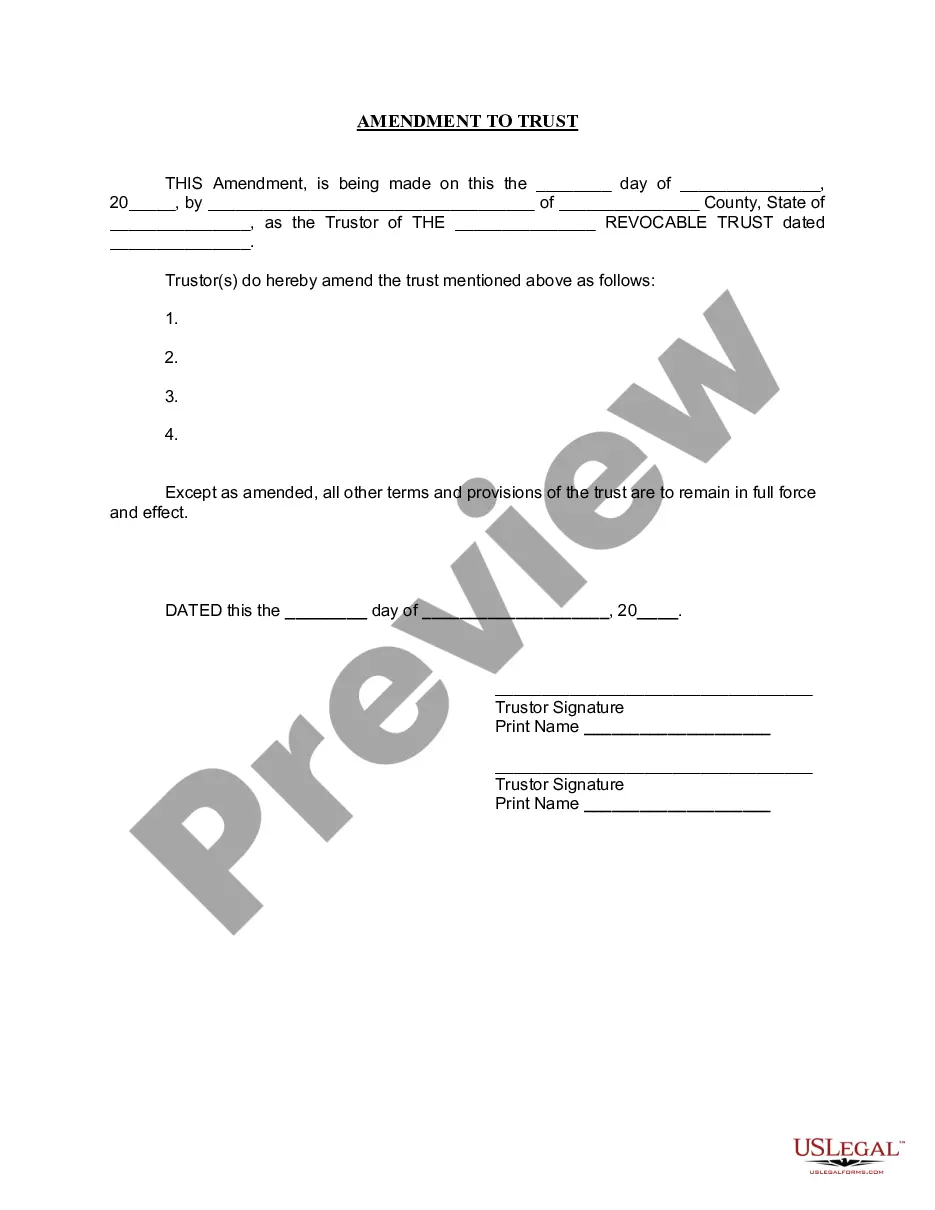

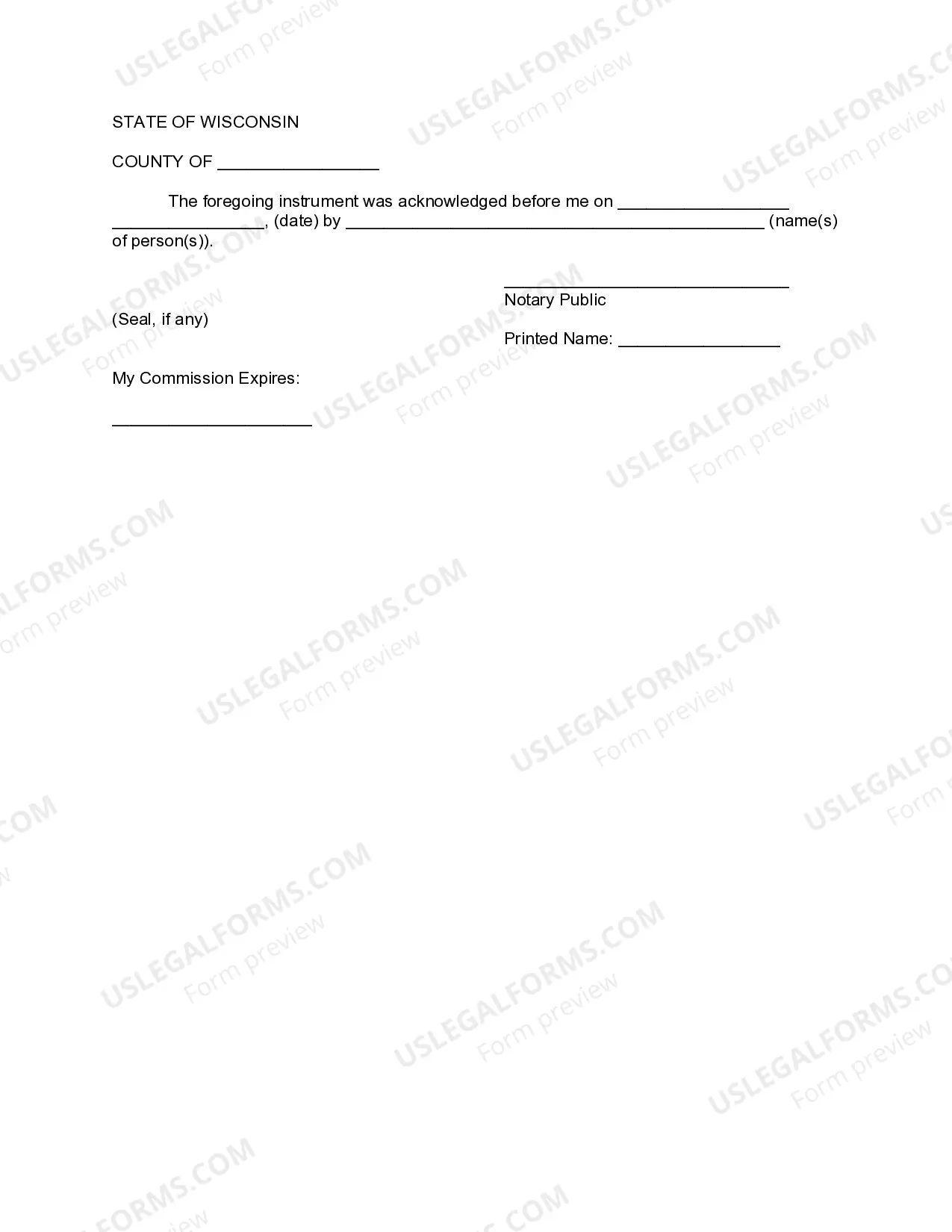

This form is for amending a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form permits the Trustor to amend certain properties of the trust without changing the purpose or nature of the trust. Except for the amended provisions, all other parts of the trust will remain in full force and effect. The Trustor(s) signature(s) is needed, and it must be signed in front of a notary public.

Wisconsin Trust Forms

Description

Form popularity

FAQ

Not all trusts are required to file Form 1041. Generally, a trust must file this form if it has gross income of $600 or more in a taxable year, or if it has a nonresident alien as a beneficiary. It's important to evaluate your trust's financial situation, and UsLegalForms can help you figure out what forms you need for your specific trust and circumstances.

Transferring property into a trust in Wisconsin involves drafting and executing a deed that transfers ownership to the trust. This process typically requires completing Wisconsin trust forms and then properly recording the deed with your local register of deeds. UsLegalForms simplifies this process by providing state-specific forms and detailed instructions to ensure a seamless property transfer.

Form 8453, U.S. Individual Income Tax Transmittal for an IRS e-file Return, is used primarily for electronic filing of individual tax returns. While not commonly related to trusts, it may be necessary if the trust's beneficiaries file individual returns that include trust-related income. To ensure correct handling of these complex matters, UsLegalForms can provide the necessary documentation and guidance.

In Wisconsin, a trust does not necessarily have to be notarized, but it is advisable to do so. Notarization helps to validate the trust document and can prevent potential disputes later on. You can easily find Wisconsin trust forms on UsLegalForms that not only comply with local laws but also provide notarization options if needed.

Yes, trusts may need to file Form 709, the United States Gift (and Generation-Skipping Transfer) Tax Return, under certain circumstances. This is generally relevant when a trust makes a gift that exceeds the annual exclusion limit. Understanding your obligations can be complex, so consider utilizing UsLegalForms to find the necessary forms and instructions tailored to your trust's circumstances.

When dealing with a trust for tax purposes, you may need to file IRS Form 1041, which is the U.S. Income Tax Return for Estates and Trusts. This form is essential for reporting income generated by the trust and ensuring compliance with federal tax laws. If you're unsure about the process or need assistance, UsLegalForms provides trustworthy templates and guidance to help navigate this requirement.

To file a trust in Wisconsin, you typically need to complete a Wisconsin trust form. This form varies depending on the type of trust you are establishing, such as a revocable or irrevocable trust. UsLegalForms offers comprehensive resources and templates to help you select and complete the right form accurately. It's crucial to follow the specific guidelines to ensure your trust is legally valid.

Yes, you can draft your own trust in Wisconsin, but it is crucial to adhere to state laws and requirements. A DIY approach might lead to mistakes that could complicate trust administration or lead to disputes. By using Wisconsin trust forms, you can ensure that your trust meets all legal standards and effectively serves your intended purpose.

One common mistake is not being clear about the trust’s terms or failing to designate a competent trustee. Parents may overlook the importance of providing detailed instructions for the distribution of assets. By using Wisconsin trust forms, you can create a comprehensive framework that addresses these concerns and secures your children's future.

Filing income from a trust involves reporting the income on your personal tax return if you are a beneficiary. The trust itself may also need to file its own tax return if applicable. Using Wisconsin trust forms can help you navigate these requirements correctly and ensure all income is reported accurately.