Clock Twenty Deadline For 2023

Description

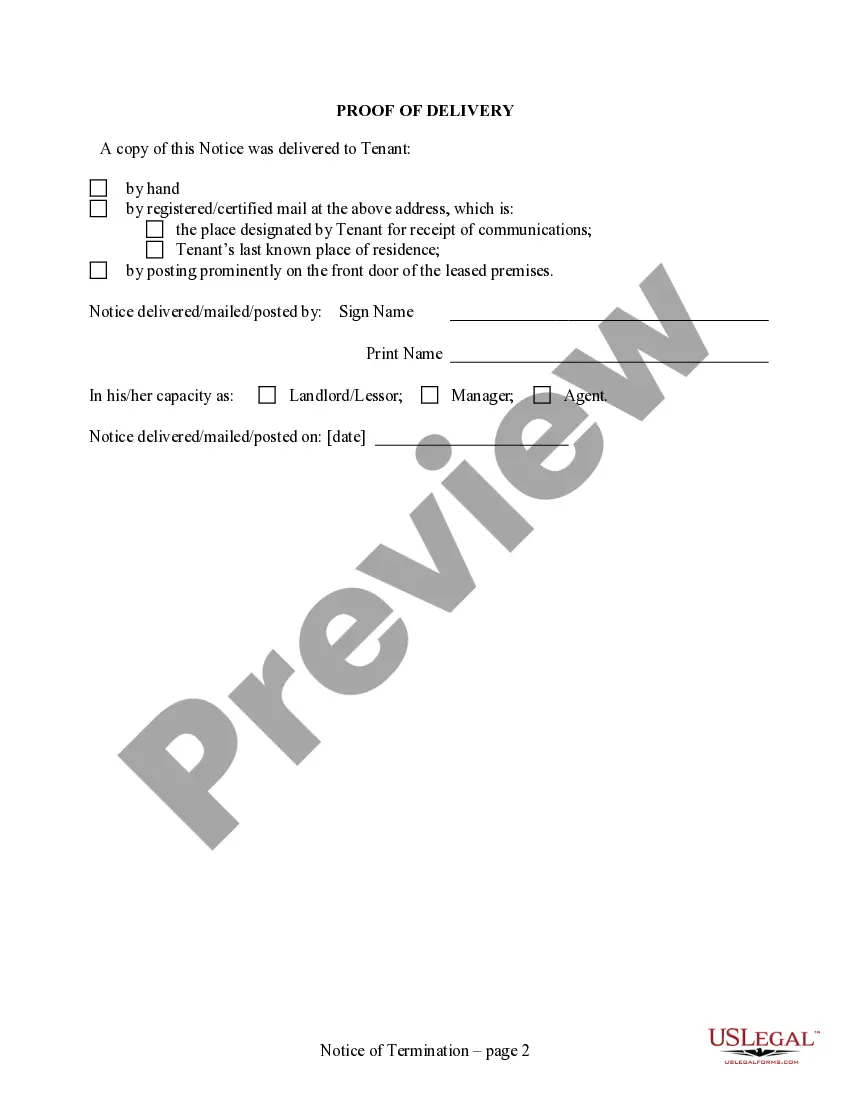

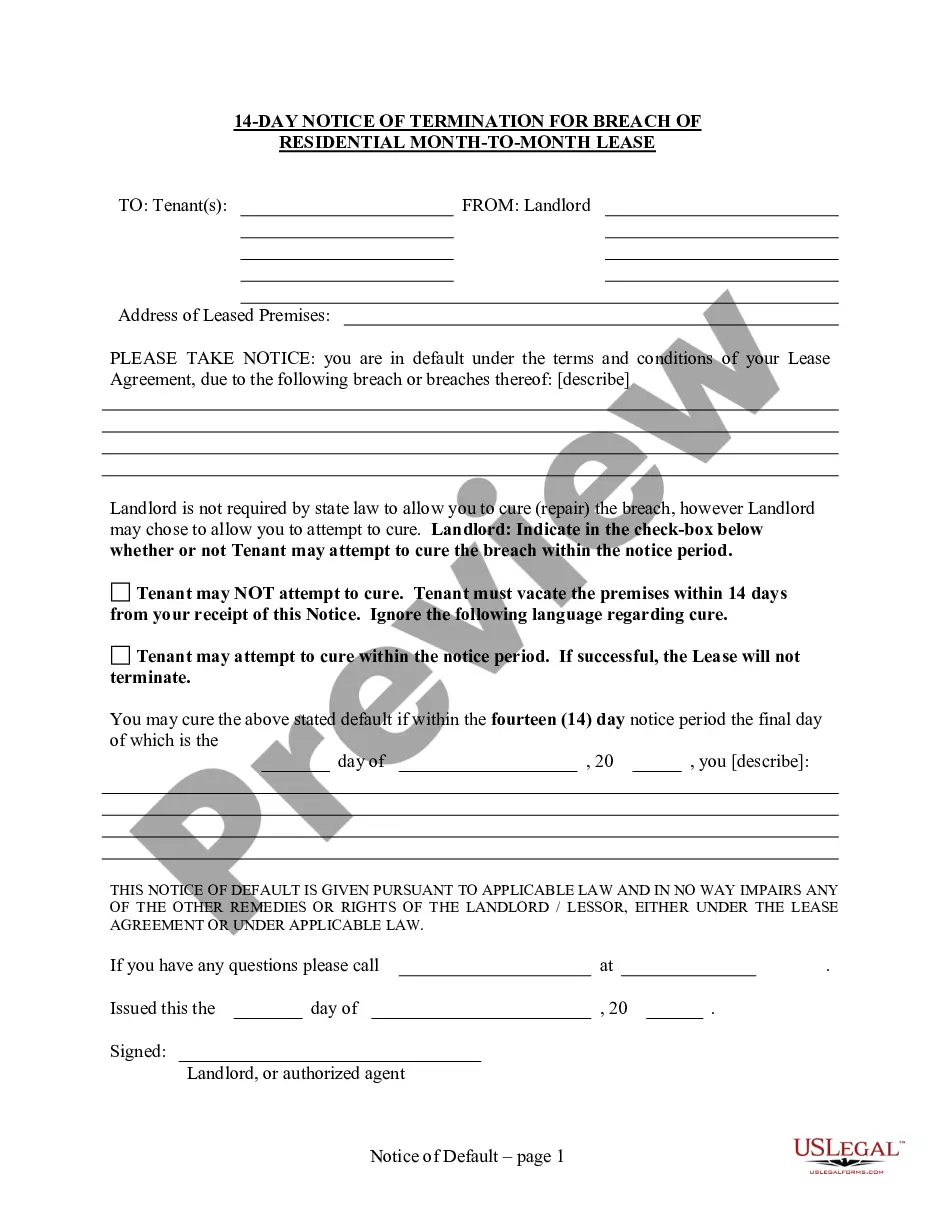

How to fill out Wisconsin 28 Day Notice To Terminate Month To Month Lease - No Right To Cure - Residential?

- Log in to your US Legal Forms account if you've used it before. Verify your subscription status; if it's expired, renew it as necessary.

- Review the form in Preview mode and read the description to ensure it meets your needs and complies with your jurisdiction.

- Should you need a different template, use the Search tab to find the right one that fits your requirements.

- Purchase your selected document by clicking the 'Buy Now' button and choose your desired subscription plan. Account registration is necessary to access additional resources.

- Complete your purchase by providing payment details through credit card or PayPal.

- Download the form directly to your device and access it any time from the 'My Forms' section in your profile.

In conclusion, US Legal Forms empowers users by providing a comprehensive legal library, ensuring accuracy and efficiency in document handling. With easy access to a vast collection, you can confidently manage your legal needs.

Get started today and take advantage of the benefits that US Legal Forms has to offer.

Form popularity

FAQ

The main tax filing deadlines for 2023 include April 18th as the standard date for submission. If you file an extension, you could have until October 16th to complete your filing. It is essential to adhere to the clock twenty deadline for 2023 to avoid penalties and ensure smooth processing of your tax returns.

You can file 2023 taxes electronically if you do so before the April 18th deadline. After this date, electronic filing may not be available without an extension. To navigate this process effectively, consider using USLegalForms to help you stay on track of the clock twenty deadline for 2023.

The main tax filing dates for 2023 are primarily centered around April 18th, which is the date for most taxpayers. If you qualify for an extension, you may have until mid-October to complete your filing. Be mindful of the clock twenty deadline for 2023 to avoid any pitfalls during tax season.

Filing electronically after the April 18th deadline is generally not permitted without a valid extension. However, if you have a valid reason for late filing, it’s best to consult the IRS directly. Missing the clock twenty deadline for 2023 might lead to complications, so explore your options carefully.

To file a belated return for the assessment year 2023-24, you will need to prepare your tax documents accurately and submit them. Even after the clock twenty deadline for 2023 has passed, you can still file your return under certain circumstances. Consider using our platform, USLegalForms, to guide you through the process seamlessly and ensure compliance.

Typically, the deadline to file federal taxes is April 15. However, in 2023, the date was extended to April 18. It's crucial to keep track of the clock twenty deadline for 2023 so to avoid any penalties for late filing.

As of now, there has been no official announcement from the IRS indicating an extension of the tax deadline for 2023. Therefore, it's important to plan ahead and meet the clock twenty deadline for 2023. Staying informed of IRS updates can help you avoid any last-minute stress in meeting your obligations.

The cut-off date to file taxes in 2023 is April 18th. This marks the last day you can submit your federal tax return without facing penalties. Keep this date in mind as you prepare your forms. Remember, missing the clock twenty deadline for 2023 could result in late fees or other complications.

To effectively put day and date in a sentence, you should state the day first, followed by the date. For example, 'On Sunday, February 5, 2023, we will celebrate the event.' This makes your message clear and is particularly useful when relating to important dates like the Clock twenty deadline for 2023.

You can write day, time, and date together by following the order: 'Day, time, and date.' For example, 'Thursday, PM, March 30, 2023' is an effective way to present this information. This clear structure greatly aids communication, especially when referencing the Clock twenty deadline for 2023.