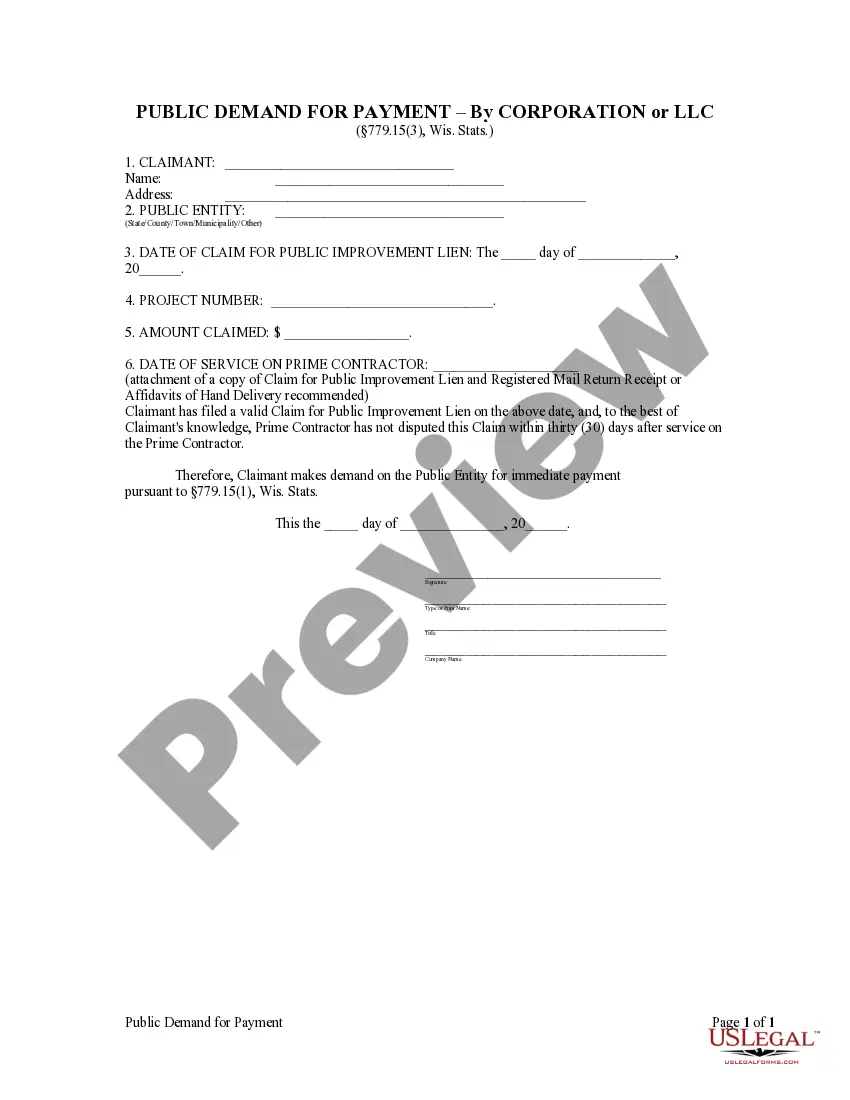

This Public Demand for Payment - Corporation is a form notice attached to a construction project. Every prime contractor who enters into a contract with the owner for a work of improvement on the owner's land and who has contracted or will contract with any subcontractors or materialmen to provide labor or materials for the work of improvement shall include in any written contract with the owner the notice required by this paragraph, and shall provide the owner with a copy of the written contract. If no written contract for the work of improvement is entered into, the notice shall be prepared separately and served personally or by registered mail on the owner or authorized agent within 10 days after the first labor or materials are furnished for the improvement by or pursuant to the authority of the prime contractor.

Wi Corporation Wisconsin Form Wi-z

Description

How to fill out Wi Corporation Wisconsin Form Wi-z?

There's no longer a need to squander time searching for legal documents to satisfy your local state's regulations.

US Legal Forms has gathered all of them in one location and made them easier to access.

Our platform provides over 85k templates for any business and personal legal matters compiled by state and area of use. All forms are expertly created and verified for authenticity, ensuring you receive the current Wi Corporation Wisconsin Form Wi-z.

Creating legal documents under federal and state regulations is quick and straightforward with our platform. Experience US Legal Forms today to keep your paperwork organized!

- If you are acquainted with our platform and already possess an account, ensure your subscription is active before obtaining any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all obtained documents whenever necessary by navigating to the My documents tab in your profile.

- For those who have not interacted with our platform previously, the procedure will require a few additional steps to finish.

- Here's how new users can find the Wi Corporation Wisconsin Form Wi-z in our library.

- Examine the page content thoroughly to ensure it contains the sample you need.

- Utilize the form description and preview options if available.

- Use the Search field above to look for another sample if the one currently displayed does not meet your needs.

- After locating the correct template, click Buy Now next to the title.

- Select the desired subscription plan and either create an account or Log In.

- Complete your subscription payment with a card or via PayPal to continue.

- Choose the file format for your Wi Corporation Wisconsin Form Wi-z and download it to your device.

- Print the form to fill it out manually or upload the sample if you prefer working in an online editor.

Form popularity

FAQ

You can obtain Wisconsin tax forms from the Wisconsin Department of Revenue's website. This user-friendly platform allows you to access various forms and instructions tailored to your needs. For a seamless experience, the Wi corporation Wisconsin form wi-z may assist you in identifying which tax forms are relevant for your business structure. Make sure to download and complete the necessary forms before the tax deadline to stay compliant.

To form an LLC in Wisconsin, you need to file the appropriate documents with the state. Start by submitting the Articles of Organization, which you can find on the official Wisconsin Department of Financial Institutions website. Additionally, consider using the Wi corporation Wisconsin form wi-z to simplify the process and ensure accuracy. It's also wise to draft an operating agreement outlining the management structure and rules for your LLC.

The number of exemptions you should claim in Wisconsin generally depends on your personal and financial situation, such as your marital status and dependents. It's essential to assess your eligibility and consider any specific state guidelines. Utilizing the Wi corporation Wisconsin form wi-z will help clarify the exemptions applicable to your corporate tax filings, allowing for accurate reporting.

Certain entities and individuals may qualify for exemption from Wisconsin income tax, including specific nonprofits and organizations recognized under federal tax laws. Additionally, some income types, like certain retirement benefits, may also be exempt. It’s vital to consult the state guidelines or seek advice when using the Wi corporation Wisconsin form wi-z to ensure all exemptions apply correctly.

The nonresident income tax form for Wisconsin is the Form 1NPR, which is used by individuals who receive income from Wisconsin sources but do not reside in the state. This form allows nonresidents to report their Wisconsin income accurately. If you operate as a corporation, be sure to check if you'll need the Wi corporation Wisconsin form wi-z to address your tax responsibilities.

Any corporation that generates income in Wisconsin is typically required to file a state tax return. This applies to both domestic and foreign corporations. Filing the appropriate forms, including the Wi corporation Wisconsin form wi-z, ensures that your business meets state tax obligations.

Yes, Wisconsin imposes a corporate income tax on corporations that conduct business in the state. The tax is calculated based on the corporation's net income, and the rates can vary depending on income levels. To navigate this requirement effectively, the Wi corporation Wisconsin form wi-z is an essential tool.

Doing business in Wisconsin involves actively engaging in transactions, sales, or operations that generate revenue within the state. This can include maintaining a physical presence, having employees, or regularly conducting business activities. Understanding this definition is crucial for determining whether you need to file the Wi corporation Wisconsin form wi-z.

Filing a Wisconsin corporate income tax return is necessary for all corporations doing business in Wisconsin. This includes corporations that operate their primary business activities within the state or derive income from Wisconsin-based sources. To facilitate this process, utilizing the Wi corporation Wisconsin form wi-z can help ensure compliance and accuracy when reporting income.

You can pick up tax filing forms at your local tax office or the Wisconsin Department of Revenue. Additionally, many forms are available online for easy access. Using platforms like uslegalforms can also provide you with essential documents, such as the Wi corporation Wisconsin form wi-z, right at your fingertips.