Wi Corporation Wisconsin Withdrawal

Description

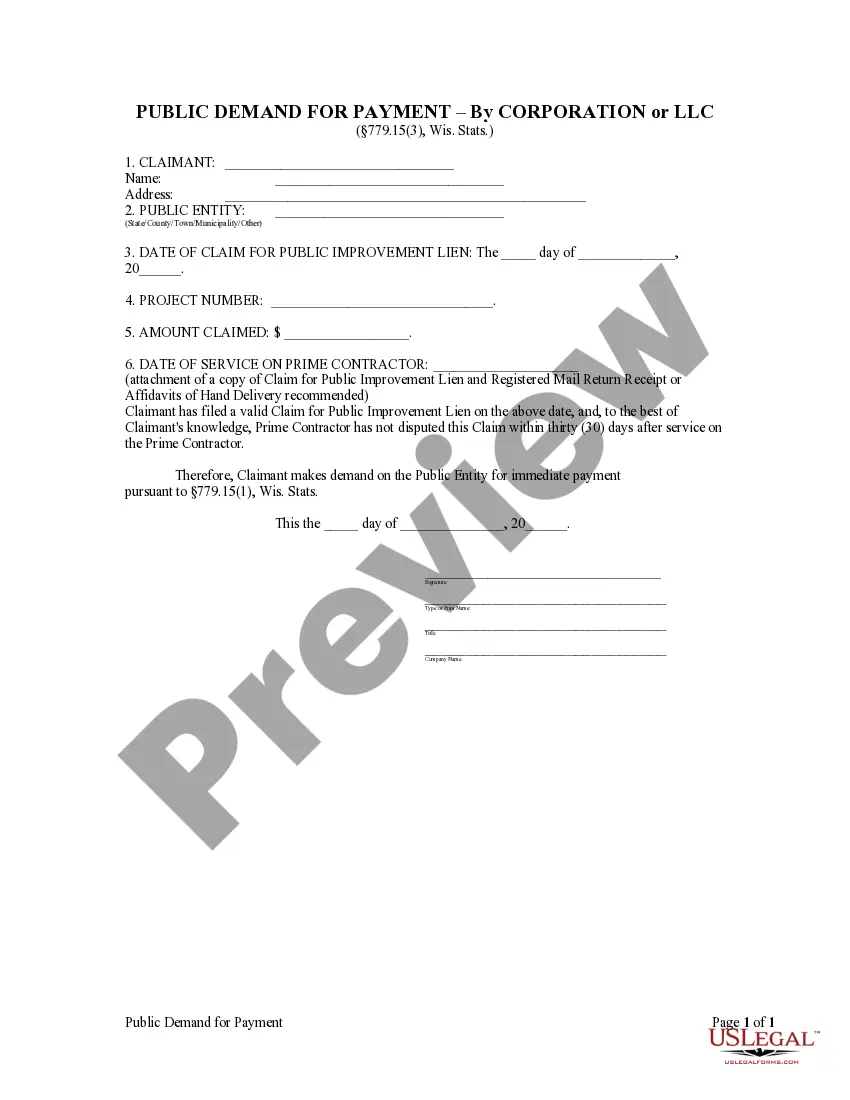

How to fill out Wisconsin Public Demand For Payment By Corporation?

What is the most dependable service to acquire the Wi Corporation Wisconsin Withdrawal and other current versions of legal documents? US Legal Forms is the solution!

It’s the largest assortment of legal paperwork for any purpose. Each template is expertly crafted and verified for adherence to federal and local statutes and regulations.

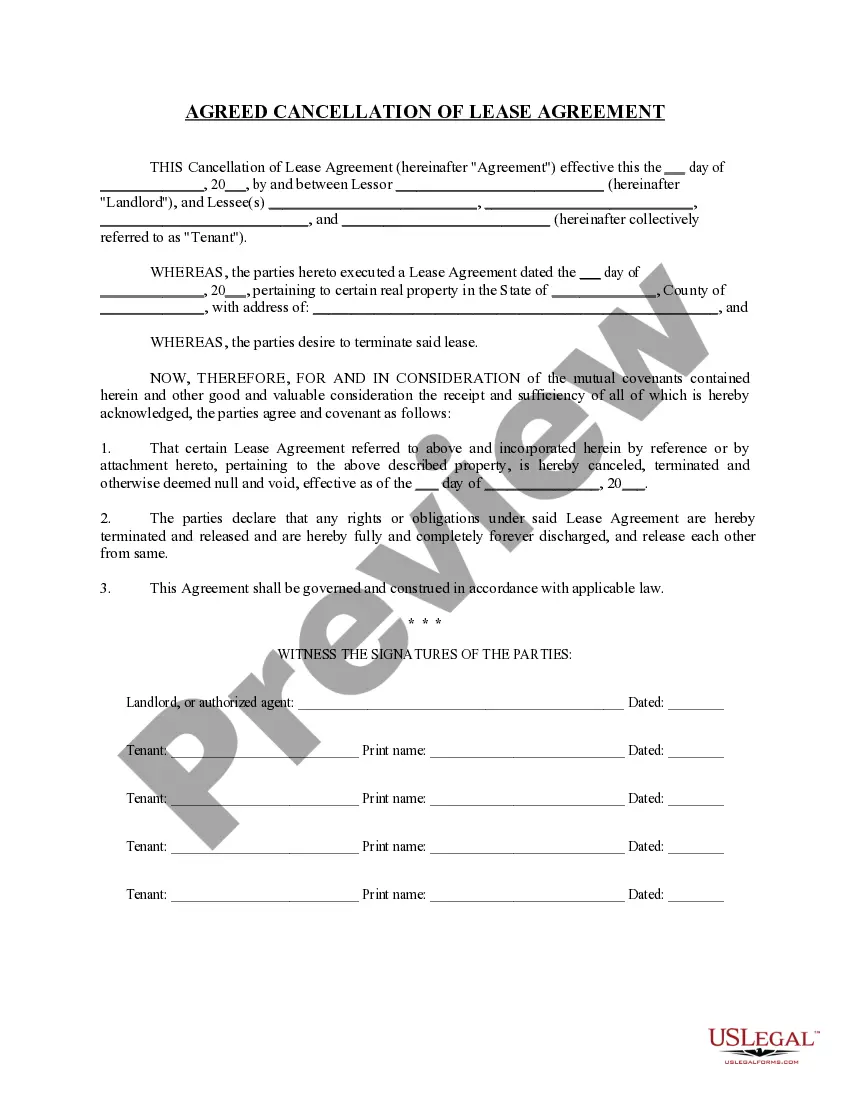

Form compliance review. Before acquiring any template, ensure it meets your usage requirements and your state or county’s regulations. Review the form description and use the Preview if it’s available.

- They are categorized by sector and jurisdiction, making it easy to find the one you require.

- Experienced users of the platform only need to Log In to the system, confirm their subscription status, and click the Download button next to the Wi Corporation Wisconsin Withdrawal to retrieve it.

- Once saved, the document is stored for future use in the My documents section of your account.

- If you don’t yet have an account with us, here are the steps to create one.

Form popularity

FAQ

Closing a corporation in Wisconsin involves several important steps that ensure proper compliance with state laws. First, the corporation’s board must adopt a resolution to dissolve, followed by approval from shareholders. Afterward, the corporation must file articles of dissolution with the state, which officially initiates the Wi corporation Wisconsin withdrawal process. Moreover, it's wise to consult resources like UsLegalForms to simplify and expedite the closing procedure.

A statutory close corporation in Wisconsin is a type of business entity designed for small, closely-held companies. This structure allows for a more flexible management style, as it does not require the same formalities as larger corporations. In the context of Wi corporation Wisconsin withdrawal, this designation is particularly beneficial for owners who wish to maintain more control over their business operations without extensive regulatory burdens.

Officially closing an LLC involves a series of tasks that ensure compliance with state laws. Begin with settling your debts and notifying relevant parties such as employees and suppliers. Afterward, you'll need to file the necessary dissolution forms with the state. Using platforms like USLegalForms can simplify this process and provide the necessary documentation for your Wi corporation Wisconsin withdrawal.

To dissolve a corporation in Wisconsin, you must file the Articles of Dissolution with the Secretary of State. Start by ensuring all business affairs, such as paying off debts and fulfilling tax obligations, are in order. After filing the necessary paperwork, you should notify your stakeholders about the decision. For a smoother experience, consider using resources offered by USLegalForms during the Wi corporation Wisconsin withdrawal process.

Dissolving an LLC in Wisconsin can be straightforward if you follow the proper steps. While it may seem daunting, taking it step by step makes the process manageable. Firstly, you'll need to settle debts, notify members, and file the Articles of Dissolution. If you need assistance, platforms like USLegalForms can guide you through the nuances of the Wi corporation Wisconsin withdrawal.

To check if your desired business name is available in Wisconsin, you can access the Wisconsin Department of Financial Institutions website. They provide a searchable database where you can easily see if a name is already in use. It's vital to ensure your name is unique to avoid complications during the Wi corporation Wisconsin withdrawal process. This step can save you time and potential legal issues down the line.

When you decide to proceed with a Wi corporation Wisconsin withdrawal, understanding the tax implications is critical. You must settle any outstanding taxes, both federal and state, before dissolving your LLC. Additionally, any gains or losses from the sale of assets must be reported on your tax return. Consulting a tax professional can help clarify specific obligations for your situation.

If you fail to submit your annual report in Wisconsin, your corporation could face administrative dissolution by the state. This dissolution impacts your ability to conduct business and may lead to complications during any future Wi corporation Wisconsin withdrawal. It’s important to stay on top of your reporting to maintain good standing. Uslegalforms can provide the necessary tools and guidance to help you remain compliant.

Yes, filing an annual report is a requirement for businesses operating in Wisconsin. This report provides the state with updated information about your corporation, including addresses and officer details. Neglecting this obligation can lead to issues during your Wi corporation Wisconsin withdrawal, making compliance essential. Uslegalforms offers helpful resources to assist in preparing your report.

Closing a corporation in Wisconsin involves several key steps. First, you must ensure all debts and taxes are settled. Then, you'll need to file the appropriate forms with the Wisconsin Department of Financial Institutions to formalize your Wi corporation Wisconsin withdrawal. Platforms like uslegalforms provide resources and templates to help you navigate this process effectively, ensuring a smooth closure.