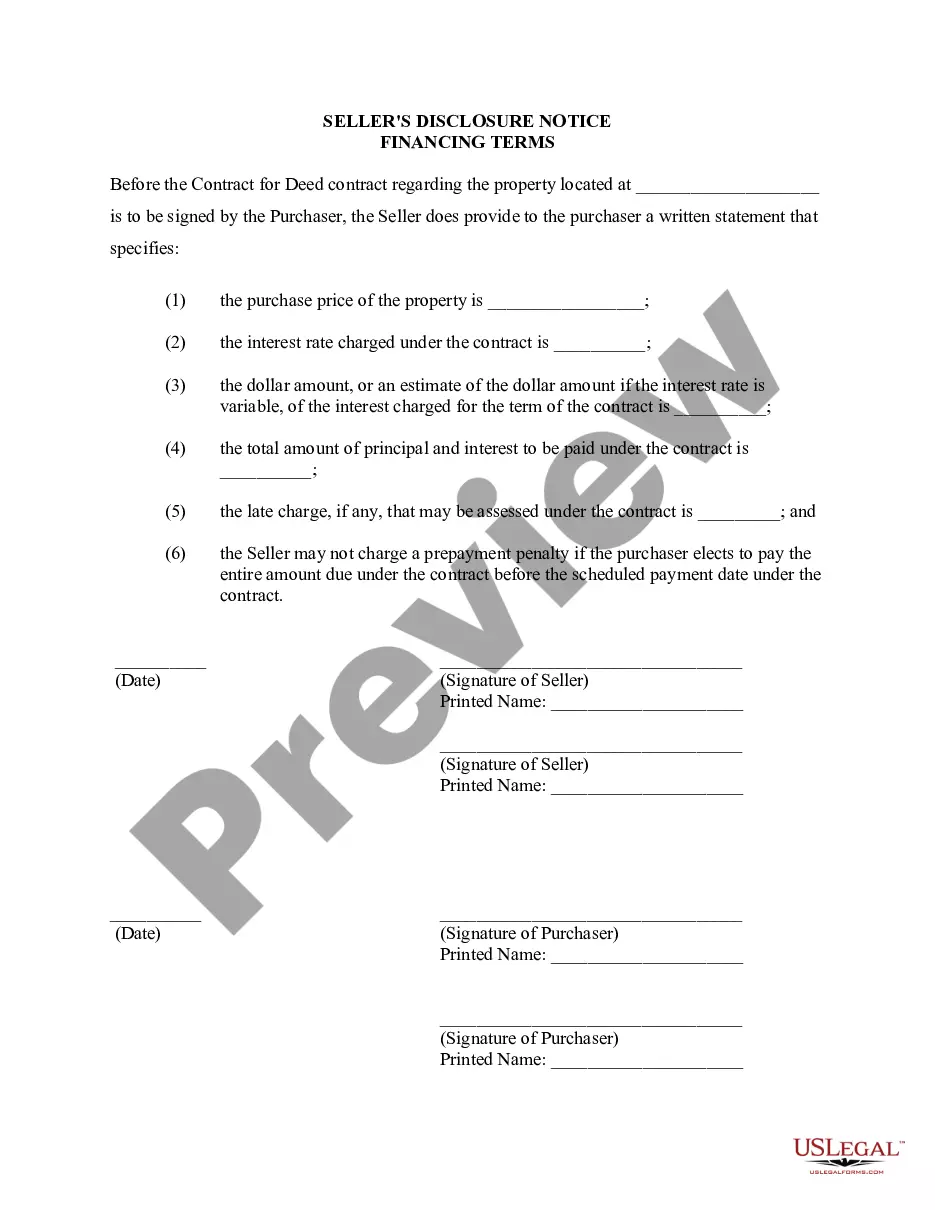

This Seller's Disclosure Notice of Financing Terms Contract for Deed serves as notice to Purchaser of the purchase price of property and how payments, interest, and late charges are set. This document should be completed by Seller of property and provided to the Purchaser at or before the signing of the contract for deed.

Financing For Real Estate Projects

Description

Form popularity

FAQ

Project financials encompass all financial aspects of a project, including estimated costs, funding sources, and projected revenues. Understanding project financials is crucial for ensuring proper management of resources and making informed decisions throughout the development process. For those seeking financing for real estate projects, a clear picture of financials can be the key to securing investment.

To seek funding for a project, clearly define your goals and present a detailed plan that highlights potential risks and rewards. Identify possible funding sources, such as banks, private investors, or government grants, and tailor your pitch to their interests. Platforms like uslegalforms can also help you navigate the legal aspects of securing funding, ensuring you're prepared.

To get financing for real estate, start by assessing your financial situation and credit history. It is crucial to prepare a strong project proposal that outlines how you plan to use the funds and the expected returns. You can then approach traditional lenders or alternative financing solutions to find the best fit for your needs.

A project is financed by combining different sources of funds, such as equity from investors, loans from banks, and grants from government programs. The financing structure can vary depending on the project type and its risk level. Understanding your project’s financial needs will help you determine the best combination of funding sources.

While $5000 may seem low for investing in real estate, it can be a starting point for financing for real estate projects, especially when considering partnerships or creative financing options. You might look into real estate investment trusts (REITs) or crowdfunding platforms where smaller amounts can contribute to larger projects. Additionally, using this initial investment wisely can help you leverage further funding.

Getting into project finance involves understanding the real estate market and knowing how to evaluate projects. You may start by obtaining relevant education or certifications in finance or real estate. Networking with industry professionals and exploring mentorship opportunities can help you gain necessary insights and develop connections.

To get financing for real estate projects, first, outline the details of your project, including costs and potential returns. Next, determine the type of financing you need, such as loans or investor contributions. You can then approach banks, private lenders, or explore crowdfunding platforms to secure funds.

When assessing financing options, consider project feasibility, creditworthiness, market conditions, and risk management strategies. Each factor plays a crucial role in determining the success of financing for real estate projects. A thorough evaluation can strengthen your position when seeking funds, improving your chances for approval.

The steps involved in project financing typically start with researching potential funding sources and creating a detailed project proposal. Once you have identified and approached potential investors or lenders, you will negotiate terms and finalize contracts. This process is critical to achieving successful financing for real estate projects.

The requirements of project finance include a compelling project outline, a comprehensive feasibility study, and a clear repayment strategy. Lenders also appreciate having a solid team in place that demonstrates expertise in real estate development. Meeting these criteria is essential when seeking effective financing for real estate projects.