Wi Nonresident Withholding

Description

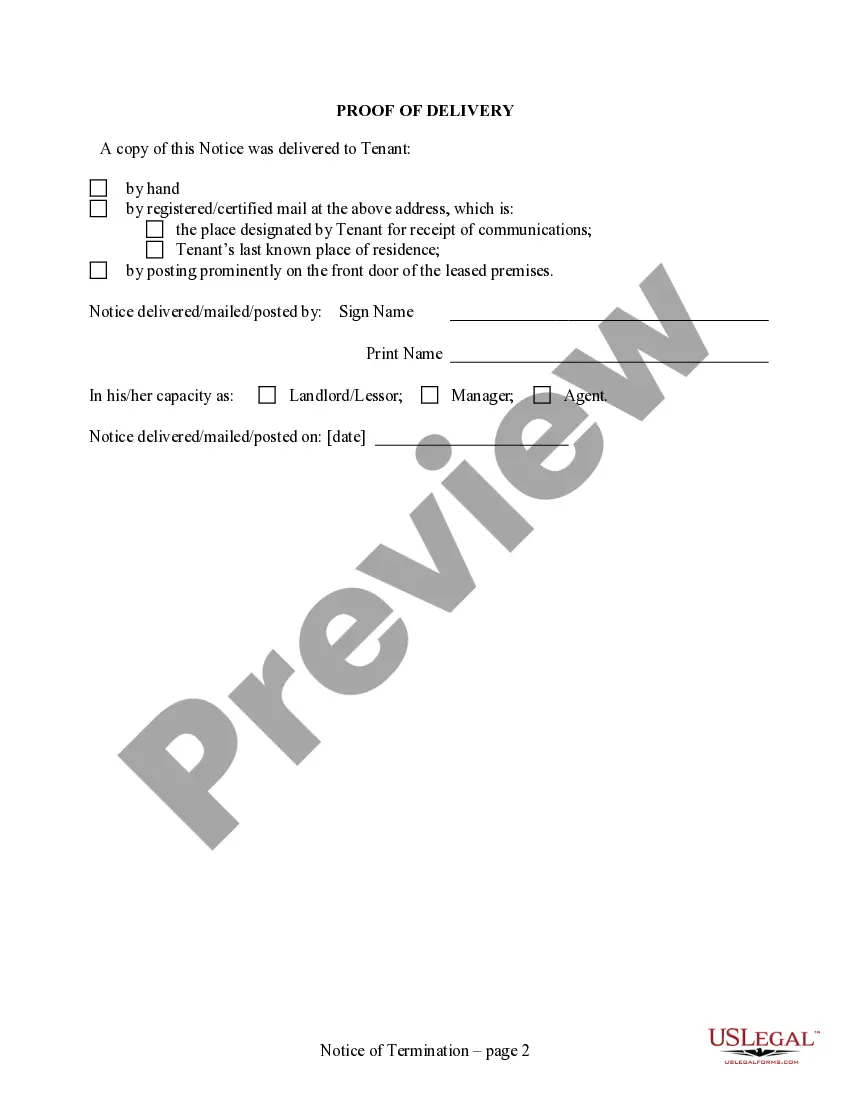

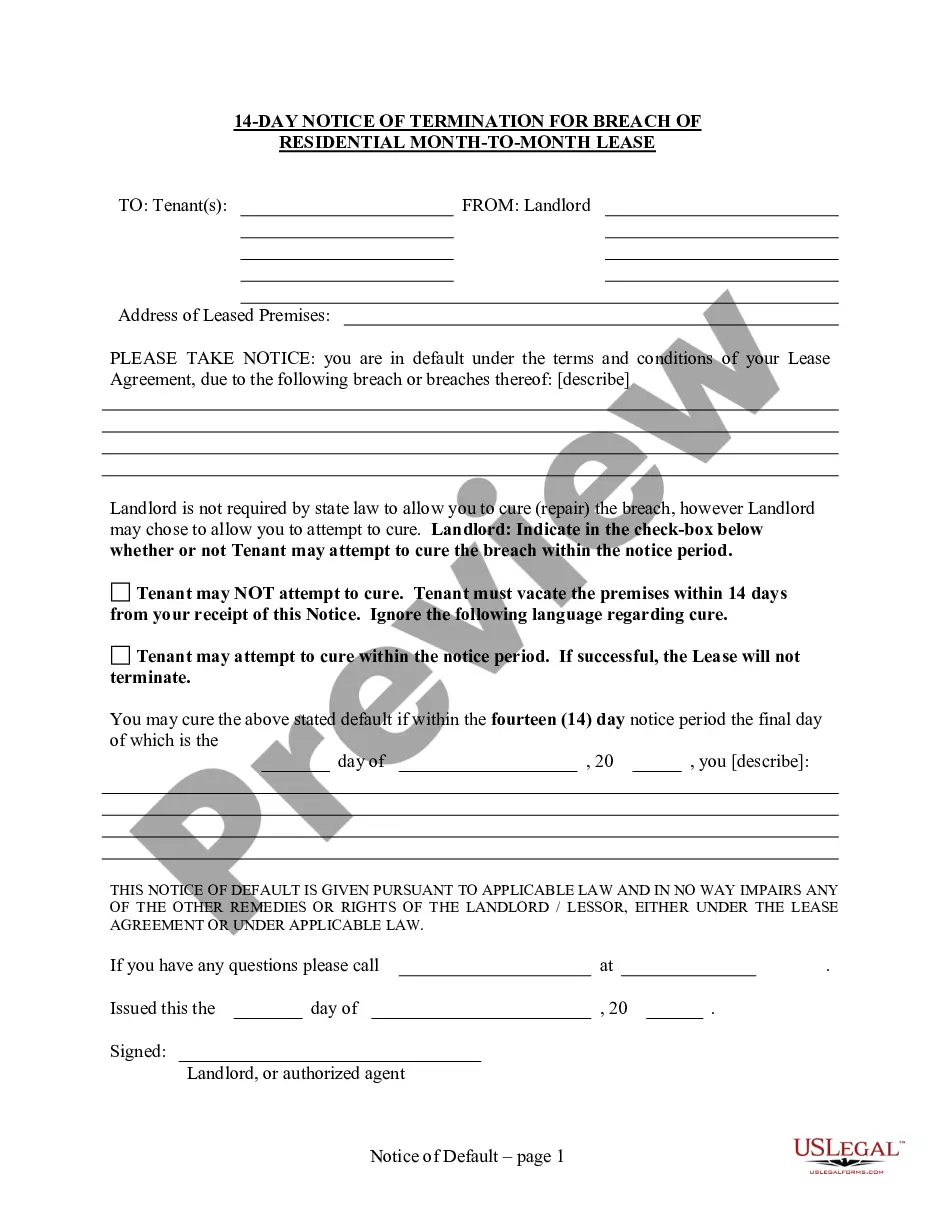

How to fill out Wisconsin 28 Day Notice To Terminate Month To Month Lease - No Right To Cure - Residential?

It’s clear that you cannot become a legal expert instantly, nor can you determine how to swiftly prepare Wi Nonresident Withholding without a specialized background.

Assembling legal documents is a lengthy process that necessitates specific education and expertise.

So why not entrust the development of the Wi Nonresident Withholding to the professionals.

Preview it (if this option is available) and review the accompanying description to determine if Wi Nonresident Withholding is what you’re looking for.

If you need any other template, restart your search. Create a free account and select a subscription plan to purchase the form. Click Buy now. Once the payment is completed, you can download the Wi Nonresident Withholding, complete it, print it, and send or mail it to the relevant individuals or organizations.

- With US Legal Forms, one of the most comprehensive legal document repositories, you can find everything from court papers to templates for in-office correspondence.

- We understand how crucial compliance and adherence to federal and local regulations are.

- That’s why, on our platform, all forms are location-specific and current.

- Here’s how to begin with our platform and acquire the document you require in just moments.

- Identify the document you need using the search bar at the top of the page.

Form popularity

FAQ

Common Forms Form 1NPR - Nonresident and Part-year Resident Income Tax Return. Domicile Questionnaire (2022) Schedule WD - Capital Gains and Losses. Schedule U - Underpayment of Estimate Tax by Individuals and Fiduciaries (2022)

through entity is required to make quarterly withholding tax payments on a nonresident member's share of income attributable to Wisconsin. The passthrough entity must make quarterly payments of withholding tax on or before the 15th day of the 3rd, 6th, 9th, and 12th month of the taxable year.

Wisconsin WT-4 Instructions Complete the section labeled ?Figure your total withholding exemptions below?. Step 1 is a guideline for how many exemptions you would like to claim. If you know how many exemptions you would like to claim please list the number on Line 1 box d. Please sign and date the form and return.

Nonresidents - Wisconsin taxes only your income from Wisconsin sources. Part-year residents - During the time you are a Wisconsin resident, Wisconsin taxes your income from all sources. During the time you are not a resident of Wisconsin, Wisconsin only taxes your income from Wisconsin sources.

(a) Nonresident persons employed in Wisconsin and residing in a state with which Wisconsin has reciprocity shall file form W-220, ?Nonresident Employee's Withholding Reciprocity Declaration,? with their Wisconsin employers to be exempt from withholding of Wisconsin income taxes.