Will Vs Trust Wisconsin

Description

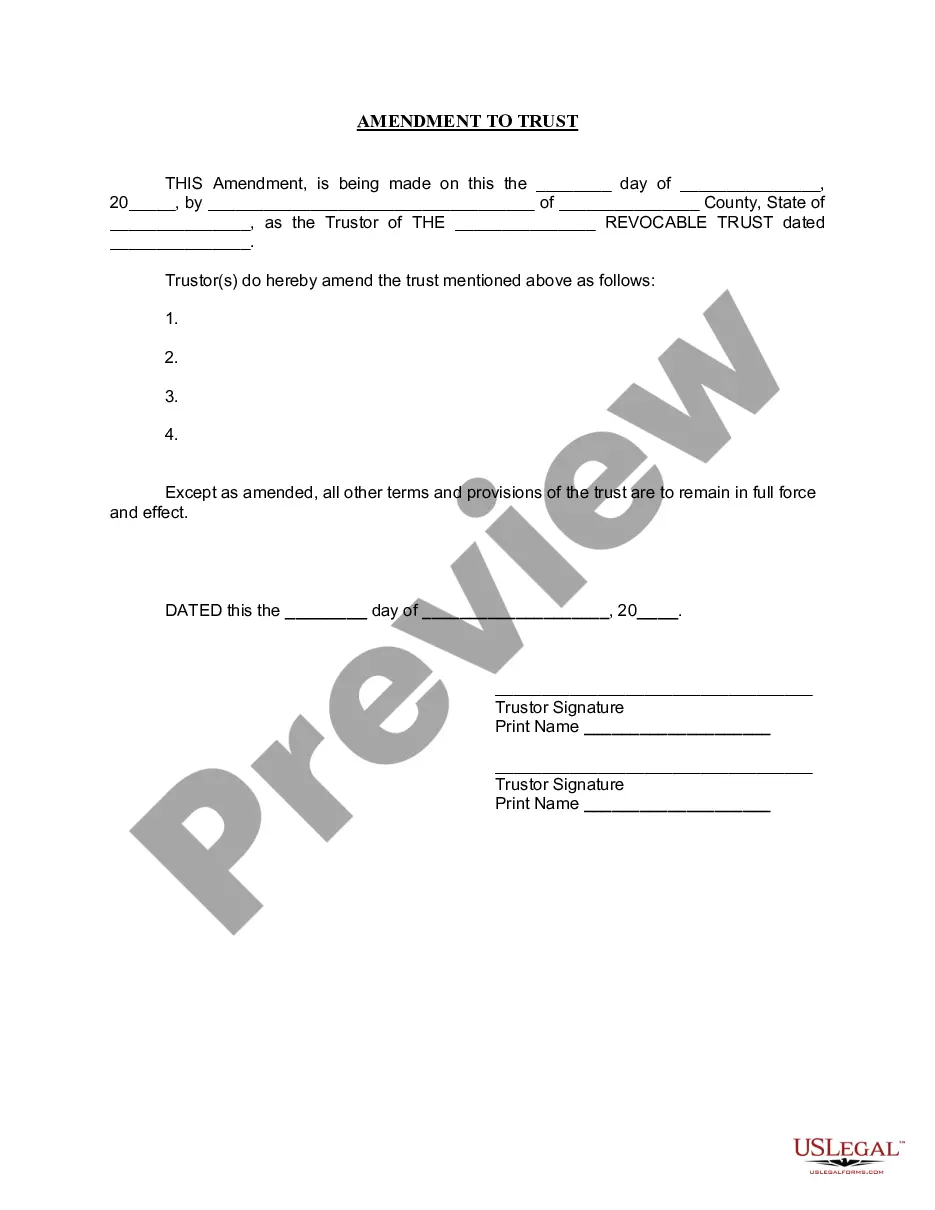

How to fill out Wisconsin Amendment To Living Trust?

Securing a reliable location to obtain the latest and suitable legal templates is a significant part of managing bureaucracy. Finding the correct legal documents requires accuracy and careful consideration, which is why sourcing samples of Will Vs Trust Wisconsin solely from dependable providers, such as US Legal Forms, is crucial. An incorrect template can waste your time and delay your situation. With US Legal Forms, you have minimal concerns. You can access and review all pertinent information about the document's application and significance for your case and within your locality.

Follow these steps to finalize your Will Vs Trust Wisconsin.

Eliminate the hassles involved with your legal documentation. Explore the comprehensive US Legal Forms library where you can access legal samples, verify their applicability to your situation, and download them immediately.

- Use the library navigation or search bar to locate your template.

- Check the form's details to ensure it meets the criteria of your state and region.

- Examine the form preview, if available, to confirm it is the one you require.

- Return to the search and find the appropriate template if the Will Vs Trust Wisconsin does not meet your specifications.

- If you are certain about the form's relevance, download it.

- As a registered user, click Log in to verify and access your selected templates in My documents.

- If you do not possess an account yet, click Buy now to acquire the form.

- Choose the pricing option that aligns with your needs.

- Advance to the registration process to complete your purchase.

- Finalize your transaction by selecting a payment method (credit card or PayPal).

- Select the document format for downloading Will Vs Trust Wisconsin.

- Once you have the form on your device, you can modify it using the editor or print it out and fill it manually.

Form popularity

FAQ

Deciding whether to have a trust or a will in Wisconsin depends on various factors such as the size of your estate and your family dynamics. Trusts provide flexibility and confidentiality, making them ideal for certain situations. To clarify your options, consider using the US Legal Forms platform to create a customized estate plan that meets your needs and addresses the will vs trust in Wisconsin question effectively.

A trust is often considered better than a will because it avoids the probate process, which can be lengthy and costly. Additionally, a trust provides greater control over asset distribution during your lifetime and after death. When considering the will vs trust in Wisconsin, keep in mind that trusts can offer tax benefits and protection from creditors.

Generally, the trust comes first in terms of managing assets, especially those placed within it. A will typically serves as a backup to handle assets not designated to the trust. In understanding the will vs trust in Wisconsin, it’s important to consider how each document interacts with your overall estate plan.

Whether a trust is better than a will in Wisconsin depends on your personal circumstances. Trusts offer benefits like privacy and avoiding probate, which makes them attractive to many people. However, wills are simpler and may serve your needs if your estate is small or straightforward. Evaluating the will vs trust in Wisconsin is key to making the right choice.

In Wisconsin, when you have both a will and a trust, the terms of the trust typically take precedence over the will. This means that assets placed in the trust will bypass the probate process outlined in the will. Understanding the differences between a will vs trust in Wisconsin is crucial for effective estate planning.

Choosing between a will and a trust in Wisconsin depends on your financial situation and estate planning goals. A will is simpler and allows for straightforward distribution of your assets after your death. In contrast, a trust can manage your assets during your lifetime and provide for your beneficiaries without going through probate. Consider the benefits of both options carefully; using a platform like US Legal Forms can help you understand the details of will vs trust Wisconsin and guide you in making the best decision.

If you pass away without a Will, your estate is ?intestate? and it will be up to the court to decide how to distribute your property. Dealing with intestacy can be difficult and time consuming for all parties remaining.

To create a living trust in Wisconsin, sign your written trust document before a notary public. Next, transfer ownership of assets into the trust to make it effective.

You can make your own will in Wisconsin, using Quicken WillMaker & Trust. However, you may want to consult a lawyer in some situations. For example, if you think that your will might be contested or if you want to disinherit your spouse, you should talk with an attorney.