Life Estate Deed Explained

Description

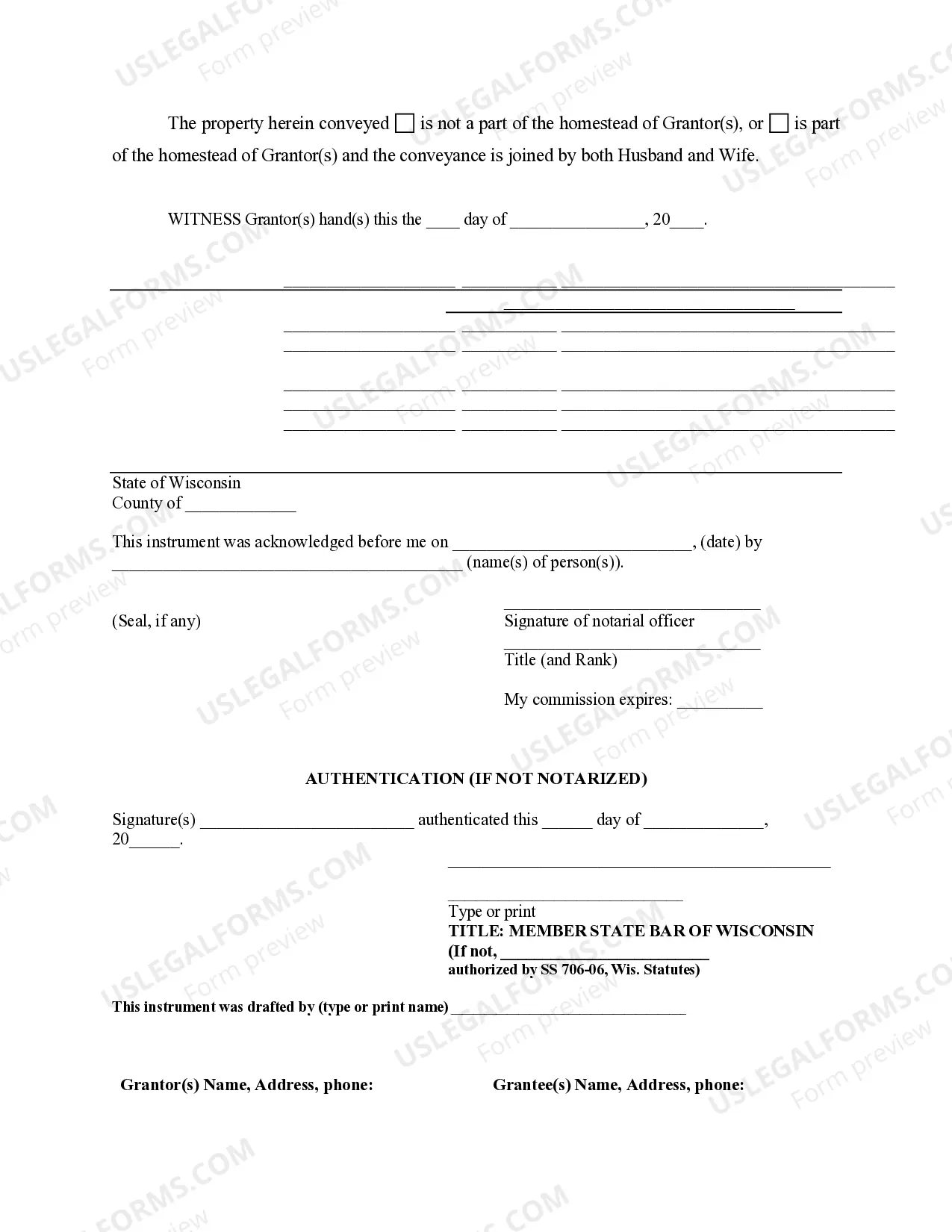

How to fill out Wisconsin Warranty Deed To Child Reserving A Life Estate In The Parents?

Creating legal documents from the ground up can occasionally be overwhelming.

Certain situations may require extensive research and significant expenses.

If you're in search of a more straightforward and cost-effective method of generating Life Estate Deed Explained or any other documentation without unnecessary complications, US Legal Forms is consistently accessible to you.

Our online repository of over 85,000 current legal forms encompasses nearly every facet of your financial, legal, and personal affairs. With just a few clicks, you can swiftly obtain state- and county-compliant templates meticulously assembled for you by our legal experts.

However, before proceeding to download the Life Estate Deed Explained, consider these suggestions: Review the document preview and descriptions to ensure you've located the correct document. Verify that the template you choose complies with your state and county regulations. Select the appropriate subscription plan to acquire the Life Estate Deed Explained. Download the file, then complete, sign, and print it. US Legal Forms boasts an impeccable reputation and over 25 years of experience. Join us today and make form completion a simple and efficient process!

- Utilize our platform whenever you need dependable and trustworthy services to effortlessly find and download the Life Estate Deed Explained.

- If you are already familiar with our services and have set up an account, simply Log In to your account, locate the form, and download it or re-download it at any moment from the My documents section.

- Don’t have an account? No worries.

- Setting one up takes just a few minutes, allowing you to explore the library.

Form popularity

FAQ

If you hold the life estate your obligated to make repairs that are essential to the preservation of the property, your obligated to pay the interest on any outstanding mortgages and Property taxes.

An additional potential problem with a Life Estate is that it does not offer creditor protection to the beneficiary, so if the heir has a debt or is sued, the creditor or court can come after the house. As you can see, a traditional Life Estate has the potential to create major conflict within a family.

The life tenant is the property owner for life and is responsible for costs such as property taxes, insurance, and maintenance. Additionally, the life tenant also retains any tax benefits of homeownership.

In addition, life estates allow the owner to control the property in all respects, except that they cannot sell or mortgage the property without the consent of their heirs. If created in a timely manner, a life estate can even help its creator qualify for Medicaid assistance.

There is no simple way to reverse a life estate because a life estate deed is a legal transfer of the title of a property. This is legally binding and the transaction is complete when the life estate is executed. Essentially, in order to reverse a life estate both parties would need to agree to make it happen.