Transfer Affidavit Valued Form 2766

Description

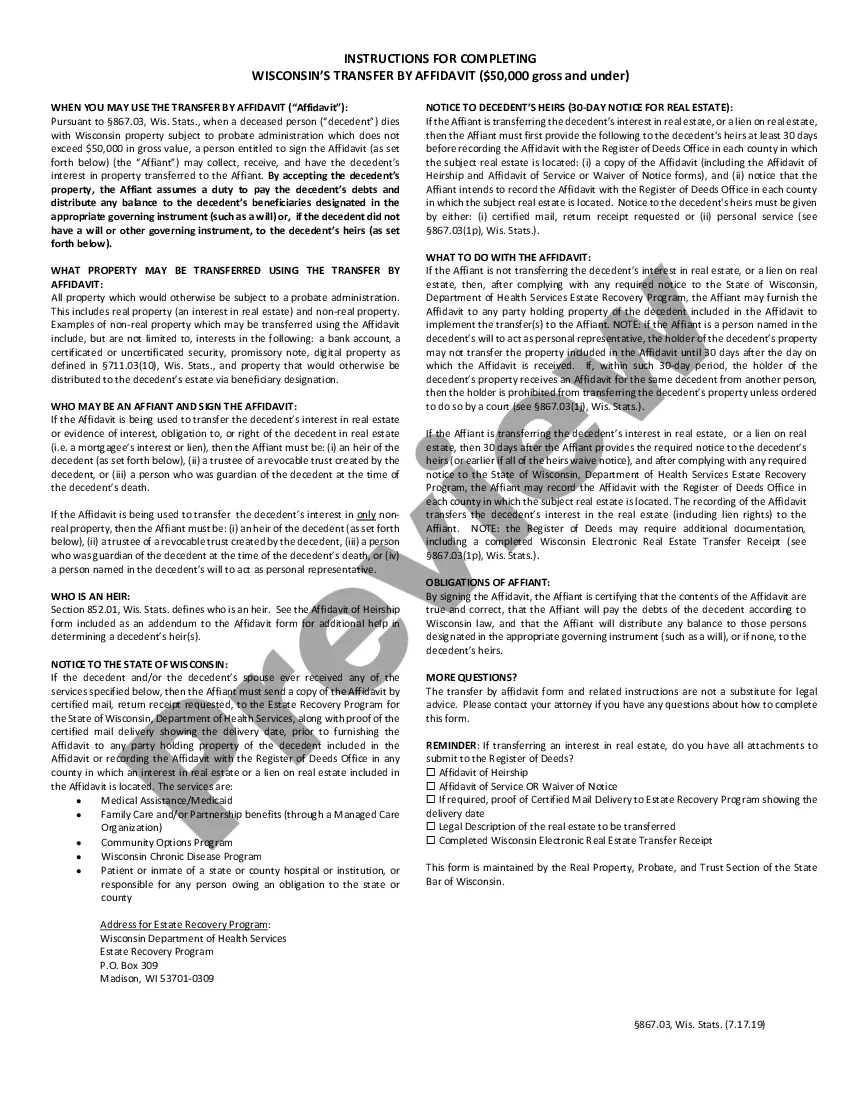

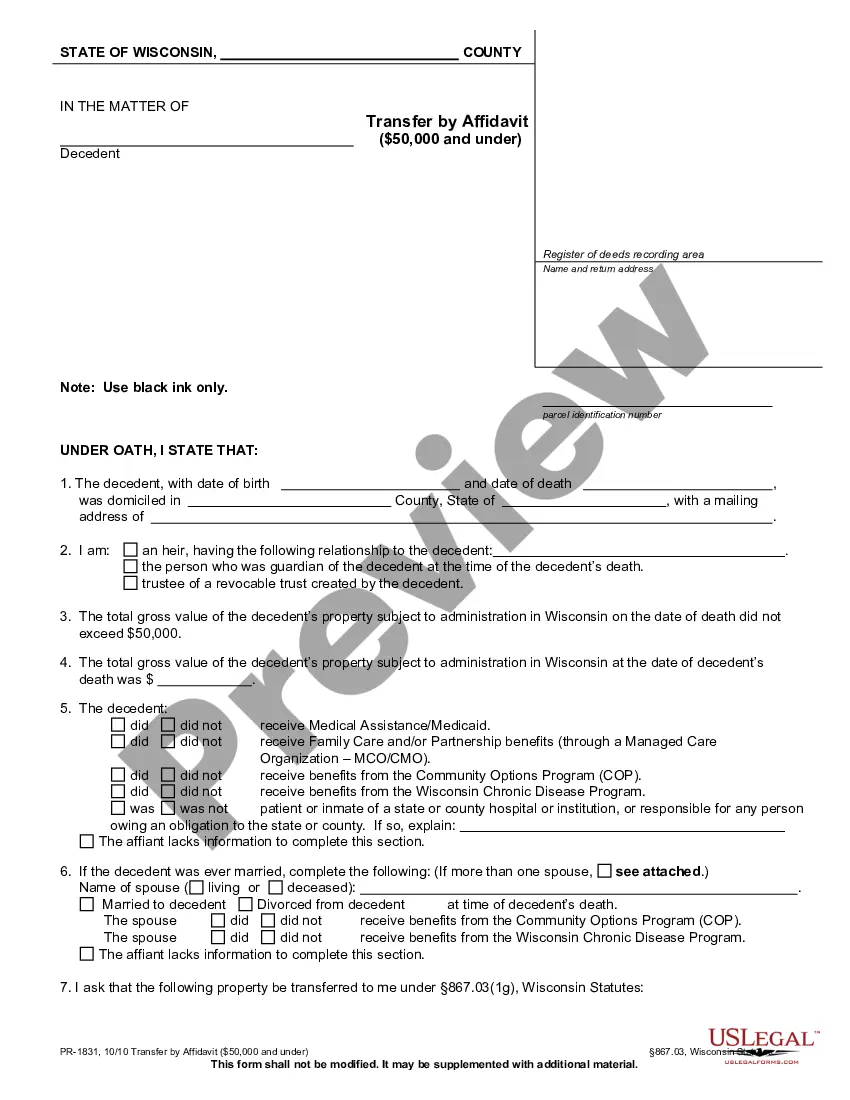

How to fill out Wisconsin Transfer By Affidavit For Estates Valued Under $50,000?

Whether for business purposes or for personal affairs, everyone has to deal with legal situations at some point in their life. Completing legal documents needs careful attention, starting with selecting the correct form template. For instance, if you pick a wrong edition of a Transfer Affidavit Valued Form 2766, it will be rejected when you send it. It is therefore crucial to have a trustworthy source of legal files like US Legal Forms.

If you need to obtain a Transfer Affidavit Valued Form 2766 template, follow these simple steps:

- Find the template you need using the search field or catalog navigation.

- Examine the form’s description to ensure it matches your situation, state, and region.

- Click on the form’s preview to view it.

- If it is the incorrect document, get back to the search function to locate the Transfer Affidavit Valued Form 2766 sample you need.

- Download the template when it matches your needs.

- If you already have a US Legal Forms account, simply click Log in to gain access to previously saved documents in My Forms.

- In the event you don’t have an account yet, you may obtain the form by clicking Buy now.

- Pick the proper pricing option.

- Finish the account registration form.

- Select your payment method: you can use a credit card or PayPal account.

- Pick the document format you want and download the Transfer Affidavit Valued Form 2766.

- Once it is downloaded, you are able to fill out the form by using editing software or print it and finish it manually.

With a substantial US Legal Forms catalog at hand, you never need to spend time searching for the appropriate template across the internet. Use the library’s simple navigation to find the proper template for any situation.

Form popularity

FAQ

Affidavit must be filed by the new owner with the assessor for the city or township where the property is located within 45 days of the transfer. The information on this form is NOT CONFIDENTIAL.

Affidavit must be filed by the new owner with the assessor for the city or township where the property is located within 45 days of the transfer. The information on this form is NOT CONFIDENTIAL.

The home seller typically pays the real estate transfer taxes. The state tax is calculated at $3.75 for every $500 of value transferred and the county tax is calculated at $0.55 for every $500 of value transferred.

State Law requires a Property Transfer Affidavit to be filed whenever real estate is transferred (even if you are not recording a deed).

The State of Wisconsin allows its residents to utilize a Transfer by Affidavit to avoid probate when the decedent's estate does not exceed $50,000 in gross value.