Limited Business

Description

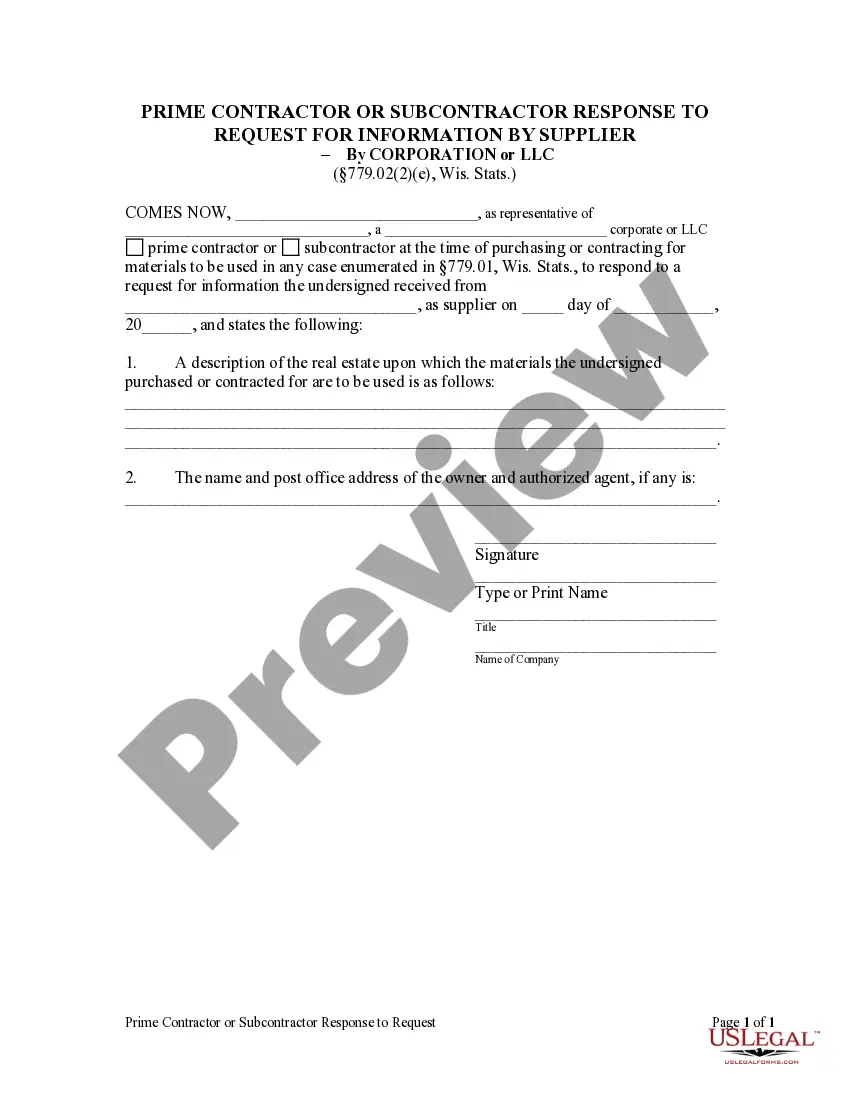

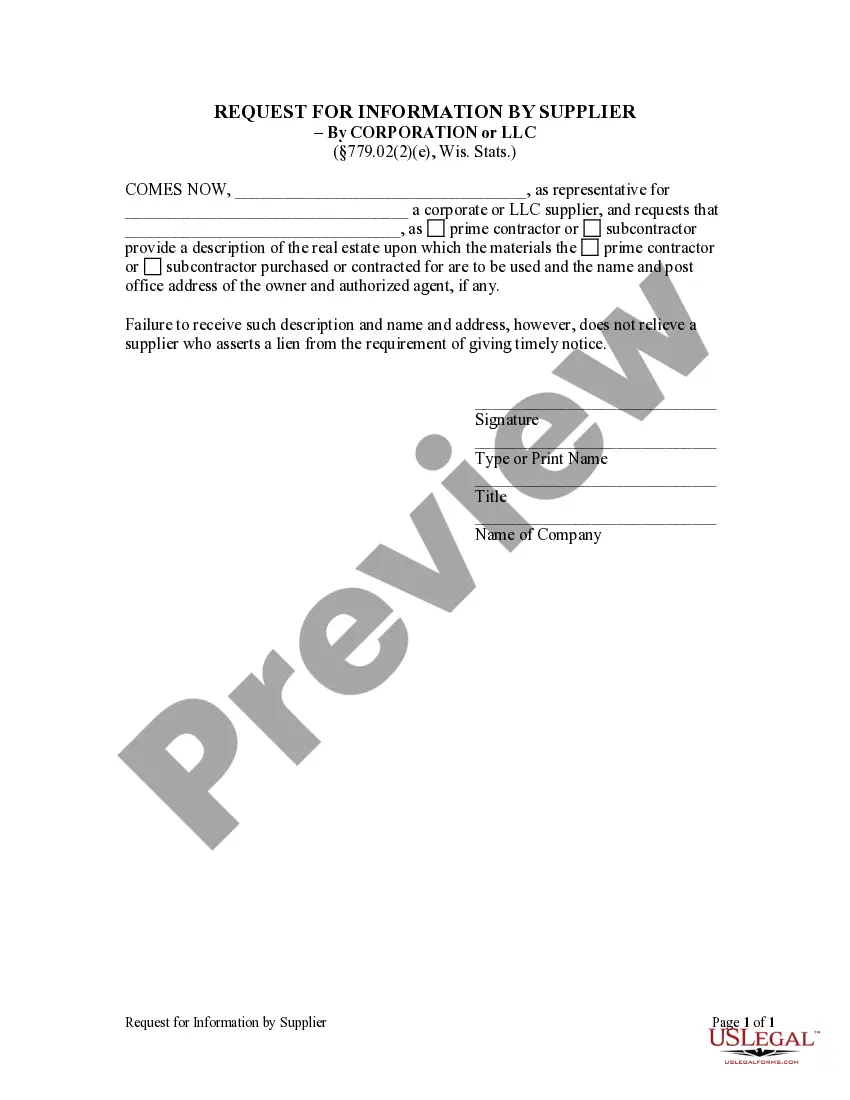

How to fill out Wisconsin Request For Information By Supplier - Corporation?

- If you are a returning user, log in to your account to access and download your desired form template directly.

- For new users, begin by reviewing the form selection in Preview mode to find the right document that adheres to local jurisdiction regulations.

- Use the Search feature to locate any additional templates, ensuring accuracy in your selection.

- Proceed to purchase the document by clicking the Buy Now button and choosing a subscription plan that suits your needs.

- Complete your purchase by entering your payment information, either through credit card or PayPal.

- Finally, download your form and save it on your device. You'll also find it in the My Forms section of your account for easy access.

By utilizing US Legal Forms, you gain access to a comprehensive resource that streamlines legal documentation. Their extensive library exceeds competitors, providing more effective solutions for your limited business needs.

Take action today and explore how US Legal Forms can empower your limited business with the right legal documents!

Form popularity

FAQ

If a business is a limited company, it operates as a distinct legal entity, separate from its owners. This separation means that the company can own assets, enter into contracts, and is responsible for its own debts. The owners, or shareholders, enjoy limited liability, which protects their personal wealth. Using USLegalForms, you can easily set up your limited business and ensure compliance with all necessary regulations.

The term 'limited' in business refers to the limitation of liability protection for the owners of the company. This means that if the business incurs debt or faces legal issues, the personal assets of the owners are generally shielded from claims. This structure encourages investment, as investors know their risk is limited. Choosing a limited business structure can provide peace of mind as you grow your enterprise.

While both a limited company and an LLC provide limited liability protection, they differ in terms of legal structure and taxation. A limited company is a formal corporate structure that may be owned by shareholders, while an LLC combines aspects of both partnerships and corporations. Limited businesses often face different regulatory requirements compared to LLCs. Understanding these differences helps you choose the right structure for your needs.

Being a limited company means that the business has a separate legal identity distinct from its owners. In this structure, the liability of the owners is limited to the amount they invest in the business. This means personal assets remain protected against business debts. A limited business structure can help establish credibility and trust with clients and partners.

Having an LLC for your side hustle can be beneficial, although not strictly required. It can help protect your personal assets and create a more professional image. Additionally, an LLC can simplify the process of switching your side hustle into a full-time limited business later on. Assess your needs and future goals when deciding.

Forming an LLC can be a worthwhile investment for a small business. It offers personal liability protection, potential tax benefits, and increases your business's credibility. Many entrepreneurs find that the advantages of an LLC outweigh the costs. Consider your individual business goals when making your decision.

Yes, you must report all business income, even if it is under $600. The IRS requires you to indicate all earnings from your limited business when filing taxes. Failure to report income could lead to penalties or audits. Keep accurate financial records to ensure compliance.

While you can start a small business without an LLC, forming one is often beneficial. An LLC helps protect your personal assets from business liabilities. It can also improve your credibility and make it easier to secure financing. Evaluate your business plans to determine the best structure for you.

Even if your limited business earns a small amount, you may still need to file taxes. The IRS requires you to report all income, regardless of the amount. If you earn more than the threshold for your filing status, you definitely must report your income. Stay informed about tax deadlines and requirements to avoid penalties.

Generally, you will file your personal and LLC taxes separately. An LLC is a separate legal entity, so it must maintain its own financial records. Depending on your business structure and income level, you may need to file specific forms for your limited business. Always consult a tax professional to navigate this process.