This Limited Liability Company LLC Formation Package includes Step by Step Instructions, Articles of Formation, Operating Agreement, Resolutions and other forms for formation of a Limited Liability Company in the State of Wisconsin.

Starting An Llc In Wisconsin With R

Description

Form popularity

FAQ

There is no formal 'renewal' process for your LLC in Wisconsin; however, you must file an annual report. This annual report is essential for keeping your business active and compliant with state regulations. By staying on top of this requirement, you can ensure that your LLC remains in good standing in Wisconsin.

Filing taxes for an LLC in Wisconsin with R involves understanding your tax obligations, which depend on your business structure. Many LLCs are required to file either a federal tax return or an informational return based on their chosen tax status. Additionally, you may need to file state-specific forms. Using resources from uslegalforms can provide clear guidance through this complex process.

Creating an LLC in Wisconsin with R is typically a straightforward process and can take anywhere from a few days to a couple of weeks. The timeframe largely depends on how you file your Articles of Organization. Online filings are usually processed more quickly than paper submissions. It's advisable to prepare all necessary documents in advance to speed up the process.

Yes, when starting an LLC in Wisconsin with R, you are required to file an annual report. This report keeps the state updated on your company's information, such as its address and members. It is essential to file this report to maintain good standing in Wisconsin and avoid any penalties.

When starting an LLC in Wisconsin with R, you have options for how to file your taxes. The best choice largely depends on your business structure and goals. Many LLCs choose to be taxed as a sole proprietorship, partnership, or corporation. Consulting a tax professional can help clarify your particular needs and ensure compliance.

The processing time for starting an LLC in Wisconsin can vary. Typically, online filings are processed faster, often within a few business days. By using services from US Legal Forms, you can expedite the process and ensure all documents are correctly completed for timely approval.

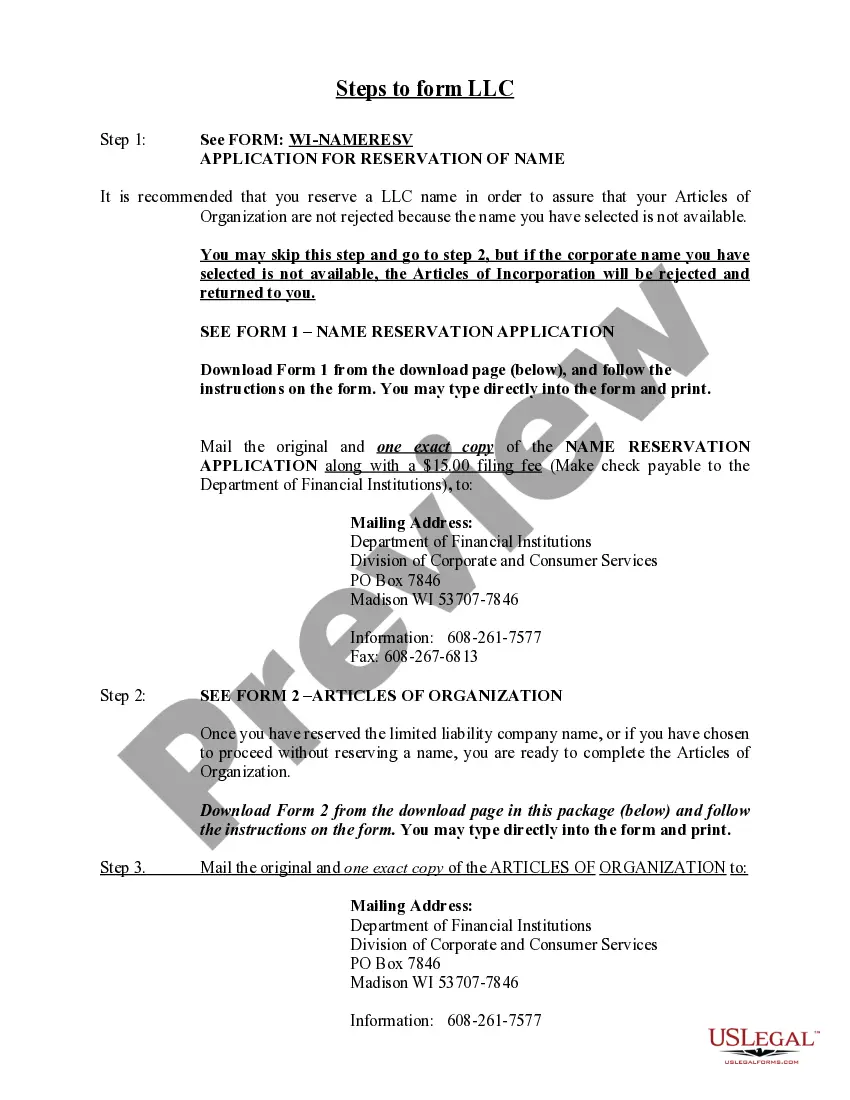

Filing for an LLC in Wisconsin involves submitting the Articles of Organization to the state. You can complete this online or by mail, providing necessary details about your business. Platforms like US Legal Forms simplify this process by offering templates and step-by-step guidance, making it easier to start an LLC in Wisconsin.

Yes, when starting an LLC in Wisconsin, you are required to designate a registered agent. This individual or business receives legal documents and government notices on behalf of your LLC. You can serve as your own agent or use a service like US Legal Forms to find a registered agent to ensure compliance.

While every state has its advantages, many find that Wyoming is considered one of the easiest states to form an LLC. However, if you are specifically interested in starting an LLC in Wisconsin with r, you will find the process fairly straightforward as well, thanks to the clear guidelines and support available through local resources. Ultimately, the best state depends on your business needs and preferences.

Yes, obtaining an Employer Identification Number (EIN) is an important step when starting an LLC in Wisconsin with r. An EIN functions like a Social Security number for your business, enabling you to open a bank account and hire employees. It is also necessary for tax purposes, making it essential to secure this number promptly after forming your LLC.