Starting An Llc In Wisconsin With B

Description

Form popularity

FAQ

To begin your journey of starting an LLC in Wisconsin with b, you will need to choose a unique name for your LLC, appoint a registered agent, and file Articles of Organization with the state. Alongside these, you should draft an Operating Agreement to outline the management structure and procedures of your LLC. Utilizing resources like US Legal Forms can greatly assist you in compiling and submitting the necessary paperwork efficiently.

One of the key benefits of starting an LLC in Wisconsin with b is the limited liability protection it offers to its owners. This structure ensures that personal assets are generally protected from business debts and lawsuits. Additionally, LLCs benefit from flexible management options and pass-through taxation, which can lead to significant tax savings. Overall, an LLC provides a robust foundation for your business.

Starting an LLC in Wisconsin with b entails specific tax considerations. Wisconsin LLCs are typically taxed as pass-through entities, meaning profits and losses are reported on the owners’ personal tax returns. However, if chosen, an LLC can elect to be taxed as a corporation, potentially offering some tax advantages. It's wise to consult a tax professional to understand the best option for your situation.

When considering starting an LLC in Wisconsin with b, it's important to note that many entrepreneurs find Wisconsin to be a straightforward state for this process. The requirements are clear, and the filing fees are reasonable compared to other states. If you prefer a streamlined approach, tools like US Legal Forms can simplify forming your LLC and ensuring compliance with state regulations.

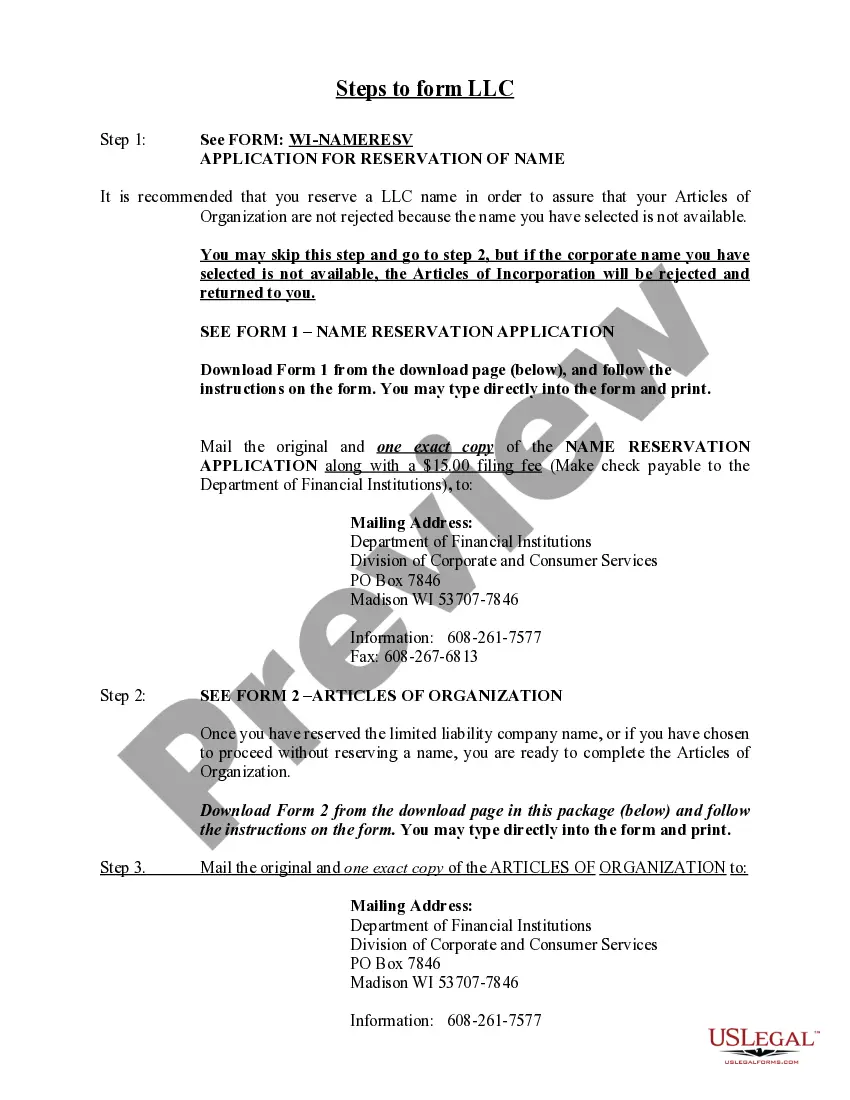

Yes, when starting an LLC in Wisconsin with b, you must register with the Wisconsin Department of Financial Institutions. This registration ensures that your LLC is recognized legally and allows you to conduct business within the state. It's a straightforward process that involves submitting the necessary documents online or via mail.

To set up an LLC in Wisconsin, you will need to file your Articles of Organization and obtain an EIN. It's advisable to create an operating agreement, although it's not mandatory. After these steps, you may want to consult platforms like uslegalforms for templates and guidance tailored to starting an LLC in Wisconsin with b.

While Wisconsin does not legally require an operating agreement for LLCs, it is highly recommended to have one in place when starting an LLC in Wisconsin with b. This document outlines the management structure, responsibilities, and procedures of your LLC. Having this agreement can help prevent disputes and clarify expectations between members.

In most cases, you will need an Employer Identification Number (EIN) when starting an LLC in Wisconsin with b. An EIN is necessary for tax purposes, even if you do not plan on hiring employees. It allows you to open a business bank account, apply for licenses, and fulfill tax obligations.

Yes, Wisconsin does allow single member LLCs. Starting an LLC in Wisconsin with b means you can establish your business sole ownership and enjoy personal liability protection. This structure is a great option for individuals looking to minimize their risk and streamline their business operations.

Yes, to successfully start an LLC in Wisconsin with b, you must file Articles of Organization. This essential document officially creates your LLC and even designates your registered agent. Additionally, this filing can be done online or by mail with the Wisconsin Department of Financial Institutions.