Expiring Twenty Deadline For 202

Description

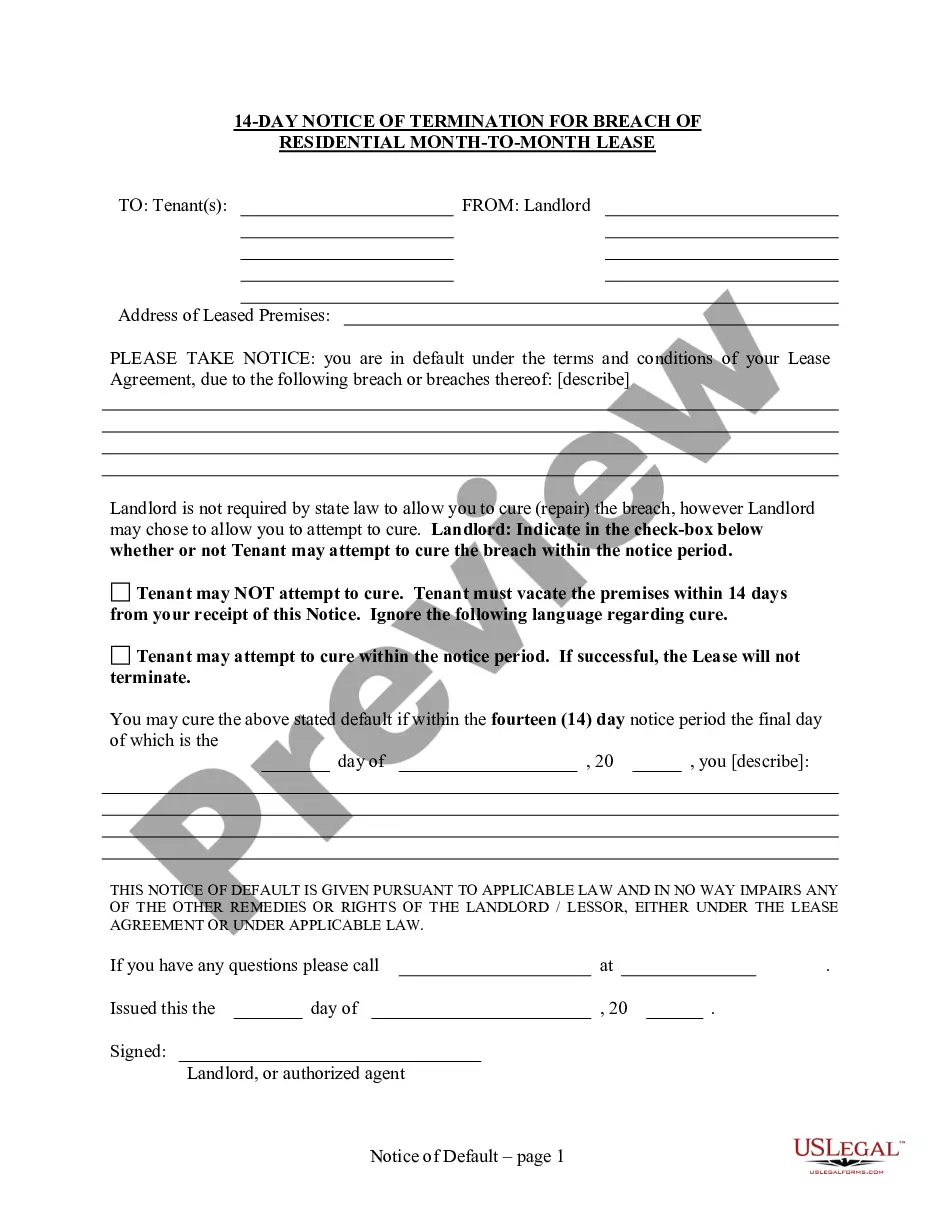

How to fill out Wisconsin 28 Day Notice To Terminate Month To Month Lease - No Right To Cure - Residential?

- If you are an existing user, log in to your account to access the Download button for your desired form template. Ensure your subscription is active; renew it if necessary based on your payment plan.

- For new users, start by checking the Preview mode and description of the preferred form to ensure it meets your jurisdiction requirements.

- If the form isn’t suitable, utilize the Search tab to find an alternative that fits your needs.

- Proceed to purchase the document by clicking the Buy Now button and selecting your preferred subscription plan, which requires account registration to unlock the resource library.

- Complete your transaction by entering your payment details, either through credit card or PayPal.

- Download the form and save it to your device; you can access it anytime later through the My Forms section of your profile.

With US Legal Forms, you not only access a comprehensive collection of forms but also enjoy expert assistance for form completion, ensuring all your legal documents are accurate and enforceable.

Don’t hesitate! Start simplifying your legal processes today with US Legal Forms and navigate the expiring twenty deadline with ease.

Form popularity

FAQ

You can find your I-20 expiration date on the second page of your I-20 document, usually located next to the program end date. It is important to monitor this date closely, as it relates to your legal status in the United States. If you have concerns about the expiring twenty deadline for 202, consider visiting uslegalforms for resources to help you navigate your options smoothly.

To determine if your I-20 is valid, check the issue date and the program end date printed on the document. If you are within the authorized period, your I-20 is valid. Additionally, ensure there are no updates or changes that have not been officially documented. Keeping an eye on the expiring twenty deadline for 202 will help you stay compliant with your visa requirements.

You can file back taxes for the past six years in certain circumstances, specifically if you are due a refund. However, it is essential to stay aware of the expiring twenty deadline for 202, which affects your eligibility for refunds. For comprehensive form guidance and support, consider US Legal Forms, which can streamline your filing process.

Yes, you can still file your taxes after April 18, but you may face penalties or interest on any taxes owed. It’s still advisable to submit your taxes as soon as you can, especially before the expiring twenty deadline for 202 approaches. Use US Legal Forms to ensure you have all the necessary information and resources to file accurately.

Unfortunately, you cannot get a tax refund from five years ago due to the three-year limit set by the IRS. Therefore, it becomes crucial to act on your tax filings before the expiring twenty deadline for 202. Explore US Legal Forms for more information about filing and refund claims.

Yes, you can still file your 2019 taxes and potentially receive a refund in 2024. However, keep in mind that you must file before the expiration of the three-year statute of limitations, coinciding with the expiring twenty deadline for 202. Consider using platforms like US Legal Forms to help you navigate this process easily.

To claim your stimulus check without filing taxes, you need to use the IRS’s appropriate form for non-filers. It's important to be aware of deadlines, like the expiring twenty deadline for 202, to ensure you receive your funds. Check resources like US Legal Forms for straightforward guidance on the process.

If your I-20 expires, you may face difficulties in maintaining your legal status in the U.S. It's crucial to act promptly and consult with a legal professional or your school’s international office for assistance. Remember, understanding your deadlines, including the expiring twenty deadline for 202, can significantly impact your situation.

Yes, you can file a tax return from 10 years ago. However, it's essential to keep in mind the expiring twenty deadline for 202 to ensure you claim the maximum refund possible. Using resources like US Legal Forms can simplify the process, allowing you to locate the necessary forms and guidance easily.

After your I-20 expires, you should immediately assess your options, which may include applying for reinstatement or preparing to leave the U.S. Ignoring this matter can lead to serious immigration consequences. Consider utilizing uslegalforms for guidance on resolving your status and meeting the expiring twenty deadline for 202.