Llc Company Meaning

Description

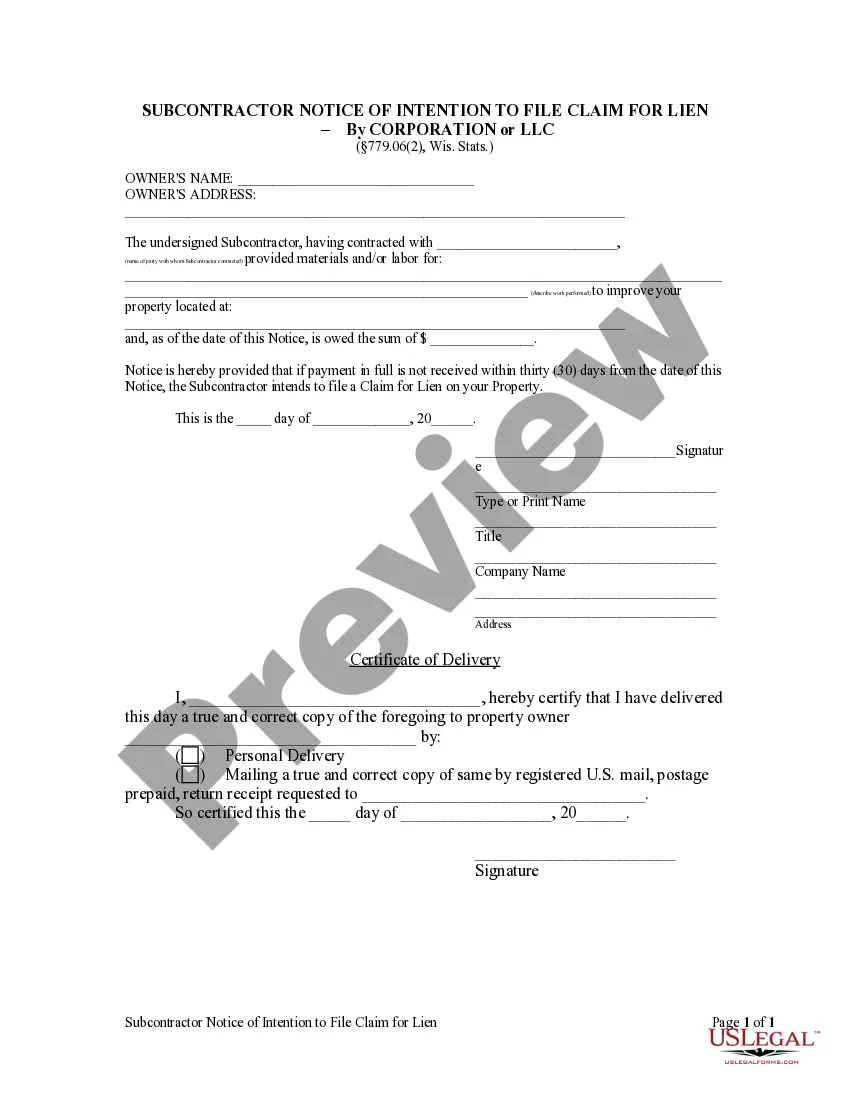

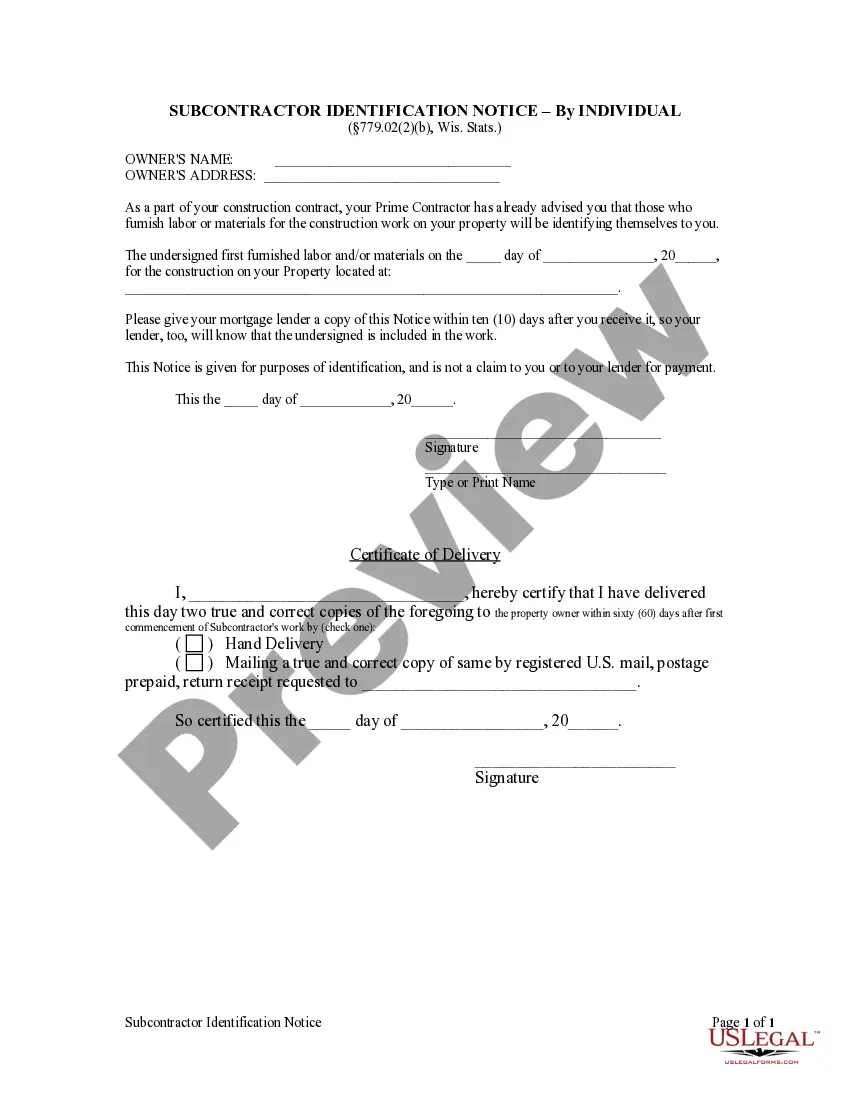

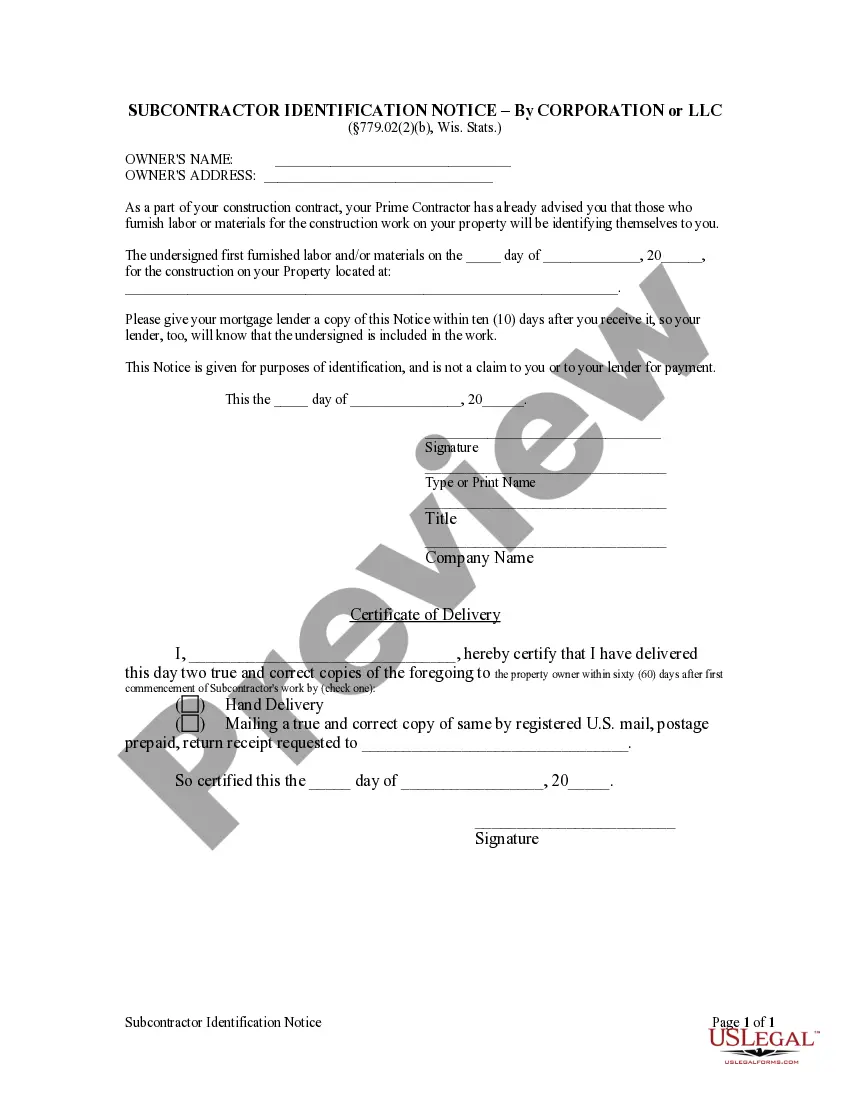

How to fill out Wisconsin Subcontractor's Identification Notice By Corporation?

- Log in to your account at US Legal Forms to access your previously saved forms. Ensure your subscription is active or renew it if needed.

- If you are new, start by exploring the form preview and description to confirm that it aligns with your needs and complies with local jurisdiction requirements.

- Should you find any discrepancies, leverage the Search feature at the top to locate a suitable template.

- Select the document that fits your requirements and click 'Buy Now' to choose your desired subscription plan. Registration is necessary for full access.

- Complete your purchase using your credit card or PayPal account for a seamless transaction.

- Finally, download the form and save it to your device. You can revisit the downloaded forms anytime from the 'My Forms' section in your account.

Using US Legal Forms simplifies the process of obtaining legal documents. Their extensive library, featuring over 85,000 customizable forms, caters to varied legal needs.

Feel confident in your decision-making by accessing legal templates today. Start by visiting US Legal Forms and experience their robust service!

Form popularity

FAQ

Yes, you can have an LLC and choose not to conduct business; however, it is essential to understand your ongoing obligations. You may still need to file annual reports or tax returns, depending on your state's requirements. Knowing the LLC company meaning helps reinforce your responsibilities, ensuring that your LLC remains in good standing even during inactivity. US Legal Forms can assist you in staying compliant with minimum effort.

Filing your LLC separately means that you can treat it as an independent entity for tax purposes. However, you need to file any paperwork required by your state to maintain that separate status. It's vital to understand the LLC company meaning, as this knowledge aids in compliance and enables you to realize the benefits of limited liability. Consulting resources like US Legal Forms can provide clarity on this process.

Yes, you can file your LLC by yourself, but it's crucial to follow all legal requirements. This typically involves completing and submitting the Articles of Organization to your state. However, if you're unsure or want to save time, platforms like US Legal Forms can help you streamline the process, ensuring everything is done correctly and efficiently. Knowing the LLC company meaning can ease your filing journey.

A single owner LLC typically files taxes using Schedule C as part of their personal tax return. This means the business income and expenses are reported on the owner's Form 1040. Understanding the LLC company meaning is key, as it helps you navigate tax obligations effectively, ensuring you maximize deductions while adhering to tax laws.

Filing an LLC involves submitting specific formation documents with the appropriate state authority. This process legally establishes your business as a Limited Liability Company and provides you with liability protection. Understanding the LLC company meaning ensures you complete all necessary steps effectively. Using platforms like US Legal Forms simplifies this process, helping you file correctly.

Failing to file taxes for your LLC can lead to significant penalties and interest on unpaid taxes. The IRS may classify your LLC as inactive, which could jeopardize your limited liability protection. Moreover, consistent non-compliance can trigger audits and legal complications. Being aware of the LLC company meaning can guide you in meeting your tax responsibilities.

The benefits of having an LLC include limited liability, which protects your personal assets, and flexibility in management and taxation. LLCs also allow for easier access to business funding, as they create a more credible business image. Additionally, owners enjoy pass-through taxation, avoiding double taxation issues commonly found in corporations. Comprehending the LLC company meaning can greatly enhance your appreciation of these advantages.

Starting an LLC is generally worth it for most entrepreneurs seeking liability protection and operational flexibility. The potential for reduced personal risk and the simplicity of management structures make it a favorable choice. While there are costs and administrative duties involved, the benefits often outweigh them. Thus, understanding the LLC company meaning underscores its value in the business landscape.

The point of having an LLC lies in the protection and flexibility it offers. This structure allows owners to limit their personal liability while benefiting from pass-through taxation. An LLC can adapt to various business needs, providing a straightforward approach to management and operations. Learning the LLC company meaning highlights the strategic advantages of choosing this business formation.

To understand the LLC company meaning, start by researching its legal definition and benefits. You can consult online resources, legal websites, or guides from professional organizations that specialize in business structures. Moreover, platforms like US Legal Forms offer comprehensive explanations and documents needed to form an LLC, helping you grasp its significance effectively. Engaging with these tools can enhance your knowledge of what an LLC entails.